City Holding trades at $127.61 and has moved in lockstep with the market. Its shares have returned 6.8% over the last six months while the S&P 500 has gained 5.4%.

Is now the time to buy CHCO? Find out in our full research report, it’s free.

Why Does City Holding Spark Debate?

With roots dating back to 1957 and a strategic presence along the I-64 and I-81 corridors, City Holding (NASDAQGS:CHCO) operates as a financial holding company providing banking, trust, and investment services through its subsidiary City National Bank across West Virginia, Kentucky, Virginia, and Ohio.

Two Positive Attributes:

1. Net Interest Income Drives Additional Growth Opportunities

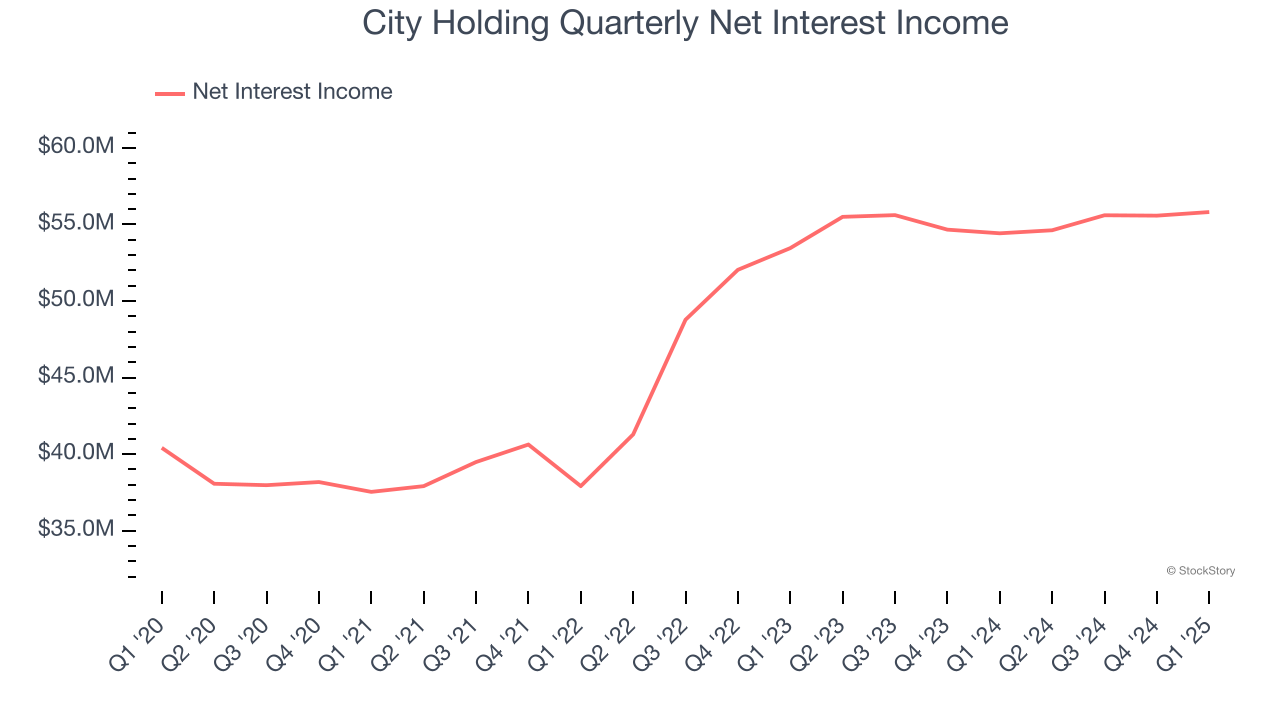

While banks generate revenue from multiple sources, investors view net interest income as the cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of non-interest income.

City Holding’s net interest income has grown at a 9.9% annualized rate over the last four years, a step above the broader bank industry. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

2. Outstanding Long-Term EPS Growth

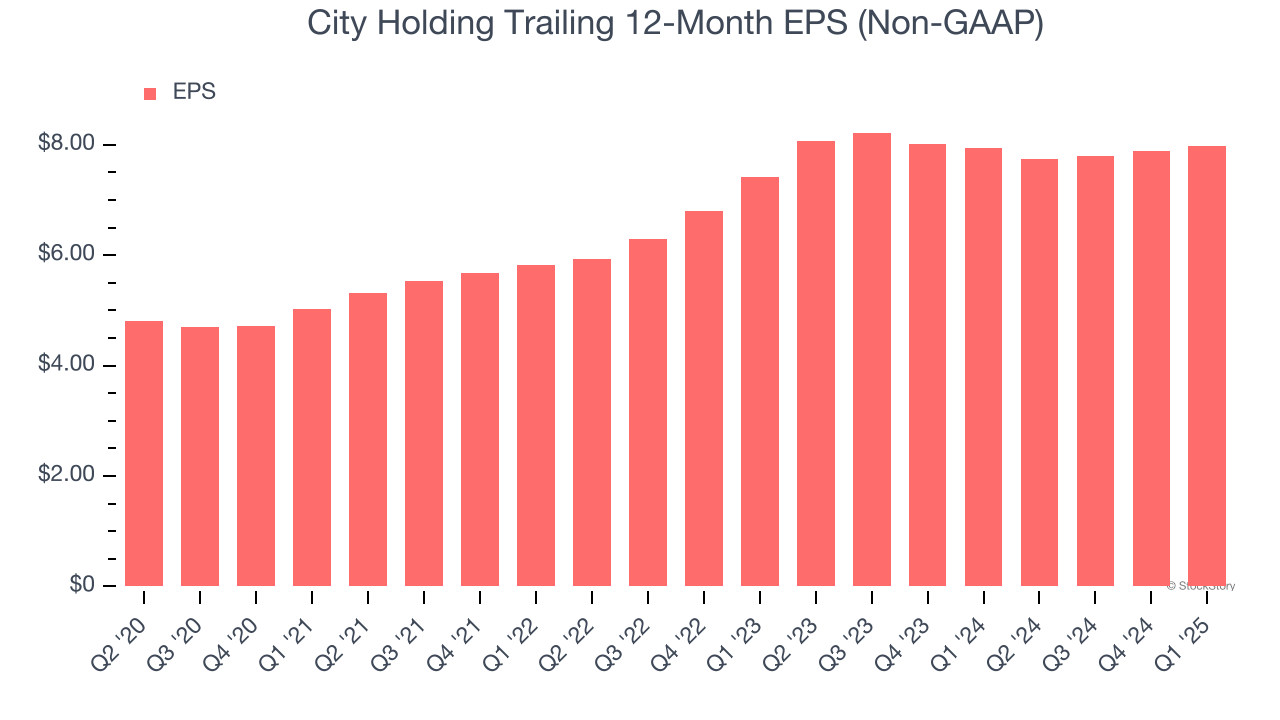

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

City Holding’s EPS grew at an astounding 10.3% compounded annual growth rate over the last five years, higher than its 3.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

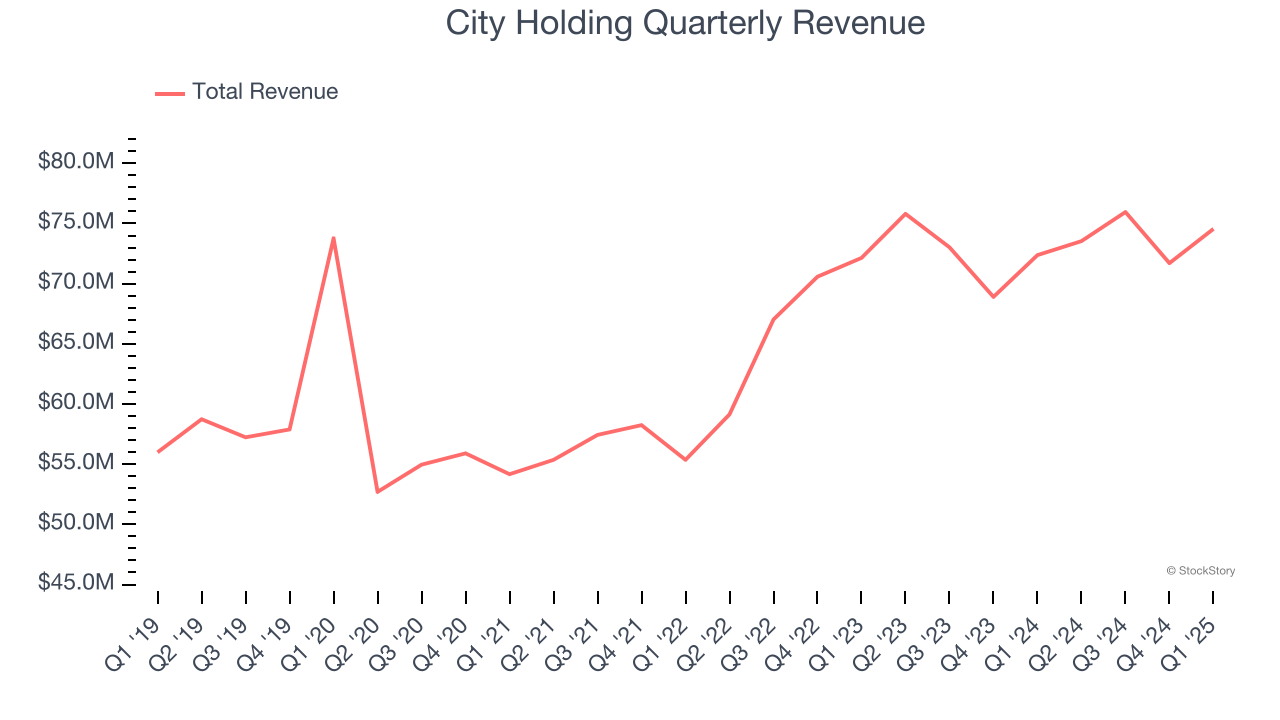

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

Over the last five years, City Holding grew its revenue at a mediocre 3.6% compounded annual growth rate. This wasn’t a great result compared to the rest of the bank sector, but there are still things to like about City Holding.

Final Judgment

City Holding’s positive characteristics outweigh the negatives, but at $127.61 per share (or 2.3× forward P/B), is now the right time to buy the stock? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.