Data center infrastructure is turning into one of the biggest spending races in the market. Deal activity in the sector hit a record $61 billion in 2025, showing the rapid pace of companies locking in enough data center space and computing power for artificial intelligence work. And this is further fueled by generative AI workloads that are pushing today’s power and server capacity to the limit.

Demand for AI-ready data centers is soaring so quickly that supply could fall behind. This is the reason behind the largest cloud providers that are rushing to add more capacity, along with specialized chips and better cooling systems. One of the clearest winners from this shift is Amazon (AMZN), since AWS is spending heavily to stay ahead as AI infrastructure spending keeps rising.

Amazon has already doubled AWS power capacity since 2022 and added 3.8 gigawatts in the last year alone, more than any other cloud provider, with plans to double that again by 2027 to keep up with AI demand. At the same time, Amazon’s Trainium-based AI infrastructure has grown into a multibillion-dollar business, posting triple-digit growth as AWS invests in custom silicon and large-scale data center expansion to support AI-focused workloads.

With global data center revenue projected to reach roughly $739.05 billion by 2030, can Amazon’s hyperscale build-out turn this data center supercycle into meaningful upside for its stock in 2026? Let’s find out.

Amazon’s Financial Engine

As the world’s largest online retailer and cloud provider, Amazon runs a broad business that brings together e-commerce, subscription services, digital advertising, and its main cloud arm, Amazon Web Services (AWS), which is still the company’s biggest profit driver.

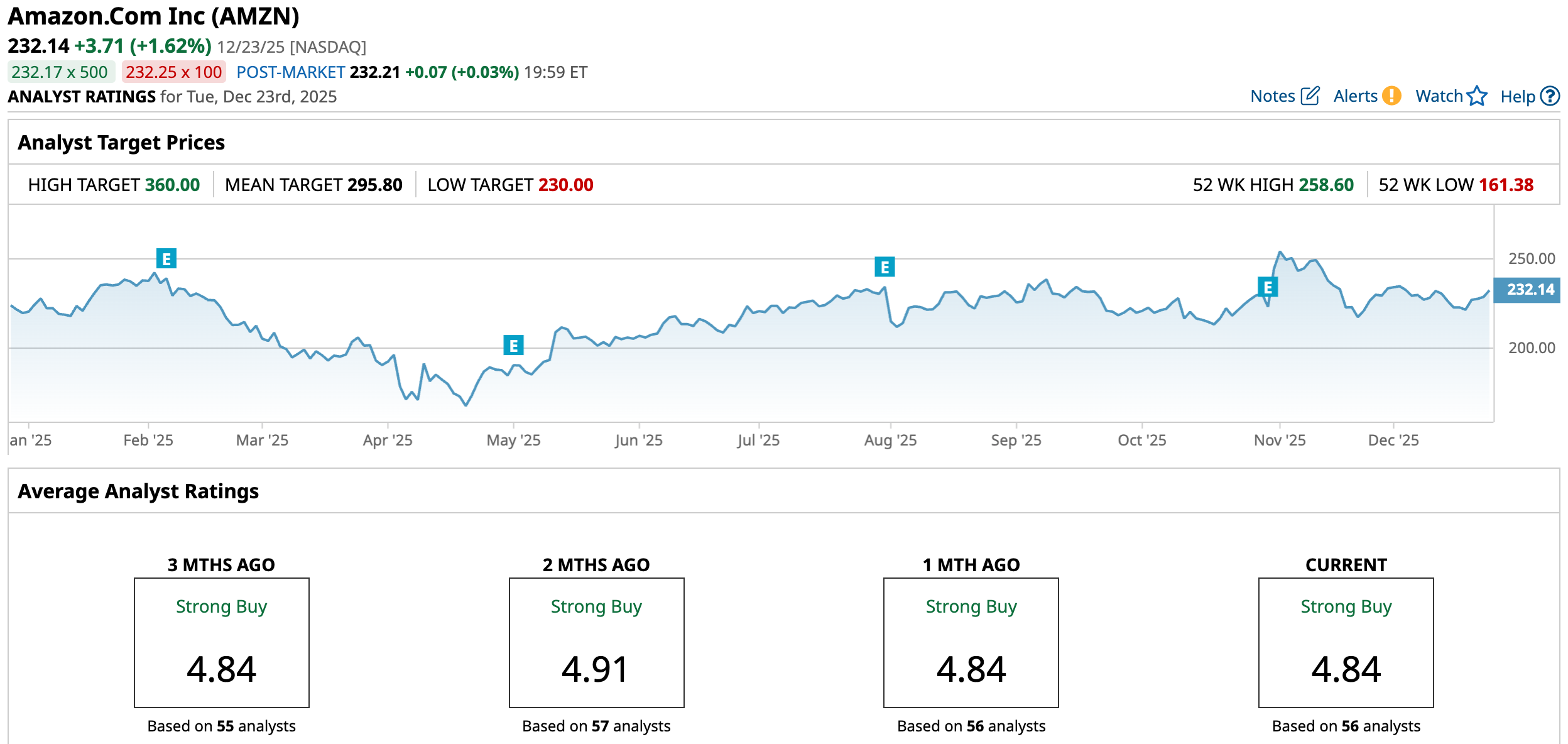

Over the past year, Amazon’s stock has moved up in a slow but steady way, gaining 3.15% over the past 52 weeks and 5.81% year-to-date (YTD).

Also, the valuation shows investors are willing to pay up for that outlook, with a forward price-to-earnings ratio of 31.7x, well above the sector average of 17.87x, which signals the market expects stronger earnings from Amazon than the typical peer group.

That view is supported by the latest financial results. For the third quarter ended Sept. 30, 2025, Amazon reported net sales of $180.2 billion, up 13% from a year earlier. Operating income came in at $17.4 billion. But without special charges of $2.5 billion tied to a legal settlement and $1.8 billion in planned role eliminations severance costs, operating income would have been $21.7 billion.

Net income climbed to $21.2 billion, or $1.95 per diluted share, up from $15.3 billion last year. Free cash flow fell to $14.8 billion, primarily due to a $50.9 billion increase in property and equipment investments, which underscores Amazon's substantial investment in scaling its infrastructure, particularly cloud and data center capacity, to support its next stage of growth.

Amazon’s Growth Foundations

Amazon expanded its Nova portfolio this year, and it directly strengthens its AI infrastructure push tied to the data center demand shaping the 2026 growth story. The company introduced four new Frontier Nova models along with Nova Forge, a service that lets organizations build their own custom model versions using an “open training” approach that brings proprietary data into the process early. Amazon also rolled out Nova Act, which reached a 90% reliability rate for browser-based automation workflows, giving enterprises a more dependable way to automate online tasks as they scale digital operations.

On top of that, Amazon upgraded Bedrock AgentCore with real-time, policy-based controls that block unauthorized agent actions, plus AgentCore Evaluations for ongoing quality checks. It also added AgentCore Memory, which helps AI agents learn from past experiences so decision-making improves over time. Organizations such as Cohere Health, Thomson Reuters, and S&P Global Market Intelligence are already using AgentCore in production deployments.

Meanwhile, Amazon expanded its work with SolarWinds, allowing the IT management company to build in generative AI through Amazon Bedrock. The partnership supports AI-driven automation and observability for SolarWinds, highlighting how AWS is becoming the underlying AI infrastructure that many large enterprises rely on.

Analysts See More Room to Run

For the fourth quarter of 2025, management is guiding net sales to a range of $206.0 billion to $213.0 billion, which would mean 10% to 13% year-over-year (YOY)growth. Operating income is expected to land between $21.0 billion and $26.0 billion, compared with $21.2 billion in the same quarter last year. The next earnings release is set for Feb. 5, 2026, and analysts are looking for earnings of $1.97 per share for the current quarter and $7.17 for full-year 2025. That works out to an estimated YOY growth of 5.91% for the quarter and 29.66% for the full year.

That outlook helps explain why Oppenheimer recently raised its Amazon price target to 305 from 290. The firm pointed to Amazon’s plan to double AWS capacity by 2027. It also suggested each added gigawatt could bring in about $3 billion in revenue, which could have a “meaningful” impact on cash flow as new data centers come online in this AI-heavy environment. Barclays analyst Ross Sandler made a similar point, saying “AWS has secured significant AI capacity over the next several years,” and his team expects growth to accelerate from here, as more AI work moves onto that expanded capacity.

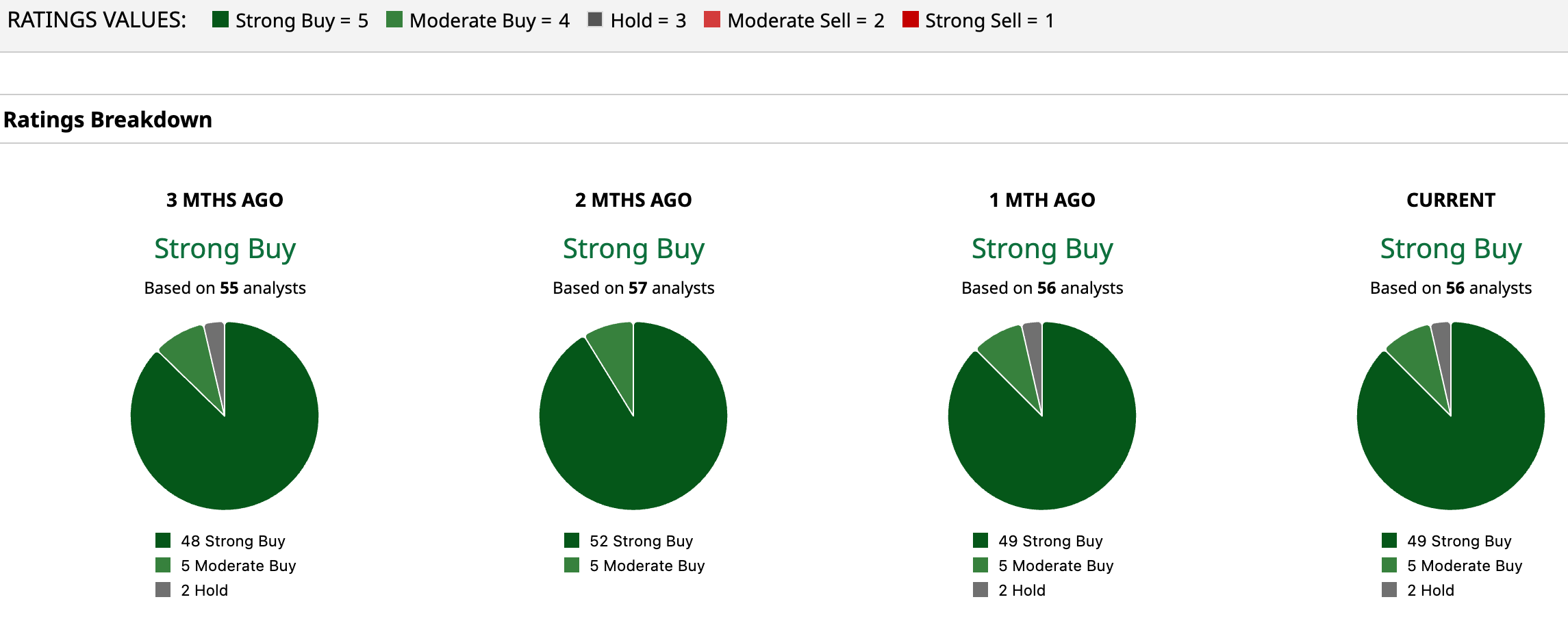

Overall, all 56 analysts surveyed rated Amazon a consensus “Strong Buy,” with 49 “Strong Buy,” five “Moderate,” and two “Hold.” The average price target of $295.80 suggests about 27.4% upside from the current level.

Conclusion

Amazon looks like one of the cleanest ways to play the $61 billion data center supercycle heading into 2026, with AWS-led infrastructure spending, surging AI demand, and a packed product roadmap all pointing in the same direction. The company is leaning hard into power capacity, custom silicon, and AI-native services at the exact moment enterprises are scrambling for compute. Also, Wall Street clearly likes what it sees, with strong earnings growth estimates and a roughly 30% implied upside from here. Nothing is guaranteed, but if data center and AI investment stay on their current trajectory, Amazon’s shares look more likely to grind higher than to stall.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart