Data center stocks have become central to investor portfolios as cloud computing and artificial intelligence (AI) drive record demand for capacity and networking gear. These names tend to combine durable revenue with capital-spending cycles that can amplify earnings when enterprise customers expand deployments.

Analyst ratings on Barchart point to three leaders for 2026. First of all, we have Nvidia (NVDA), which supplies the GPUs and AI accelerators that power modern data centers, positioning it to capture infrastructure spending. Secondly, Amazon (AMZN) benefits from Amazon Web Services’ dominant cloud share and steady enterprise demand. Finally, Broadcom (AVGO) offers networking silicon and systems that glue hyperscale racks together, with recurring software and semiconductor revenue.

Together, these stocks offer diversified exposure to the data-center buildout that analysts expect to keep accelerating into 2026. Without further ado, let's examine these names more closely.

Data Center Stock #1: Nvidia

Nvidia is the leading designer of GPUs and AI accelerators for data centers. Its processors power cloud servers, AI training, and inference applications worldwide. In late 2025, Nvidia reported record-breaking results, showing its dominance in the AI chip market. With new architectures like Blackwell and Rubin, and an expanding software/model stack, Nvidia stands at the forefront of the data-center AI revolution.

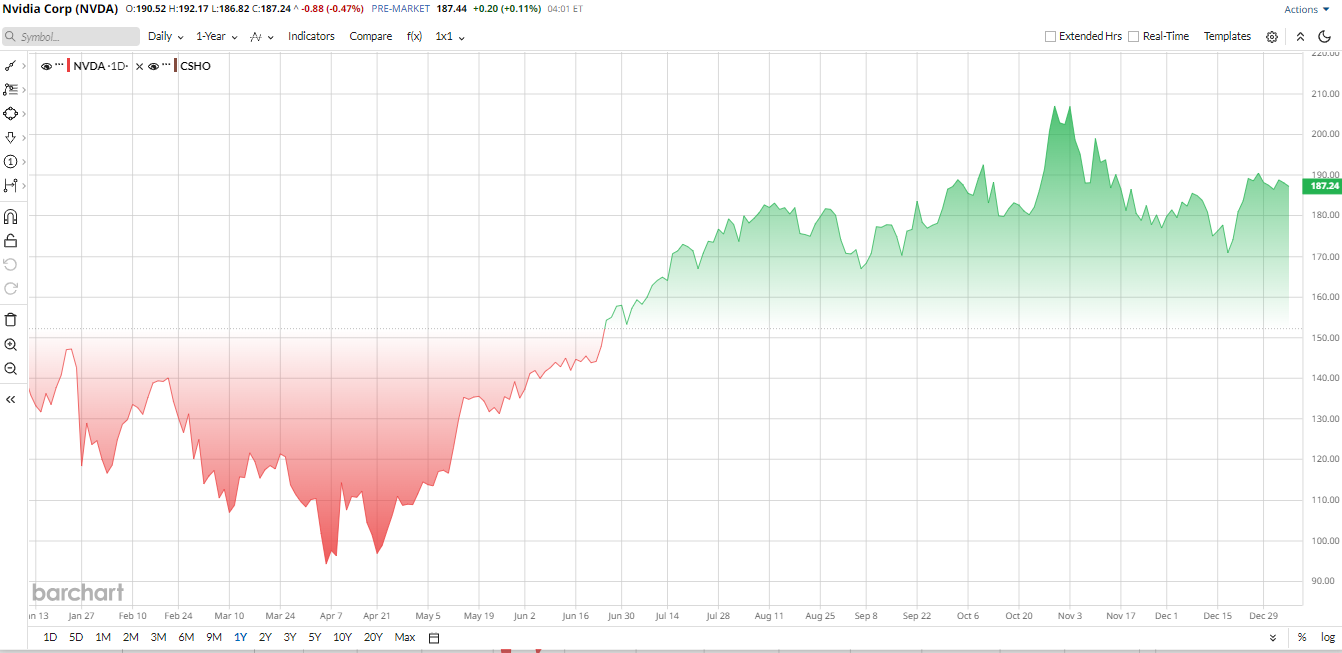

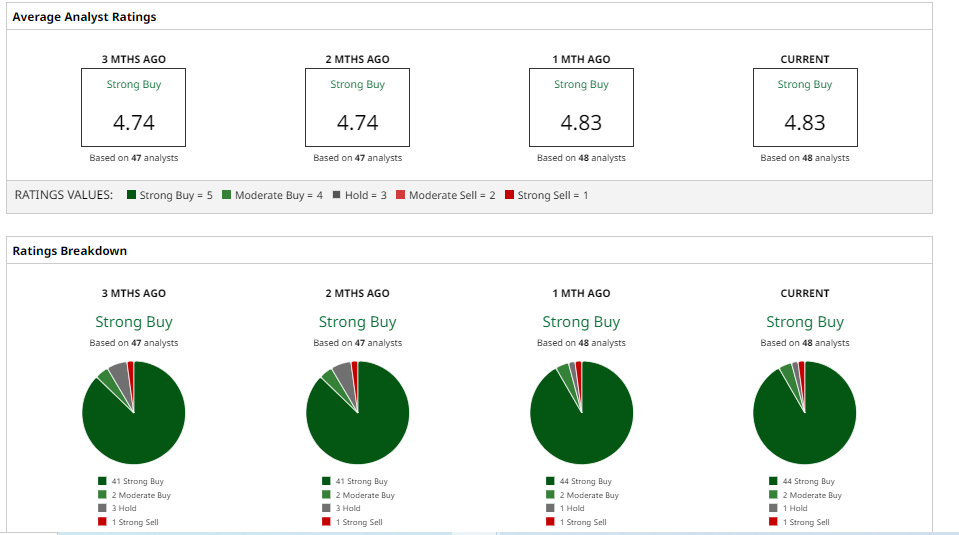

The most valuable company in the world with a market capitalization of around $4.6 trillion, NVDA stock rallied strongly in the last two years on the AI boom but has since retreated from late-2025 highs on fears of an AI bubble burst. After hitting an all-time peak near $212 in October 2025, the stock trades around $185 in early January 2026. NVDA stock is roughly flat so far year-to-date (YTD).

On the valuation side, Nvidia is extremely rich. NVDA trades at a trailing price-to-earnings (P/E) multiple of around 48 times and a price-to-cash flow multiple of 61 times. These multiples imply very high growth built in. In short, Nvidia's valuation is in “bubble” territory, reflecting sky-high expectations for its AI/data-center role.

Nvidia’s top-line and profit growth remain explosive, with its recent financials exceptional. In the third quarter of fiscal 2026, revenue hit $57 billion, up 62% year-over-year (YOY), driven by a record $51.2 billion in data center sales, which were up 66% YOY. Gross margin stayed at 73%. Nvidia generated $37 billion in shareholder returns via buybacks and dividends over the first nine months. Looking ahead, management guided for Q4 revenue to around $65 billion, implying continued strength. CEO Jensen Huang noted that “cloud GPUs are sold out” as AI demand accelerates.

Moreover, after a strong finish to 2025, Nvidia kicked off 2026 with major CES announcements. CEO Jensen Huang unveiled Rubin, an “extreme codesigned” six-chip AI platform now in production. Huang also introduced new AI models like Alpamayo for autonomous vehicles. These moves show that Nvidia is expanding from chips into a full-stack AI ecosystem. All of this tells us that future growth prospects for Nvidia remain tied to AI, with the firm's roadmap assuming continued hyper-growth.

Analysts remain mostly bullish on NVDA stock’s long-term outlook, although they warn that much future growth is already priced in. The 48 analysts with coverage of the stock have a consensus "Strong Buy" rating for NVDA. The mean price target of $256 indicates upside potential of 38% from current levels.

So, Nvidia seems to be a high-beta play on generative AI as its top-notch tech and CES roadmap suggest more growth ahead. Still, investors will have to judge whether the lofty valuation is justified.

Data Center Stock #2: Amazon

Amazon is the world’s largest online retailer and a leading cloud services provider through AWS. It dominates e-commerce while AWS leads cloud computing, making Amazon central to data-center growth. Management has aggressively boosted data center and AI investments through custom AI chips and big-capacity clusters as demand soars. This combination of scale in retail and cloud positions Amazon at the heart of the AI/data-center boom.

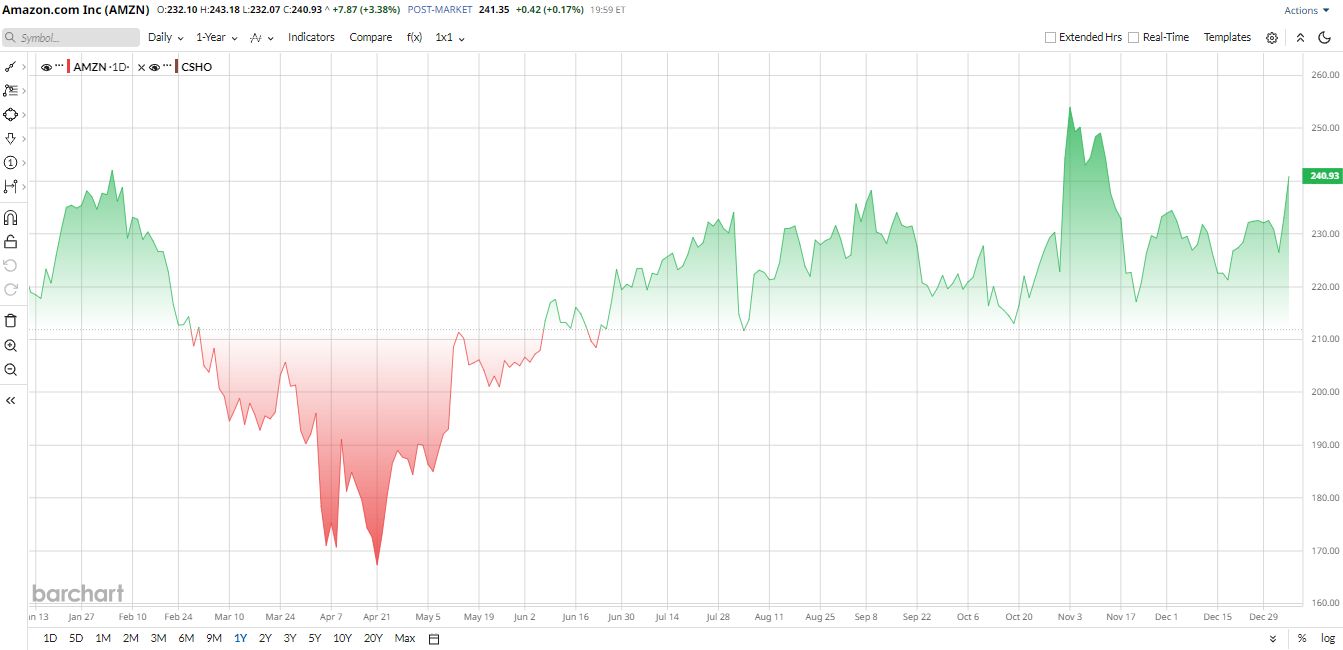

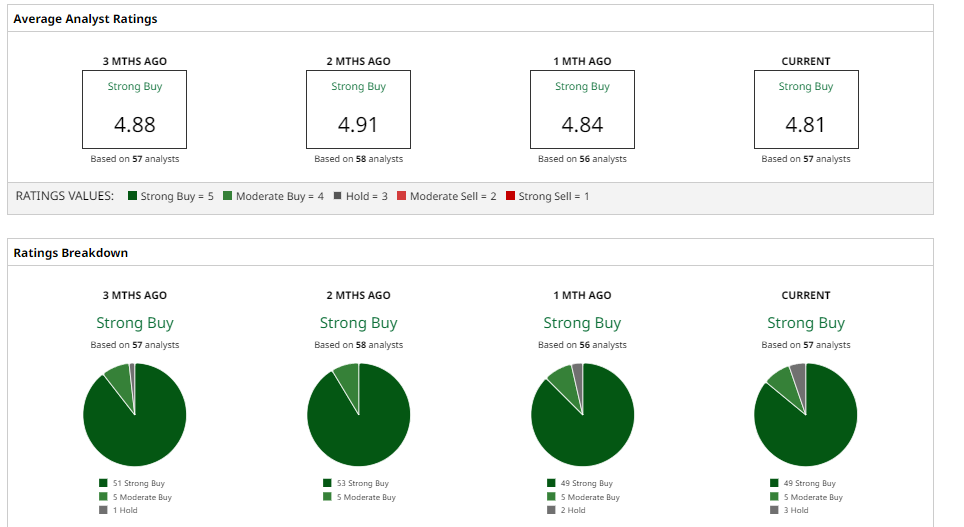

Valued at $2.6 trillion by market cap, AMZN stock has been mostly range-bound in 2025. The stock is up roughly 10% over the past year. However, shares are up about 40% since last spring on strong earnings surprises. The shares recently traded near their 52-week high, reflecting renewed investor interest in AWS-led growth.

Just like Nvidia, Amazon is richly priced. It trades near 31 times forward earnings, implying very high growth expectations. This earnings multiple is similar to high-growth tech names, although Amazon’s core retail business typically commands lower multiples. In short, Amazon’s valuation suggests investors are pricing in accelerating AWS and AI growth.

Amazon delivered strong results as Q3 sales rose 13% YOY to $180 billion, with AWS revenue up 20% to $33 billion. Operating income was $17.4 billion, roughly flat YOY, but that included $4.3 billion of one-time charges. On a normalized basis, operating income would have been $21.7 billion.

Net income surged to $21.2 billion, up from $15.3 billion previously, boosted by a $9.5 billion investment gain from Anthropic. Trailing 12-month operating cash flow was $130.7 billion, up 16% YOY, but free cash flow fell to $14.8 billion from $47.7 billion as capital spending jumped. Amazon’s revenues and cash flows are growing on robust online sales and cloud demand, even as it ploughs capital into AI infrastructure.

Amazon continues to push its AI/data-centrer demand. In late 2025, AWS pledged up to $50 billion to expand AI-focused cloud capacity for U.S. government agencies. Amazon also announced a $15 billion buildout of new Indiana data center campuses to support enterprise AI and cloud workloads. CFO Brian Olsavsky noted that Amazon’s 2025 capital spending topped $100 billion, mostly on AWS, and will remain elevated in 2026.

Looking ahead, Amazon’s growth is tied to cloud/AI adoption and e-commerce strength. CEO Andy Jassy observed that “AI drives meaningful improvements in every corner of our business,” with AWS growth re-accelerating to 20% YOY. Analysts expect continued AWS momentum as enterprises deploy AI workloads.

Wall Street analysts remain bullish on AMZN stock. Analysts with coverage of AMZN assign a consensus "Strong Buy" rating. The mean price target of $294.96 implies 20% upside potential from here.

Data Center Stock #3: Broadcom

Broadcom is a global semiconductor and infrastructure software giant. It designs custom ASIC chips and networking products like switches and adapters used extensively in data centers. Broadcom’s products serve hyperscale cloud customers and telecoms. The firm's acquisition of VMware has also given it a strong position in data-center virtualization and hybrid cloud.

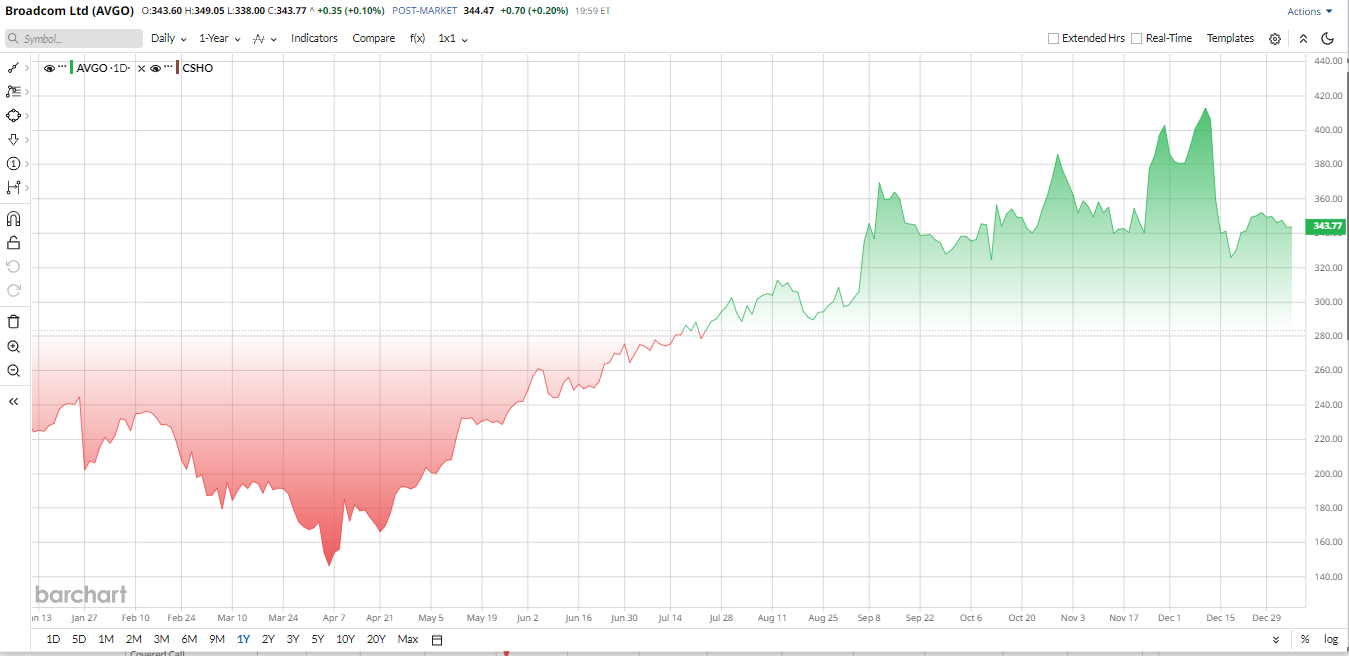

AVGO stock performed very well in 2025. Shares have surged about 45% over the past year, making AVGO one of the top gainers in its niche. Shares closed around $343 on Jan 7, 2026. That rally comes on the heels of enthusiasm over Broadcom’s AI-focused business and strong cash flows.

Similarly, the valuation of Broadcom is very rich. AVGO trades around 41 times forward earnings and about 1.2 times P/E-to-growth. Such multiples are well above sector norms, implying that much growth is already priced in. AVGO stock pays a small dividend with a 0.70% yield, but that is secondary to its growth story.

Broadcom’s recent financial results were robust. In Q4, revenue landed at $18 billion, up 28% YOY. Profitability remains robust at EPS of $1.74. CEO Hock Tan highlighted that AI-driven demand was accelerating. Tan said that AI semiconductor revenue grew 74% YOY, and guided for Q1 revenue to about $19.1 billion, another 28% above the prior year. For fiscal 2025, Broadcom earned about $43 billion in adjusted EBITDA, a 35% YOY gain, and generated a record $26.9 billion in free cash flow.

Wall Street is confident that Broadcom should benefit from ongoing data-center buildouts and AI adoption. Management said that AI semiconductor momentum is “continuing,” expecting AI-driven sales to keep doubling.

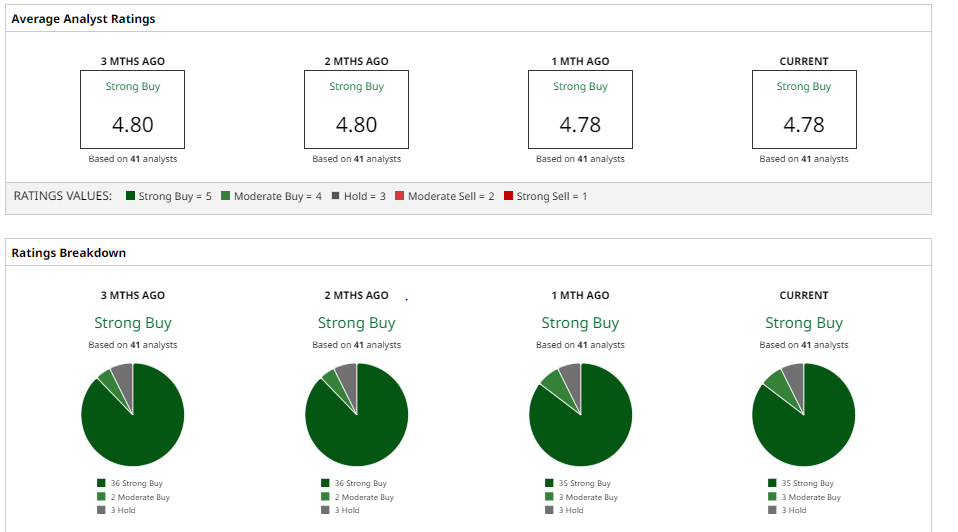

Analysts generally view Broadcom as a steady grower thanks to its diversified business. The consensus among 41 analysts with coverage is a “Strong Buy” rating with a mean price target of $456.20, suggesting 37% upside potential.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Follow the Smart Money: 2 Undervalued Stocks With Aggressive Share Buybacks and Unusual Options Activity

- Warren Buffett Loved American Express Stock. With the Oracle of Omaha Now in Retirement, How Should You Play AXP in 2026?

- The 3 Best Warren Buffett Stocks to Buy for 2026

- These Are the 3 Best Data Center Stocks to Buy for 2026