Semiconductor giant Broadcom Inc. (AVGO) has been among the big winners in the artificial intelligence (AI)-fueled market, and its recent correction hasn’t done much to alter that. After registering an impressive 120% gain last year, the stock took a sharp dip recently. Yet, it continues to remain in focus on Wall Street as a high-quality stock that stands to gain from AI expenditure well into next year.

That sentiment was reiterated recently by GMO Portfolio Manager Tom Hancock, who considered Broadcom a relatively safe AI bet because it’s more diversified. Not all stocks with an AI link rely on a single product cycle or market demand. Broadcom already has multiple product cycles with semiconductor and infrastructure software business. The growth engine for Broadcom is AI, but that isn’t its lone source. Its biggest weakness, according to Hancock, is valuations.

About Broadcom Stock

Broadcom primarily designs and provides semiconductor solutions and infrastructure software. It is headquartered in California and ranks among the most prominent and strategically significant participants in global technology infrastructure.

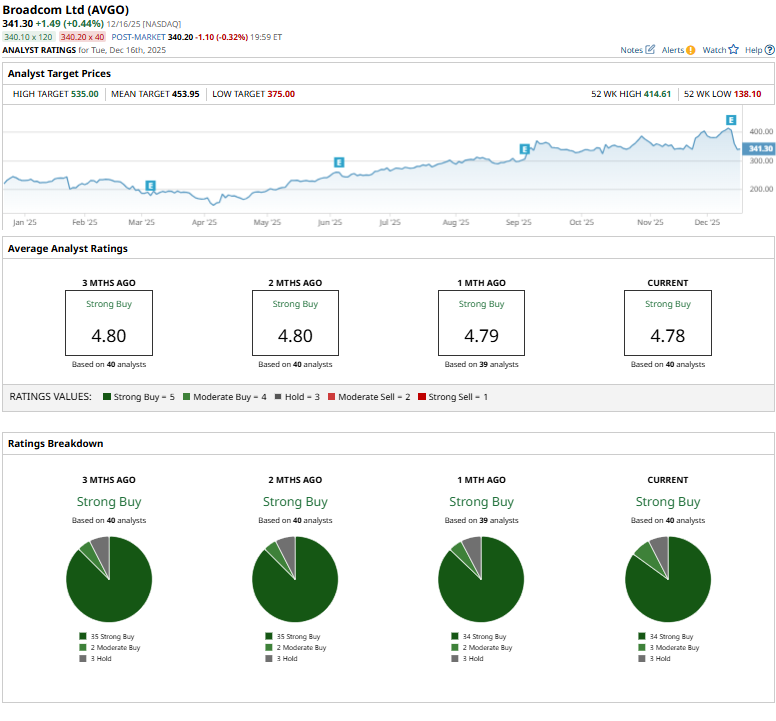

The performance of AVGO stock over the past year has been remarkable. Broadcom has a current market cap of $1.6 trillion. Its stock price range has varied from $138 to $415 over the past 52 weeks, primarily due to the strength of the AI sector and its volatility. Even after the latest drop, it is clear that Broadcom has performed remarkably well compared to the rest of the market, thus firmly establishing it as a leader rather than purely speculative.

Valuation is an area where people have differing views. As of current market prices, Broadcom’s price-to-earnings ratio remains above 45x, and its price-to-sales ratio remains above 25x. By no standards is Broadcom stock cheap, but then again, its margins, cash flow visibility, and customer loyalty warrant a premium.

Broadcom also pays a dividend. It isn’t very high, but it is significant nonetheless. The company just boosted its dividend payout by 10%, with a payout rate of $0.65 per share. It marked the fifteenth year of dividend growth.

Broadcom Beats on Earnings

The latest earnings report from Broadcom continued to fuel the bull camp. For the fourth quarter of fiscal 2025, revenue stood at $18 billion, an increase of 28% compared to the previous year. Non-GAAP diluted earnings per share (EPS) of $1.95 marked a 37% increase, while GAAP diluted EPS almost doubled.

However, it was AI that stole the show. The company reported 74% year-over-year growth in AI semiconductor revenue. Looking ahead, it forecasts a doubling of AI semiconductor revenue on a year-over-year basis. Evidently, there are no signs of slowing demand yet.

Guidance was also strong. Looking ahead to fiscal 2026, for the first quarter, Broadcom forecasted revenue of about $19.1 billion, implying a 28% increase from the previous year. Adjusted EBITDA margins are forecast at about 67%, consistent with its excellent margins at scale. Free cash flow continues to be a bright spot, offering opportunities for the firm to invest, repay debt, and distribute payouts simultaneously.

What Do Analysts Expect for Broadcom Stock?

Overall, analyst sentiment remains largely positive. The stock enjoys a “Strong Buy” rating consensus. The average price target among analysts is approximately $454, reflecting upside potential from current market levels. Some price targets are significantly above $500, as there is no doubting the profitability facilitated by AI and the perception that it will continue to grow. On the low side, some price targets are set around $375.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- JPMorgan Says the Dip in Broadcom Stock Is a Screaming Buy. Are You Loading Up on Shares Now?

- Is SoundHound Stock a Buy for 2026? This Analyst Thinks So.

- Netflix Says the Warner Bros’ Deal Is All About ‘Growth.’ Will NFLX Stock Keep Growing in 2026?

- Southwest Airlines and TJX Hit New 52-Week Highs: Which Is More Likely to Fly Higher in 2026 and beyond?