Atlanta-based Intercontinental Exchange, Inc. (ICE) engages in the provision of market infrastructure, data services, and technology solutions for institutions, corporations, and government entities. With a market cap of $83 billion, ICE operates through Exchanges, Fixed Income and Data Services, and Mortgage Technology segments.

The company has notably underperformed the broader market over the past year. ICE stock prices have dipped 1.4% on a YTD basis and declined 4.9% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 15.1% gains in 2025 and 18.5% surge over the past year.

Narrowing the focus, Intercontinental Exchange has also underperformed the Financial Select Sector SPDR Fund’s (XLF) 8.5% uptick in 2025 and 13.3% gains over the past 52 weeks.

Intercontinental Exchange’s stock price dropped 1.4% in the trading session following the release of its mixed Q3 results on Oct. 30. While the company’s exchange revenues observed a 4% decline compared to the year-ago quarter, its fixed income & data services revenues increased 5.5% year-over-year, and mortgage technology revenues inched up by 3.7%. Overall, the company’s topline after deducting transaction-based expenses increased 2.6% year-over-year to $2.4 billion, missing the consensus estimates by a whisker.

Nonetheless, its adjusted EPS increased 10.3% year-over-year to $1.71, surpassing the Street’s expectations by 5.6%. Further, ICE has generated record revenues and operating income over the past three quarters, enabling it to return over $1.7 billion to stockholders via repurchases and dividends.

For the full fiscal 2025, ending in December, analysts expect ICE to deliver an adjusted EPS of $6.87, up 13.2% year-over-year. Moreover, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

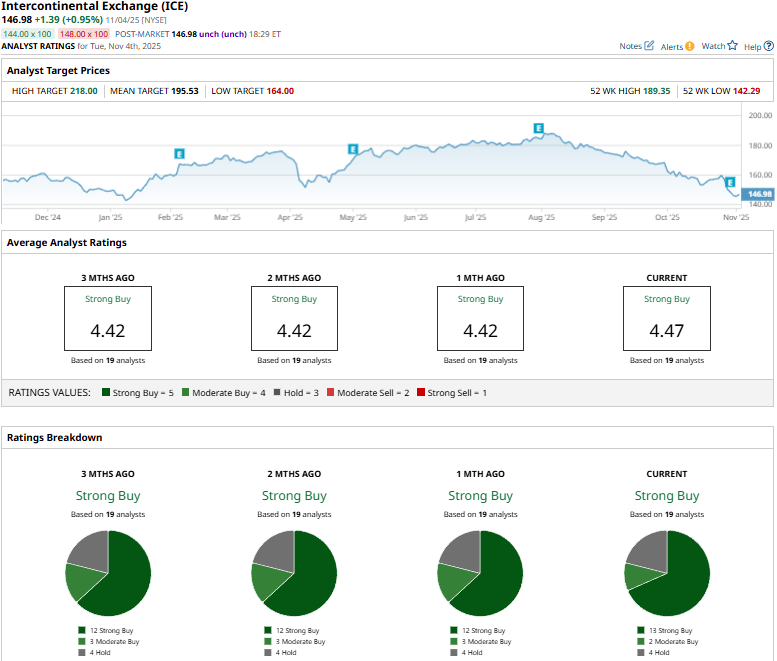

Among the 19 analysts covering the ICE stock, the consensus rating is a “Strong Buy.” That’s based on 13 “Strong Buys,” two “Moderate Buys,” and four “Holds.”

This configuration is slightly more optimistic than a month ago, when 12 analysts gave “Strong Buy” recommendations.

On Oct. 31, JP Morgan (JPM) analyst Kenneth Worthington maintained an “Overweight” rating on ICE, but reduced the price target from $202 to $180.

ICE’s mean price target of $195.53 represents a 33% premium. Meanwhile, the Street-high target of $218 suggests a notable 48.3% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart