Research and advisory firm Gartner (NYSE: IT) met Wall Streets revenue expectations in Q3 CY2025, with sales up 2.7% year on year to $1.52 billion. Its non-GAAP profit of $2.76 per share was 13.7% above analysts’ consensus estimates.

Is now the time to buy Gartner? Find out by accessing our full research report, it’s free for active Edge members.

Gartner (IT) Q3 CY2025 Highlights:

- Revenue: $1.52 billion vs analyst estimates of $1.52 billion (2.7% year-on-year growth, in line)

- Adjusted EPS: $2.76 vs analyst estimates of $2.43 (13.7% beat)

- Operating Margin: 5.7%, down from 16.6% in the same quarter last year

- Free Cash Flow Margin: 17.6%, down from 38.1% in the same quarter last year

- Market Capitalization: $18.62 billion

Gene Hall, Gartner’s Chairman and Chief Executive Officer, commented, “Third quarter financial results were ahead of expectations. Contract value grew 3%, or 6% excluding the US Federal business. We increased our Adjusted EBITDA and margin guidance for the year and continue to expect CV to accelerate in 2026. Seeing extraordinary value and a unique opportunity, we repurchased more than $1 billion of stock, a Gartner record for a single quarter.”

Company Overview

With over 2,500 research experts guiding organizations through complex technology landscapes, Gartner (NYSE: IT) provides research, advisory services, and conferences that help executives make better decisions about technology and other business priorities.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $6.46 billion in revenue over the past 12 months, Gartner is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

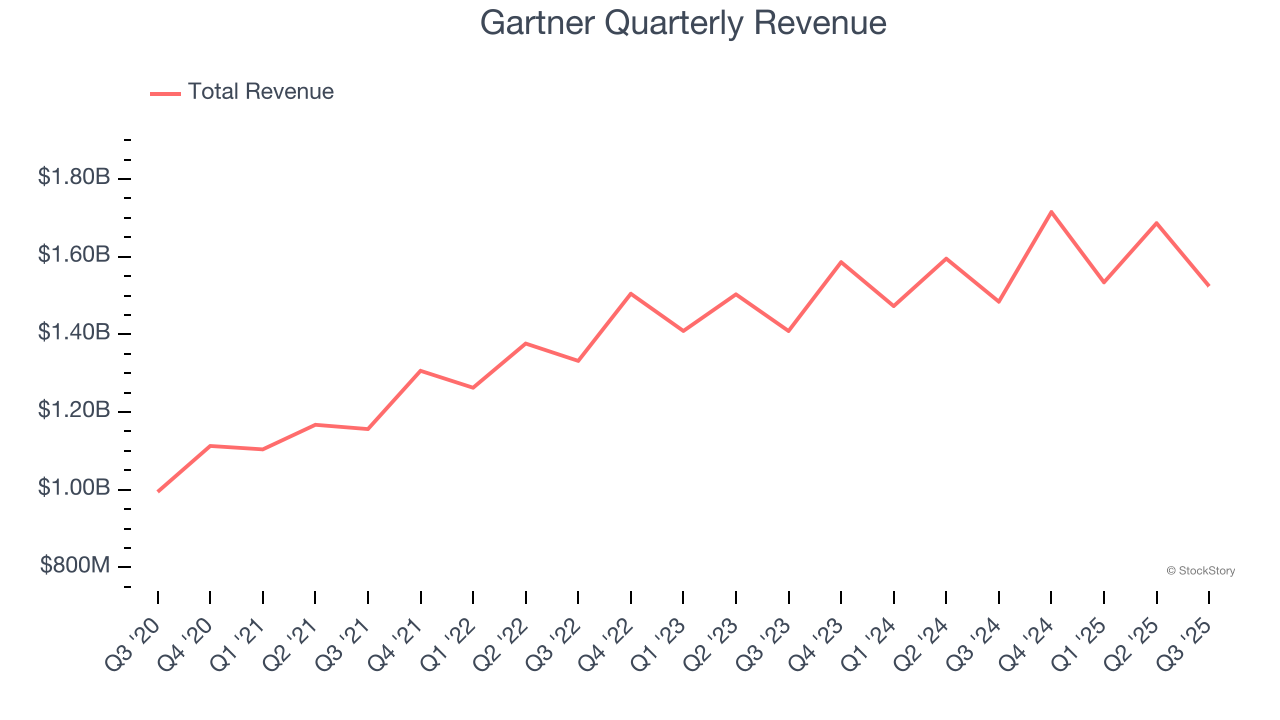

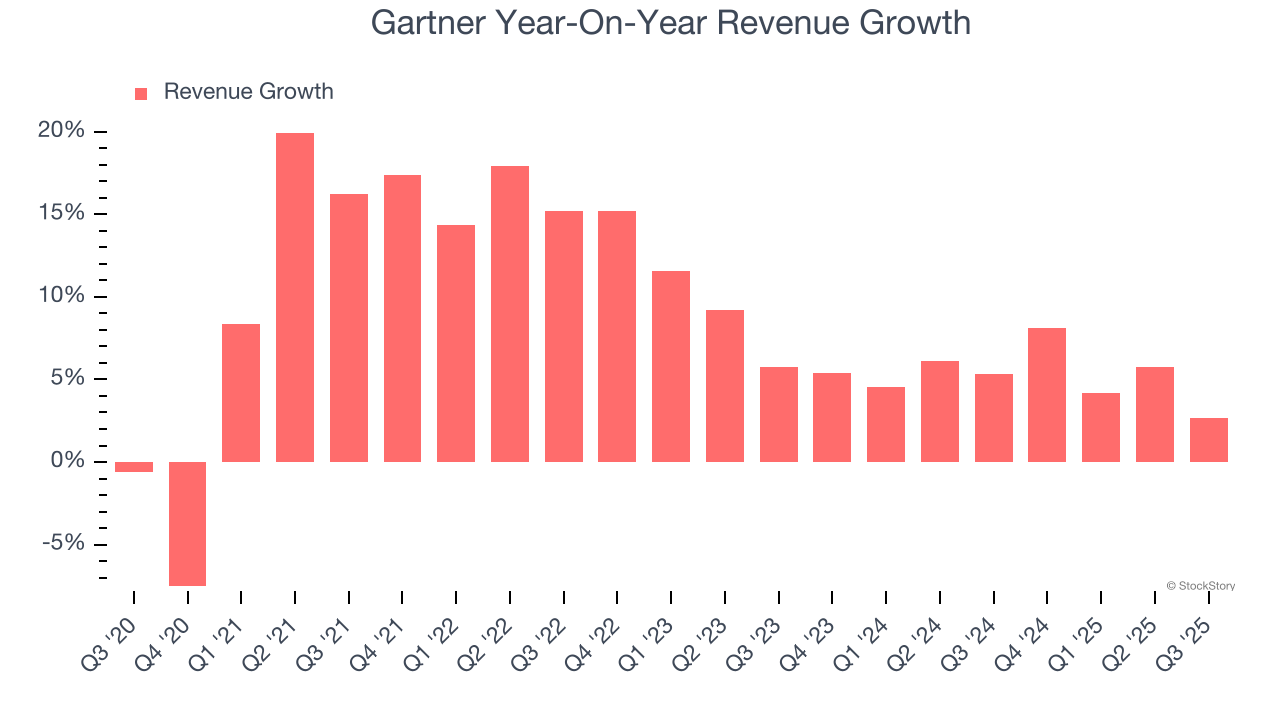

As you can see below, Gartner’s 9% annualized revenue growth over the last five years was impressive. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Gartner’s annualized revenue growth of 5.3% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Gartner grew its revenue by 2.7% year on year, and its $1.52 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

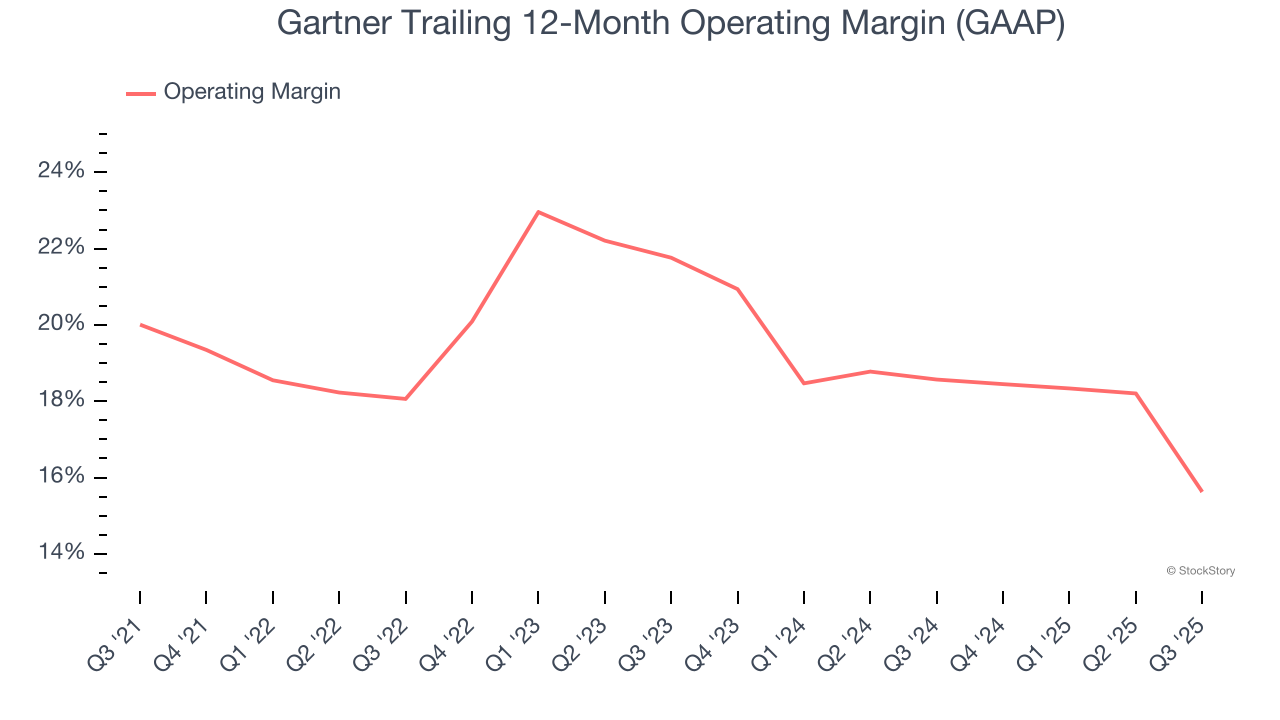

Gartner has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 18.7%.

Analyzing the trend in its profitability, Gartner’s operating margin decreased by 4.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Gartner generated an operating margin profit margin of 5.7%, down 10.9 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

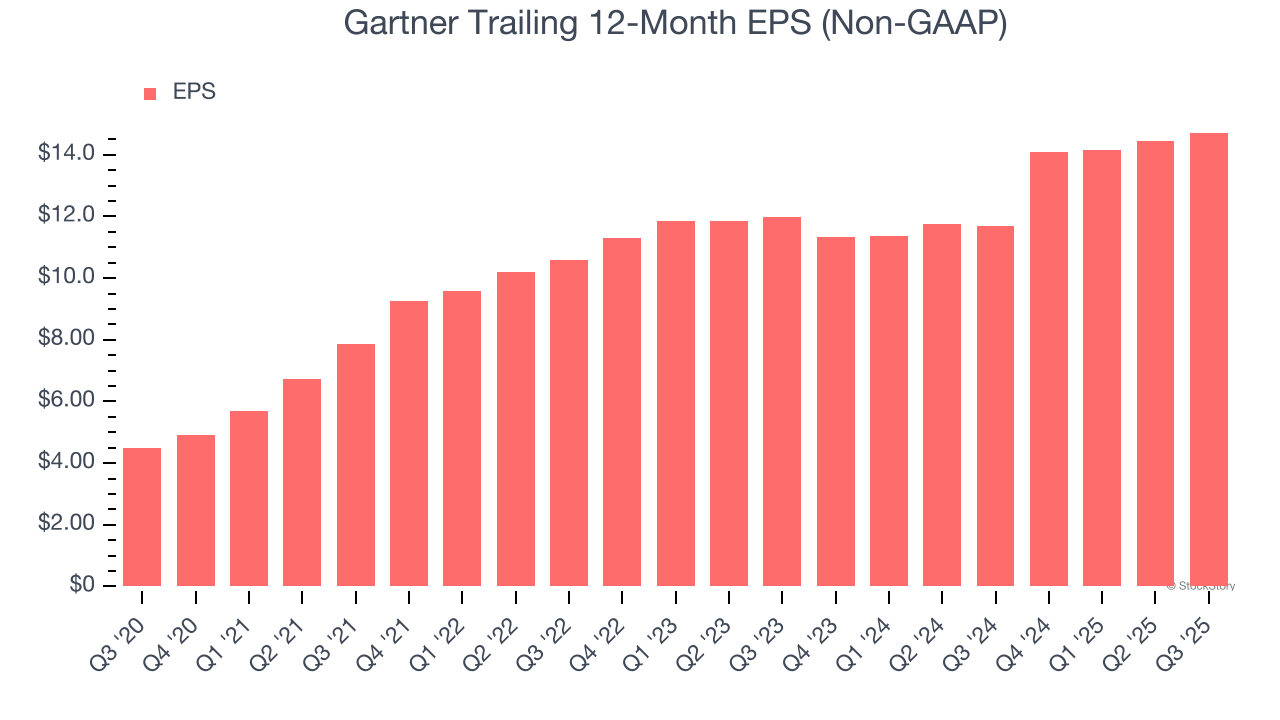

Gartner’s EPS grew at an astounding 26.8% compounded annual growth rate over the last five years, higher than its 9% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

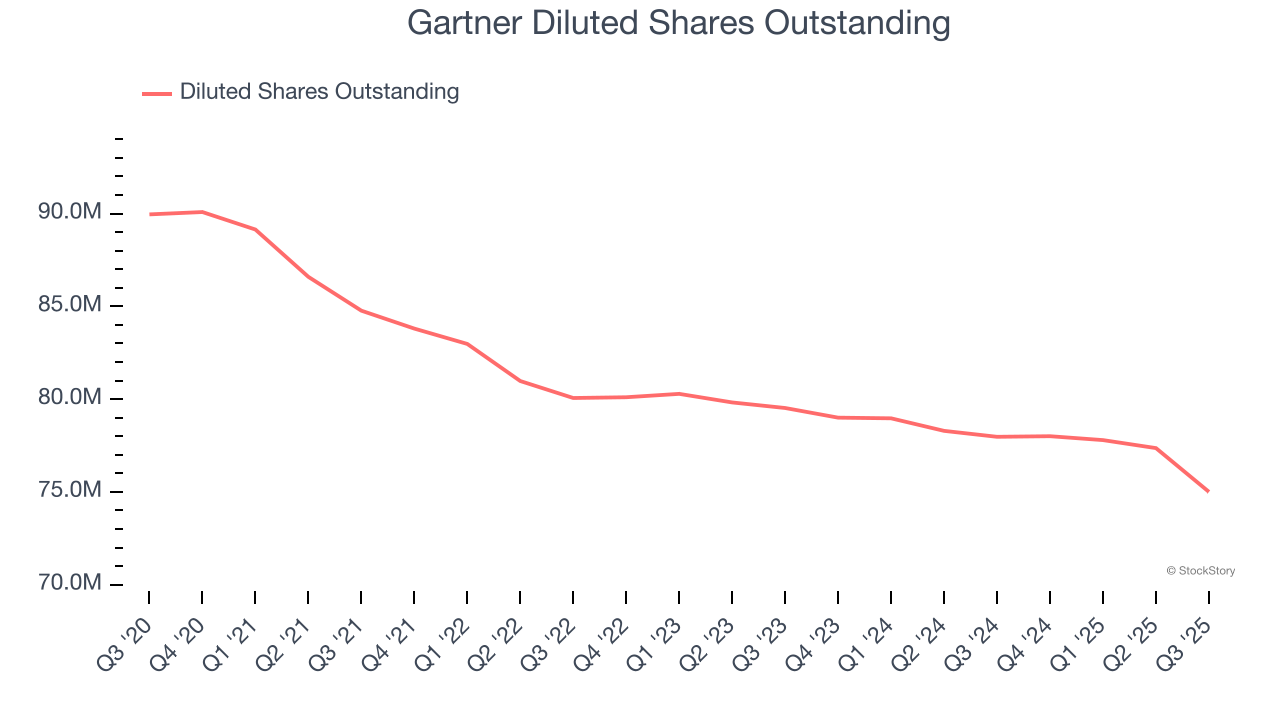

Diving into the nuances of Gartner’s earnings can give us a better understanding of its performance. A five-year view shows that Gartner has repurchased its stock, shrinking its share count by 16.6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Gartner, its two-year annual EPS growth of 10.8% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, Gartner reported adjusted EPS of $2.76, up from $2.50 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Gartner’s full-year EPS of $14.72 to shrink by 14.2%.

Key Takeaways from Gartner’s Q3 Results

It was good to see Gartner beat analysts’ EPS expectations this quarter despite in line revenue. Investors were likely hoping for more, and shares traded down 2.8% to $239.16 immediately following the results.

Is Gartner an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.