VANCOUVER, BC / ACCESSWIRE / November 11, 2021 / Viva Gold Corp. (TSXV:VAU)(OTCQB:VAUCF) (the "Company" or "Viva") is pleased to announce excellent results for its 2021 reverse circulation ("RC") drill program announced on July 12, 2021. The holes drilled in the program successfully confirmed that the mineral system remains open and strong laterally to the east, while also extending mineralization to depth.

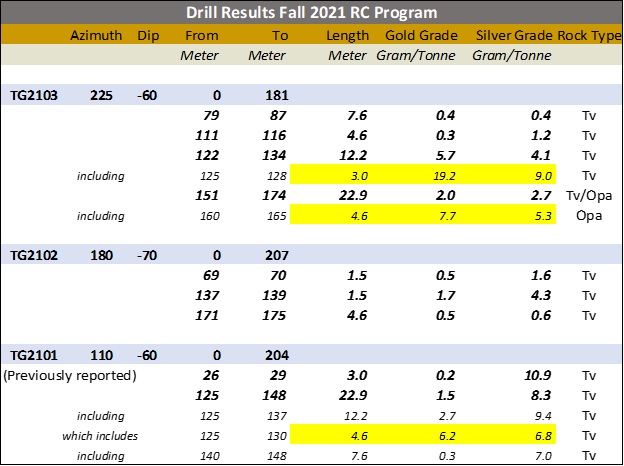

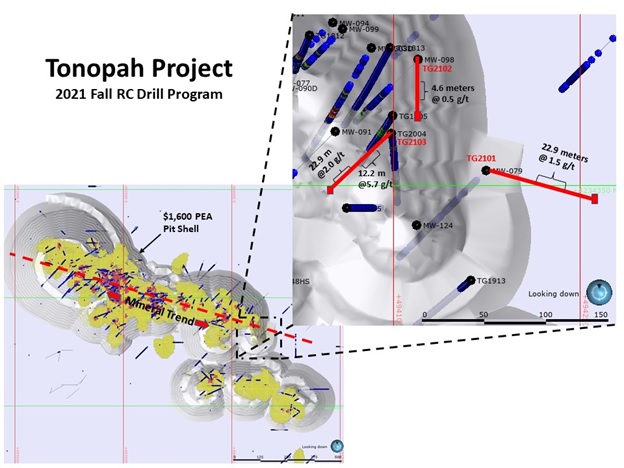

Hole TG 2103 was drilled southwest across the principal east-west trend of mineralization at the eastern end of the PEA design pit. The hole successfully intercepted a cumulative 47.3 meters at an average grade of 2.5 grams per tonne ("g/t") in four zones: one inside the pit shell, and three zones over 66 meters at depth below the previously modelled pit bottom. The fourth zone in this sequence encountered 22.9 meters at 2.0 g/t at the tertiary volcanic ("Tv")/Palmetto argillite ("Opa") contact, indicating the presence of a new high-grade mineral zone or feeder system at a relatively shallow depth. Gold mineralization had not previously been encountered in the Opa at the eastern quadrant of the main PEA pit.

Hole TG 2102 was drilled to the south from the northern side of the PEA pit and intercepted several zones of gold mineralization in Tv. This hole was designed to test the northern extent of the bedded zones of mineralization in the Tv and did not extend sufficiently south to fully intercept the centerline plane of the principal trend. It confirmed the potential northern limit of several lenses of mineralization in this area.

Hole TG 2101 was drilled along the centerline strike of the main trend to the east and intercepted 23 meters at 1.53 g/t in Tv in a major step-out as previously disclosed in the September 15, 2021 release.

Viva has used the results of its last two drill programs, combined with data driven geostatistical analysis and variography, to re-interpret its previous geologic model of the Tonopah Project. Gold mineralization in the older Opa formation tends to be structurally controlled, high angle, and oriented along a predominant northwest-southeast trend; mineralization in the younger tertiary volcanics is controlled by bedding structure and/or lithology, is flatter laying, and trends in an approximate east-west direction. Prior resource models did not differentiate orientation by rock type. This new model will be used as a basis for an updated resource estimate which will include data from 22 additional drillholes completed in 2020 and 2021.

James Hesketh, President & CEO states, "Beside producing spectacular results, this drill program, was very successful in demonstrating that the mineral system at Tonopah remains wide open for extension both laterally and to depth at its eastern extent. The new high-grade zone of mineralization intercepted in TG 2103 at the Tv/Opa contact is intriguing, while the easterly extension along the Tv trend demonstrated in TG 2101 clearly shows the potential to further extend mineralization in that direction. Both results demand follow-up. We believe that we have clearly identified upside potential at Tonopah and are excited to start drilling operations as drill rigs and crews become available. We have commenced a new resource study using our re-interpreted geologic model, which we believe will add to the declared resource when complete. Our goal is to continue to add to our resource base to make the project economics even more attractive for project financing, while continuing to de-risk the project by completing metallurgical and technical studies as well as baseline environmental and cultural studies".

James Hesketh, MMSA-QP, has approved the scientific and technical disclosure contained in this press release. Mr. Hesketh is not independent of the Company; he is an Officer and Director.

About Viva Gold Corp:

Viva Gold Corp holds 100% of the Tonopah Gold Project, a large land position consisting of approximately 10,500 acres with demonstrated high-grade gold in the ground, on the prolific Walker Lane Trend in western Nevada, 30 kilometers south-east of the World class Round Mountain mine. The project has a measured and indicated contained mineral gold resource of 326k ounces at a gold grade of 0.79 grams/tonne and 181k ounces of Inferred resource at 0.67 grams/tonne. Viva is advancing the project towards feasibility and permitting.

Viva is committed to Environmental, Social and Responsible Governance ("ESG") of its business. We realize these issues are also important to investors. We strive to operate in a manner that supports environmental and social initiatives and responsible corporate governance.

Viva Gold trades on the TSX Venture exchange "VAU", on the OTCQB "VAUCF" and on the Frankfurt exchange "7PB". Viva has a tight capital structure with 55.6 million shares outstanding and a strong management team and board with both gold exploration and production experience. Viva is building market awareness as the Company advances the high-grade Tonopah Gold Project. For additional information on Viva Gold and the Tonopah Gold Project, please visit our website: www.vivagoldcorp.com.

For further information please contact:

James Hesketh, President & CEO

(720) 291-1775

jhesketh@vivagoldcorp.com

Valerie Kimball, Director Investor Relations

(720) 933-1150

vkimball@vivagoldcorp.com

Renmark Financial Communications Inc.

Daniel Gordon: dgordon@renmarkfinancial.com

Tel: (416) 644-2020 or (212) 812-7680

www.renmarkfinancial.com

Forward-Looking Information:

This news release contains certain information that may constitute forward-looking information or forward-looking statements under applicable Canadian securities legislation (collectively, "forward-looking information"), including but not limited to drilling operations and estimates of gold mineral resource at the Tonopah Gold Project. This forward-looking information entails various risks and uncertainties that are based on current expectations, and actual results may differ materially from those contained in such information. These uncertainties and risks include, but are not limited to, the strength of the global economy, inflationary pressures, pandemics, and permitting issues related to ESG initiatives; the price of gold; operational, funding and liquidity risks; the potential for achieving targeted drill results, the degree to which mineral resource estimates are reflective of actual mineral resources; the degree to which factors which would make a mineral deposit commercially viable are present; the risks and hazards associated with drilling and mining operations; and the ability of Viva to fund its capital requirements. Risks and uncertainties about the Company's business are more fully discussed in the Company's disclosure materials filed with the securities regulatory authorities in Canada available at www.sedar.com. Readers are urged to read these materials. Viva assumes no obligation to update any forward-looking information or to update the reasons why actual results could differ from such information unless required by law.

Cautionary Note to U.S. Investors --- The United States Securities and Exchange Commission permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this report, such as "measured," "indicated," "inferred," and "resources," that the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Viva Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/672283/Viva-Gold-Drills-122-Meters-at-57gt-Gold-and-229-Meters-at-20gt-at-its-Tonopah-Gold-Project-in-Nevada