Williams-Sonoma currently trades at $197 and has been a dream stock for shareholders. It’s returned 461% since December 2019, blowing past the S&P 500’s 89.1% gain. The company has also beaten the index over the past six months as its stock price is up 29.1% thanks to its solid quarterly results.

Is there a buying opportunity in Williams-Sonoma, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We’re happy investors have made money, but we don't have much confidence in Williams-Sonoma. Here are three reasons why you should be careful with WSM and a stock we'd rather own.

Why Is Williams-Sonoma Not Exciting?

Started in 1956 as a store specializing in French cookware, Williams-Sonoma (NYSE: WSM) is a specialty retailer of higher-end kitchenware, home goods, and furniture.

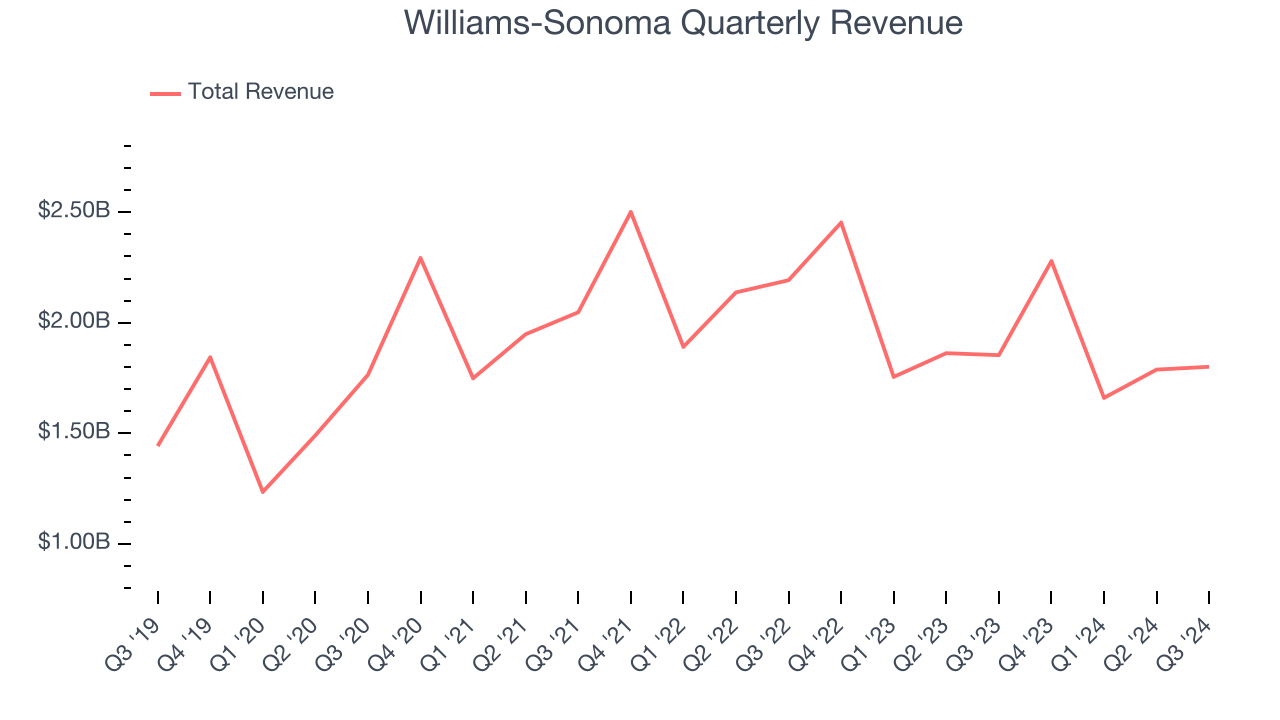

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Williams-Sonoma grew its sales at a tepid 5% compounded annual growth rate. This was below our standard for the consumer retail sector.

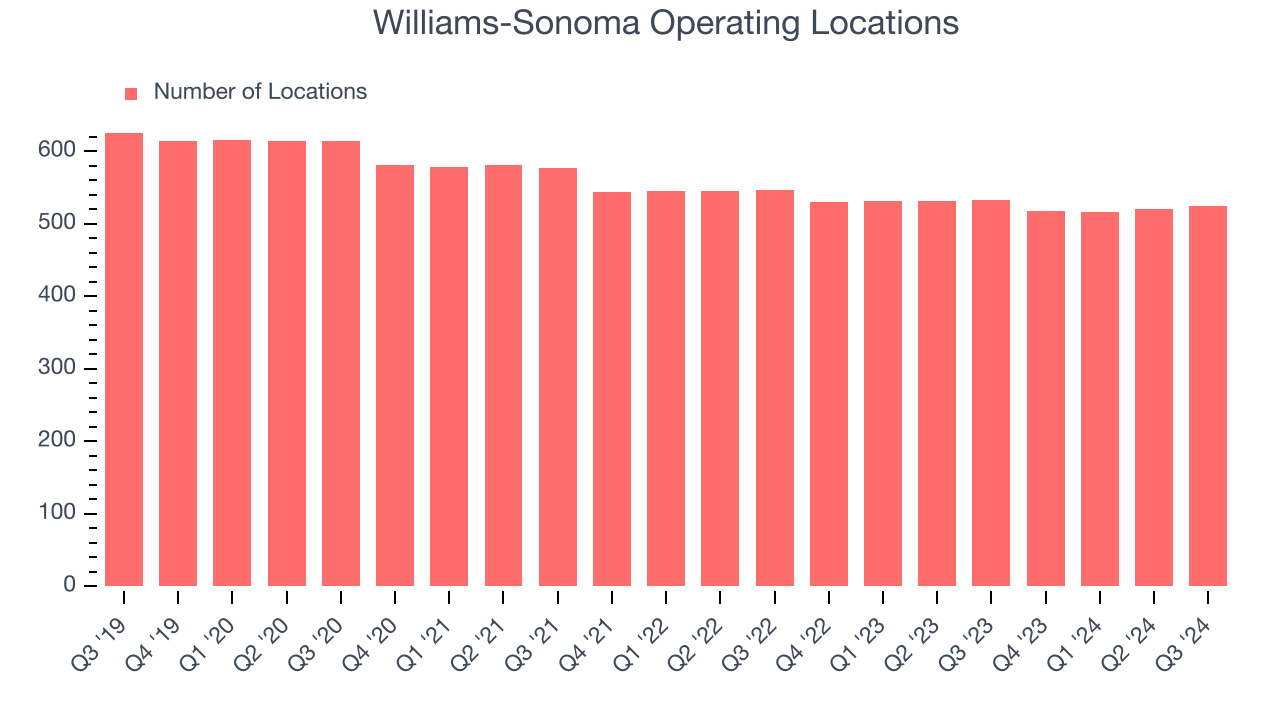

2. Stores Are Closing, a Headwind for Revenue

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Williams-Sonoma listed 525 locations in the latest quarter and has generally closed its stores over the last two years, averaging 2.3% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

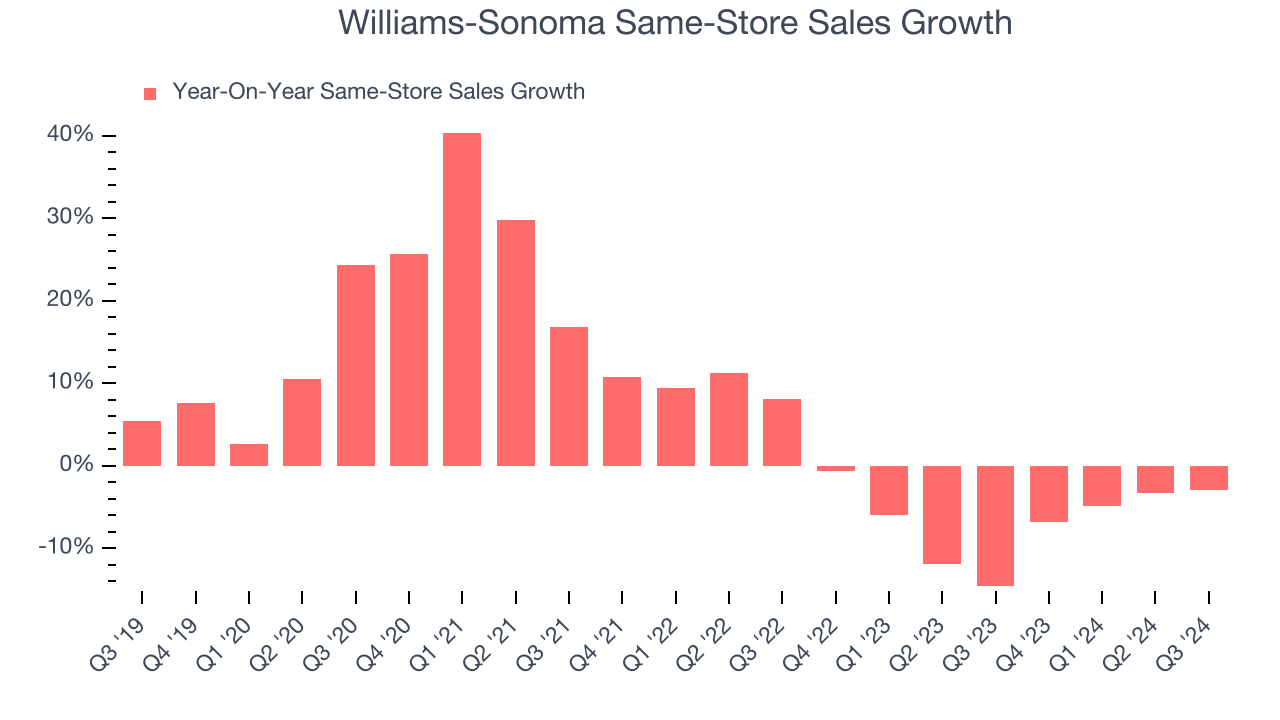

3. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Williams-Sonoma’s demand has been shrinking over the last two years as its same-store sales have averaged 6.4% annual declines.

Final Judgment

Williams-Sonoma isn’t a terrible business, but it doesn’t pass our quality test. With its shares beating the market recently, the stock trades at 24.1× forward price-to-earnings (or $197 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. We’d recommend looking at TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Williams-Sonoma

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.