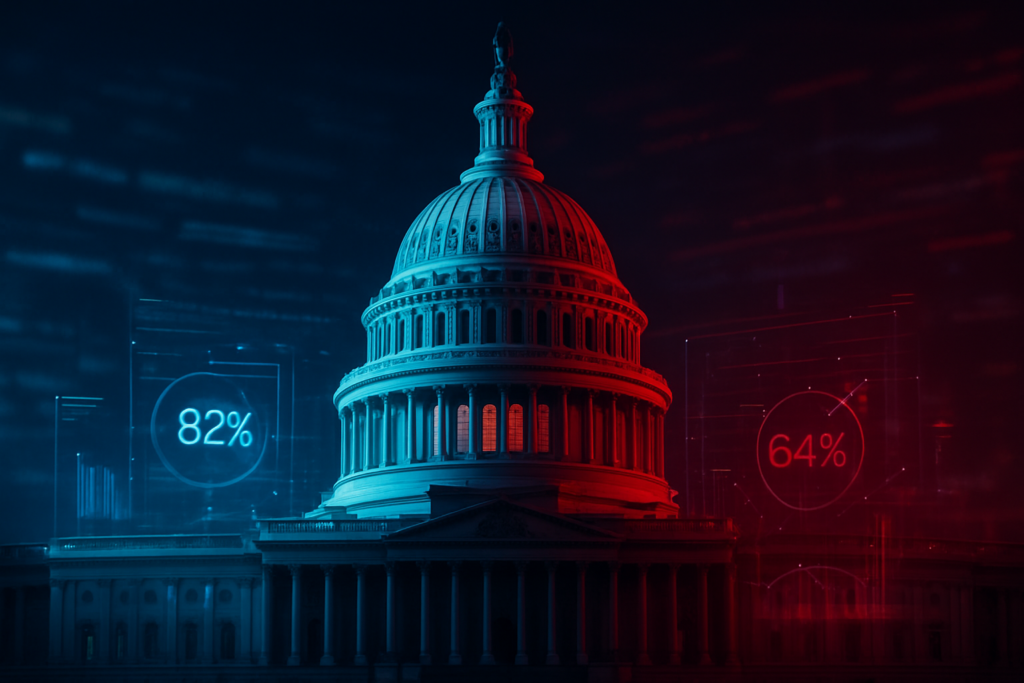

As the 2026 midterm election cycle enters its most volatile phase, prediction markets have coalesced around a startlingly clear vision of the future: a deeply divided Washington. According to the latest data from Polymarket and Kalshi, the probability of Democrats retaking the House of Representatives has surged to a dominant 82%, while Republicans maintain a resilient 64% chance of holding the Senate. This "split-decision" forecast has become the primary benchmark for political strategists and financial analysts alike.

The widening gap between the two chambers reflects a unique political landscape in February 2026. While national sentiment has shifted toward the "Blue Wave" in the lower house—fueled by recent Supreme Court rulings on redistricting and a series of federal immigration controversies—the Senate’s structural map remains a formidable "red firewall." For the first time in a midterm cycle, these probabilities aren't just being discussed in niche forums; they are being broadcast as real-time truth by the world's largest media conglomerates.

The Market: What's Being Predicted

The "Balance of Power" markets on Polymarket, a decentralized prediction platform, have seen record-breaking liquidity this quarter, with hundreds of millions of dollars now backing the current 82/64 split. The House contract, which pays out if Democrats secure a simple majority, has climbed steadily from 72% in late 2025 to its current 82% high. Conversely, the Senate market has seen more friction, with Republican odds softening slightly from 68% to 64% over the last thirty days, yet remaining the clear favorite.

On Kalshi, a platform regulated by the Commodity Futures Trading Commission (CFTC), trading volume has similarly spiked. The resolution criteria for these markets are tied to the official certification of the 2026 election results. Unlike traditional polling, which often suffers from a "non-response" bias, these markets are "prediction-incentivized," meaning every percentage point represents real capital moving in response to new information. This has created a highly efficient price discovery mechanism that reacts in minutes to breaking news.

Why Traders Are Betting

Traders are pointing to two primary catalysts for the 82% House probability. First, a landmark U.S. Supreme Court decision in January 2026 regarding California’s redistricting has effectively "unlocked" several previously competitive seats for the Democratic party. Second, what has been dubbed the "Minnesota ICE Scandal"—a series of controversial federal enforcement actions in the Midwest—has significantly energized the Democratic base, a trend captured instantly by the markets well before it appeared in traditional suburban polling.

The Republican "Senate Firewall" at 64% is driven by a starkly different set of data. The 2026 Senate map is historically favorable to the GOP, featuring difficult defensive battles for incumbent Democrats in states like Georgia and Alaska. Institutional traders argue that while the national "generic ballot" mood favors Democrats, the individual state-level math makes a Republican Senate hold the most likely outcome. Large "whale" positions on Polymarket have been observed "hedging" their House bets by doubling down on GOP Senate control, a strategy that anticipates a gridlocked legislative environment through 2028.

Broader Context and Implications

The 2026 cycle marks the official "Institutionalization Phase" of prediction markets. Warner Bros. Discovery (NASDAQ: WBD), the parent company of CNN, recently announced an exclusive partnership with Kalshi to integrate real-time "Market-Implied Probability" tickers into their live broadcasts. CNN’s chief data analyst, Harry Enten, now uses these odds to fact-check traditional polls, arguing that the 80% market confidence in candidates like Jon Ossoff is a more reliable indicator of voter sentiment than 400-person phone surveys.

Similarly, News Corp (NASDAQ: NWSA), through its Dow Jones division, has embedded Polymarket data across the digital platforms of The Wall Street Journal and MarketWatch. These outlets now feature a "Market-Implied Earnings Calendar," which correlates the 82% chance of a Democratic House with projected volatility in the defense and healthcare sectors. This integration signals that prediction markets are no longer a "fringe" tool but are now viewed with the same authority as the S&P 500 or the Treasury yield curve.

What to Watch Next

As we move toward the primary season in late spring, several events could disrupt the current 82/64 equilibrium. Key milestones include the March 2026 jobs report and the first set of "swing-district" primaries in Pennsylvania and Virginia. Should Democrats underperform in these early contests, the 82% House probability could see a "correction" back toward the mid-70s.

Conversely, the Republican Senate odds are highly sensitive to candidate quality. Traders are closely monitoring whether the GOP nominates "moderate-leaning" candidates in states like Michigan and Arizona. If the party leans into more polarizing figures, the 64% Senate "firewall" could collapse, potentially moving the market toward a "Blue Sweep" scenario, which currently sits at a modest 44% probability.

Bottom Line

The 2026 Midterm markets represent a paradigm shift in how we understand political outcomes. The 82% probability of a Democratic House and a 64% chance of a Republican Senate suggest that traders are pricing in a return to legislative gridlock. For investors, this data is a crucial signal to prepare for a "status quo" environment where major policy shifts—such as tax code overhauls or massive infrastructure spending—become significantly more difficult to pass.

Ultimately, the adoption of these markets by giants like Warner Bros. Discovery (NASDAQ: WBD) and News Corp (NASDAQ: NWSA) confirms that prediction markets have become the new "Gold Standard" for real-time probability. As we head into the summer, the "Wisdom of the Crowd" will likely remain a step ahead of the pundits, providing a cold, capital-backed look at the future of American governance.

This article is for informational purposes only and does not constitute financial or betting advice. Prediction market participation may be subject to legal restrictions in your jurisdiction.

PredictStreet focuses on covering the latest developments in prediction markets.

Visit the PredictStreet website at https://www.predictstreet.ai/.