Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Commercial Vehicle Group (NASDAQ: CVGI) and the best and worst performers in the heavy transportation equipment industry.

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

The 13 heavy transportation equipment stocks we track reported a mixed Q1. As a group, revenues missed analysts’ consensus estimates by 1.7%.

Luckily, heavy transportation equipment stocks have performed well with share prices up 17.2% on average since the latest earnings results.

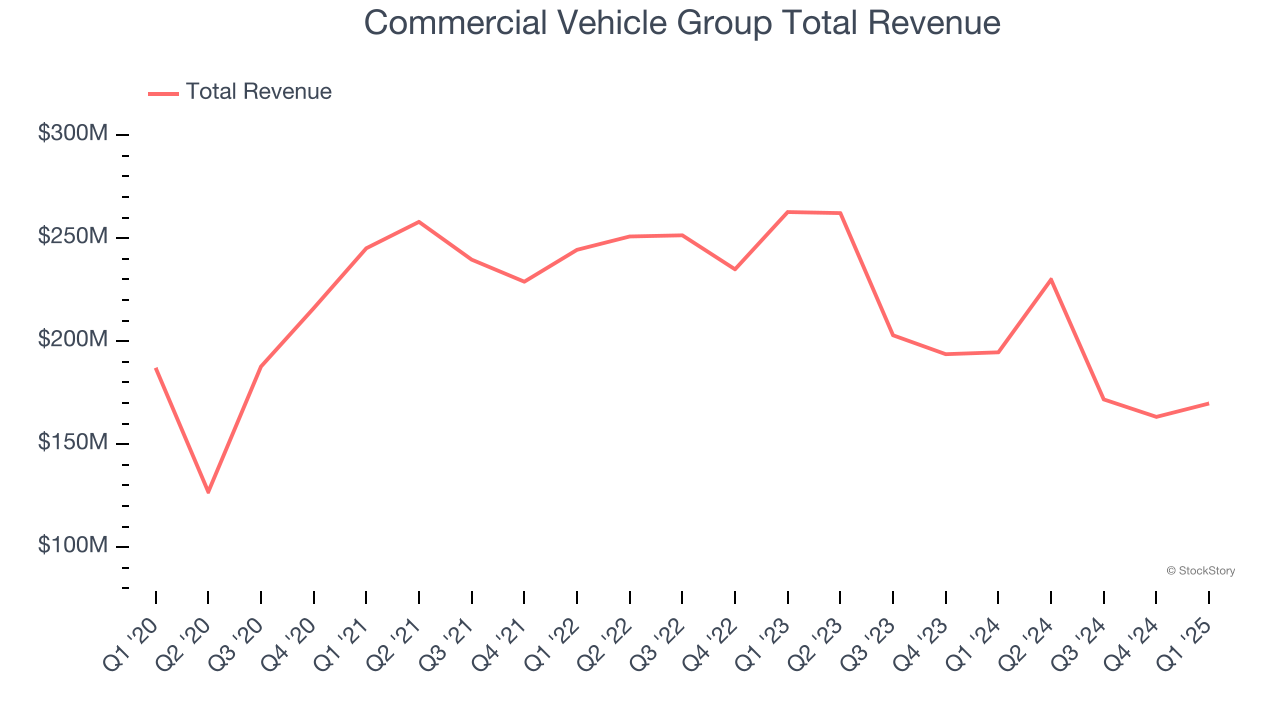

Commercial Vehicle Group (NASDAQ: CVGI)

Formed from a partnership between two distinct companies, CVG (NASDAQ: CVGI) offers various components used in vehicles and systems used in warehouses.

Commercial Vehicle Group reported revenues of $169.8 million, down 12.8% year on year. This print exceeded analysts’ expectations by 3.8%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

James Ray, President and Chief Executive Officer, said, “Our first quarter results demonstrate sequential improvement in margins and free cash flow. Cash generation and debt paydown remain key priorities for CVG, as we look to build on our strong free cash performance in the first quarter through further margin improvement, working capital reduction, and reduced capital expenditures. We are beginning to see the benefits of efforts made in 2024, including strategic divestments of non-core businesses, to transform CVG. These divestitures, as well as our priority on improving operational efficiency, have allowed us to streamline operations, lower our cost structure, and drive cash generation to pay down debt. Despite industry-wide and global macroeconomic headwinds, we are prioritizing strong execution from the top down within CVG focused on cost mitigation, margin improvement, and operational efficiency.”

Interestingly, the stock is up 65.4% since reporting and currently trades at $1.46.

Is now the time to buy Commercial Vehicle Group? Access our full analysis of the earnings results here, it’s free.

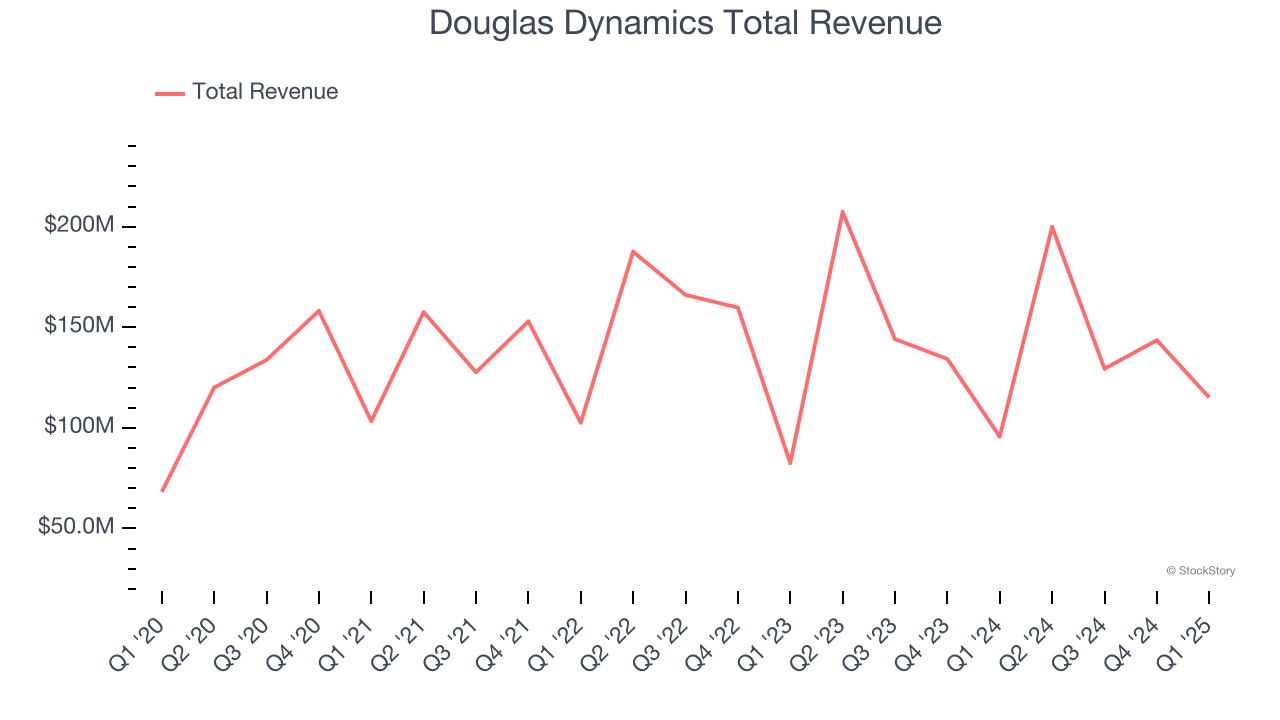

Best Q1: Douglas Dynamics (NYSE: PLOW)

Once manufacturing snowplows designed for the iconic jeep vehicle precursor, Douglas Dynamics (NYSE: PLOW) offers snow and ice equipment for the roads and sidewalks.

Douglas Dynamics reported revenues of $115.1 million, up 20.3% year on year, outperforming analysts’ expectations by 6.7%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Douglas Dynamics delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 18.3% since reporting. It currently trades at $28.88.

Is now the time to buy Douglas Dynamics? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Wabash (NYSE: WNC)

With its first trailer reportedly built on two sawhorses, Wabash (NYSE: WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

Wabash reported revenues of $380.9 million, down 26.1% year on year, falling short of analysts’ expectations by 7.1%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

As expected, the stock is down 3.6% since the results and currently trades at $9.60.

Read our full analysis of Wabash’s results here.

Trinity (NYSE: TRN)

Operating under the trade name TrinityRail, Trinity (NYSE: TRN) is a provider of railcar products and services in North America.

Trinity reported revenues of $585.4 million, down 27.7% year on year. This result lagged analysts' expectations by 5.6%. It was a slower quarter as it also logged a significant miss of analysts’ EPS estimates and a slight miss of analysts’ EBITDA estimates.

Trinity had the slowest revenue growth among its peers. The stock is up 7% since reporting and currently trades at $26.87.

Read our full, actionable report on Trinity here, it’s free.

Greenbrier (NYSE: GBX)

Having designed the industry’s first double-decker railcar in the 1980s, Greenbrier (NYSE: GBX) supplies the freight rail transportation industry with railcars and related services.

Greenbrier reported revenues of $762.1 million, down 11.7% year on year. This print missed analysts’ expectations by 15.2%. Overall, it was a disappointing quarter as it also recorded full-year revenue guidance missing analysts’ expectations.

Greenbrier had the weakest performance against analyst estimates and weakest full-year guidance update among its peers. The stock is up 6% since reporting and currently trades at $47.45.

Read our full, actionable report on Greenbrier here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.