Deere currently trades at $461.71 and has been a dream stock for shareholders. It’s returned 255% since April 2020, nearly tripling the S&P 500’s 91.4% gain. The company has also beaten the index over the past six months as its stock price is up 12.8%.

Is now the time to buy Deere, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

We’re happy investors have made money, but we don't have much confidence in Deere. Here are three reasons why we avoid DE and a stock we'd rather own.

Why Do We Think Deere Will Underperform?

Revolutionizing agriculture with the first self-polishing cast-steel plow in the 1800s, Deere (NYSE: DE) manufactures and distributes advanced agricultural, construction, forestry, and turf care equipment.

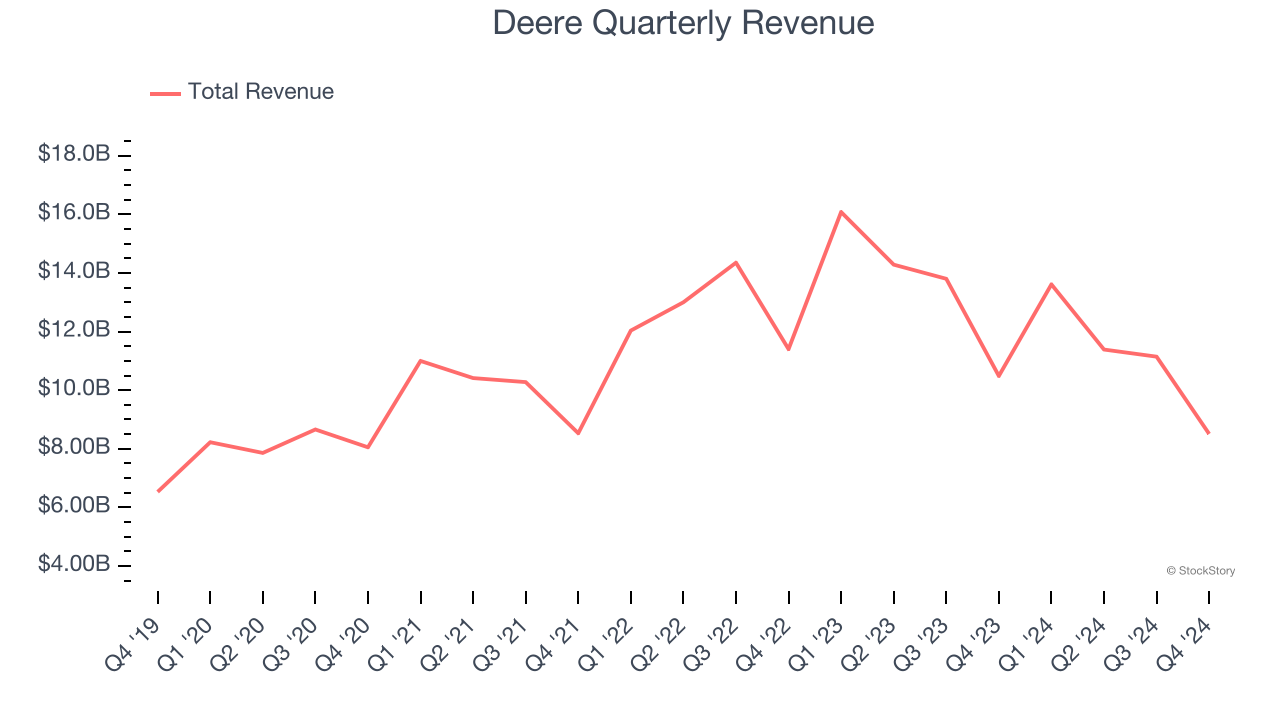

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Deere’s sales grew at a sluggish 3.4% compounded annual growth rate over the last five years. This was below our standard for the industrials sector.

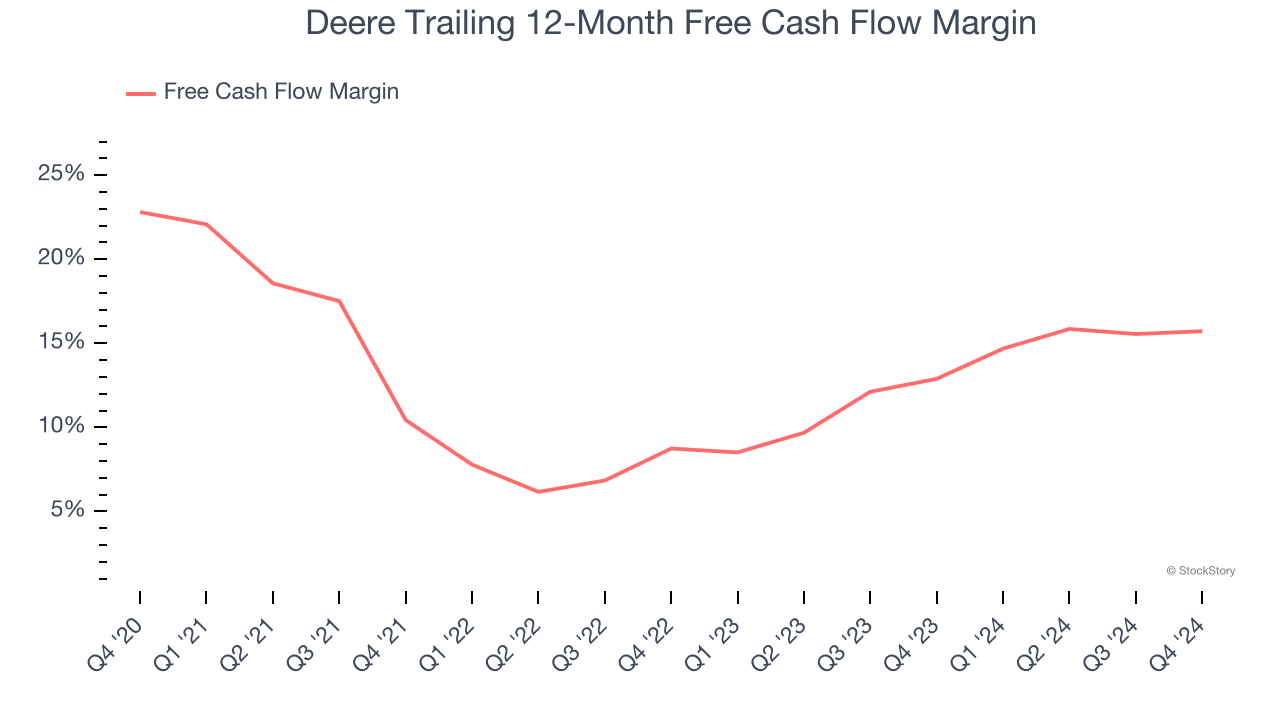

2. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Deere’s margin dropped by 7.1 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. Deere’s free cash flow margin for the trailing 12 months was 15.7%.

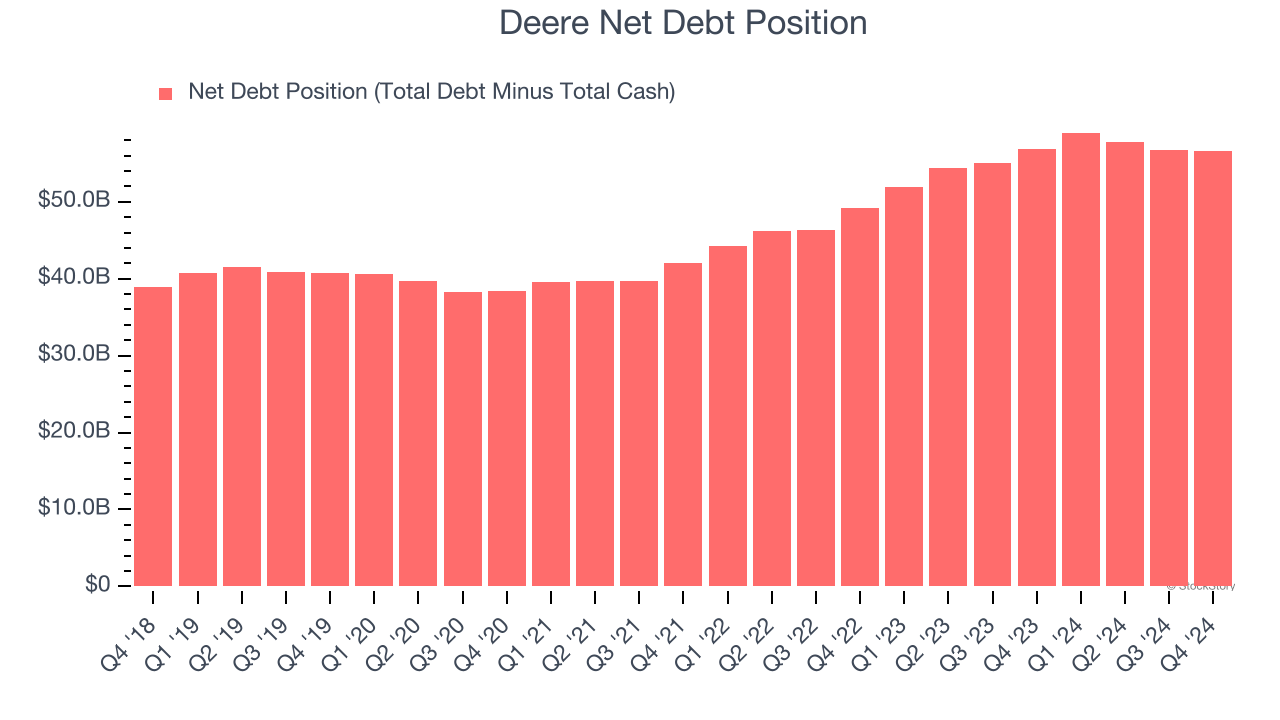

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Deere’s $64.38 billion of debt exceeds the $7.82 billion of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $9.79 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Deere could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Deere can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Deere, we’ll be cheering from the sidelines. With its shares outperforming the market lately, the stock trades at 22.8× forward price-to-earnings (or $461.71 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. Let us point you toward the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Deere

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.