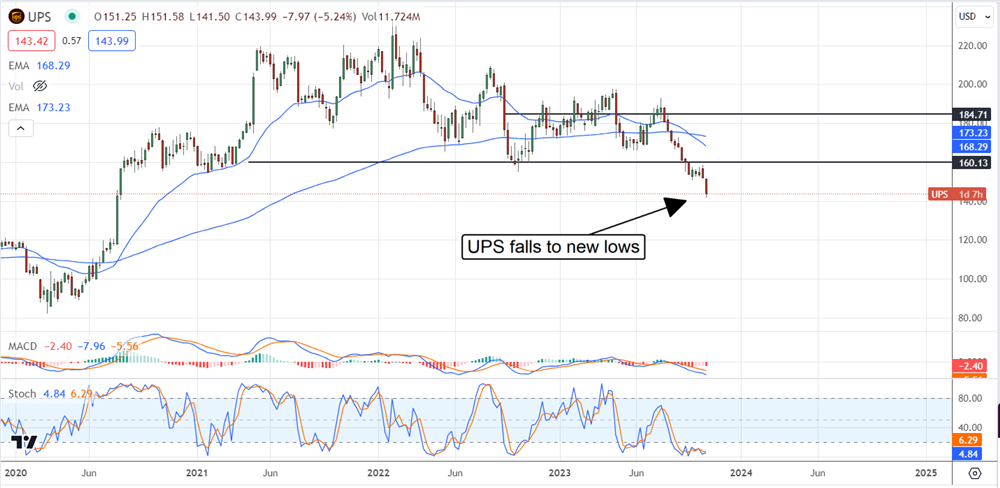

Shares of United Parcel Service (NYSE: UPS) were trading within a range at the start of Q3 and were not expected to set new lows, yet it did. The company’s effort to reposition itself for growth and earnings is working, but global macroeconomic conditions pulled the rug out from under the market.

Today's takeaway is that UPS is still a solid company and an investible stock, but now is not a good time to buy it. There are reasons to believe the market will continue to fall in 2023 and possibly in 2024, but that is the near-term story. The long-term story is that this high-yielding future Dividend Aristocrat is setting up a generational buying opportunity that investors will not want to miss. All it takes to capture it is a little patience and some capital in reserve.

UPS revenue is weak and weakening

UPS Q3 results are consistent with the 2023 trend in that top-line weakness was offset by bottom-line strength. The company reported $21.06 billion in net revenue, down 13% compared to last year, and missed the Marketbeat.com consensus by 200 basis points. By itself, the 200 bps miss isn’t all that much, but this is the 4th consecutive quarter of top-line decline and underperformance, and the YOY decline is accelerating.

Segmentally, results are weak across the board. The Domestic segment contracted 11.1% on an 11.5% decline in volume, while the International fell 11.1% on a mid-single-digit decline in volume and pricing. Supply chain solution was the weakest and revealed broad weakness within the freight industry, with a decline of 21.4% due to volume and pricing. With these trends in place and economic conditions still tight and expected to remain tight, if not tightened, we should expect to see this trend sustained into Q4 2023 and next year.

Guidance is lowered, UPS shares fall

Adding insult to injury, the company lowered its guidance and capital spending plan. The executive team forecasts revenue of $92.3 billion max compared to the prior $93 billion and for margin to contract. The company lowered its adjusted operating margin target to a max of 11.3% or down 50 bps at the high end, impacting capital returns. The company expects to maintain its CAPEX plans and the dividend but is reducing targeted repurchases to a max of $2.25 billion. That’s down $0.75 billion or about 25% and will undercut market momentum.

UPS improves operational quality: margin not as bad as expected

Among the positives in the UPS report is the margin. The margin news isn’t good per se, but not as bad as expected, helping set the business up for a rebound. The Q3 adjusted earnings fell nearly 50% YOY due to deleveraging and lower realized prices, but not as much as feared. The $1.57 adjusted earnings beat by a penny despite the top-line weakness and play into the capital return outlook. UPS is cutting back on share repurchases but still repurchases shares and pays a solid dividend. Repurchases will ramp up eventually, and the dividend is growing.

Regarding the dividend, this stock pays about 4.5% and is growing. The payout ratio is reasonably low even with reduced guidance, and there is a history of increases. The company has increased 14 years and is on track to become a Dividend Aristocrat.

Additionally, UPS is investing in growth. The company announced a new acquisition the day before the release, which should aid the business. The purchase is Happy Returns, a PayPal (NASDAQ: PYPL) business and reverse logistics company that provides return services for merchants and consumers.

Happy Returns has 800 merchant partners and over 6000 drop-off locations to bring the UPS total to over 12,000, including UPS Stores. This move is significant for UPS because it will drive traffic to its locations and may impact merchants like Amazon (NASDAQ: AMZN) and Kohl’s (NYSE: KSS), which have similar product return set-ups.

Analysts view UPS as undervalued

The analysts' activity in UPS is not bullish; it is 1 of the Most Downgraded stocks on the Marketbeat platform, but they Hold and see the market moving higher. The price targets have been lowered steadily throughout the year and may fall further, but, as it stands, the low price target is 10% above the post-release price action, suggesting a deep value.

The caveat is that price targets may be revised lower now that guidance is lower, and that will pressure the market lower until there is a change in the outlook. A rebound should form when the market begins to see stabilization in the economic outlook and business.