Wrapping up Q2 earnings, we look at the numbers and key takeaways for the diversified banks stocks, including PNC Financial Services Group (NYSE: PNC) and its peers.

At their core, diversified banks take in deposits and engage in various forms of lending, which means revenue is generated through interest rate spreads (difference between loan and deposit rates) and fees. Other revenue comes from adjacent services such as wealth management, card and account fees, and products such as annuities. These institutions benefit from rising interest rates that improve NIMs (net interest margins), digital transformation reducing operational costs, and expanding wealth management services as populations age. However, they face headwinds including fintech competition disrupting traditional models (how disruptive is crypto?), stringent regulatory requirements increasing compliance costs, and cybersecurity threats requiring substantial technology investments. Economic downturns also pose risks through potential loan defaults and compressed margins during accommodative monetary policy periods.

The 7 diversified banks stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.4%.

Thankfully, share prices of the companies have been resilient as they are up 5.1% on average since the latest earnings results.

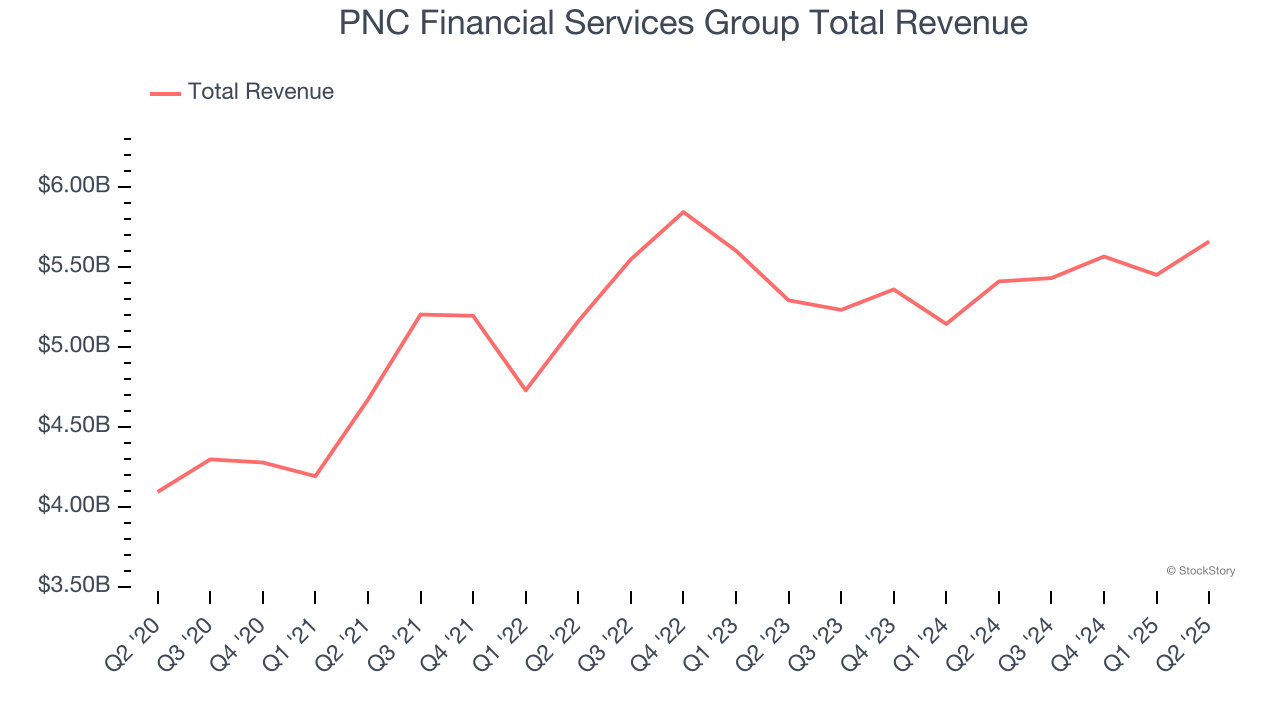

PNC Financial Services Group (NYSE: PNC)

Tracing its roots back to 1852 when Pittsburgh's industrial boom demanded stronger financial institutions, PNC (NYSE: PNC) is a diversified financial institution that provides retail banking, corporate banking, and asset management services through a coast-to-coast branch network.

PNC Financial Services Group reported revenues of $5.66 billion, up 4.6% year on year. This print exceeded analysts’ expectations by 1.3%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ tangible book value per share estimates and a beat of analysts’ EPS estimates.

Interestingly, the stock is up 6.3% since reporting and currently trades at $204.23.

Is now the time to buy PNC Financial Services Group? Access our full analysis of the earnings results here, it’s free.

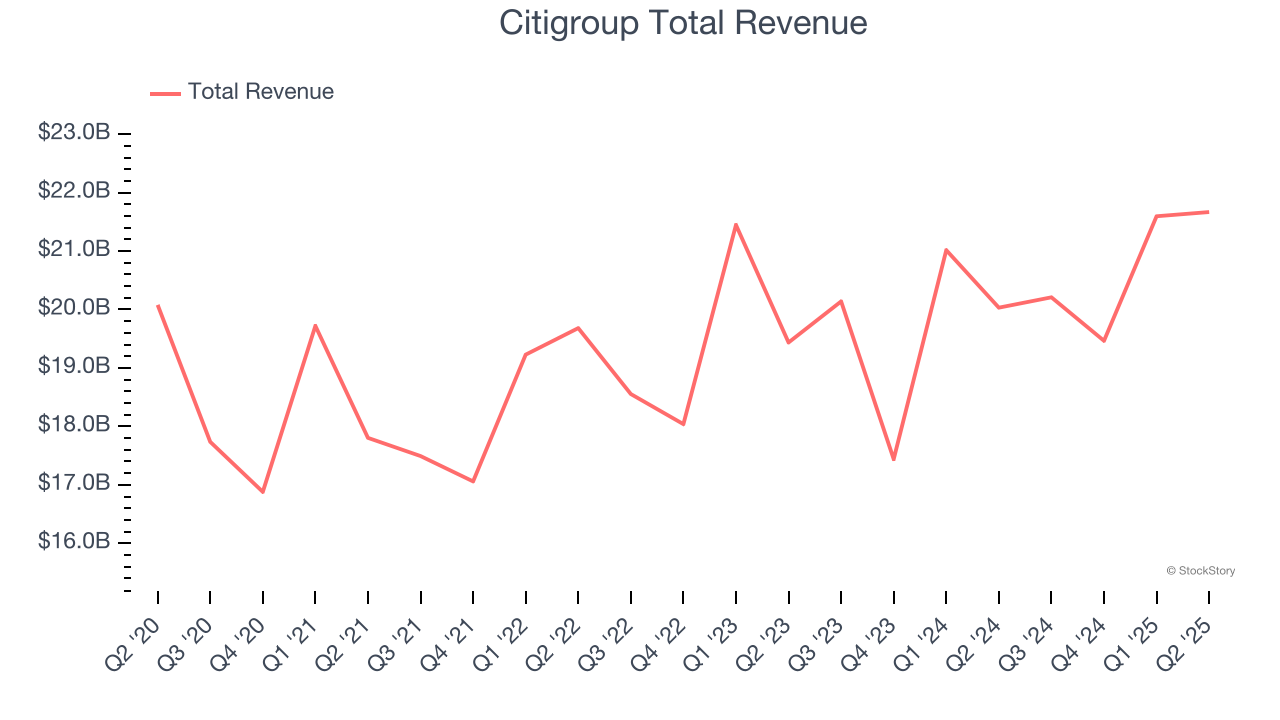

Best Q2: Citigroup (NYSE: C)

With operations in nearly 160 countries and a history dating back to 1812, Citigroup (NYSE: C) is a global financial services company that provides banking, investment, wealth management, and payment solutions to consumers, corporations, and governments.

Citigroup reported revenues of $21.67 billion, up 8.2% year on year, outperforming analysts’ expectations by 3.5%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ net interest income estimates.

Citigroup scored the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 9.6% since reporting. It currently trades at $95.85.

Is now the time to buy Citigroup? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: U.S. Bancorp (NYSE: USB)

With roots dating back to 1863 and a presence across 26 states primarily in the Midwest and West, U.S. Bancorp (NYSE: USB) is one of America's largest banks providing lending, deposit services, wealth management, payment processing, and merchant services to individuals and businesses.

U.S. Bancorp reported revenues of $6.98 billion, up 2% year on year, falling short of analysts’ expectations by 0.7%. It was a slower quarter as it posted a miss of analysts’ net interest income estimates and a miss of analysts’ tangible book value per share estimates.

U.S. Bancorp delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 6.3% since the results and currently trades at $48.57.

Read our full analysis of U.S. Bancorp’s results here.

JPMorgan Chase (NYSE: JPM)

Tracing its roots back to 1799 when its earliest predecessor was founded by Aaron Burr, JPMorgan Chase (NYSE: JPM) is a leading financial services company offering investment banking, consumer banking, commercial banking, and asset management services globally.

JPMorgan Chase reported revenues of $44.91 billion, down 10.5% year on year. This number surpassed analysts’ expectations by 2.9%. Zooming out, it was a satisfactory quarter as it also recorded a beat of analysts’ EPS estimates.

JPMorgan Chase had the slowest revenue growth among its peers. The stock is up 3.5% since reporting and currently trades at $298.81.

Read our full, actionable report on JPMorgan Chase here, it’s free.

Wells Fargo (NYSE: WFC)

Founded during the California Gold Rush in 1852 to provide banking and express delivery services to miners and merchants, Wells Fargo (NYSE: WFC) is a diversified financial services company that provides banking, lending, investment, and wealth management services to individuals and businesses.

Wells Fargo reported revenues of $20.82 billion, flat year on year. This print topped analysts’ expectations by 0.8%. Taking a step back, it was a mixed quarter as it also produced a beat of analysts’ EPS estimates but a slight miss of analysts’ net interest income estimates.

The stock is down 2% since reporting and currently trades at $81.71.

Read our full, actionable report on Wells Fargo here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.