Current Price Overview

By December 22, 2025, Polygon (POL)formerly referred to as MATIC, is selling at around $ 0.11 USD per token in the market. This represents a great deal of depreciation against all time highs of approximately $2.88 USD, which suggests a phase of consolidation and low bullish tempo in the overall marketplace.

Polygon is still one of the important Layer-2 scaling solutions of Ethereum, capable of supporting decentralized applications and at the same time providing reduced charges on transactions. Its performance in the market still depends on the market sentiment, development trends, and the macroeconomic factors.

Price Trend Analysis

Past and Short-Term Results

Polygon, in the last one year, has showed prolonged sideways movement at low levels with some volatility being as a result of the larger crypto markets and changes in risk-on/risk-off sentiment. The shift between the MATIC ticker to POL in the Polygon 2.0 evolution and continued improvements of its scaling infrastructure have ensured that technical focus has remained elevated, despite lagging price growth. (Wikipedia)

Forecast for 2026

The authoritative models differ greatly regarding the long-term perspective of the price of Polygon:

- Polygon have an average price of $0.23 to $0.27 USD the average price of Polygon in the year 2026 with the possibility of greater than that in case the market mood is positive and it is adopted by more people. These estimates are based on the further evolution of the Polygon ecosystem and gradual recovery of the risk appetite of investors.

- Technical analysis forecasts predict more possibilities of the possible outcomes and all the average prices in 2026 may approximate with $0.34 USD and all the monthly price channels exhibit the slight upward possibilities in case the situation is stable.

- Other predictions vehicles remain more bullish, stating that given good market cycles and a resurgence of interest in altcoins, Polygon will be above 2.00 USD by 2026, but these challenges are based on promising assumptions that are not yet reflected in consensus data.

In all these situations, projections indicate that there is a continuum of incremental recovery all the way to greater upside. The difference shows the price of Polygon as very sensitive to macroeconomic factors, risk sentiment, and ecosystem adoption measures.

The Major Future Price Movement Drivers

A number of aspects will tend to determine the rise and fall of Polygon by 2026:

1. Network Adoption and Utility:

The ecosystem, which is still supported by Polygon, is used to carry out decentralized finance (DeFi), non-fungible tokens (NFTs), and other applications on Ethereum through the Layer-2 scaling technologies. Further uptake of these technologies would result in the high level of transactional and governance activity, which would facilitate token demand and potentially contribute to price stability.

2. Market Sentiment and Macro Conditions:

The prices of cryptocurrencies have a significant correlation with the general mood in the market and macroeconomic factors. Favorable regulatory changes, speculative interest in mid-cap stocks such as Polygon would be boosted by risk-on conditions and greater flows in investments.

3. Technological Developments:

The development of Polygon, such as the improvement of zero-knowledge proofs and multi-chain integration, as per Polygon 2.0, may enhance the competitiveness of the platform and its usefulness in the long term.

4. Supply Dynamics:

Similar to most tokens, circulating supply and possible token unlock schedules can have an impact on the short-term price pressure. The response of prices to supply movement will frequently rely on the ability of the demand in the larger market.

Staking Stablecoin Contract and Participation of Poain

The issue of price volatility is one of the key concerns of long-term crypto planning. To investors who prefer predictable returns or price swings-free income generation, a different participation strategy that provides Poain investors with an alternative method of participation is suggested as the Staking Stablecoin Contract which uses stablecoin allocations, not the actual POL price changes.

Mechanism of Stablecoin Staking Contract

• Stablecoin Allocation: Stakeholders place the stablecoins in a safe staking agreement at the Poain platform.

• Daily Yield: Smart contracts are able to disperse income on a 24-hour cycle, which means that they generate a consistent passive income regardless of the price of the underlying token.

• Less Volatility Exposure: The returns are distributed in stablecoins, so the participants are less sensitive to the changes in prices of such assets as POL.

• Easy Entry: Minimum requirements are low which allows more investors to invest and enjoy recurring yield.

This will improve financial planning and diversification of portfolios, by integrating yield-focused portfolio with the conventional crypto exposure.

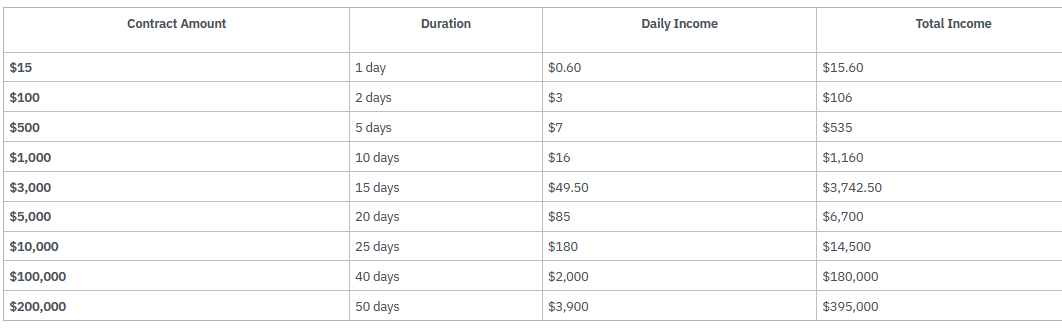

Example Contract Structure

Profit Ratio and Efficiency of the company

The platform of Poain provides organized profit ratios along with various contract terms when staking the stablecoin through the various staking stables. These ratios indicate anticipated yield in relation to the length of the staking period whereby, longer staking period attracts higher returns. Since yields are earned by using programmed smart contract systems, as opposed to the price increase in an asset, users can more effectively determine the potential income in the future.

Such steady streams of income over the coin-based strategies can appear in a strong way to supplement price-related strategies, especially in markets where the prices of tokens are range bound or are not favorable.

Registration Bonus: Incentive $115

As an incentive to attract new users and get involved, Poain is currently providing a registration bonus of $115 USD charged to new accounts of users after successfully going through the onboarding process. The bonus will allow the participants to start a staking contract of a stablecoin at once, which will enable participants to start earning yield with minimal initial capital requirements.

Such incentive not only reduces the entry barrier, but also gives participants an opportunity to test the benefits of Poain platform with their own hands.

Summary

Polygon (POL) is currently being traded around $0.11 USD, which indicates a long stretch of price stabilization amidst the more general issues in the market. The projections in 2026 have been diverse with the moderate projections indicating possible incremental growth whereas other

Company name: Poain BlockEnergy Inc.

Website: https://poaintoken.com

Email: marketing1@poain.com

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com