Fulton Financial has been treading water for the past six months, recording a small return of 4.3% while holding steady at $19.33. The stock also fell short of the S&P 500’s 11.2% gain during that period.

Is there a buying opportunity in Fulton Financial, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Fulton Financial Not Exciting?

We're sitting this one out for now. Here are three reasons why FULT doesn't excite us and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

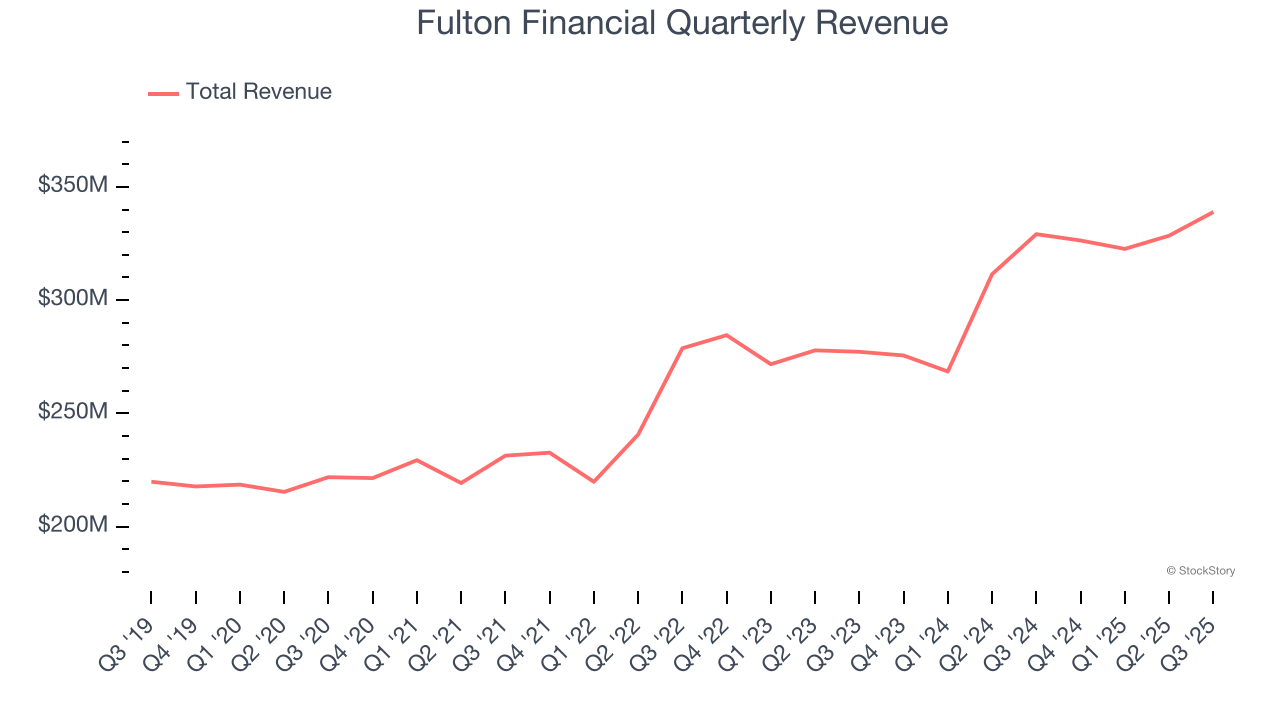

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

Unfortunately, Fulton Financial’s 8.5% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the banking sector.

2. Efficiency Ratio Expected to Falter

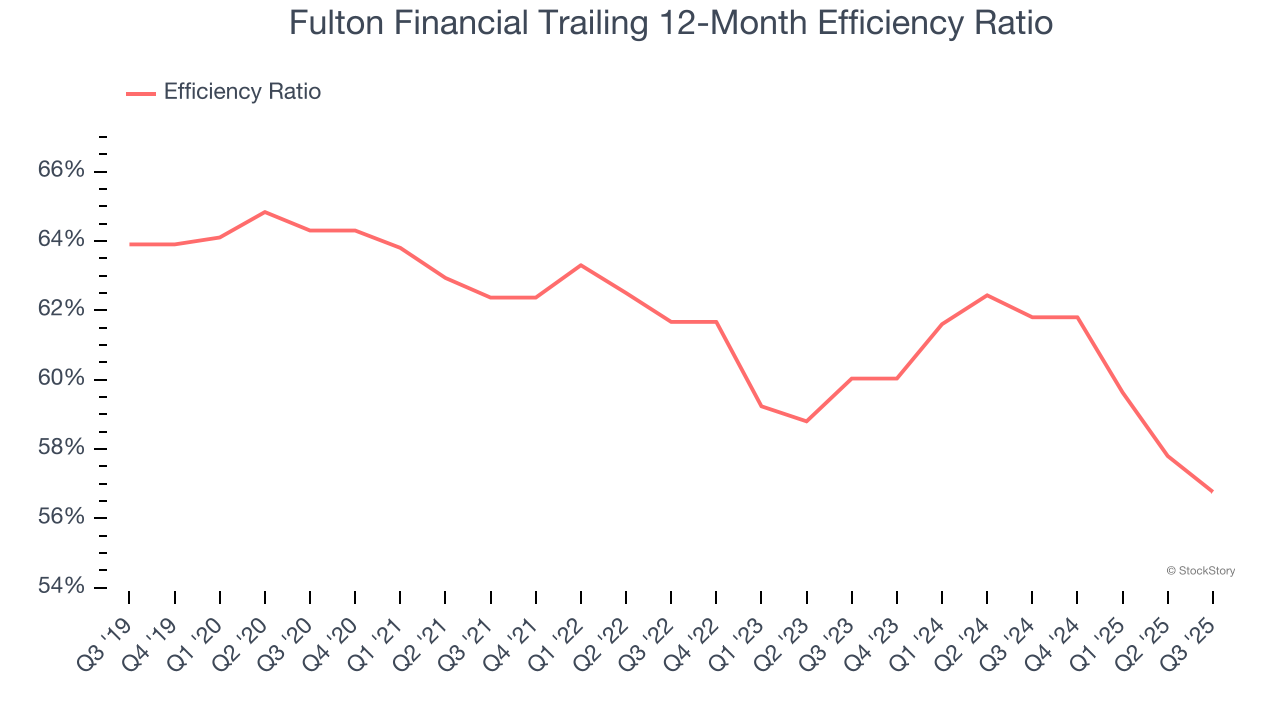

Topline growth alone doesn't tell the complete story - the profitability of that growth shapes actual earnings impact. Banks track this dynamic through efficiency ratios, which compare non-interest expenses such as personnel, rent, IT, and marketing costs to total revenue streams.

Investors focus on efficiency ratio changes rather than absolute levels, understanding that expense structures vary by revenue mix. Counterintuitively, lower efficiency ratios indicate better performance since they represent lower costs relative to revenue.

For the next 12 months, Wall Street expects Fulton Financial to become less profitable as it anticipates an efficiency ratio of 59.8% compared to 56.8% over the past year.

3. Projected TBVPS Growth Is Slim

Tangible book value per share (TBVPS) growth comes from a bank’s ability to profitably lend while maintaining prudent risk management and efficient operations.

Over the next 12 months, Consensus estimates call for Fulton Financial’s TBVPS to grow by 9.1% to $15.70, paltry growth rate.

Final Judgment

Fulton Financial isn’t a terrible business, but it isn’t one of our picks. With its shares lagging the market recently, the stock trades at 1.1× forward P/B (or $19.33 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.