Solar tracker company Nextpower (NASDAQ: NXT) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 33.9% year on year to $909.4 million. The company expects the full year’s revenue to be around $3.46 billion, close to analysts’ estimates. Its non-GAAP profit of $1.10 per share was 17.1% above analysts’ consensus estimates.

Is now the time to buy Nextpower? Find out by accessing our full research report, it’s free.

Nextpower (NXT) Q4 CY2025 Highlights:

- Revenue: $909.4 million vs analyst estimates of $813.8 million (33.9% year-on-year growth, 11.7% beat)

- Adjusted EPS: $1.10 vs analyst estimates of $0.94 (17.1% beat)

- Adjusted EBITDA: $213.6 million vs analyst estimates of $179.8 million (23.5% margin, 18.8% beat)

- The company lifted its revenue guidance for the full year to $3.46 billion at the midpoint from $3.38 billion, a 2.6% increase

- Management raised its full-year Adjusted EPS guidance to $4.31 at the midpoint, a 4% increase

- EBITDA guidance for the full year is $820 million at the midpoint, above analyst estimates of $811.2 million

- Operating Margin: 19.4%, down from 22.1% in the same quarter last year

- Free Cash Flow Margin: 13%, down from 19.9% in the same quarter last year

- Market Capitalization: $15.92 billion

Company Overview

With its technology playing a key role in the massive 1.2 gigawatt Noor Abu Dhabi solar farm project, Nextpower (NASDAQ: NXT) is a provider of solar tracker systems that help solar panels follow the sun.

Revenue Growth

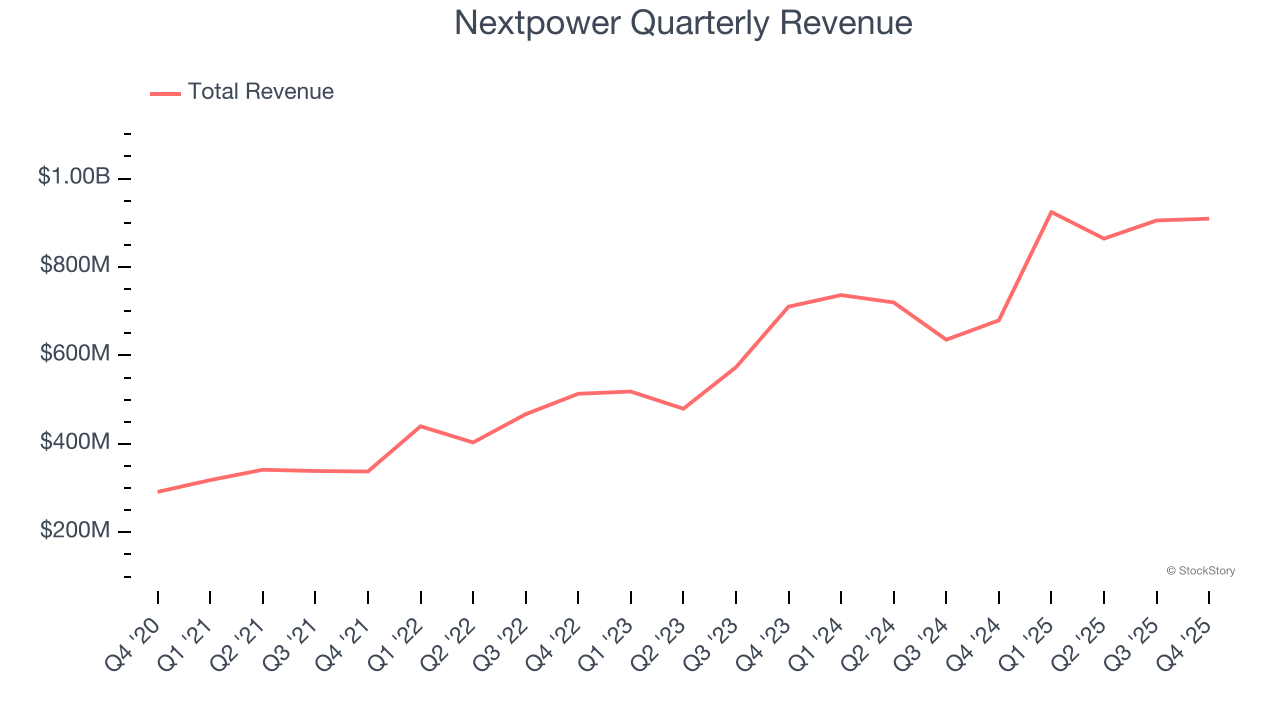

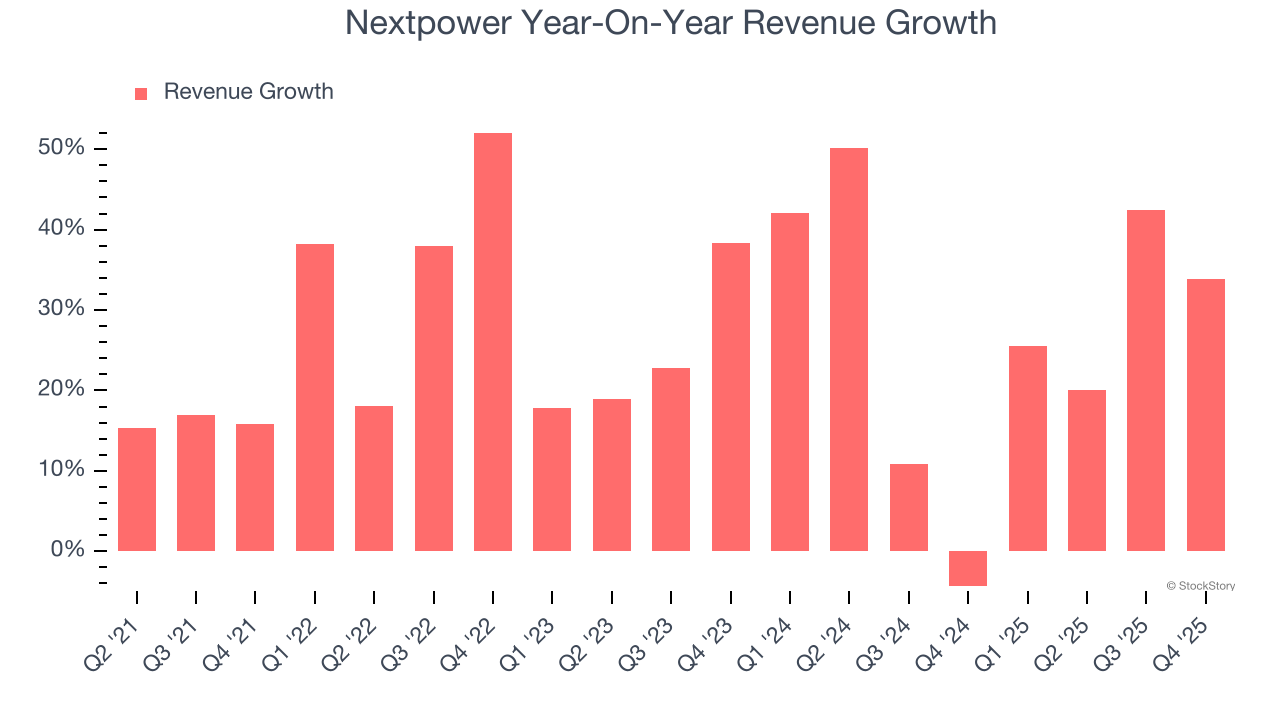

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Nextpower’s sales grew at an incredible 25% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Nextpower’s annualized revenue growth of 25.7% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Nextpower reported wonderful year-on-year revenue growth of 33.9%, and its $909.4 million of revenue exceeded Wall Street’s estimates by 11.7%.

Looking ahead, sell-side analysts expect revenue to grow 2.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

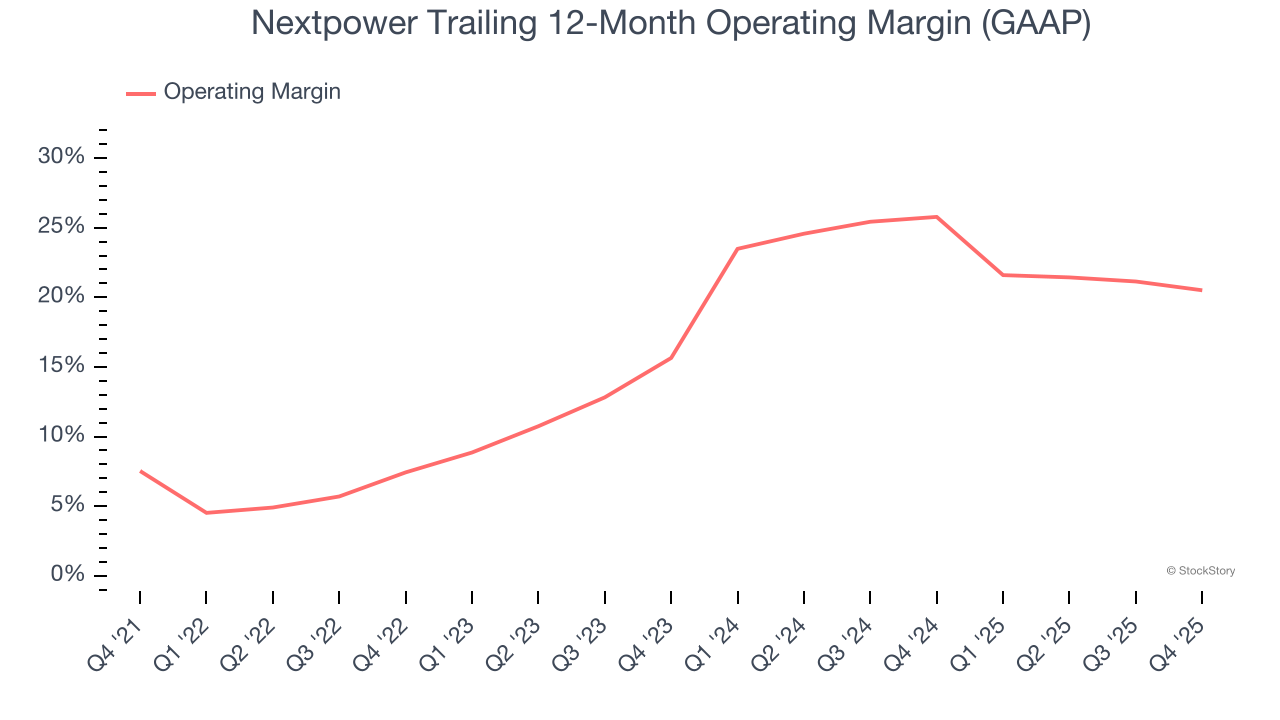

Nextpower has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Nextpower’s operating margin rose by 13 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q4, Nextpower generated an operating margin profit margin of 19.4%, down 2.7 percentage points year on year. Since Nextpower’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

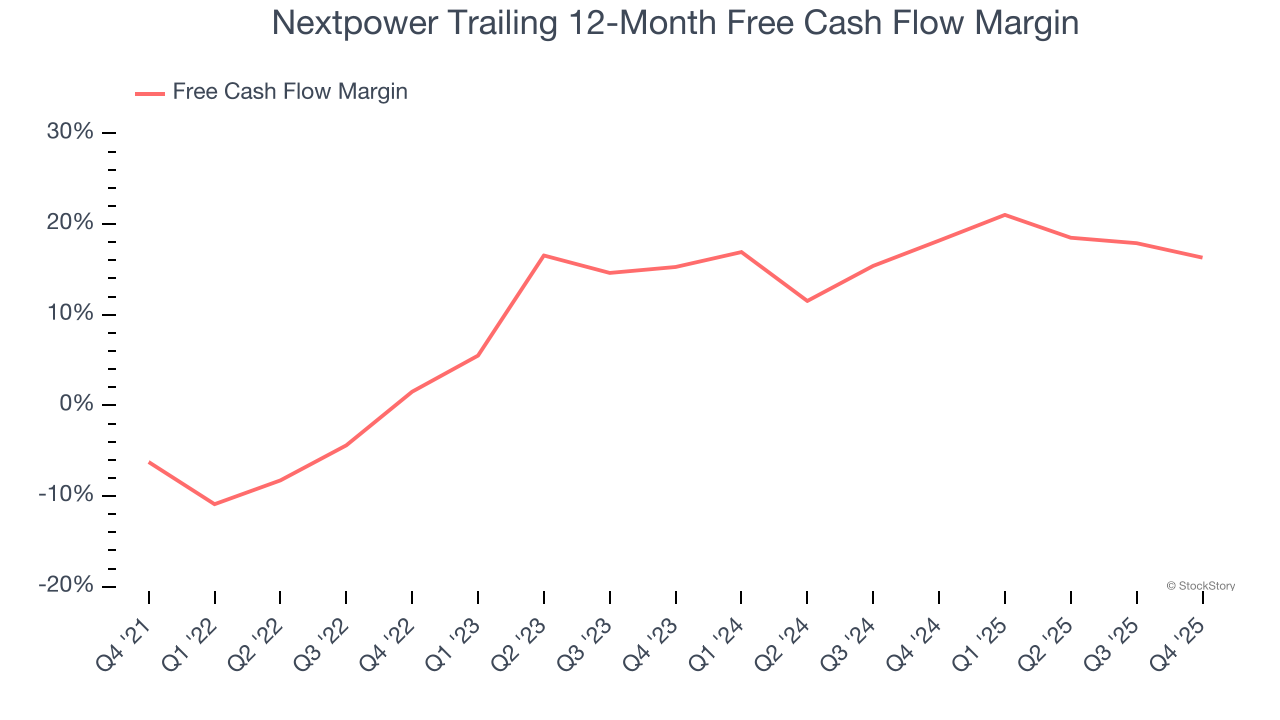

Nextpower has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 11.7% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Nextpower’s margin expanded by 22.5 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Nextpower’s free cash flow clocked in at $118.5 million in Q4, equivalent to a 13% margin. The company’s cash profitability regressed as it was 6.8 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

Key Takeaways from Nextpower’s Q4 Results

We were impressed by how significantly Nextpower blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 5.4% to $111.60 immediately after reporting.

Indeed, Nextpower had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).