Aerospace and defense company Hexcel (NYSE: HXL) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, but sales fell by 2.1% year on year to $489.9 million. The company’s full-year revenue guidance of $1.92 billion at the midpoint came in 0.5% above analysts’ estimates. Its non-GAAP profit of $0.50 per share was 8.3% above analysts’ consensus estimates.

Is now the time to buy Hexcel? Find out by accessing our full research report, it’s free.

Hexcel (HXL) Q2 CY2025 Highlights:

- Revenue: $489.9 million vs analyst estimates of $474.2 million (2.1% year-on-year decline, 3.3% beat)

- Adjusted EPS: $0.50 vs analyst estimates of $0.46 (8.3% beat)

- Adjusted EBITDA: $63.5 million vs analyst estimates of $89.03 million (13% margin, 28.7% miss)

- The company reconfirmed its revenue guidance for the full year of $1.92 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $1.95 at the midpoint

- Operating Margin: 6.1%, down from 14.3% in the same quarter last year

- Free Cash Flow Margin: 1.6%, down from 4.3% in the same quarter last year

- Market Capitalization: $5.03 billion

Chairman, CEO and President Tom Gentile said, “Hexcel delivered sales and adjusted EPS in line with expectations for the second quarter of 2025, based on modest sequential growth in three of our four major commercial aerospace programs, with the exception being softness in the Airbus A350 as expected and previously communicated due to production rate decreases announced by Airbus and destocking of excess inventory in the supply chain. There was continued growth in the Other Commercial Aerospace market, and we were pleased to see Defense, Space and Other providing robust growth yet again with a high single digit step-up over the second quarter of 2024. Overall production levels and reduced capacity utilization, along with actions to reduce inventory meant gross margin remained subdued. The opportunity for significant margin leverage and cash flow generation remains strong, and we are encouraged by the more positive tones and progress conveyed by the commercial airframe and engine OEM’s in recent months.”

Company Overview

Founded shortly after World War II by a group of engineers from UC Berkley, Hexcel (NYSE: HXL) manufactures lightweight composite materials primarily for the aerospace and defense sectors.

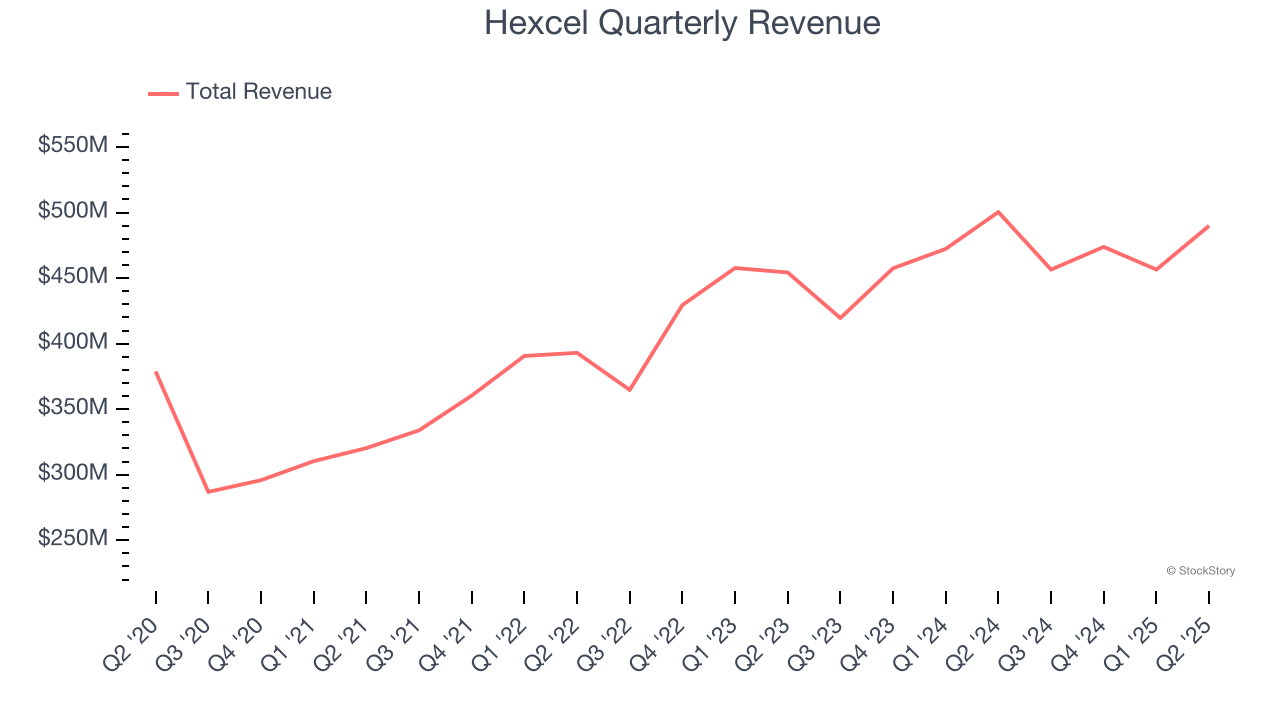

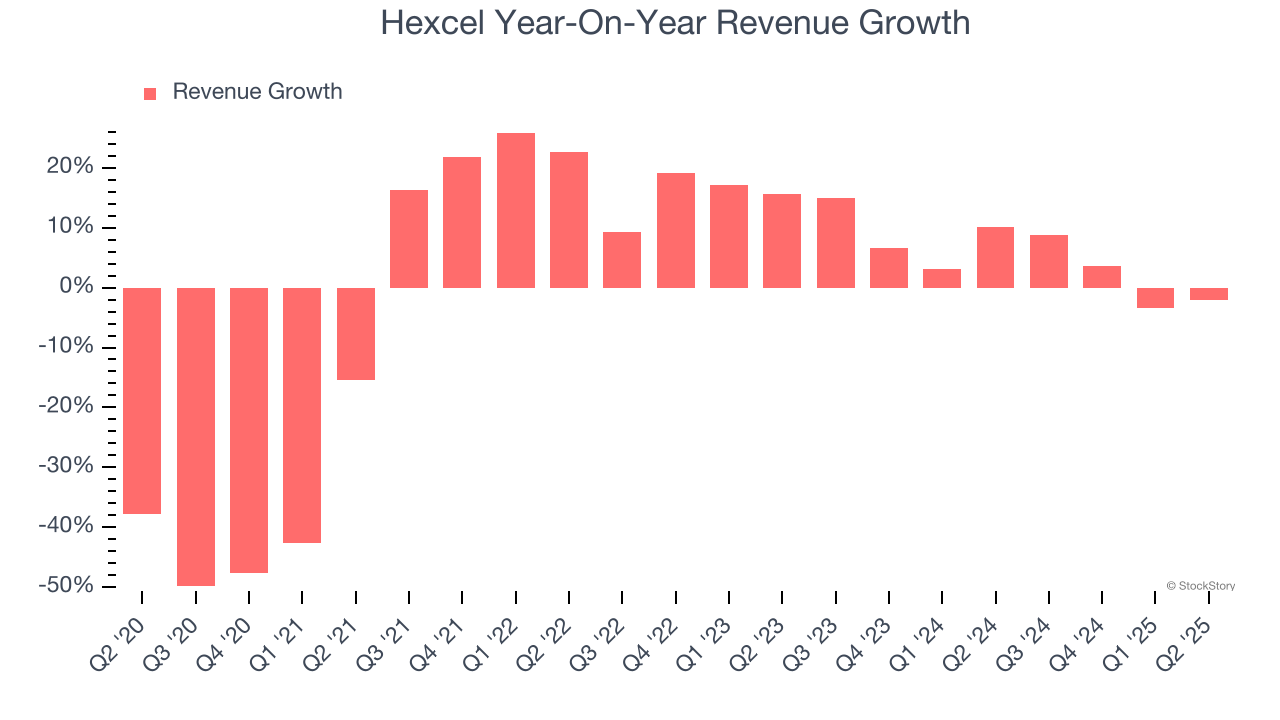

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Hexcel struggled to consistently generate demand over the last five years as its sales dropped at a 1.8% annual rate. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Hexcel’s annualized revenue growth of 4.9% over the last two years is above its five-year trend, but we were still disappointed by the results.

Hexcel also breaks out the revenue for its most important segments, Commercial aerospace and Space & defense, which are 59.8% and 40.2% of revenue. Over the last two years, Hexcel’s Commercial aerospace revenue (customers like Airbus, Boeing) averaged 7.2% year-on-year growth while its Space & defense revenue (government customers) averaged 12.8% growth.

This quarter, Hexcel’s revenue fell by 2.1% year on year to $489.9 million but beat Wall Street’s estimates by 3.3%.

Looking ahead, sell-side analysts expect revenue to grow 6.6% over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

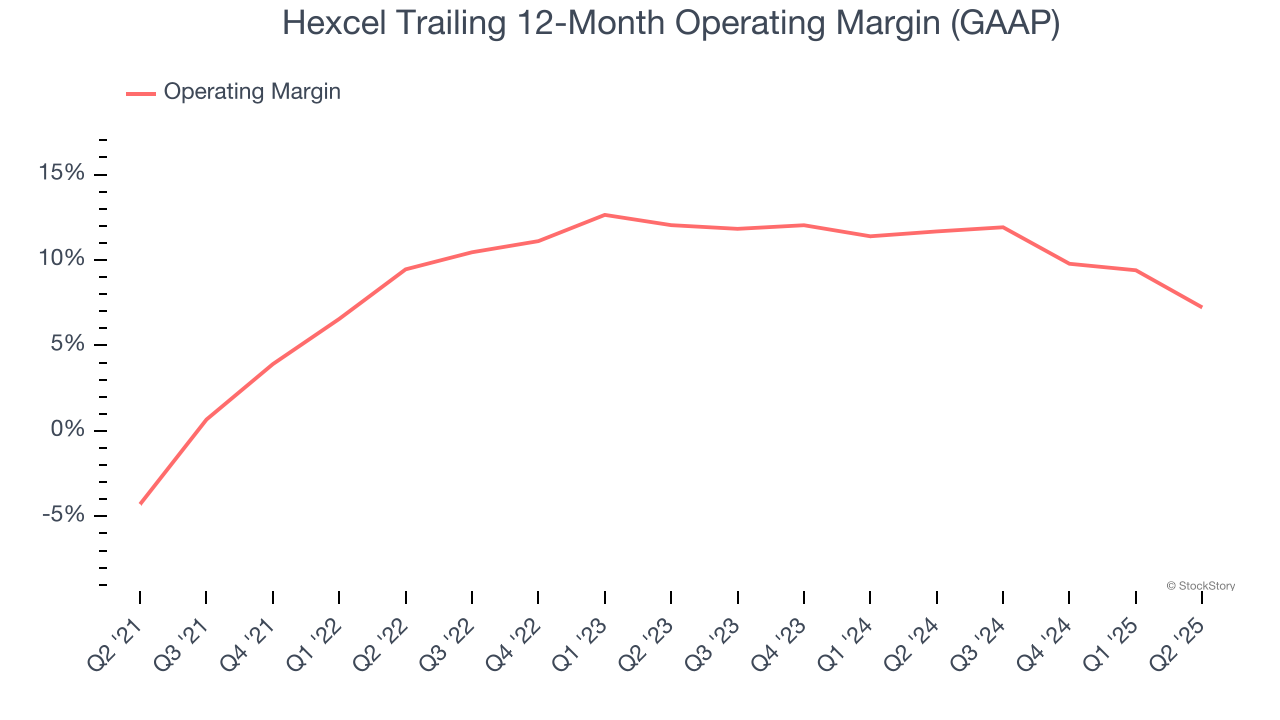

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Hexcel was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.9% was weak for an industrials business.

On the plus side, Hexcel’s operating margin rose by 11.5 percentage points over the last five years.

This quarter, Hexcel generated an operating margin profit margin of 6.1%, down 8.2 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

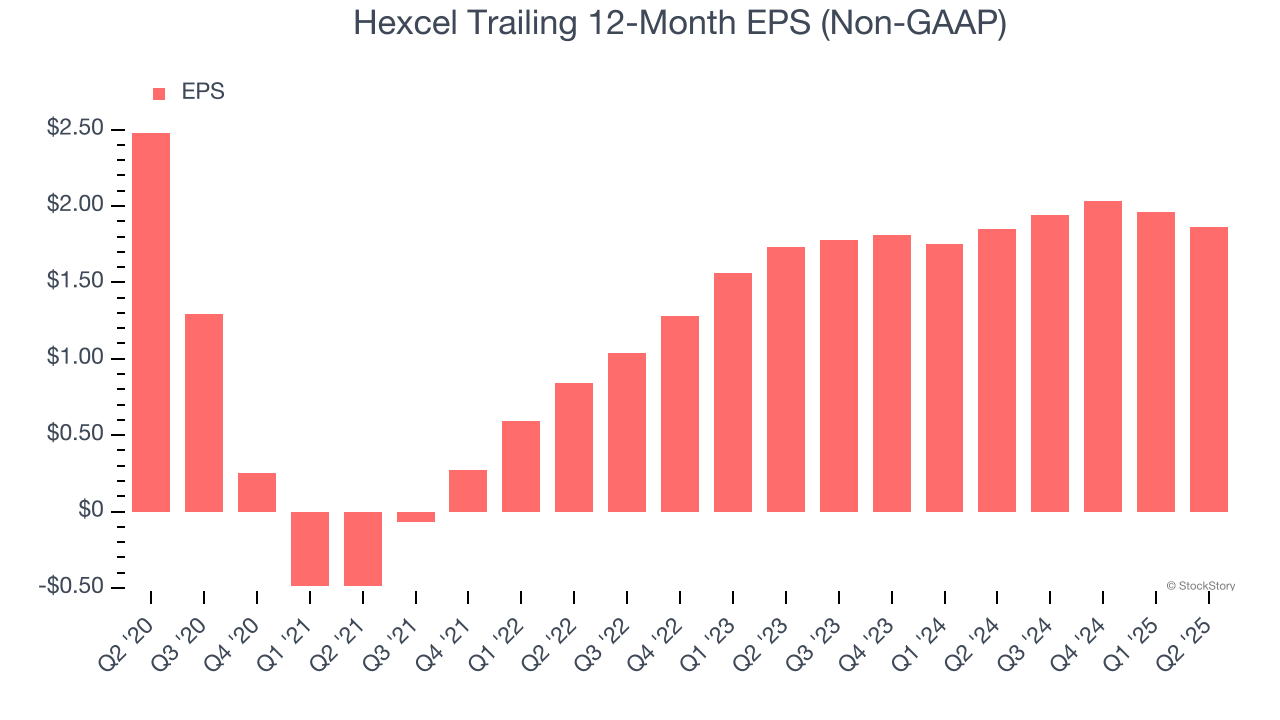

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Hexcel, its EPS declined by 5.6% annually over the last five years, more than its revenue. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Hexcel, its two-year annual EPS growth of 3.7% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q2, Hexcel reported EPS at $0.50, down from $0.60 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 8.3%. Over the next 12 months, Wall Street expects Hexcel’s full-year EPS of $1.86 to grow 19.8%.

Key Takeaways from Hexcel’s Q2 Results

We were impressed by Hexcel’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also glad its revenue and EPS outperformed Wall Street’s estimates in the reported quarter. Overall, this print had some key positives. The stock remained flat at $62.97 immediately after reporting.

Hexcel put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.