Over the past six months, F.N.B. Corporation’s stock price fell to $13.70. Shareholders have lost 11.1% of their capital, disappointing when considering the S&P 500 was flat. This might have investors contemplating their next move.

Is there a buying opportunity in F.N.B. Corporation, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is F.N.B. Corporation Not Exciting?

Even though the stock has become cheaper, we're cautious about F.N.B. Corporation. Here are three reasons why FNB doesn't excite us and a stock we'd rather own.

1. Lackluster Revenue Growth

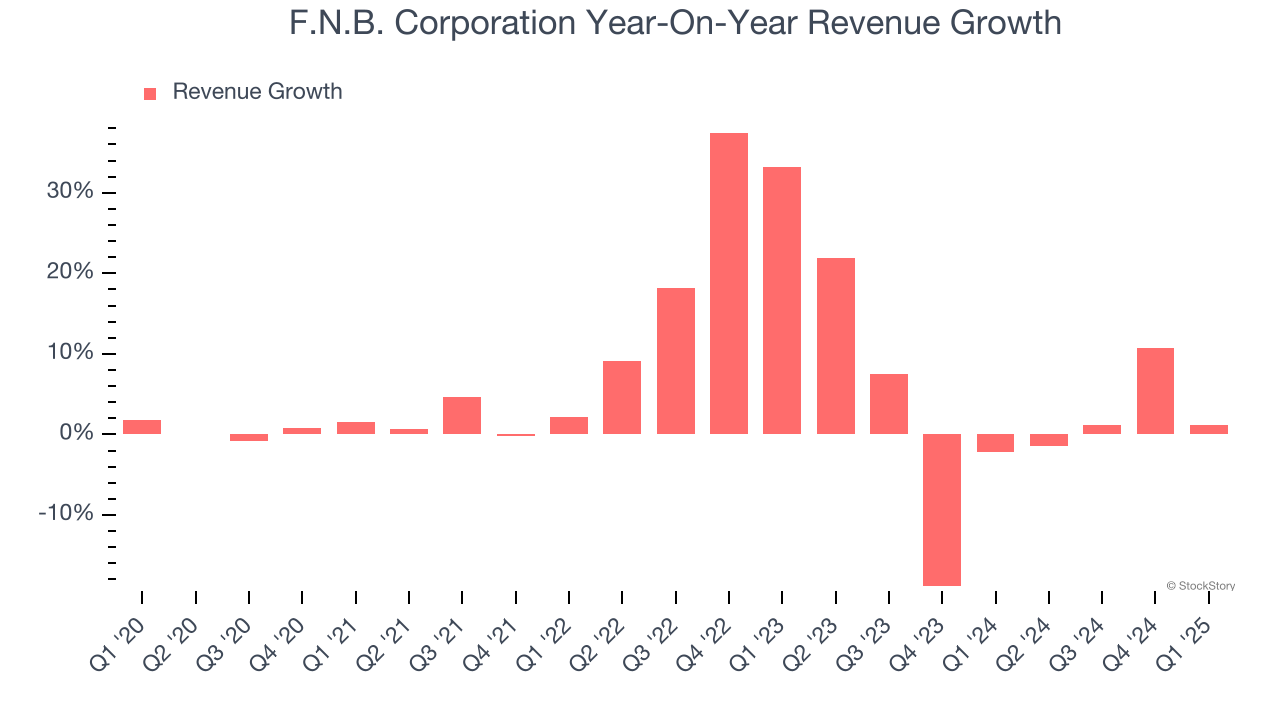

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, inflation readings, and industry trends. F.N.B. Corporation’s recent performance shows its demand has slowed as its annualized revenue growth of 1.7% over the last two years was below its five-year trend.

2. Low Net Interest Margin Reveals Weak Loan Book Profitability

Net interest margin represents how much a bank earns in relation to its outstanding loans. It’s one of the most important metrics to track because it shows how a bank’s loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, we can see that F.N.B. Corporation’s net interest margin averaged a subpar 3.2%, indicating the company has weak loan book economics.

3. EPS Took a Dip Over the Last Two Years

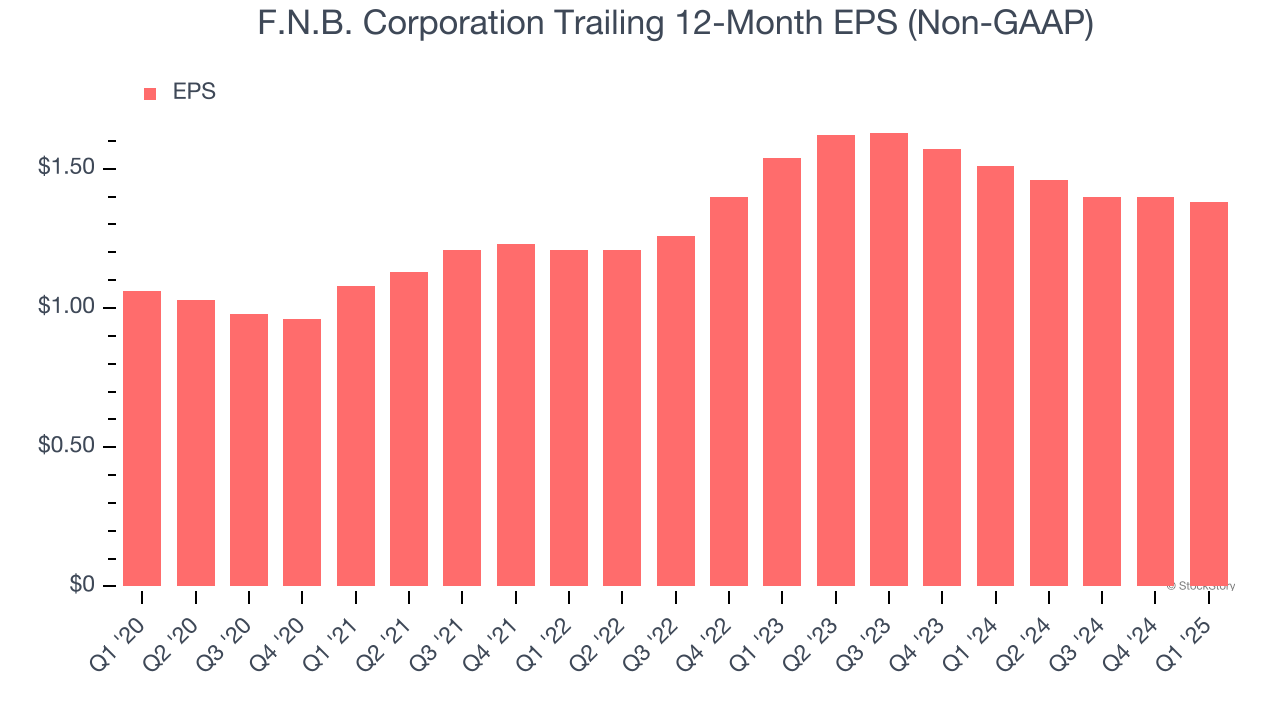

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for F.N.B. Corporation, its EPS declined by 5.3% annually over the last two years while its revenue grew by 1.7%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

F.N.B. Corporation isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 0.7× forward P/B (or $13.70 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at one of our all-time favorite software stocks.

Stocks We Would Buy Instead of F.N.B. Corporation

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.