The first news of the week had to do with charges levied against US Fed Chairman Jerome Powell for the crime of not lowering interest rates fast enough for the US president.

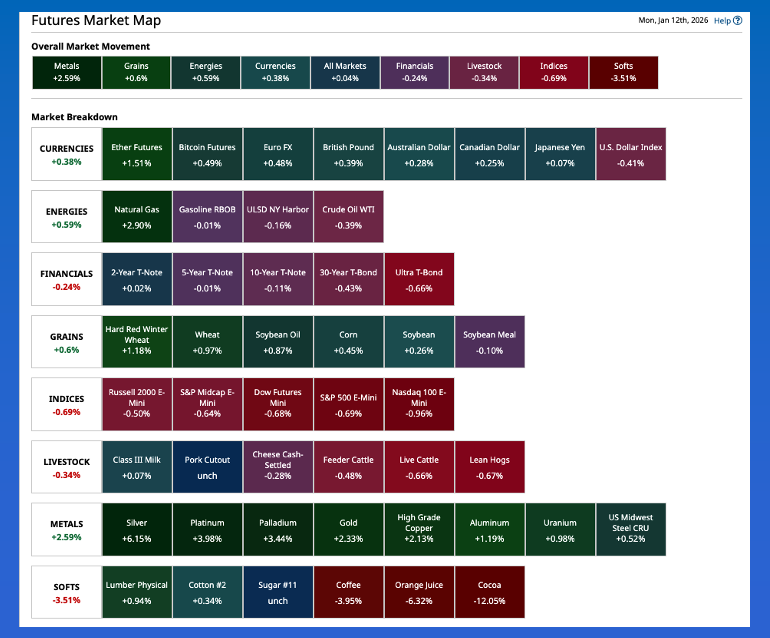

The US dollar index was under pressure overnight while the Metals sector rocketed higher once again.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.The Grains sector awaits the release of USDA's January WASDE at noon (ET). Based on National Cash Indexes at the end of December, we already know what real fundamentals were.

Morning Summary: I wanted to write about something different this morning, this week, but alas, it isn’t to be. The first thing I saw on CNBC’s Squawk Box Europe program pre-dawn Monday was a video of US Fed Chairman Powell talking about criminal charges levied against him by the US administration, and how these charges were driven by nothing more than the US president being unhappy with US interest rates[i]. At threat, as I’ve talked about before, is the Fed’s independence to do the job it is designed to do – handle the country’s monetary policy. The US dollar index is down at this writing, dropping as much as 0.41 and sitting near its session low on the idea the president’s demands will be met – eventually. Maybe he will get one of his political opponents arrested, maybe not, but eventually he will name the next Fed Chair, someone who will do exactly what he (presumably) is told and immediately lower rates regardless of reads on the US economy. Given this, it is interesting to note US stock index futures are lower to start the day. Meanwhile, copper (HGH26) was up 2.1%, gold (GCG26) was showing a gain of 2.3%, and silver (SIH26) jumped to a new all-time high of $84.69, up $5.35 (6.7%) overnight.

Corn: If anything tells you about the state of the United States these days, it is the fact I would rather talk about the January WASDE report from USDA than what leads market news each morning. Is the WASDE necessary? No. Are the numbers real? Of course not. Will trends of the markets in the Grains sector change due to today’s reports? Probably not. (I have to hedge my bets because algorithms could be triggered by imaginary numbers and news stories.) Anyway, the corn market was quietly higher pre-dawn Monday with hours ahead before the release of USDA’s latest at noon (ET). What should we expect from these reports? Using the cattle market and associated government reports as a guide, where the US president wants lower prices so USDA has miraculously come up with numbers to make sure that decree is met, it would not be surprising to see the agency release numbers designed to raise the US corn price. I have no idea what those numbers will be, but I do know at the end of December, based on the National Corn Index ($CNCI), immediate US supplies were large in relation to demand. Meanwhile, the outlook was still bullish given the May-July futures spread covered 30% calculated full commercial carry.

Soybeans: The soybean market was also quietly higher early Monday morning. The March issue posted a 4.5-cent trading range, from down 1.0 cent to up 3.5 cents on trade volume of 10,000 contracts and was sitting one tick off its overnight high at this writing. Was the world’s largest buyer in the market? Possibly. It is that time of year after all, with Brazil’s next crop still on the horizon. For now, the soybean market has stabilized, priming the pump for an uptick in volatility following the release of USDA’s January WASDE report later today. As with corn, I have no idea what numbers the agency has come up with, but we could read the real supply and demand situation at the end of December. The National Soybean Index ($CNSI) was priced near $9.69, holding above the previous 5-year end of December low near $9.50 but below the 10-year average end of December figure of $10.59. The March-May futures spread covered a neutral 49% calculated full commercial carry as compared to the end of November’s 29%, and the end 2025 edition of the spread closing December 2024 covering 42%. The bottom line is US fundamentals were neutral, but a bit more burdensome than the previous year.

Wheat: The wheat sub-sector was in the green pre-dawn Monday as well. What stands out to me here is the uptick in overnight trade volume for the HRW market. March was sitting 7.25 cents higher and on its session high while registering nearly 5,000 contracts changing hands. This development is made more interesting with a look back at last Friday’s CFTC Commitments of Traders report (legacy, futures only) showing Watson held a net-long futures position of 1,630 contracts as of Tuesday, January 6, a switch of 3,430 contracts from the previous week. This was the first time funds held a net-long futures position in HRW since 4,120 contracts the week of October 22, 2024. However, the March futures contract closed January 6 at $5.2150, down 0.5 cent for the week indicating commercial interests were selling while Watson was buying. As of Monday morning, the March issue is up nearly 17.0 cents from last Tuesday’s settlement indicating Watson has been adding to its position. Fundamentally, we know all three National Cash Indexes of the wheat sub-sector ($CSWI) ($CRWI) ($CRSI) were below previous 5-year end of December lows as 2025 came to an end. This told us supplies were larger in relation to demand across the board.

[i] You can read the CNBC.com story here: (LINK)

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart