Universal Health Services has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 14.5% to $190.79 per share while the index has gained 17.7%.

Is now the time to buy Universal Health Services, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Universal Health Services Not Exciting?

We're swiping left on Universal Health Services for now. Here are three reasons you should be careful with UHS and a stock we'd rather own.

1. Same-Store Sales Falling Behind Peers

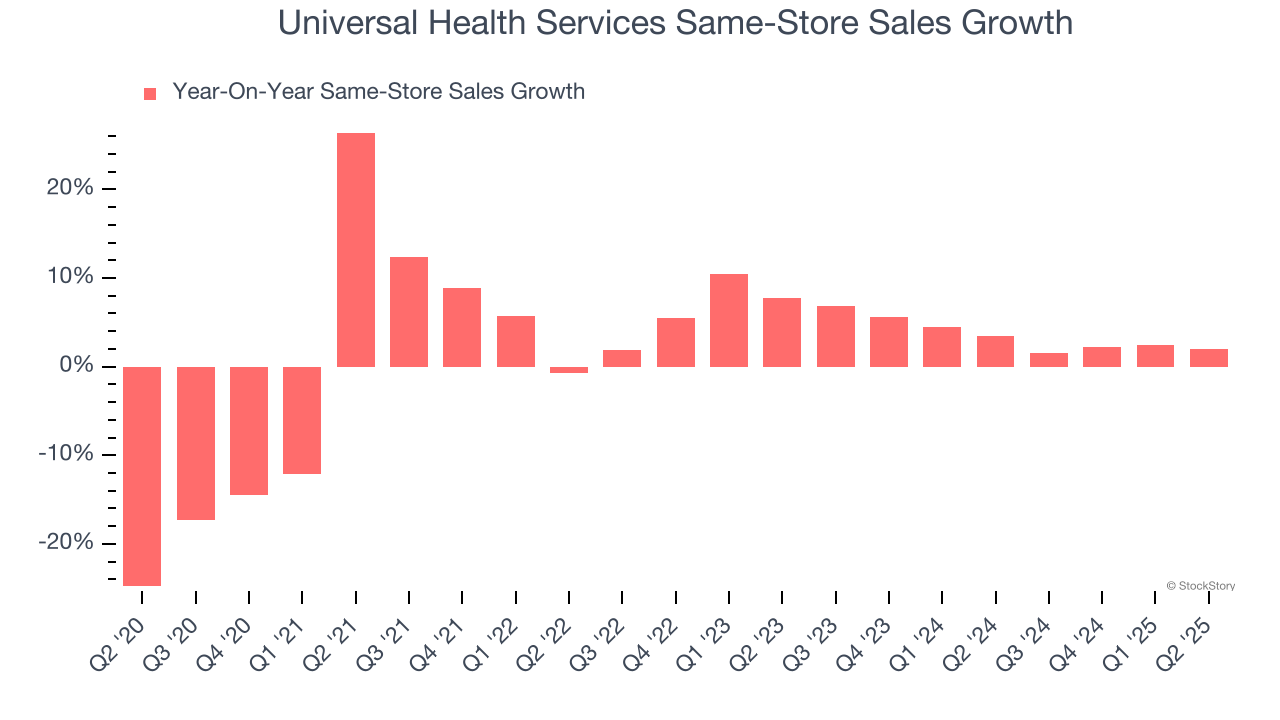

In addition to reported revenue, same-store sales are a useful data point for analyzing Hospital Chains companies. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into Universal Health Services’s underlying demand characteristics.

Over the last two years, Universal Health Services’s same-store sales averaged 3.6% year-on-year growth. This performance slightly lagged the sector and suggests it might have to change its strategy or pricing, which can disrupt operations.

2. Shrinking Adjusted Operating Margin

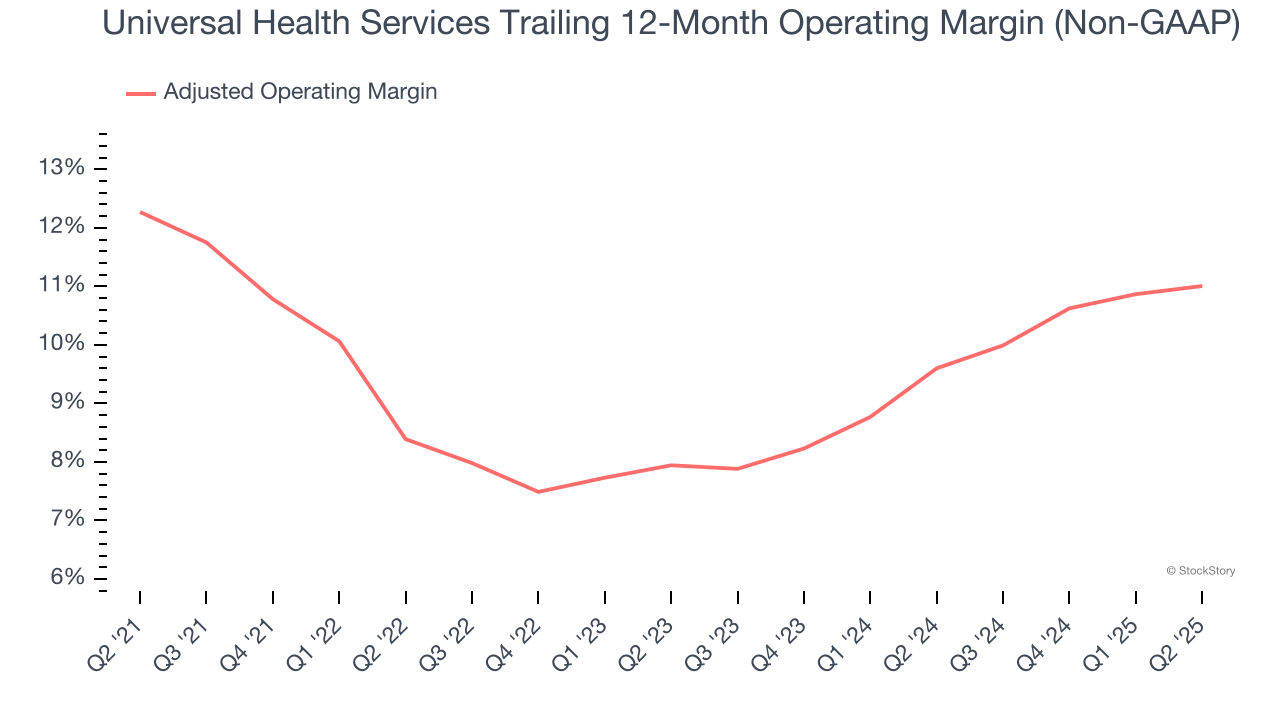

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Looking at the trend in its profitability, Universal Health Services’s adjusted operating margin decreased by 1.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Universal Health Services’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its adjusted operating margin for the trailing 12 months was 11%.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

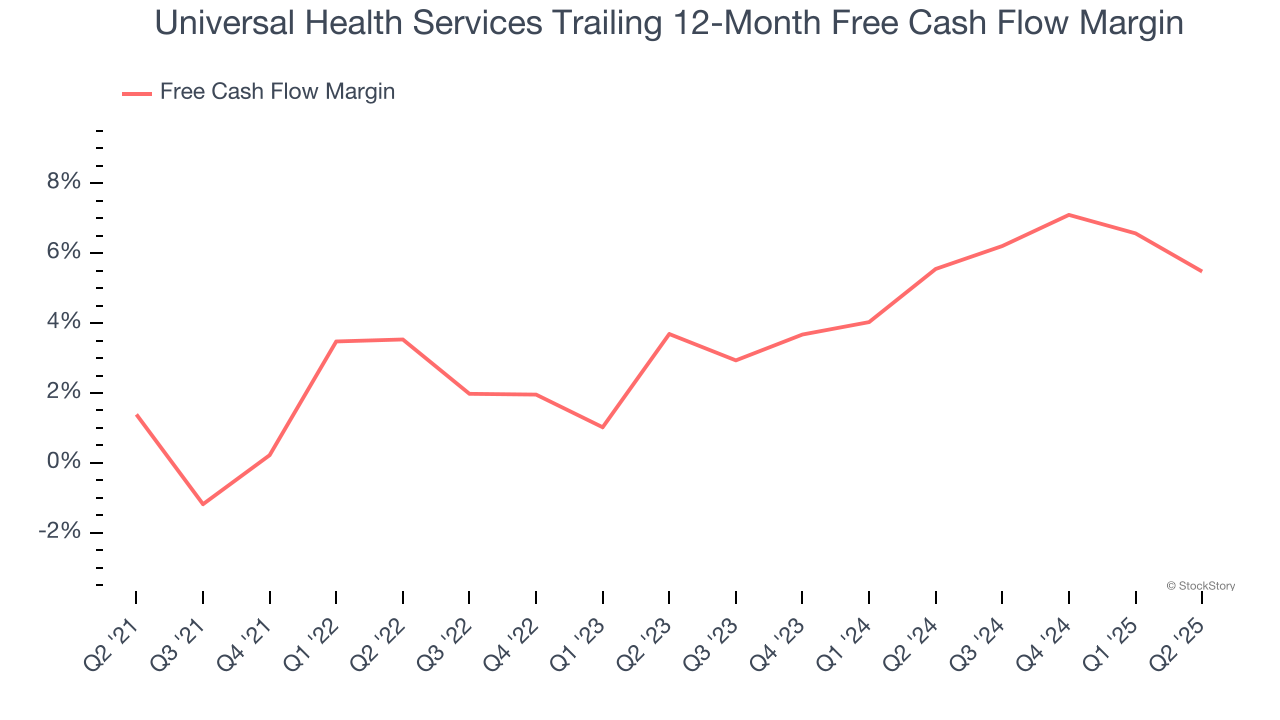

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Universal Health Services has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.1%, subpar for a healthcare business.

Final Judgment

Universal Health Services isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 9.4× forward P/E (or $190.79 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. We’d recommend looking at the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Universal Health Services

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.