Chinese stocks had a strong year and are set to outperform the U.S. markets in 2025. The rally in Chinese stocks, which began last year after the country started unleashing stimulus measures, gained traction this year. While the artificial intelligence (AI) euphoria faded in the U.S. and the “Magnificent 7” did not have that magnificent a performance in 2025, the fever caught up with Chinese stocks. Alibaba (BABA) emerged as the preeminent AI play in the world’s second-largest economy. The stock, which was once “uninvestable” for being in the wrong books of Chinese authorities, saw a near FOMO trade this year.

While BABA is down over 20% from its recent highs, it is up a cool 75% for the year, which far outstrips the gains of the average U.S. tech stock. In this article, we’ll examine BABA’s 2025 performance and discuss its 2026 outlook at a time when the AI rally seems to be losing steam.

BABA Stock Rallied in 2025

The year started on a strong note for Alibaba, and it was up 50% for the year by mid-February. Several factors helped propel BABA stock higher this year. In January, Chinese AI startup DeepSeek revealed its low-cost AI model, which triggered a buying spree in Chinese tech names (and a simultaneous crash in U.S. AI giants). The rally in Chinese tech stocks gained traction in February after President Xi Jinping met with Chinese entrepreneurs, including Alibaba’s co-founder Jack Ma.

Ma and Alibaba became the face of China’s tech crackdown, so the meeting was quite an about-turn for the country’s political leadership and a sign that it is backing its tech companies amid the AI war with the U.S.

Notably, Alibaba has seemed like the partner of choice for foreign companies looking to offer AI services in the communist country. AstraZeneca (AZN), Bosch, and BMW (BMWKY) are some of the foreign companies that partnered with Alibaba for AI. Similarly, Apple (AAPL) selected BABA as the partner to bring “Apple Intelligence” features to its iPhones in China.

Meanwhile, Alibaba’s joyride ended by mid-March, and it plunged below $100 in April after U.S. President Donald Trump announced stiff tariffs on China. However, the two countries reached a truce of sorts, which helped allay fears of further escalation in trade tensions.

One defining theme for Alibaba this year was the fall in profits amid rising AI capex and continued losses in the instant commerce business. However, there is optimism over both these businesses. Alibaba is already reaping the rewards of its AI capex in the form of higher cloud revenues. The instant commerce business has the potential to be the next big thing for the Chinese tech giant—something we are witnessing in its neighbor, India, where instant delivery apps are fast gaining ground.

BABA Stock Forecast

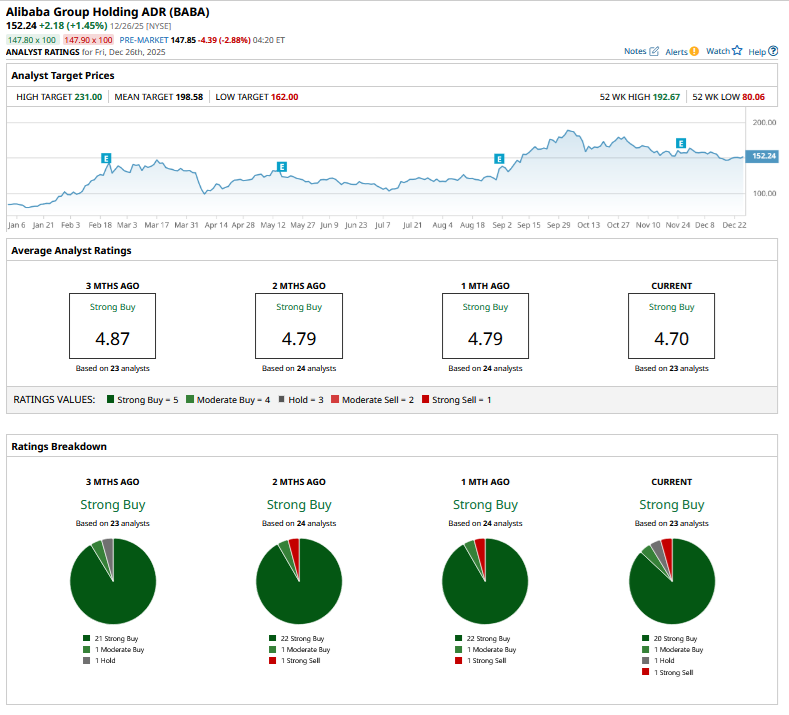

Wall Street analysts continue to have a bullish bias towards BABA, and it has a consensus rating of “Strong Buy” from the 23 analysts polled by Barchart. The stock has a mean target price of $198.58, which is 30% higher than the current price levels.

Why Alibaba Stock Is a Good Buy for 2026

While there have been some concerns over the stimulus-fueled revival in the Chinese economy, I remain constructive on Chinese stocks as an asset class in general and BABA in particular as we head into 2026.

Alibaba might continue to see pressure on short-term profitability amid instant commerce losses and AI capex, with the situation not being much different from U.S. tech giants, which are staring at a depreciation tsunami on their burgeoning AI capex. However, these investments are positioning Alibaba for long-term growth, as both instant commerce and AI hold tremendous potential.

Alibaba is the leader in China’s AI cloud market with a market share higher than the next three competitors. The company has emerged as a worthy competitor to Western AI rivals and even developed AI chips. This would not only help it lower reliance on third parties but could potentially become a significant business line as it signs up third-party customers. Alibaba has also announced data centers globally in countries like France, the UAE, Brazil, and Japan, which makes it a growing player in the global AI market.

Consensus estimates call for Alibaba’s fiscal year 2027 (ending March 2027) earnings per share (EPS) to increase by almost 50% to $8.57, which gives a 2027 price-to-earnings (P/E) multiple of 17.7x. The multiples don’t look unreasonable for Alibaba, even though they are not as mouthwatering as they were until last year. Overall, while not a table-pounding buy, I believe Alibaba's risk-reward is quite favorable for 2026, and the stock should continue its good run next year as well.

On the date of publication, Mohit Oberoi had a position in: BABA , AAPL . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Archer Aviation Stock Crashed in 2025. Will 2026 Be the Year Shares Take Flight Again?

- QuantumScape Gained 100% in 2025 and Is Set to Generate Revenue for the First Time in 2025. Options Data Suggests You Should Play QS Stock Like This for 2026.

- Dan Ives Is Betting on Cyber-AI for 2026. 1 Stock to Load Up on Now.

- Plug Power Stock Underperformed in 2025. Will 2026 Be Different?