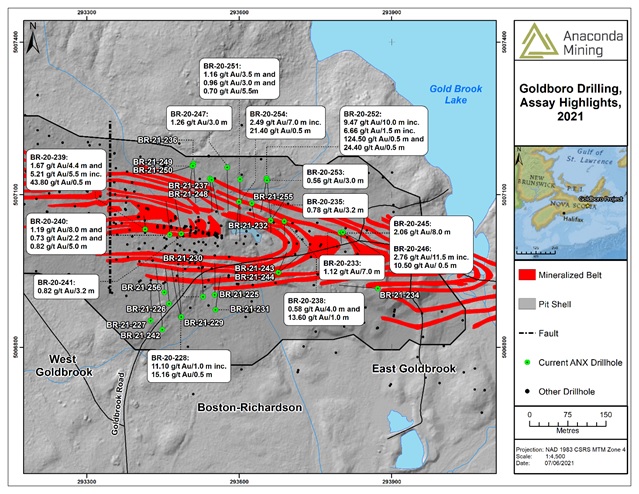

TORONTO, ON / ACCESSWIRE / June 9, 2021 / Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX)(OTCQX:ANXGF) is pleased to announce the results of a diamond drill program ("Infill Drill Program") conducted at the Company's 100%-owned Goldboro Gold Project ("Goldboro", or the "Project") in Nova Scotia, as well as the results of a drill program completed at the nearby Lower Seal Harbour Property in the winter of 2021. The Goldboro Infill Drill Program was initiated following the significantly expanded Mineral Resource Estimate ("Mineral Resource") announced on February 22, 2021, consisting of 32 holes and 3,321.5 metres (BR-21-225 to -256). The aim of the program was the conversion of Inferred Resources within the western constrained open pit outlined in the updated Mineral Resource (Exhibit A).

Selected composited highlights (core length) from the Infill Drill Program include:

- 9.47 grams per tonne ("g/t") gold over 10.0 metres (59.0 to 69.0 metres) including 6.66 g/t gold over 1.5 metres, 124.50 g/t gold over 0.5 metres and including 24.0 g/t gold over 0.5 metres in hole BR-21-252;

- 2.76 g/t gold over 11.5 metres (48.5 to 60.0 metres) including 10.50 g/t gold over 0.5 metres in hole BR-21-246;

- 5.21 g/t gold over 5.5 metres (47.5 to 53.0 metres) including 43.80 g/t gold over 0.5 metres in hole BR-21-239;

- 2.49 g/t gold over 7.0 metres (97.0 to 104.0 metres) including 21.40 g/t gold over 0.5 metres in hole BR-21-254;

- 2.06 g/t gold over 8.0 metres (26.0 to 34.0 metres) including 8.57 g/t gold over 1.0 metre in hole BR-21-245; and

- 1.12 g/t gold over 7.0 metres (20.0 to 27.0 metres) including 3.49 g/t gold over 1.0 metre in hole BR-21-233.

The Infill Drill Program aimed to upgrade certain Inferred Resources within the western constrained open pit into the Measured and Indicated categories to support the ongoing Feasibility Study, targeting approximately 27,400 ounces (418,000 tonnes at a grade of 2.04 g/t gold). The results of the Infill Drill Program within the deposit have confirmed the geological model, and drilling near the margins of the constrained pit in previously under-drilled areas outside of the main deposit demonstrate potential for additional resources near the margins of the western open pit.

" Following the recently announced significant increase to the Goldboro Mineral Resource and the related positive metallurgical recoveries, we initiated a round of shallow infill drilling focused on upgrading Inferred Resources to Measured and Indicated with the aim of incorporating them into the ongoing Feasibility Study. The drill results within shallow areas of the deposit validate the existing model and drilling near the margins of the constrained open pits demonstrate the potential to add ounces to the in-pit resources, potentially reducing the strip ratio within open pits contemplated in the Feasibility Study. Further opportunities to upgrade and increase Mineral Resources have been recognized and with the recent $8.5 million financing we are in an excellent position to act on these opportunities as we finalize the Preliminary Economic Assessment and continue with our ongoing Feasibility Study."

~ Kevin Bullock, President and CEO, Anaconda Mining Inc

Lower Seal Harbour Program

In January 2021, the Company announced that it had initiated a seven (7) hole (LSH-20-001 to 007) diamond drill program of 1,046.7 metres at the past producing Lower Seal Harbour property, located 1.6 kilometres southeast of Goldboro (Exhibit B). Lower Seal Harbour is subject to an option agreement entered into by the Company to acquire 100% of the property from a third-party. This drill program focused on testing known gold mineralization hosted on the north limb of an anticlinal structure that is parallel to a similar anticlinal structure that hosts the Goldboro Deposit, separated by approximately three (3) kilometres. The program included the twinning of two historic drill holes to confirm high-grade intersections and to sample adjacent wall rock for low-grade mineralization, and testing whether the anticlinal structure immediately south of historical mining activity contains gold mineralization at shallow levels, particularly within the hinge zone. The Company also tested two geophysical (IP chargeability anomalies) that have not been previously tested.

Highlights from the Lower Seal Harbour Program include:

- 2.36 g/t gold over 2.5 metres (254.0 to 256.5 metres), 1.80 g/t gold over 0.7 metres (202.3 to 203.0 metres) and 1.54 g/t gold over 0.5 metres (261.0 to 261.5 metres) in hole LSH-20-002;

- 0.66 g/t gold over 1.0 metre (79.0 to 80.0 metres) and 1.16 g/t gold over 0.5 metres (134.0 to 134.5 metres) in hole LSH-20-005;

- Intersection of mineralized quartz veins with minimal wall rock alteration and mineralization.

- Intersection of an IP chargeability anomalies that were caused by the presence of formational pyrite without significant alteration or gold mineralization.

No further work on the Lower Seal Harbour Property is planned at this time as the focus remains on the potential expansion of Goldboro, however the Company may plan further exploration activities in the future.

Table of selected composites from the Goldboro Infill Drill Program

Hole ID** | From (m) | To (m) | Interval (m)* | Gold (g/t) | Visible Gold |

| BR-21-227 | 73.5 | 74.0 | 0.5 | 0.89 | VG |

| BR-21-228 | 91.5 | 92.5 | 1.0 | 11.10 | |

| including | 92.0 | 92.5 | 0.5 | 15.16 | |

| BR-21-230 | 130.0 | 133.0 | 3.0 | 0.64 | |

| and | 167.7 | 168.2 | 0.5 | 1.95 | VG |

| BR-21-233 | 20.0 | 27.0 | 7.0 | 1.12 | VG |

| including | 26.0 | 27.0 | 1.0 | 3.49 | |

| BR-21-234 | 65.5 | 66.0 | 0.5 | 3.63 | |

| BR-21-235 | 10.0 | 11.0 | 1.0 | 1.76 | |

| and | 44.0 | 45.0 | 1.0 | 1.91 | |

| and | 96.8 | 100.0 | 3.2 | 0.78 | |

| including | 96.8 | 97.3 | 0.5 | 2.42 | |

| BR-21-236 | 48.0 | 49.0 | 1.0 | 4.35 | |

| BR-21-238 | 9.0 | 13.0 | 4.0 | 0.58 | VG |

| and | 55.0 | 56.0 | 1.0 | 13.60 | VG |

| and | 69.0 | 71.0 | 2.0 | 3.27 | |

| and | 95.5 | 100.0 | 4.5 | 1.81 | |

| including | 99.0 | 99.5 | 0.5 | 7.29 | |

| BR-21-239 | 22.6 | 27.0 | 4.4 | 1.67 | VG |

| including | 23.2 | 23.7 | 0.5 | 9.11 | VG |

| and | 47.5 | 53.0 | 5.5 | 5.21 | |

| including | 47.5 | 48.0 | 0.5 | 43.80 | |

| BR-21-240 | 22.0 | 30.0 | 8.0 | 1.19 | |

| and | 34.0 | 35.0 | 1.0 | 4.74 | |

| and | 46.0 | 48.2 | 2.2 | 0.73 | |

| and | 57.0 | 62.0 | 5.0 | 0.82 | |

| BR-21-241 | 21.0 | 23.0 | 2.0 | 1.31 | |

| and | 42.0 | 45.2 | 3.2 | 0.82 | |

| BR-21-245 | 26.0 | 34.0 | 8.0 | 2.06 | |

| including | 30.5 | 31.5 | 1.0 | 8.57 | |

| and | 56.0 | 59.5 | 3.5 | 0.60 | |

| BR-21-246 | 48.5 | 60.0 | 11.5 | 2.76 | VG |

| including | 50.5 | 51.0 | 0.5 | 10.50 | |

| and | 59.0 | 59.5 | 0.5 | 10.10 | VG |

| BR-21-247 | 36.0 | 37.0 | 1.0 | 7.03 | |

| and | 102.0 | 105.0 | 3.0 | 1.26 | |

| BR-21-248 | 20.0 | 21.0 | 1.0 | 1.94 | |

| and | 40.5 | 42.0 | 1.5 | 1.34 | |

| and | 76.0 | 78.0 | 2.0 | 1.14 | |

| BR-21-249 | 22.0 | 23.0 | 1.0 | 1.99 | |

| and | 43.5 | 44.0 | 0.5 | 2.49 | VG |

| BR-21-250 | 30.0 | 31.0 | 1.0 | 4.28 | |

| BR-21-251 | 123.2 | 126.7 | 3.5 | 1.16 | |

| and | 129.2 | 132.2 | 3.0 | 0.96 | |

| and | 147.5 | 153.0 | 5.5 | 0.70 | |

| BR-21-252 | 22.5 | 23.0 | 0.5 | 2.06 | VG |

| and | 59.0 | 69.0 | 10.0 | 9.47 | VG |

| including | 62.0 | 63.5 | 1.5 | 6.66 | |

| including | 66.9 | 67.4 | 0.5 | 124.50 | VG |

| and | 68.5 | 69.0 | 0.5 | 24.40 | |

| BR-21-253 | 61.0 | 64.0 | 3.0 | 0.56 | |

| BR-21-254 | 15.0 | 16.0 | 1.0 | 5.43 | |

| and | 28.0 | 29.5 | 1.5 | 1.62 | |

| and | 50.0 | 50.5 | 0.5 | 6.06 | VG |

| and | 97.0 | 104.0 | 7.0 | 2.49 | VG |

| including | 100.0 | 100.5 | 0.5 | 21.40 | VG |

*Intervals are reported as core length only. Please refer to notes below regarding true width.

**Drill holes not listed in the table may have contained intercepts of gold but are not significant and are not highlighted in the table above. Drill holes BR-21-225 to -234 are reported using assay by metallic screen. All other drill hole results are reported using fire assay only. See notes on QAQC procedures at the bottom of this press release.

Mineral Resource Statement for the Goldboro Gold Project (Previously Reported)

Resource Type | Gold Cut-off (g/t) | Category | Tonnes ('000) | Gold Grade (g/t) | Troy Ounces |

Open Pit | 0.44 | Measured | 6,137 | 2.73 | 538,500 |

| Indicated | 5,743 | 2.99 | 551,300 | ||

| Measured + Indicated | 11,880 | 2.86 | 1,089,900 | ||

| Inferred | 1,580 | 1.75 | 89,000 | ||

Underground | 2.60 | Measured | 1,384 | 7.36 | 327,700 |

| Indicated | 2,772 | 5.93 | 528,600 | ||

| Measured + Indicated | 4,156 | 6.41 | 856,200 | ||

| Inferred | 3,726 | 5.92 | 709,100 | ||

Combined* | 0.44/2.60 | Measured | 7,521 | 3.58 | 866,200 |

| Indicated | 8,515 | 3.95 | 1,079,900 | ||

| Measured + Indicated | 16,036 | 3.78 | 1,946,100 | ||

| Inferred | 5,306 | 4.68 | 798,100 |

* Combined Open Pit and Underground Mineral Resources; The Open Pit Mineral Resource is based on a 0.44 g/t gold cut-off grade, and the Underground Mineral Resource is based on 2.60 g/t gold cut-off grade.

Mineral Resource Estimate Notes

- Mineral Resources were prepared in accordance with NI 43-101 and the CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (2019). Mineral Resources that are not mineral reserves do not have demonstrated economic viability. This estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Open Pit Mineral Resources are reported at a cut-off grade of 0.44 g/t gold that is based on a gold price of CAD$2,000/oz (~US$1,550/oz) and a gold processing recovery factor of 96%.

- Underground Mineral Resource is reported at a cut-off grade of 2.60 g/t gold that is based on a gold price of CAD$2,000/oz (~US$1,550/oz) and a gold processing recovery factor of 97%.

- Assays were variably capped on a wireframe-by-wireframe basis.

- Specific gravity was applied using weighted averages to each individual wireframe.

- Mineral Resource effective date February 7, 2021.

- All figures are rounded to reflect the relative accuracy of the estimates and totals may not add correctly.

- Excludes unclassified mineralization located within mined out areas.

- Reported from within a mineralization envelope accounting for mineral continuity.

The Company has critically considered logistical matters given the ongoing COVID-19 pandemic, to ensure that this Drill Program and any other programs are executed in a way that ensures the absolute health and safety of our personnel, contractors, and the communities where we operate.

Qualified Person and Technical Report Notes

A Technical Report prepared in accordance with NI 43-101 for the Goldboro Gold Project has been filed on SEDAR (www.sedar.com). Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Resource. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

The Mineral Resource estimate was independently prepared under the supervision of Mr. Glen Kuntz, P.Geo. (Ontario) of Nordmin Engineering Ltd., a "Qualified Person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Verification included a site visit to inspect drilling, logging, density measurement procedures and sampling procedures, and a review of the control sample results used to assess laboratory assay quality. In addition, a random selection of the drill hole database results was compared with original records.

All samples and the resultant composites referred to in this release are collected using QA/QC protocols including the regular insertion of standards and blanks within the sample batch for analysis and check assays of select samples. All samples quoted in this release were analyzed at Eastern Analytical Ltd. in Springdale, NL, for Au by fire assay (30 g) with an AA finish.

All assays in this press release are reported as fire assays only. For samples analyzing greater than 0.5 g/t Au via 30 g fire assay, these samples will be re-analyzed at Eastern Analytical Ltd. via total pulp metallics. For the total pulp metallics analysis, the entire sample is crushed to -10mesh and pulverized to 95% -150mesh. The total sample is then weighed and screened to 150mesh. The +150 mesh fraction is fire assayed for Au, and a 30 g subsample of the -150mesh fraction analyzed via fire assay. A weighted average gold grade is calculated for the final reportable gold grade. Total pulp metallics assays for drillholes sited within this press release will be updated in a future news release.

This news release has been reviewed and approved by Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., a "Qualified Person", under National Instrument 43-101 Standard for Disclosure for Mineral Projects. A version of this press release will be available in French on Anaconda's website (www.anacondamining.com) in two to three business days.

ABOUT ANACONDA

Anaconda Mining is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in the top-tier Canadian mining jurisdictions of Newfoundland and Nova Scotia. The Company is advancing the Goldboro Gold Project in Nova Scotia, a significant growth project with Measured and Indicated Mineral Resources of 1.9 million ounces (16.0 million tonnes at 3.78 g/t) and Inferred Mineral Resources of 0.8 million ounces (5.3 million tonnes at 4.68 g/t) (Please see The Goldboro Gold Project Technical Report dated March 30, 2021), which is subject to an ongoing feasibility study. Anaconda also operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~15,000 hectares of highly prospective mineral property, including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking information" within the meaning of applicable Canadian and United States securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved". Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Anaconda's annual information form for the year ended December 31, 2020, available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Anaconda does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

FOR ADDITIONAL INFORMATION CONTACT:

| Anaconda Mining Inc. Kevin Bullock President and CEO (647) 388-1842 kbullock@anacondamining.com | Reseau ProMarket Inc. Dany Cenac Robert Investor Relations (514) 722-2276 x456 Dany.Cenac-Robert@ReseauProMarket.com |

Exhibit A. The location of the drill holes and assays reported from the Infill Drill Program in the western pit and associated highlights.

Exhibit B. A map of the Lower Seal Harbour area showing the location of recent drill holes.

SOURCE: Anaconda Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/650998/Anaconda-Mining-Intersects-947-GT-Gold-Over-100-Metres-and-275-GT-Gold-Over-115-Metres-From-Infill-Drilling-at-Goldboro