Water handling and recycling company Aris Water (NYSE: ARIS) announced better-than-expected revenue in Q2 CY2025, with sales up 22.7% year on year to $124.1 million. Its non-GAAP profit of $0.33 per share was in line with analysts’ consensus estimates.

Is now the time to buy Aris Water? Find out by accessing our full research report, it’s free.

Aris Water (ARIS) Q2 CY2025 Highlights:

- Revenue: $124.1 million vs analyst estimates of $120.4 million (22.7% year-on-year growth, 3.1% beat)

- Adjusted EPS: $0.33 vs analyst estimates of $0.33 (in line)

- Adjusted EBITDA: $54.56 million vs analyst estimates of $54.02 million (44% margin, 1% beat)

- Operating Margin: 21.2%, down from 23.7% in the same quarter last year

- Free Cash Flow was $52.57 million, up from -$22.96 million in the same quarter last year

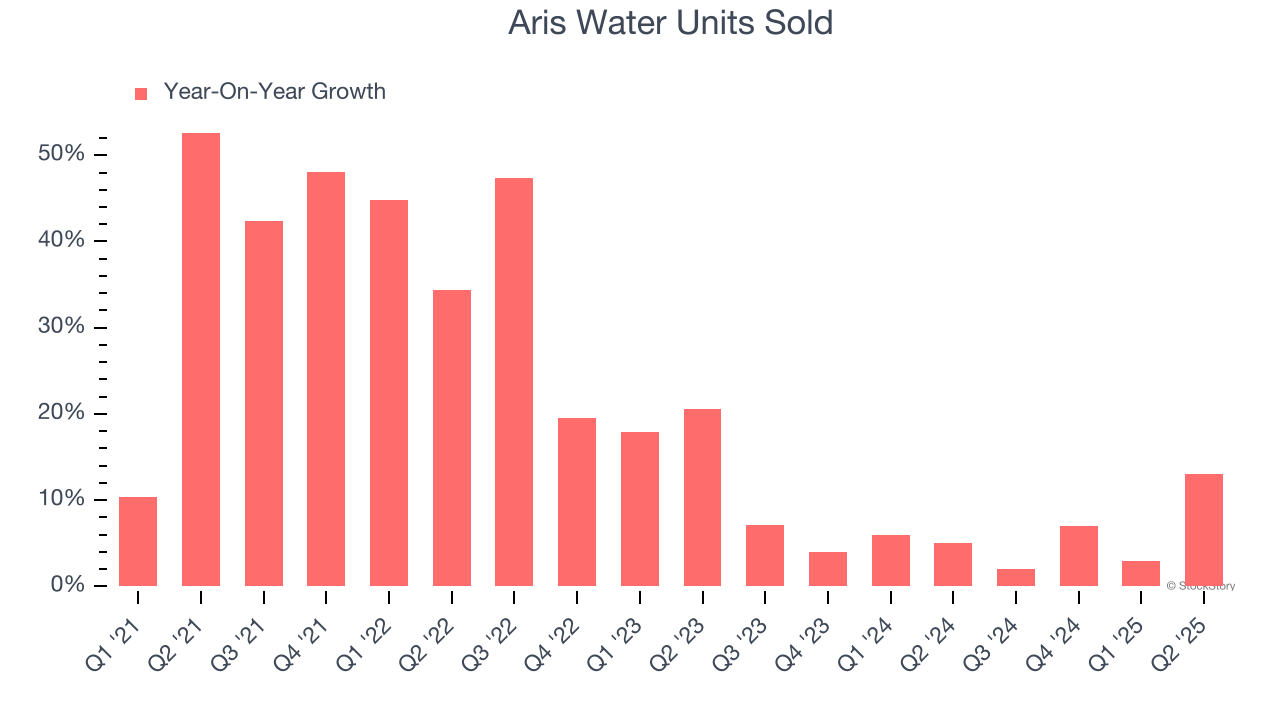

- Sales Volumes rose 13% year on year (5% in the same quarter last year)

- Market Capitalization: $772 million

Company Overview

Primarily serving the oil and gas industry, Aris Water (NYSE: ARIS) is a provider of water handling and recycling solutions.

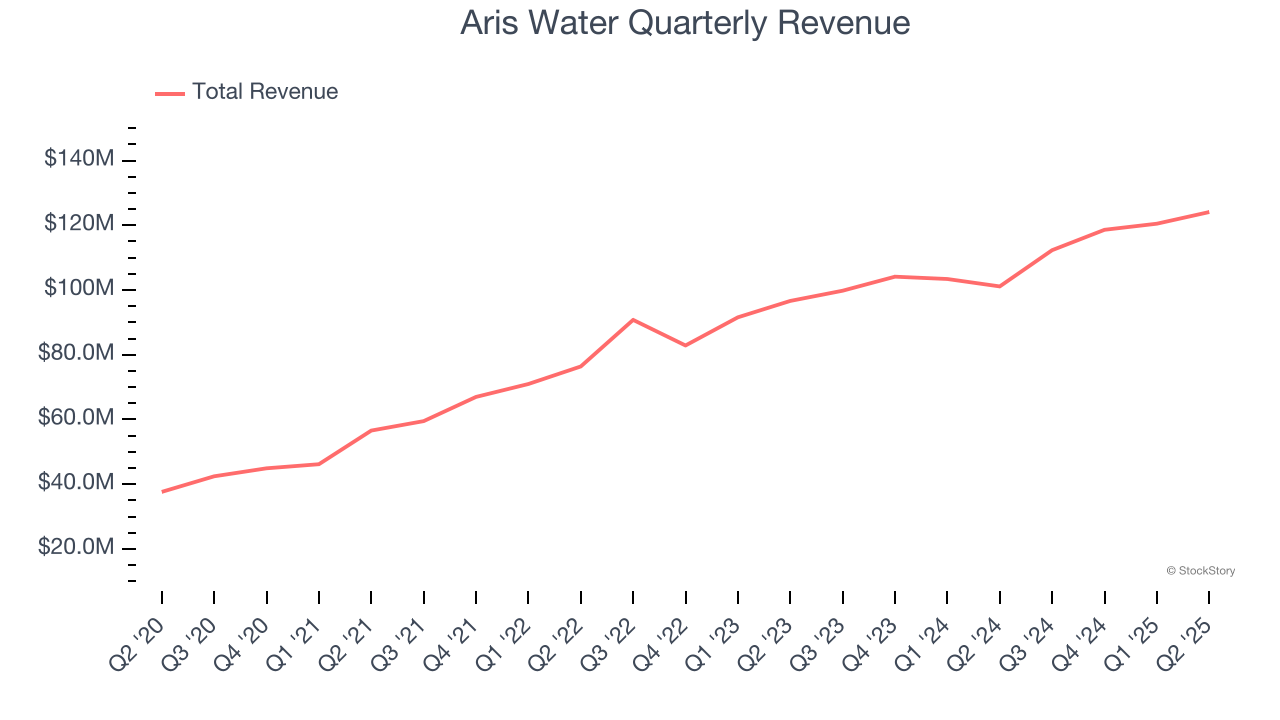

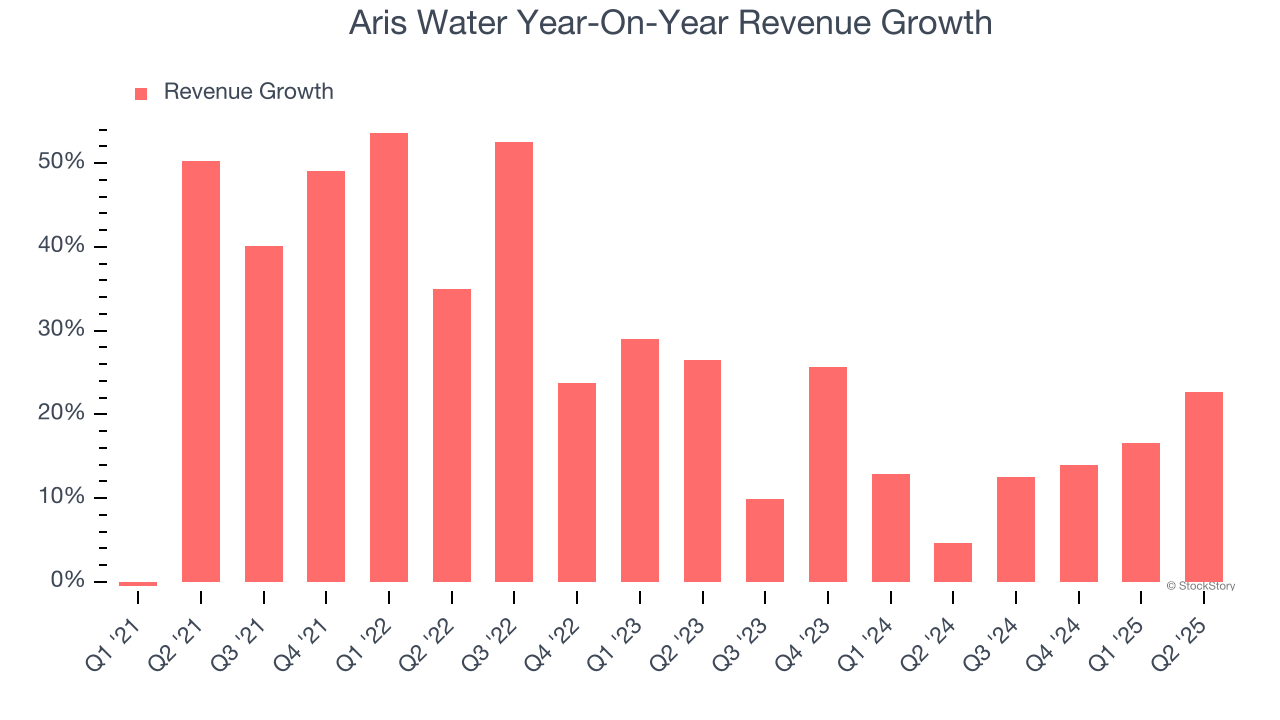

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Aris Water’s sales grew at an incredible 23.8% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Aris Water’s annualized revenue growth of 14.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can better understand the company’s revenue dynamics by analyzing its number of units sold. Over the last two years, Aris Water’s units sold averaged 5.9% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Aris Water reported robust year-on-year revenue growth of 22.7%, and its $124.1 million of revenue topped Wall Street estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to grow 2.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

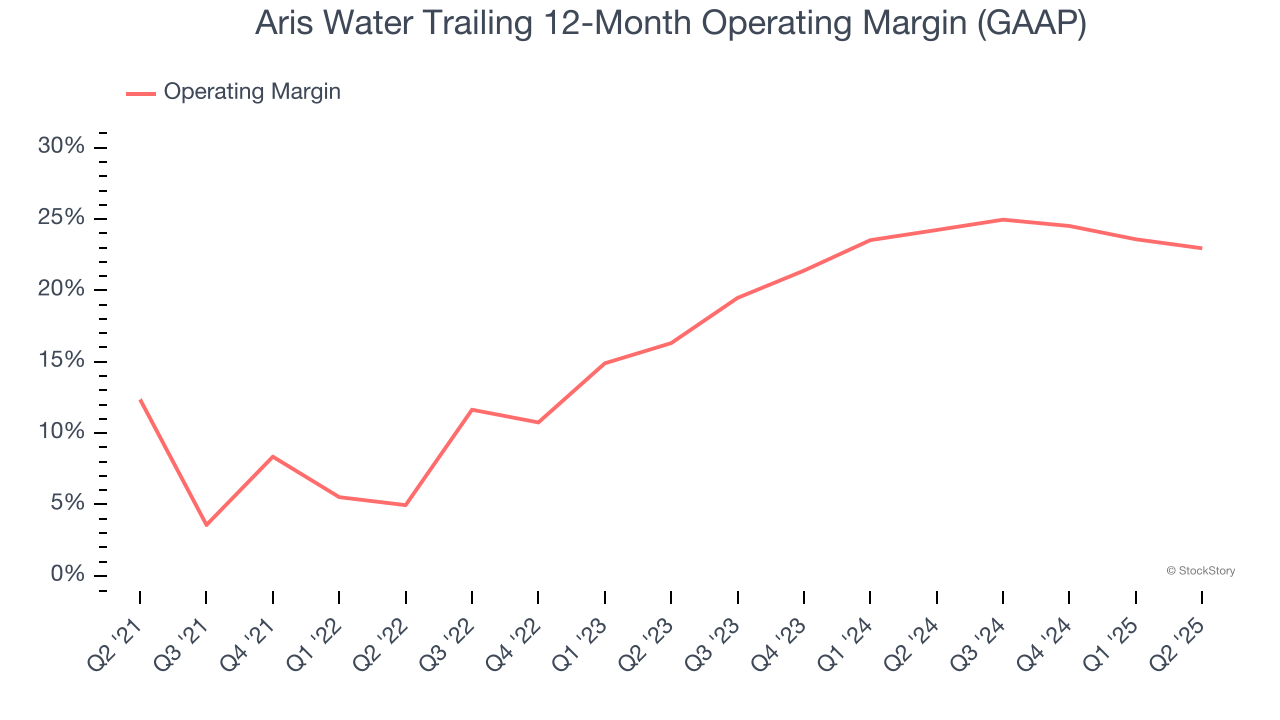

Operating Margin

Aris Water has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Aris Water’s operating margin rose by 10.6 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q2, Aris Water generated an operating margin profit margin of 21.2%, down 2.4 percentage points year on year. Since Aris Water’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

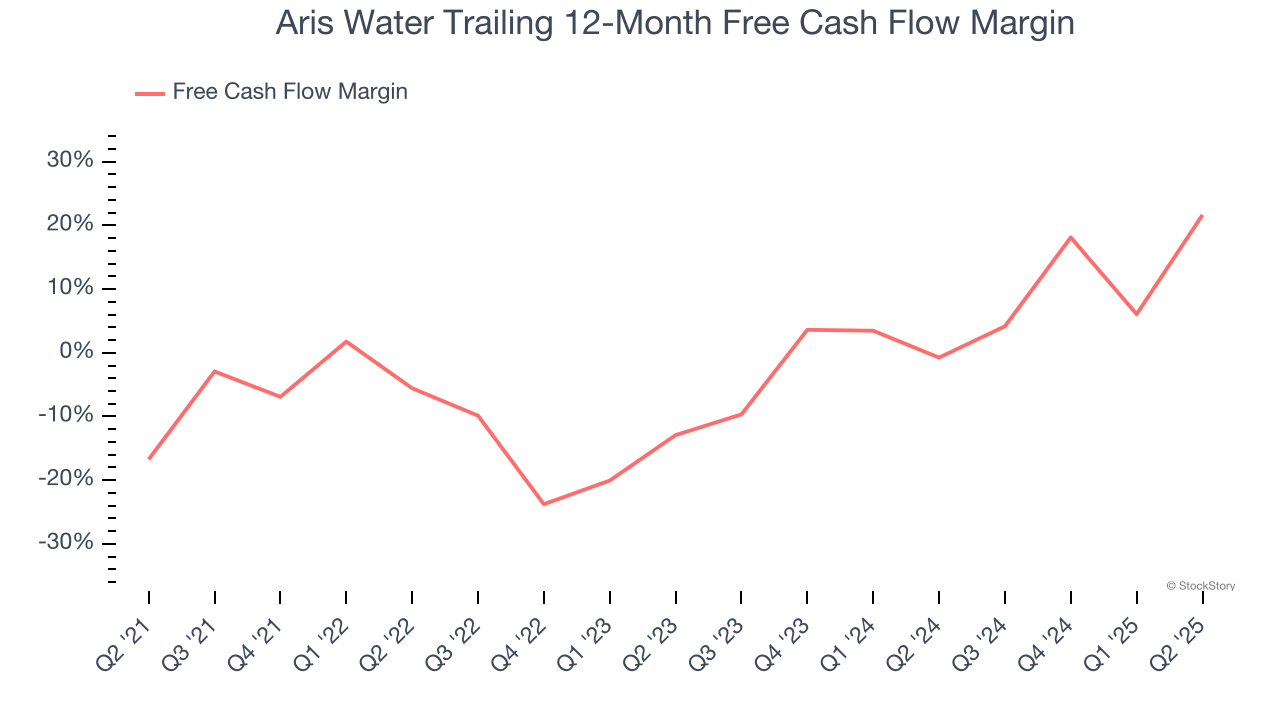

Aris Water broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders. The divergence from its good operating margin stems from its capital-intensive business model, which requires Aris Water to make large cash investments in working capital and capital expenditures.

Taking a step back, an encouraging sign is that Aris Water’s margin expanded by 38.4 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Aris Water’s free cash flow clocked in at $52.57 million in Q2, equivalent to a 42.4% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

Key Takeaways from Aris Water’s Q2 Results

We enjoyed seeing Aris Water beat analysts’ revenue expectations this quarter. We were also happy its EBITDA narrowly outperformed Wall Street’s estimates. On the other hand, its EPS slightly missed. Overall, this print had some key positives. The stock remained flat at $23.50 immediately following the results.

Aris Water had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.