While flashy growth stocks often steal the spotlight, some of the market’s most consistent winners are hiding in plain sight. This year, two Dividend Kings, companies with decades-long track records of increasing payouts, have not only delivered reliable income but also quietly outperformed the broader market.

Dividend King #1: AbbVie (ABBV)

AbbVie (ABBV) is a global biopharmaceutical company that develops and sells treatments in immunology, oncology, neuroscience, and aesthetics, including blockbuster drugs like Humira and Skyrizi. AbbVie has quietly stood out this year, supported by resilient revenue growth, expanding blockbuster franchises, and a renewed commitment to dividend increases. This has led the stock to soar 29% year-to-date (YTD), outperforming the S&P 500 Index ($SPX) gain of 17.4%.

With Humira’s patent expiration, there were concerns that AbbVie might lose its steam. However, the company reported net revenues of $15.7 billion, representing a 9.1% year-over-year (YoY) increase. The company's immunology and neuroscience portfolios drove growth, offsetting the significant decrease in Humira sales. The immunology portfolio alone delivered $7.8 billion in quarterly revenue, a roughly 12% increase, led by Skyrizi and Rinvoq. Skyrizi generated $4.7 billion in revenue, up over 47%, while Rinvoq grew by more than 35% to $2.18 billion.

Neuroscience was another bright spot, with revenues increasing by more than 20% to $2.841 billion. Key drugs like Vraylar, Botox Therapeutic, Ubrelvy, and Qulipta all experienced strong growth, highlighting AbbVie's diversification beyond immunology. Meanwhile, oncology sales remained constant at $1.682 billion, with gains in Venclexta and Elahere offsetting declines in Imbruvica.

AbbVie reported adjusted diluted profits per share of $1.86 for the quarter. Importantly, management increased its full-year 2025 adjusted EPS outlook to a range of $10.61 to $10.65. AbbVie has paid and increased dividends for the past 54 years, earning the title of a Dividend King. What truly cements AbbVie’s status as a Dividend King is its shareholder return profile. The company announced a 5.5% dividend increase beginning in February 2026, raising the quarterly payout to $1.73 per share. Since its inception in 2013, AbbVie has increased its dividend by more than 330%, highlighting its long-term commitment to income-focused investors. The company pays an attractive yield of 3.04%, higher than the healthcare average of 1.6%.

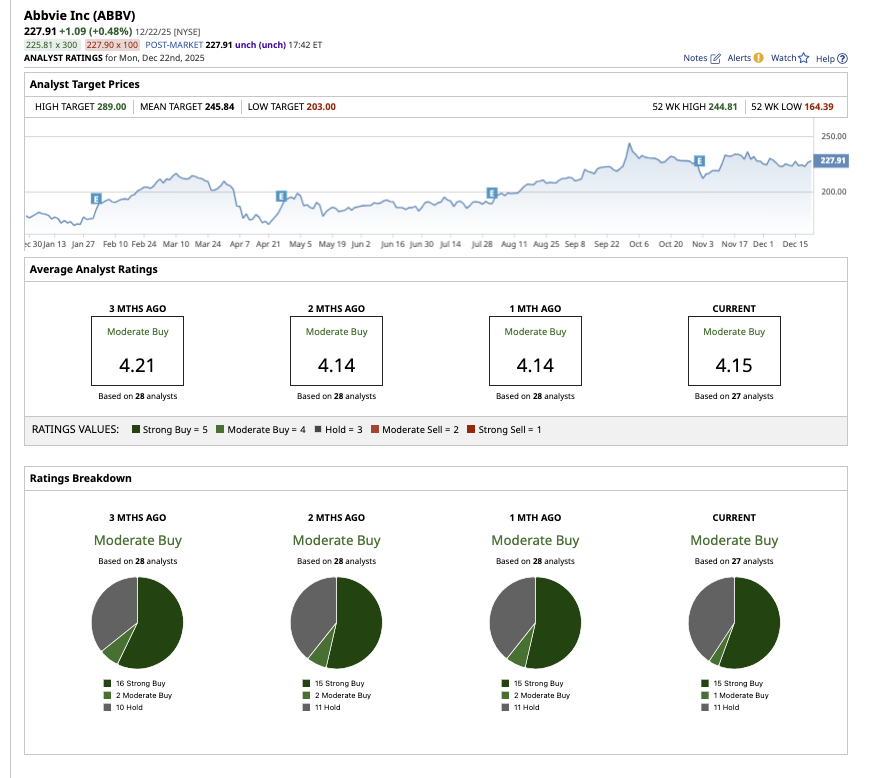

Overall, on Wall Street, AbbVie stock is a “Moderate Buy.” Out of the 27 analysts covering the stock, 15 have a “Strong Buy,” one suggests a “Moderate Buy,” and 11 recommend a “Hold” rating. The mean target price for ABBV is $245.84, which is 7.8% above its current levels. Its high price estimate of $289 implies a potential upside of 26.8% over the next 12 months.

Dividend King #2: Johnson & Johnson (JNJ)

Johnson & Johnson (J&J) (JNJ) is a global healthcare company that develops pharmaceuticals, medical devices, and healthcare products, focusing on areas like oncology, immunology, cardiovascular disease, neuroscience, and surgical technologies.

J&J's diversified healthcare business, which includes pharmaceuticals and medical equipment, has enabled the company to achieve consistent profitability even during times of economic turmoil.

What sets J&J apart as a Dividend King is its unmatched commitment to shareholders. The company has increased its dividend for more than six decades consecutively, placing it among a rare group of companies with proven cash-flow durability. This steady dividend growth, combined with consistent earnings generation, has helped J&J deliver reliable total returns when market volatility rises. J&J pays a forward yield of 2.5% higher than the healthcare average.

In the third quarter, J&J reported worldwide sales of $24 billion, reflecting 5.4% operational growth despite a significant headwind from the loss of exclusivity of STELARA. Importantly, J&J showed its ability to grow through the STELARA decline by delivering double-digit growth across 11 brands. Oncology stood out, with operational sales growth nearing 20%. DARZALEX grew almost 20% and maintained more than 50% market share across all lines of multiple myeloma therapy, while CARVYKTI posted over 80% growth, bolstering confidence in its $5 billion peak sales potential.

Immunology also remained a strength, led by TREMFYA, which delivered remarkable operational growth of 40%, driven by new indications in inflammatory bowel disease. Management now sees TREMFYA as a potential $10 billion-plus asset. In neuroscience, SPRAVATO sales surged more than 60%, benefiting from continued demand in treatment-resistant depression, while the recent acquisition of CAPLYTA added further depth to the portfolio. The MedTech business added another layer of stability and growth. Operational sales increased 5.6%, with cardiovascular results particularly strong.

Adjusted diluted EPS of $2.80 grew 15.7% YoY. Management raised full-year 2025 guidance, reaffirming adjusted EPS expectations of approximately $10.85 at the midpoint. Strong free cash flow generation and a resilient balance sheet continue to support shareholder returns.

As a long-standing Dividend King, Johnson & Johnson’s ability to deliver consistent growth, navigate major patent expirations, and invest heavily in innovation explains why it is quietly outperforming the market this year.

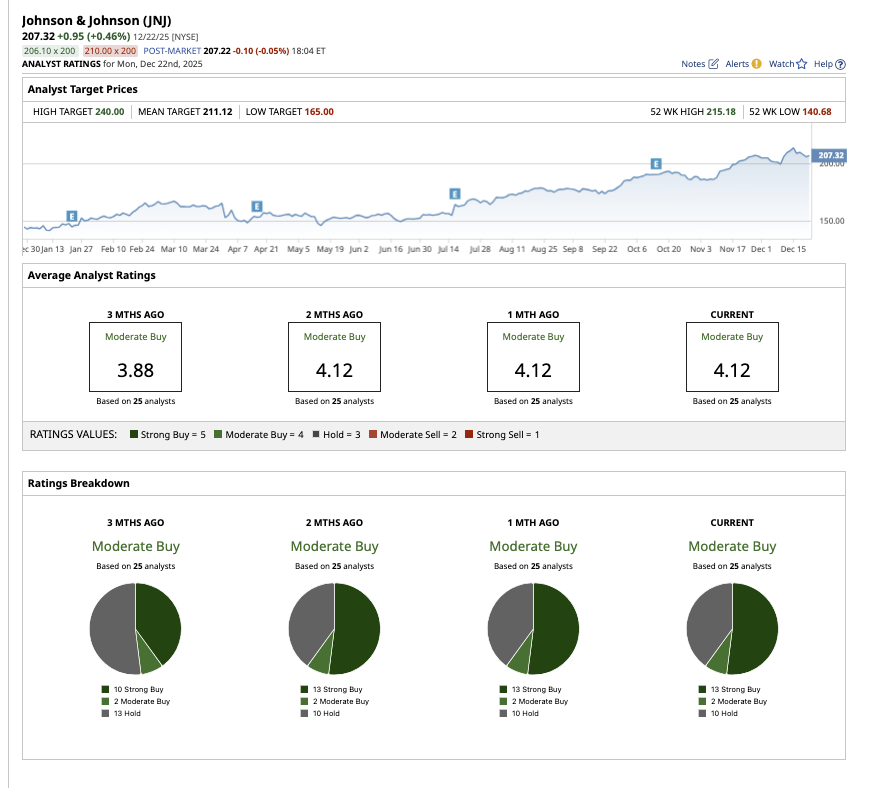

Overall, Wall Street has assigned a “Moderate Buy” rating to JNJ. Out of the 25 analysts covering the stock, 13 rate it a “Strong Buy,” two rate it a “Moderate Buy,” and 10 rate it a “Hold.” The mean target price on the stock is $211.12, which is 1.8% above current levels. Meanwhile, its high target price of $240 implies a potential upside of 15.7% in the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart