WaFd Bank has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 13.8% to $31.55 per share while the index has gained 17.7%.

Is there a buying opportunity in WaFd Bank, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is WaFd Bank Not Exciting?

We're cautious about WaFd Bank. Here are three reasons there are better opportunities than WAFD and a stock we'd rather own.

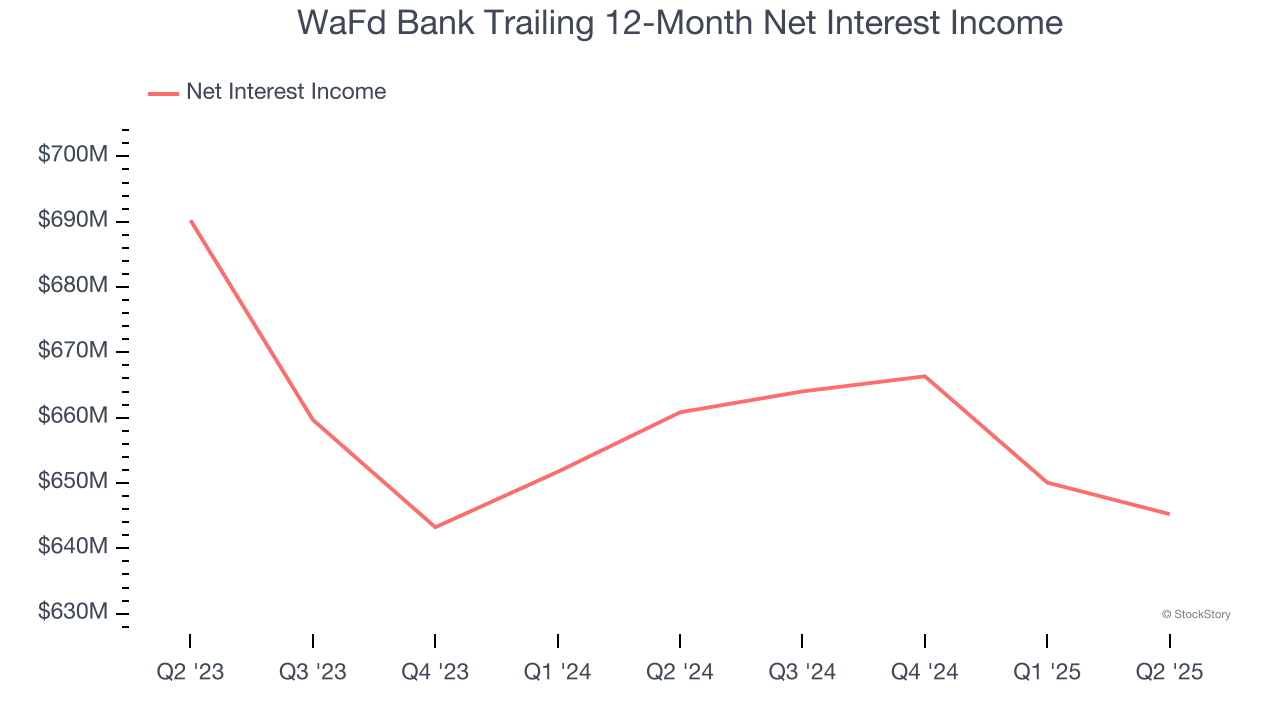

1. Net Interest Income Points to Soft Demand

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

WaFd Bank’s net interest income has grown at a 7% annualized rate over the last five years, slightly worse than the broader banking industry and in line with its total revenue.

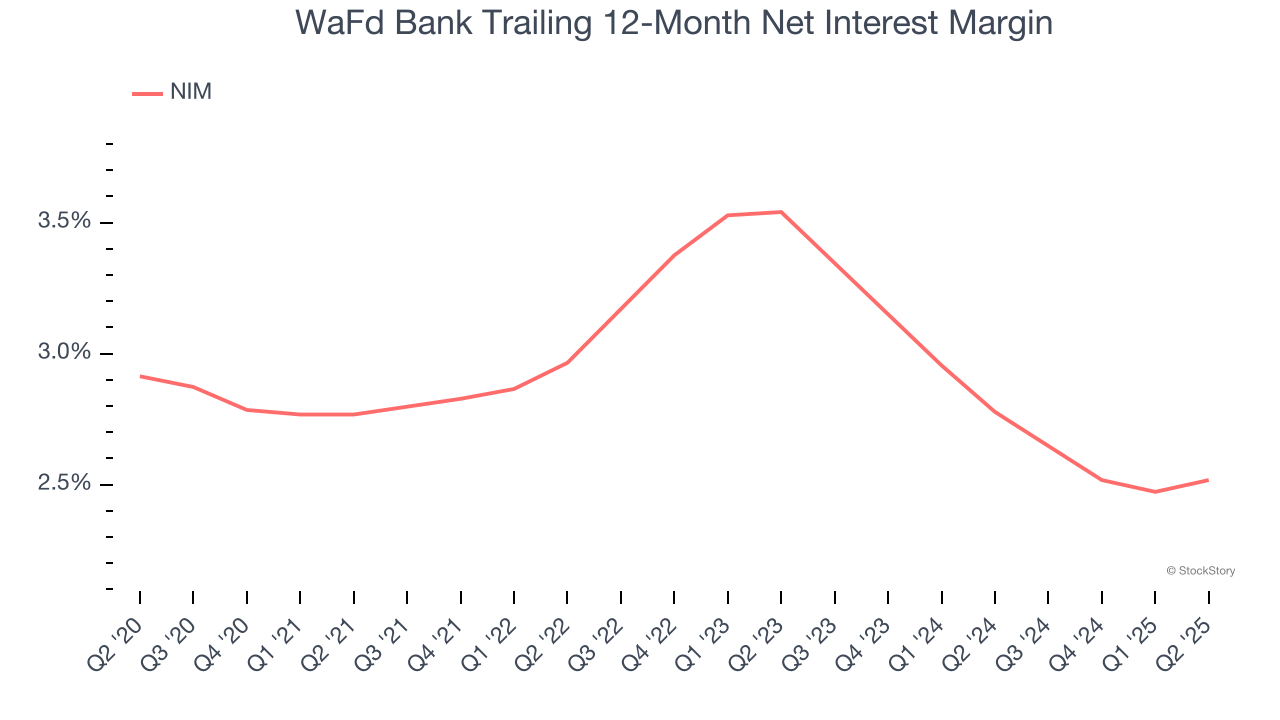

2. Net Interest Margin Dropping

Net interest margin (NIM) represents how much a bank earns in relation to its outstanding loans. It's one of the most important metrics to track because it shows how a bank's loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, WaFd Bank’s net interest margin averaged 2.6%. Its margin also contracted from 3.5% to 2.5% over that period.

This decline was a headwind for its net interest income. While prevailing rates are a major determinant of net interest margin changes over time, the decline could mean that WaFd Bank either faced competition for loans and deposits or experienced a negative mix shift in its balance sheet composition.

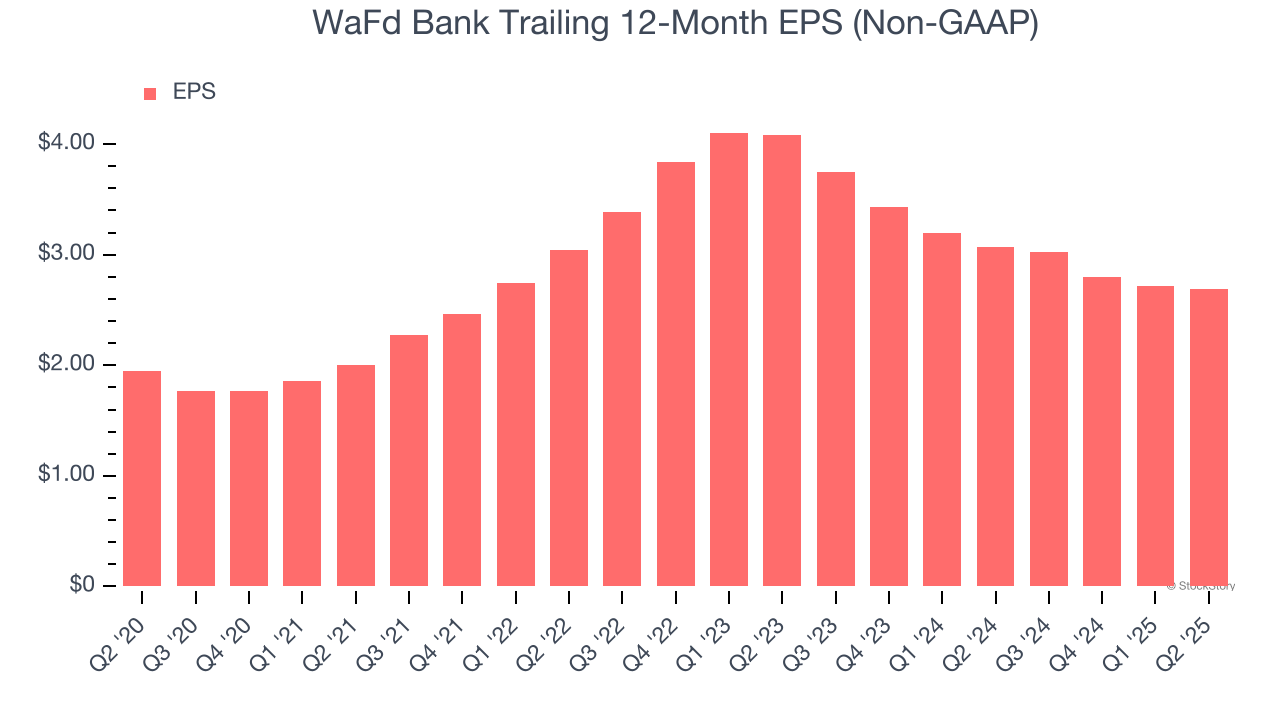

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for WaFd Bank, its EPS declined by more than its revenue over the last two years, dropping 18.8%. This tells us the company struggled to adjust to shrinking demand.

Final Judgment

WaFd Bank isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 0.9× forward P/B (or $31.55 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere. Let us point you toward the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.