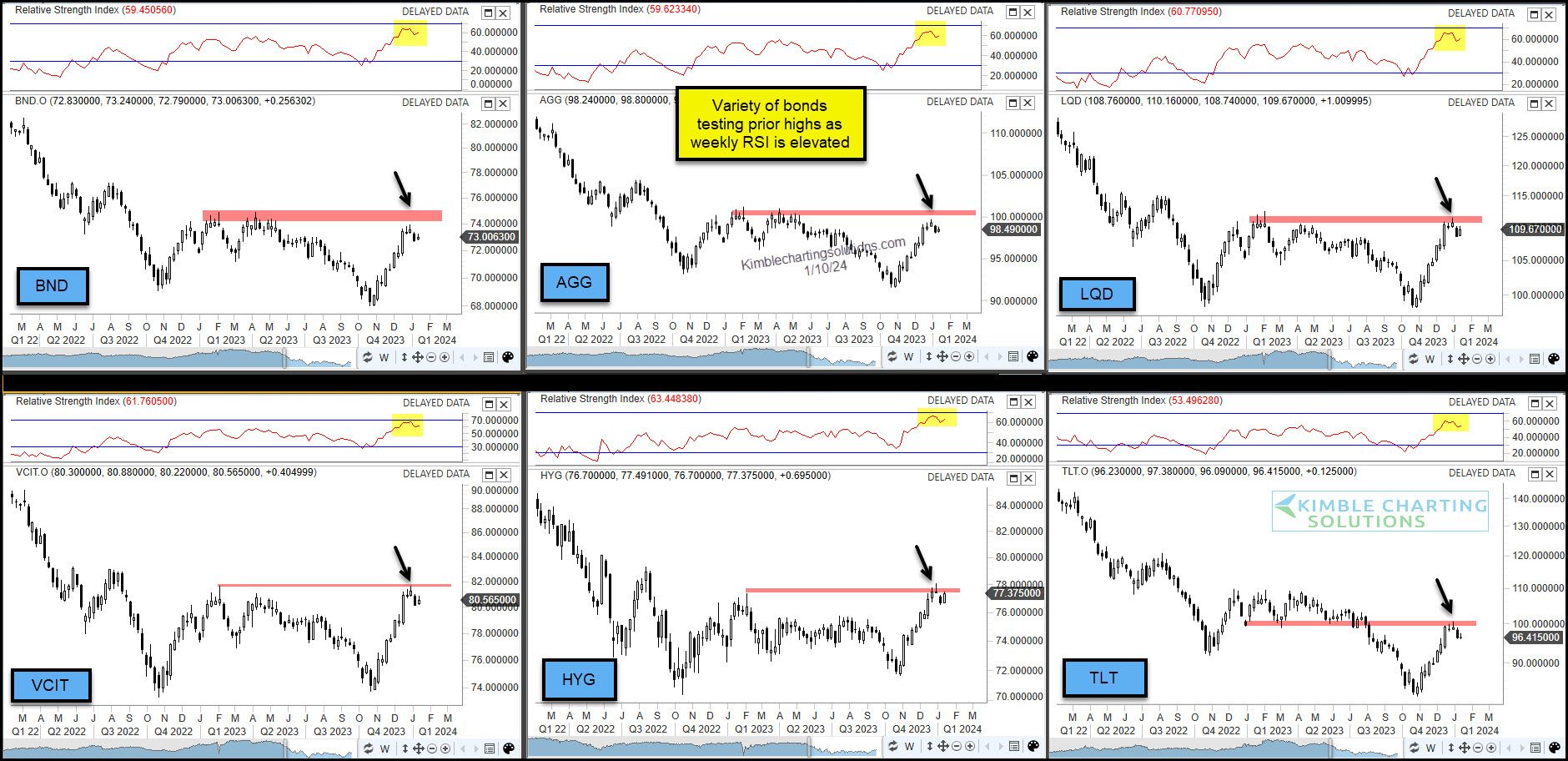

iShares iBoxx $ Investment Grade Corporate Bond ETF (NY:LQD)

All News about iShares iBoxx $ Investment Grade Corporate Bond ETF

Conventional Fund And ETF Investors Give A Cold Shoulder To Equity Funds For The Fund-Flows Week ↗

February 22, 2024

Via Talk Markets

Topics

ETFs

U.S. Weekly FundFlows: Equity ETFs Attracted $10.0 Billion Of Net Inflows During the Fund-Flows Week ↗

December 07, 2023

Via Talk Markets

Topics

ETFs

Multi-Cap Equity Funds Suffer Largest Weekly Outflow Since 2018 ↗

December 02, 2023

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.