Media and semiconductor intellectual property (IP) licensing company Adeia (ADEA) announced that it had entered a long-term media IP licensing agreement with entertainment industry giant The Walt Disney Company (DIS), which grants Disney access to Adeia’s comprehensive media IP portfolio.

The agreement also resolves all outstanding litigation between the two companies. This news sent Adeia’s stock sharply higher, with the stock gaining 30.5% intraday on Dec. 22.

While the financial terms of the deal were not disclosed, the company raised its financial outlook for the current year following the deal announcement. Adeia now expects 2025 revenue to be in the range of $425 million - $435 million, up from the prior range of $360 million - $380 million.

Let's look closely at Adeia to determine whether you should consider investing in the stock now.

About Adeia Stock

Adeia is a tech-focused firm that invents and licenses cutting-edge technologies, mainly in media, entertainment, and connected devices. Its core operations involve developing intellectual property around content discovery, user interfaces, and semiconductor innovations, which it then licenses to service providers, device makers, and other tech firms globally.

Instead of producing hardware, Adeia earns revenue through licensing deals and royalties, helping partners improve how users find and interact with digital content. The company is based in San Jose, California and has a market capitalization of $1.83 billion.

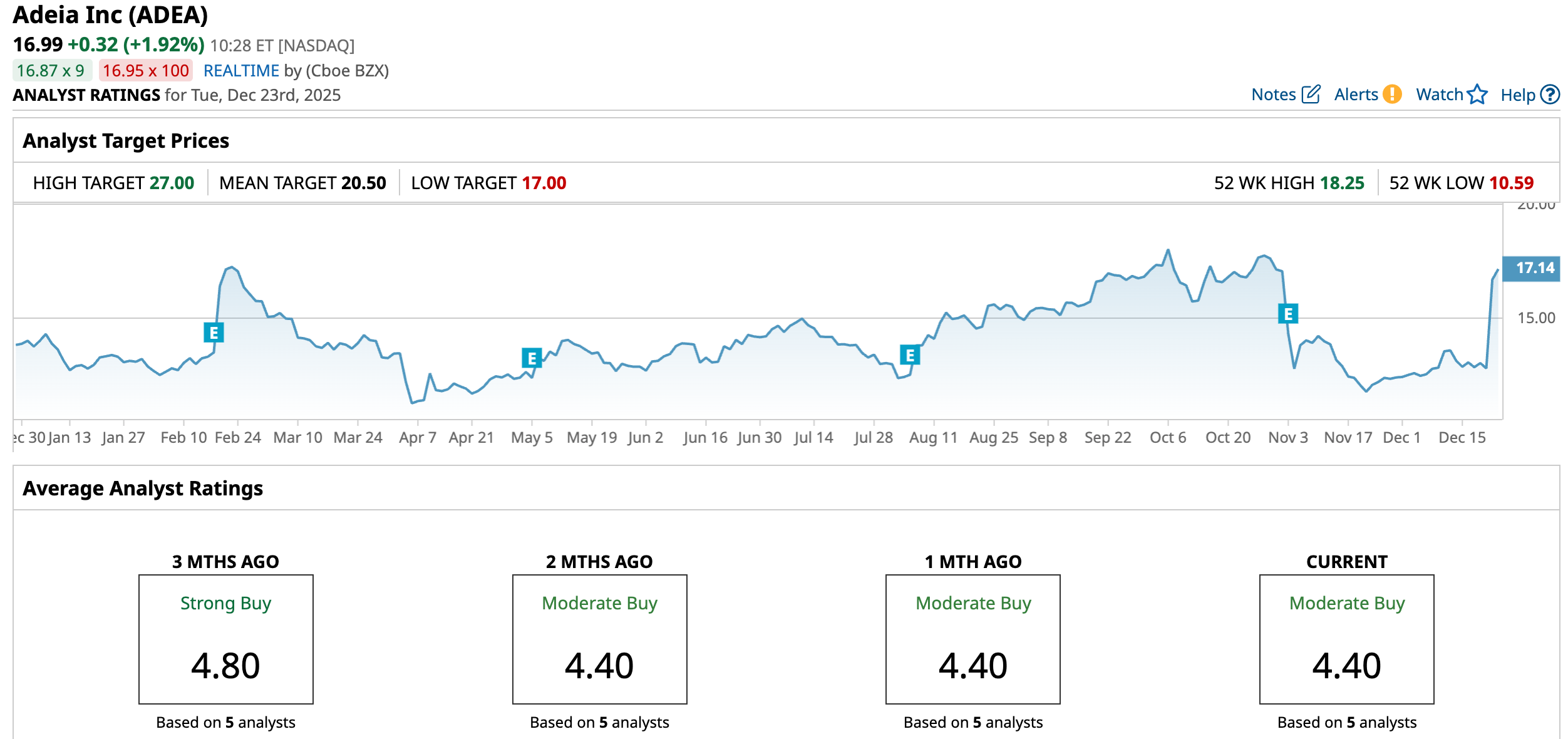

Based on the new Disney deal and confidence in the company’s IP-based business model, the stock has been holding up well on Wall Street. Over the past 52 weeks, the stock has gained 26.32%, and over the past six months, it has gained 26.97%.

Amid strong sentiment, the stock reached a 52-week high of $18.25 in early October but is down 6.2% from that level. A likely key catalyst was Adeia’s announcement of a long-term IP license agreement with Altice USA, now rebranded as Optimum Communications (OPTU). This deal reinforced the value of Adeia’s IP portfolio and its ability to secure significant licensing partnerships, boosting investor optimism about future cash flows and growth.

Adeia’s stock is trading at a lower valuation than its peers. Its price-to-earnings ratio of 19.64x is lower than the industry average of 31.09x.

What Do Adeia’s Recent Results Tell Us?

On Nov. 3, Adeia reported its third-quarter results for 2025, with the top line primarily in line with its expectations. The company’s revenue increased 1.4% year-over-year (YOY) to $87.34 million. Adeia noted that its non-Pay-TV recurring revenue grew 31% YOY, indicating that its strategy of signing agreements with firms in semiconductors, OTT, and adjacent media markets is working.

Adeia is currently a profit-generating company. However, its GAAP diluted EPS dropped by 52.9% from the prior year’s period to $0.08. After adjusting, Adeia’s non-GAAP EPS increased 3.7% YOY to $0.28. The company’s adjusted EBITDA was $50.70 million for the third quarter. Adeia had $56.09 million in cash and cash equivalents as of Sept. 30.

Also, the company announced that it had signed a long-term licensing agreement with an e-commerce customer, granting the customer access to Adeia’s media portfolio. Further, the firm shared that the Federal Court of Canada had ruled in its favor in the patent infringement case against Videotron Ltd.

More importantly, Adeia announced that it has filed patent infringement lawsuits against chip giant Advanced Micro Devices (AMD), alleging infringement of ten patents from Adeia’s semiconductor IP portfolio. Seven of the ten patents cover hybrid bonding technology, and the other three cover advanced process node technology.

What Do Analysts Think About Adeia Stock?

Following the announcement of the deal with Disney, analysts at Roth Capital reiterated their bullish stance on Adeia’s stock, maintaining a “Buy” rating and a $27 price target. Roth Capital analysts consider this development significant, given the company’s raised outlook and its IP media sales, which appear poised to return to growth next year.

Following this notable development, Rosenblatt analysts maintained a “Buy” rating on the IP licensing company and raised the price target on the stock from $17 to $20. Analysts at the firm noted that Adeia successfully defends its patents and reduces its debt.

Wall Street analysts have a mixed view about Adeia’s bottom line trajectory. For the current fiscal year, its EPS is expected to drop by 22.4% YOY to $0.83. On the other hand, for fiscal 2026, the company’s EPS is projected to increase by 32.5% annually to $1.10.

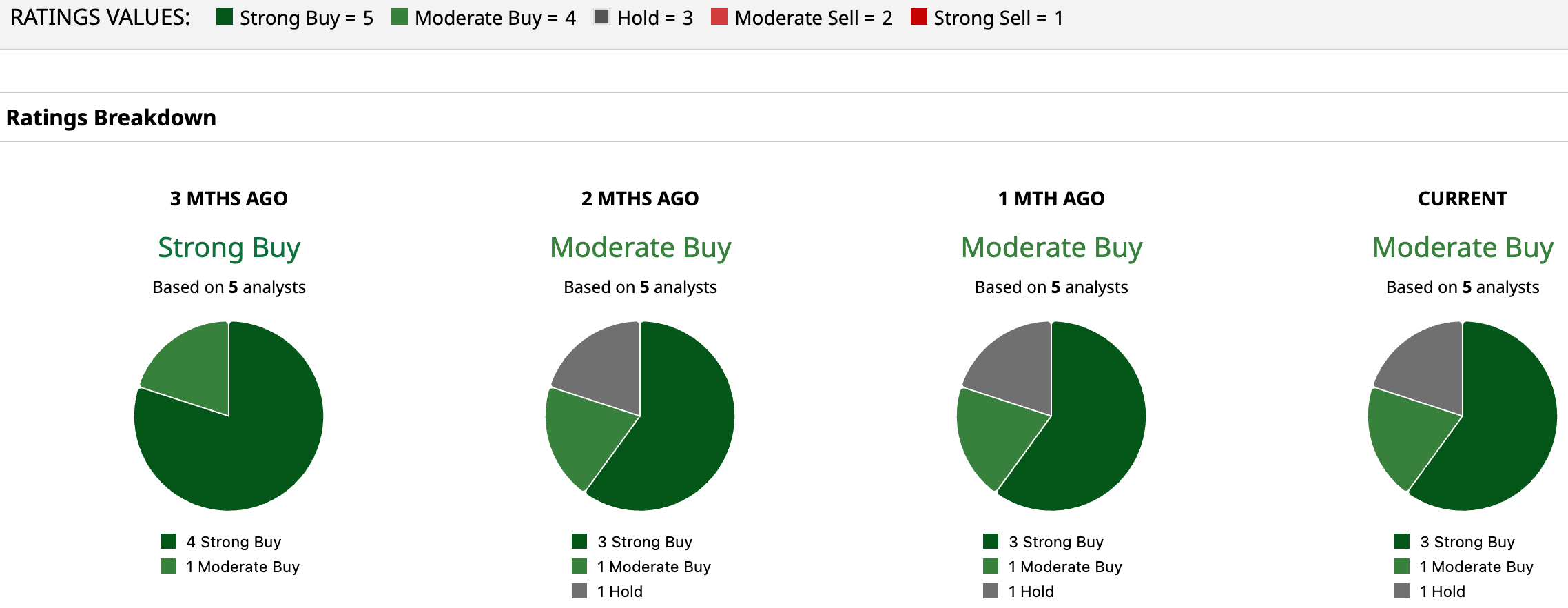

Although Adeia is not widely known on Wall Street, analysts hold a favorable view of its stock, assigning it a consensus “Moderate Buy” rating. Of the five analysts rating the stock, a majority of three analysts have given it a “Strong Buy” rating, one analyst rated it “Moderate Buy,” while one analyst gave a “Hold” rating. The consensus price target of $20.50 represents 20.7% upside from current levels. The Street-high Roth Capital-given price target of $27 indicates a 59% upside.

Key Takeaways

Adeia’s Disney deal is seen as a win by analysts, who have reaffirmed their bullish ratings following the announcement. The company’s raised outlook also aligns with the positive development surrounding the stock. Therefore, Adeia’s shares might be a buy now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Software Stock Looks ‘Washed Out’ but Analysts Think 2026 Could Be Its Turnaround Year. Why?

- This Dividend Stock Just Scored an FDA Win. Should You Buy Shares Now?

- Top 100 Stocks to Buy: AMC Entertainment Partially Exited Hycroft Mining Earlier This Month. There’s Good News and Bad News for AMC Shareholders.

- Dan Ives Thinks Trump Will Invest in This Quantum Computing Stock in 2026. Should You Buy It First?