Manufacturing company Leggett & Platt (NYSE: LEG) beat Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 5.3% year on year to $1.06 billion. On the other hand, the company’s full-year revenue guidance of $4.15 billion at the midpoint came in 4.3% below analysts’ estimates. Its non-GAAP profit of $0.21 per share was in line with analysts’ consensus estimates.

Is now the time to buy Leggett & Platt? Find out by accessing our full research report, it’s free.

Leggett & Platt (LEG) Q4 CY2024 Highlights:

- Revenue: $1.06 billion vs analyst estimates of $1.03 billion (5.3% year-on-year decline, 2.8% beat)

- Adjusted EPS: $0.21 vs analyst estimates of $0.20 (in line)

- Management’s revenue guidance for the upcoming financial year 2025 is $4.15 billion at the midpoint, missing analyst estimates by 4.3% and implying -5.3% growth (vs -7.2% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $1.10 at the midpoint, missing analyst estimates by 7.4%

- Operating Margin: 4.1%, up from -32.9% in the same quarter last year

- Free Cash Flow Margin: 9.5%, down from 11% in the same quarter last year

- Market Capitalization: $1.31 billion

President and CEO Karl Glassman commented, "In 2024, we made excellent progress on our strategic priorities, particularly the execution of our restructuring plan, which consistently met or exceeded our expectations. As part of our restructuring activities this year, we realized $22 million in EBIT benefit, generated $20 million in cash proceeds from real estate sales, minimized sales attrition, and kept costs on target. We prioritized balance sheet strength and reduced debt by $126 million. Additionally, we initiated a portfolio evaluation to assess opportunities for long-term growth and determine which businesses are the right long-term fit, through which we continue to explore a potential sale of our Aerospace Group.

Company Overview

Founded in 1883, Leggett & Platt (NYSE: LEG) is a diversified manufacturer of products and components for various industries.

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

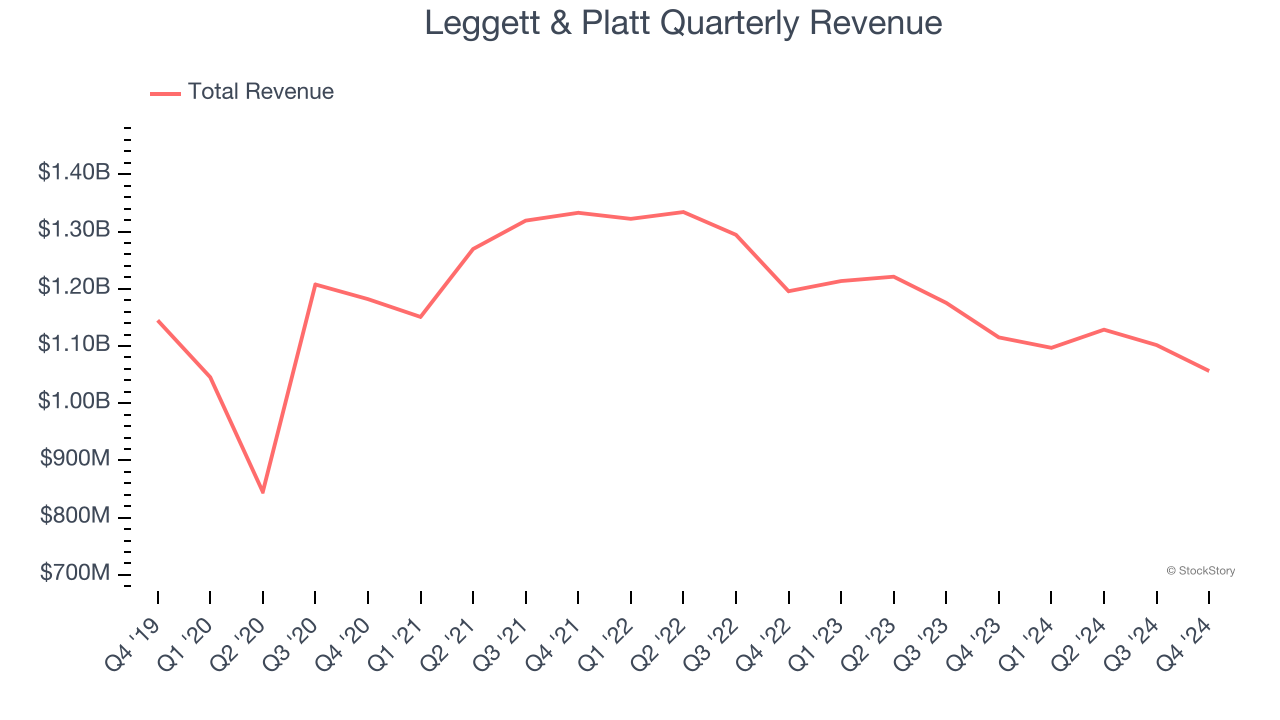

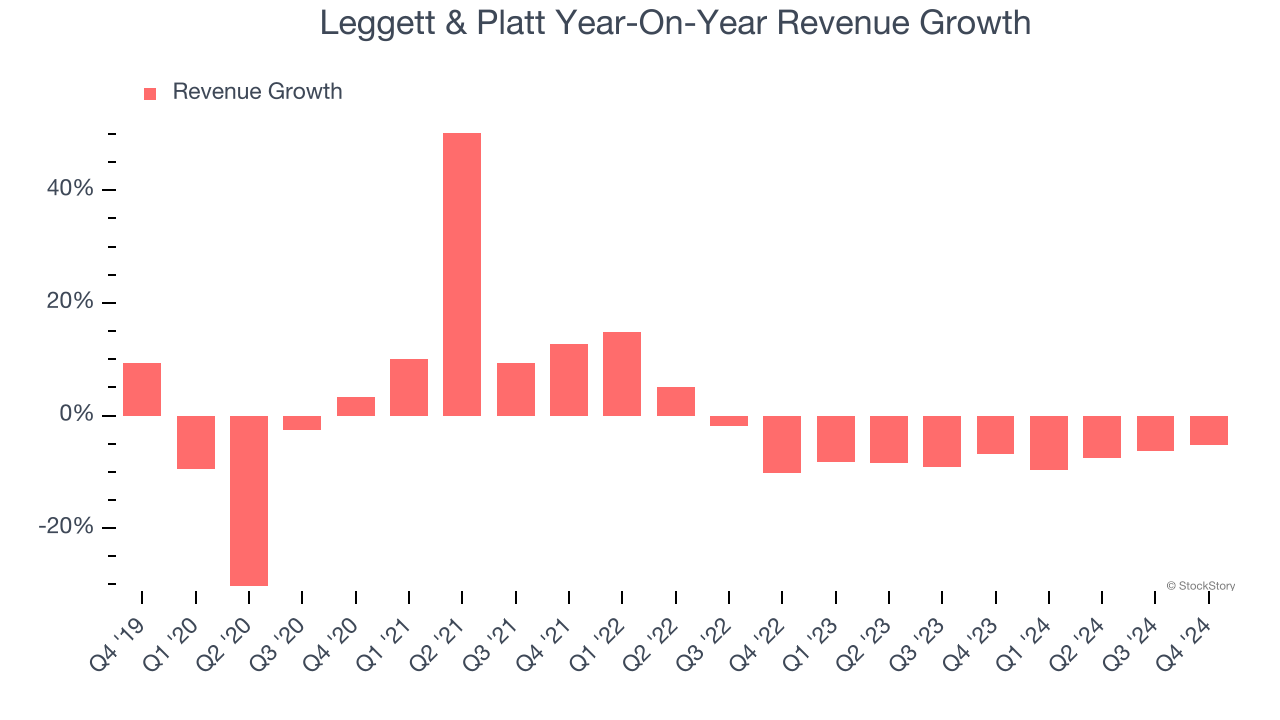

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Leggett & Platt’s demand was weak and its revenue declined by 1.6% per year. This fell short of our benchmarks and signals it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Leggett & Platt’s recent history shows its demand has stayed suppressed as its revenue has declined by 7.7% annually over the last two years.

This quarter, Leggett & Platt’s revenue fell by 5.3% year on year to $1.06 billion but beat Wall Street’s estimates by 2.8%.

Looking ahead, sell-side analysts expect revenue to decline by 1% over the next 12 months. Although this projection is better than its two-year trend, it's hard to get excited about a company that is struggling with demand.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

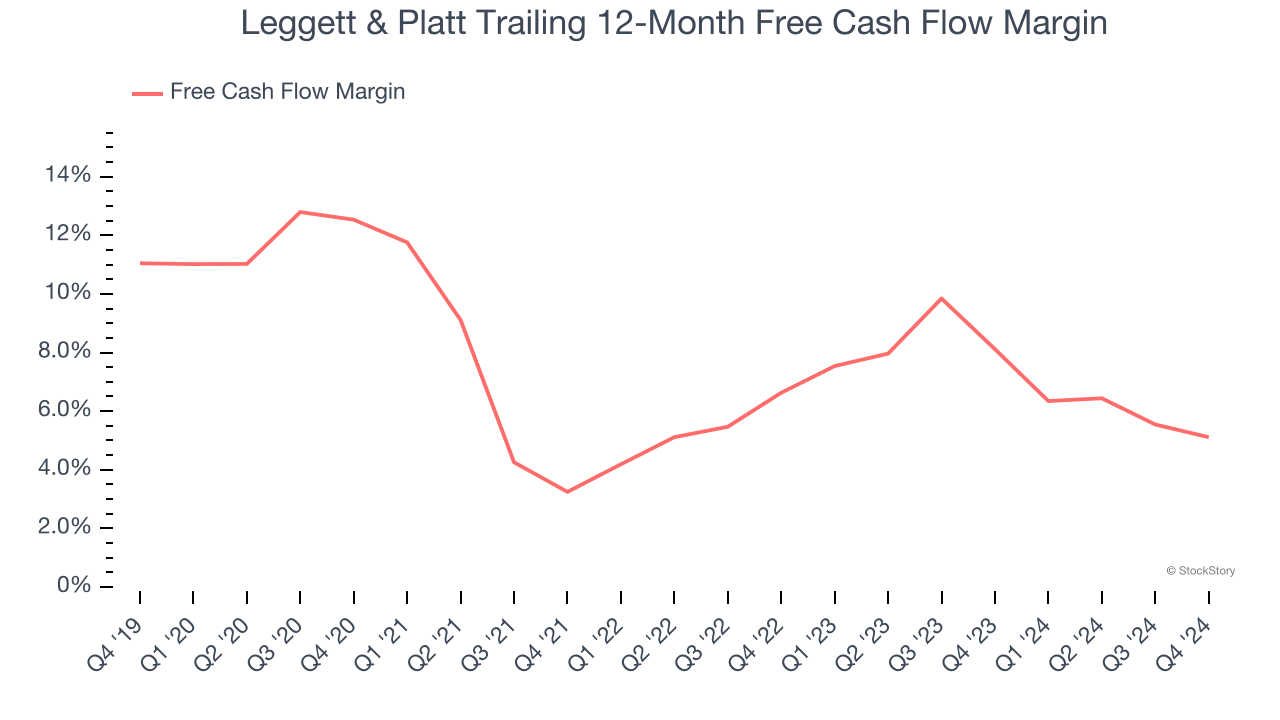

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Leggett & Platt has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.7%, subpar for a consumer discretionary business.

Leggett & Platt’s free cash flow clocked in at $100.5 million in Q4, equivalent to a 9.5% margin. The company’s cash profitability regressed as it was 1.5 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Key Takeaways from Leggett & Platt’s Q4 Results

It was encouraging to see Leggett & Platt beat analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed significantly and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. Still, it seems like expectations were low, and the stock traded up 2.4% to $10.25 immediately following the results.

So do we think Leggett & Platt is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.