RTX Corporation (RTX), headquartered in Arlington, Virginia, stands as a premier aerospace and defense firm. It thrives through its core segments, Collins Aerospace, Pratt & Whitney, and Raytheon, providing cutting-edge integrated systems, propulsion engines, and advanced defense technologies globally.

Spanning commercial aviation, military operations, and space exploration, RTX drives innovation in avionics, cybersecurity, and more, leveraging its vast scale, diverse offerings, and key alliances with governments and industry partners to tackle pressing challenges. The company has a market capitalization of $248.95 billion.

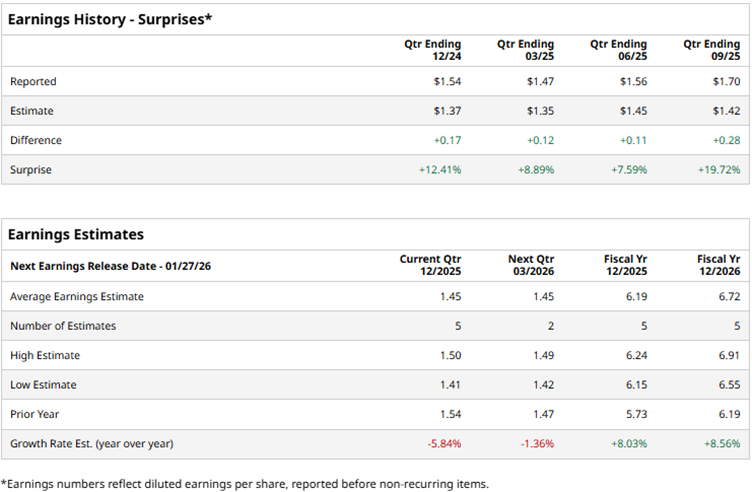

RTX is set to report its fourth-quarter results soon. Ahead of the results, Wall Street analysts expect the company to report a profit of $1.45 per diluted share in Q4, down 5.8% year over year (YOY). However, the company has a solid earnings surprise record, exceeding estimates in all four trailing quarters.

Analysts expect the company to improve its bottom line this year. For the full fiscal year 2025. Wall Street analysts expect RTX’s diluted EPS to grow by 8% annually to $6.19.

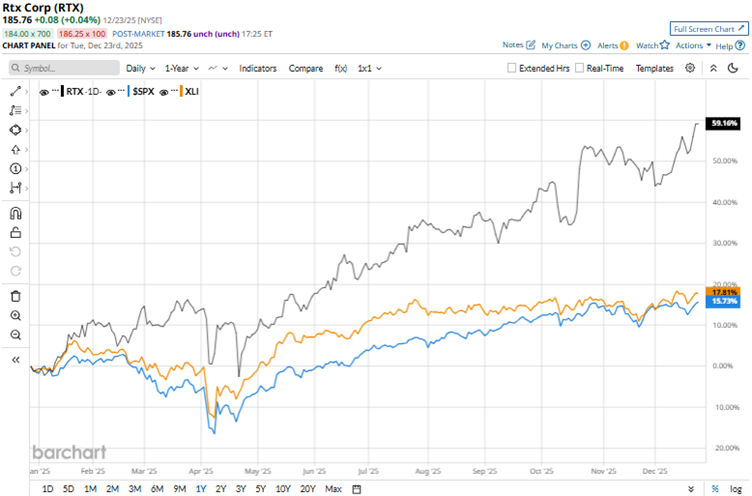

Fueled by strong revenue growth and margin expansion, RTX’s stock has been outperforming the broader market over the past year. Over the past 52 weeks, the stock has gained 59.3%, and over the past six months, it is up 27.4%. On the other hand, the broader S&P 500 Index ($SPX) has increased by 15.7% and 14.7% over the same periods, respectively.

The State Street Industrial Select Sector SPDR ETF (XLI) has gained 17.9% over the past 52 weeks and 9.1% over the past six months. Therefore, RTX has also been an outperformer in its sector over these periods.

RTX’s operations continue to be buoyed by contract awards and strategic partnerships. Recently, the company’s Raytheon business was awarded a $1.70 billion contract to supply Spain with four Patriot air and missile defense systems, marking Spain’s largest Patriot order. To improve mission outcomes, RTX partnered with Amazon Web Services (AWS). This collaboration aims to improve satellite data processing and mission-control operations.

The company’s Pratt & Whitney business also landed a $1.60 billion undefinitized contract action for the sustainment of F135 engines. These engines power all three variants of the F-35 Lightning II, which is an advanced fighter aircraft.

On Oct. 21, RTX reported solid third-quarter results for 2025. Its sales increased 12% YOY to $22.48 billion, while its adjusted EPS grew 17% annually to $1.70. Based on these robust results, the company also raised its full-year outlook. The stock gained 7.7% intraday on the same day.

Wall Street analysts have been bullish about RTX’s prospects. Among the 22 analysts covering the stock, the consensus rating is “Moderate Buy.” The rating configuration is more bullish than it was a month ago, with 14 “Strong Buy” ratings now, up from 13. The stock also has one “Moderate Buy” rating and seven “Holds.”

The mean price target of $196.28 indicates a 5.7% upside from current levels, while the Street-high price target of $215 implies a 15.7% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart