Dover Corporation (DOV) is a diversified industrial manufacturer and solutions provider headquartered in Downers Grove, Illinois. Valued at $27.5 billion by market cap, the company operates through multiple segments, including Engineered Products, Clean Energy & Fueling, Imaging & Identification, Pumps & Process Solutions, and Climate & Sustainability Technologies.

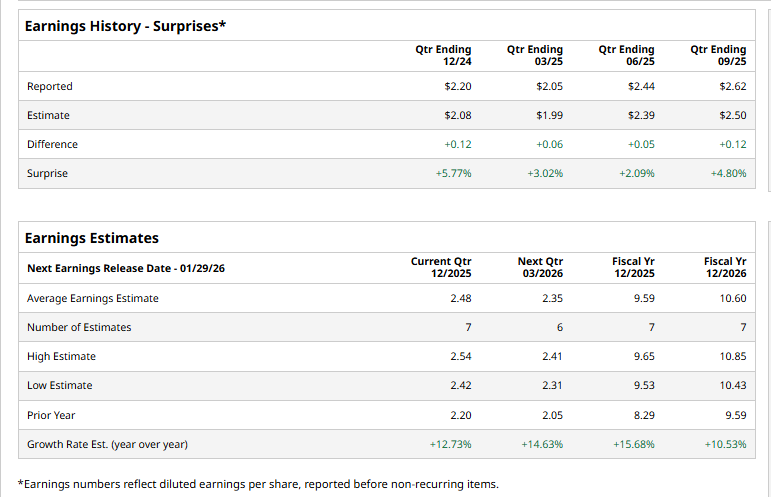

The industrial giant is expected to announce its fourth-quarter results soon. Ahead of the event, analysts expect Dover to deliver a profit of $2.48 per share, up 12.7% from $2.20 per share reported in the year-ago quarter. The company has a solid earnings surprise history overall. DOV has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For fiscal 2025, Dover is expected to report an adjusted EPS of $9.59, up 15.7% from $8.29 in 2024. In fiscal 2026, DOV’s earnings are expected to grow 10.5% year-over-year to $10.60 per share.

DOV shares have declined 5.7% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 16.9% surge and the Industrial Select Sector SPDR Fund’s (XLI) 17.7% gains during the same time frame.

Dover has lagged the broader market over the past year largely due to muted organic growth and cyclical weakness across several core industrial end markets. Investors have been cautious amid softer demand in capital goods–oriented segments, including engineered products and certain aerospace-related exposures, limiting near-term growth visibility.

Nonetheless, analysts remain optimistic about the stock’s prospects. DOV maintains a consensus “Moderate Buy” rating overall. Of the 18 analysts covering the stock, opinions include 10 “Strong Buy” and eight “Holds.” Its mean price target of $216.65 suggests an 8.9% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart