Netflix (NFLX) hasn’t started the new year on a particularly strong note but its upcoming earnings could prove the much-needed catalyst for a stock price recovery.

The mass media behemoth is scheduled to report its Q4 earnings on Jan. 20. Consensus is for it to earn $0.55 a share in the fourth quarter, up nearly 28% on a year-over-year basis.

According to Wall Street analysts, NFLX likely grew its revenue this quarter to about $12 billion as well, reinforcing its lead in the global streaming space.

Ahead of its release, Netflix is down some 34% versus its all-time high.

Netflix Stock Is Trading at a Deep Discount

According to Eric Clark, the chief of investments at Accuvest, long-term investors should consider owning NFLX stock as it’s currently trading at a major discount.

In fact, in terms of valuation, the streaming giant is nothing short of a “diamond in the dumpster” in 2026, he told CNBC in a recent interview.

Netflix is currently trading at less than 9x sales, notably below its historical multiple, signaling the bar for a positive surprise is rather low heading into its earnings release.

In other words, NFLX doesn’t need a “miracle” to rally, a simple “better-than-feared” report with steady subscriber growth would more than suffice.

What WBD Deal Really Means for NFLX Shares

Much of Netflix shares’ recent turmoil has been related to the “uncertainty” surrounding the firm’s pursuit of WBD assets.

But what has so far been a headwind may transform into a major tailwind if the streamer succeeds in acquiring those assets in 2026.

And reports that NFLX may “sweeten” the proposal soon for Warner Bros. Discovery (WBD) and make it more challenging for Paramount (PSKY) to compete with an all-cash offer already suggest the titan is fully committed to the deal.

Once Netflix brings WBD’s studio and streaming assets under its umbrella, it won’t just get rid of a major overhang, but the sheer boost to its content slate will help it command a premium multiple as well.

Wall Street Remains Bullish on Netflix

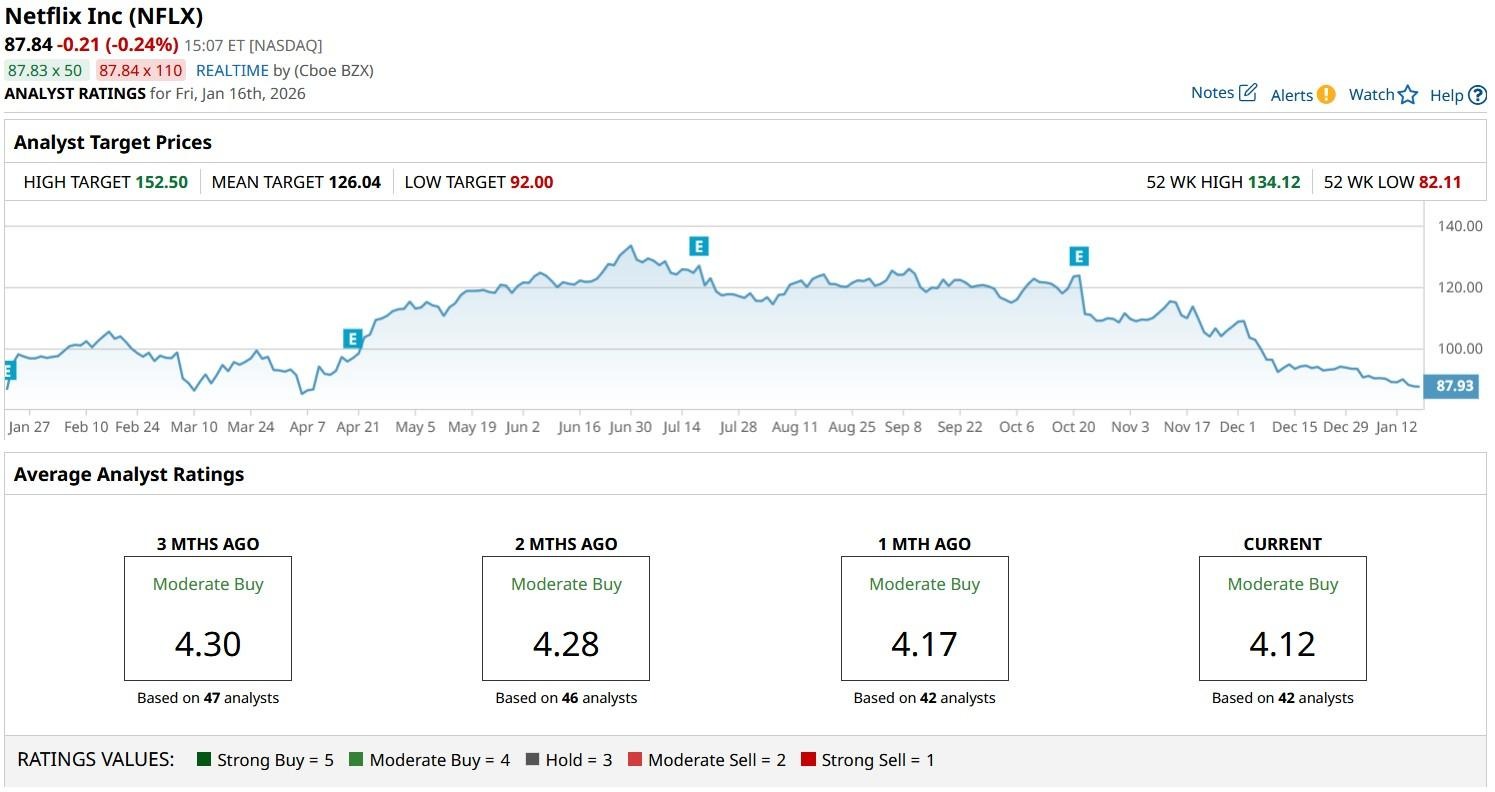

While NFLX shares are currently trading below their major moving averages (MAs), Wall Street continues to recommend owning them for the next 12 months.

The consensus rating on Netflix stock sits at “Moderate Buy” currently, with the mean target of about $126 indicating potential upside of more than 40% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Super Micro Computer Is One of the Most Shorted Stocks. Could a Squeeze Take It Higher in 2026?

- Intel Reports Earnings on January 22. Here Is Where Options Data Says INTC Stock Could Be Trading Next.

- Trump Just Took Aim at Health Insurance ‘Middlemen.’ What Does That Mean for UnitedHealth Stock?

- Dear Netflix Stock Fans, Mark Your Calendars for January 20