Every December, the stock market creates a powerful pocket of opportunity through a little-noticed force known as tax-loss selling. This practice involves investors selling their losing stocks to offset capital-gains taxes. In 2025, the effect was especially strong after a year filled with U.S. market gains. As a result, the stocks of many fundamentally sound companies were pushed lower — not because their businesses deteriorated, but simply because investors were tidying up their tax books. That selling pressure tends to fade once the calendar flips.

As 2026 gets underway, these stocks could begin to recover as bargain hunters and long-term investors step back in. That rebound is rarely instant. In fact, it tends to unfold gradually over several weeks as value investors accumulate shares that were unfairly punished by year-end tax strategies. That said, MarketWatch used a disciplined screen to identify some of the most attractive opportunities and separate true quality from struggling businesses.

The outlet's focus was mainly on companies where insiders, executives and directors own at least 20% of their company's stock and have been net buyers in recent months. Unprofitable firms were eliminated, while only those expected to grow earnings in 2026 were kept. Plus, each stock also had to be down at least 15% in 2025 to capture meaningful tax-loss selling pressure. That process narrowed the field to 11 standout names, including these two tech players.

Tech Stock #1: Freshworks

California-based Freshworks (FRSH) develops easy-to-use service software designed to improve how companies support both their customers and their employees. Its enterprise-grade platform takes a people-first approach to artificial intelligence (AI), simplifying workflows so teams can resolve issues faster and operate more efficiently without unnecessary complexity.

Trusted by nearly 75,000 organizations worldwide, including brands like Bridgestone (BRDCF), Nucor (NUE), and S&P Global (SPGI), Freshworks has built a strong global presence by delivering practical, scalable tools for modern customer experience (CX) and employee experience (EX) operations.

Currently sitting at a market capitalization of about $3.3 billion, FRSH stock has been under intense selling pressure in 2025, down 27%. Of course, the selloff last year has automatically reset its valuation. Freshworks now trades at just 16.5 times forward earnings, a steep discount to the sector median, putting FRSH stock firmly in bargain territory as investors look ahead to a potential recovery.

Based on the financials, Freshworks' fundamentals appear strong. In early November 2025, the tech company published its fiscal 2025 third-quarter earnings report, which exceeded both Wall Street’s top- and bottom-line estimates. Revenue climbed 15% year-over-year (YOY) to $215.1 million, comfortably ahead of analysts’ forecast of $208.8 million, highlighting steady demand for its software platform.

While Freshworks posted a GAAP loss of $0.02 per share, profitability remained intact on an adjusted basis. Non-GAAP EPS reached $0.16, marking a robust 45% YOY increase and crushing Wall Street’s estimate by a solid 25.5%. Profitability also improved, with non-GAAP gross margin rising to 86% from 85.7% a year earlier. The balance sheet remains strong as well, with cash, cash equivalents, and marketable securities totaling $813.2 million as of Sept. 30, 2025.

Looking ahead, management expects full-year revenue to come in between $833.1 million and $836.1 million, implying roughly 16% annual growth, while non-GAAP EPS is projected between $0.62 and $0.64. At the same time, analysts tracking Freshworks forecast that the company’s GAAP loss will narrow by nearly 88% in 2025, underscoring continued progress toward sustained profitability.

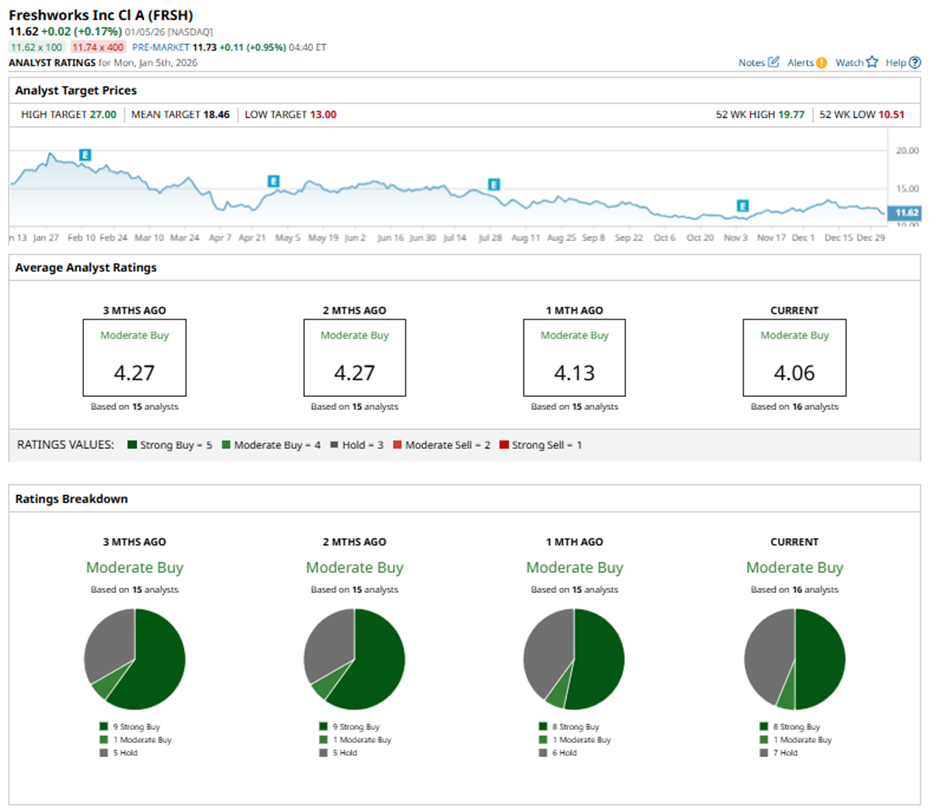

Overall, Wall Street remains optimistic about FRSH, with the stock carrying a consensus “Moderate Buy” rating. Among the 16 analysts offering recommendations, eight suggest “Strong Buy,” one advocates for a “Moderate Buy,” and the remaining seven stay on the sidelines with a “Hold" rating.

More importantly, price targets suggest a powerful rebound could be in the cards. The average price target of $18.46 indicates an impressive 57% potential upside, while the Street-high target of $27 implies an even greater potential leap of 129%.

Tech Stock #2: Certara

Founded in 2008, Pennsylvania-based Certara (CERT) develops specialized biosimulation software, technology, and services that help streamline how new medicines are discovered and brought to market. Its tools are used to model and predict drug behavior, enabling researchers to make more informed decisions throughout development. The company serves more than 2,400 biopharma firms, academic groups, and regulatory agencies across 70 countries, giving it a broad footprint across the global drug-development ecosystem.

With a market capitalization of around $1.4 billion, Certara has struggled through 2025, with the stock down nearly 19% for the year. That prolonged selloff has dragged the valuation to more appealing levels. From a valuation standpoint, Certara now trades at just 3.7 times sales, underscoring how discounted the shares have become when compared to the sector median.

Certara delivered a strong performance in its fiscal 2025 third quarter, reported in November, beating Wall Street’s expectations on both the top and bottom lines. Revenue climbed to $104.6 million, up from $94.8 million in the third quarter of 2024, marking 10% YOY growth and narrowly topping analyst estimates. The revenue increase was primarily driven by contributions from mergers and acquisitions as well as continued growth in its biosimulation software and services portfolio.

Looking deeper into the revenue mix, software revenue reached $43.8 million, representing a robust 22% increase, while services revenue totaled $60.8 million, growing almost 3% YOY. This balanced performance highlights ongoing demand for both Certara’s software tools and its specialized services offering.

Profitability also improved meaningfully during the quarter. Net income came in at $1.5 million, a sharp turnaround from a net loss of $1.4 million in the same quarter last year, representing a whopping 211% improvement. Adjusted EPS for Q3 2025 was $0.14, roughly in line with $0.13 a year earlier and comfortably above Wall Street’s forecast of $0.11, reinforcing the company’s steady earnings momentum.

The company also updated its full-year 2025 outlook, providing a more transparent view of its financial trajectory. Management now expects revenue between $415 million and $420 million, and adjusted EPS between $0.45 and $0.47, highlighting steady growth and profitability. Meanwhile, Wall Street is forecasting further progress on the bottom line, with Certara’s earnings expected to climb 7% in 2025

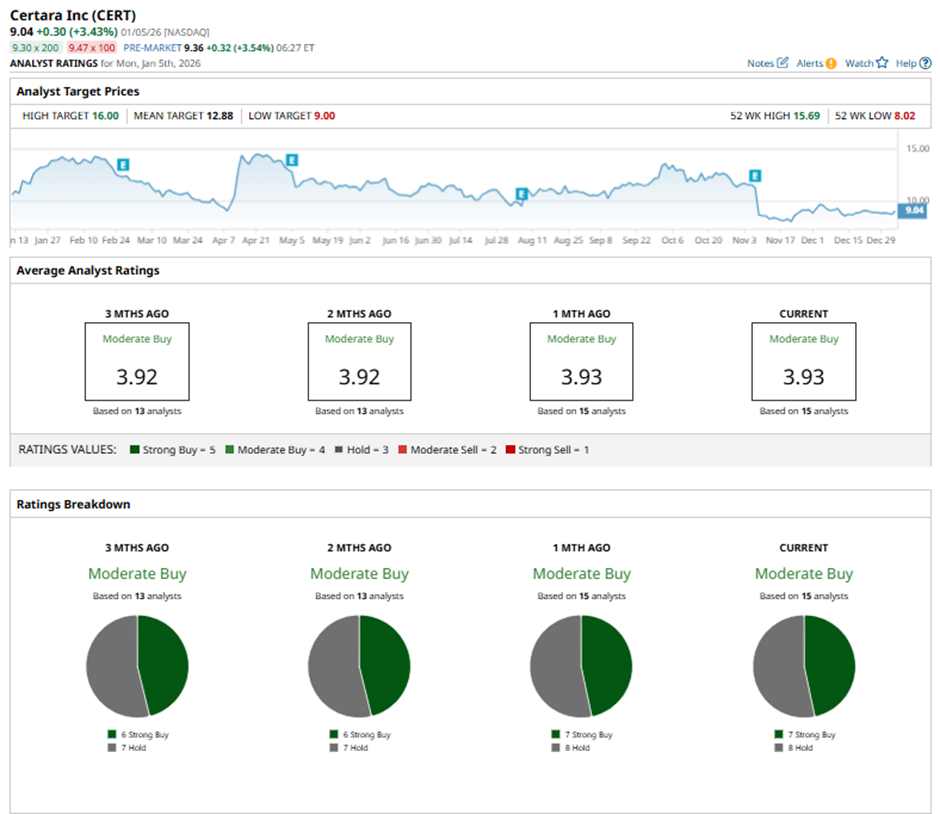

Even after last year’s pullback, Wall Street is still leaning positive on Certara’s outlook. CERT stock carries a “Moderate Buy” consensus. Seven of the 15 analysts covering shares call CERT a “Strong Buy,” while the remaining eight recommend a “Hold" rating.

Price targets point to meaningful upside ahead, with the average target of $12.88 implying about 35% potential upside. The Street-high target of $16 suggests a potential 67% rally from current levels.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- S&P 500, MidCap 400, and SmallCap 600 Welcome New Members as Indexes Rebalance for 2026

- We ‘Can't Determine Whether We are Dealing With a Pet Rock or a Barbie’: Warren Buffett Warns Investors to Only Invest In Industries They Know

- LCID Stock Crashed Last Year, But Will Robotaxis Save the Day for Lucid in 2026?

- 'Robots & Rockets Aren’t Made from Hopes & Wishes,' and How the AI Revolution is Shaping the Next Metals Bull Market