With a market cap of $27 billion, Citizens Financial Group, Inc. (CFG) provides a wide range of retail and commercial banking products and services to individuals, businesses, and institutions. It operates through Consumer Banking and Commercial Banking segments, serving customers through branches, digital platforms, and specialized industry-focused financial solutions.

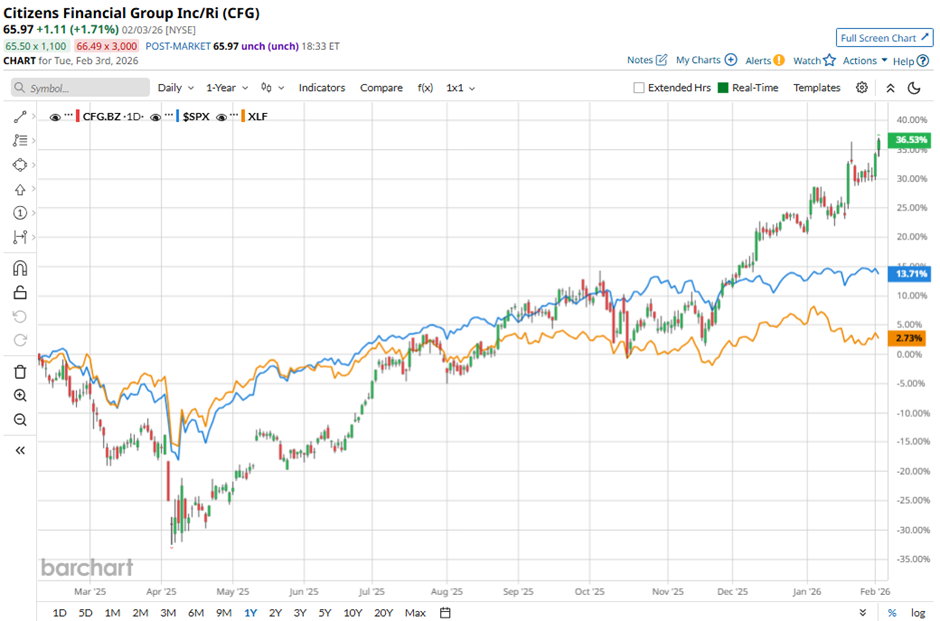

The Providence, Rhode Island-based company's shares have outperformed the broader market over the past 52 weeks. CFG stock has surged 42.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.4%. Moreover, shares of Citizens Financial are up 12.9% on a YTD basis, compared to SPX’s 1.1% rise.

In addition, shares of the bank have also outpaced the State Street Financial Select Sector SPDR ETF’s (XLF) 4.4% return over the past 52 weeks.

Shares of Citizens Financial Group climbed 7.1% on Jan. 21 after the bank reported strong Q4 2025 results, including net income of $528 million, up 32% year-over-year, and EPS of $1.13, up 36%, both beating Wall Street expectations. Investors reacted positively to revenue of $3.07 billion and revenue net of interest expense of $2.16 billion, which exceeded forecasts.

For the fiscal year ending in December 2026, analysts expect CFG’s EPS to grow 31.4% year-over-year to $5.07. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

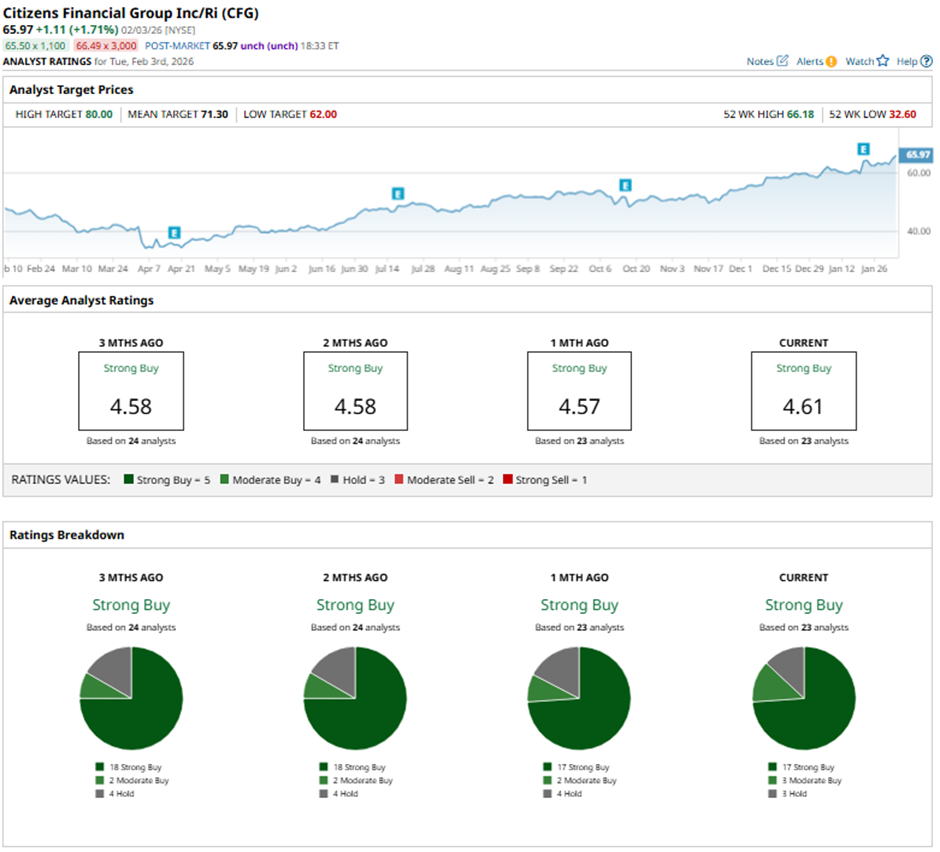

Among the 23 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 17 “Strong Buy” ratings, three “Moderate Buys,” and three “Holds.”

On Jan. 26, Citi raised its price target on Citizens Financial to $71 and maintained a “Buy” rating.

The mean price target of $71.30 represents a premium of 8.1% to CFG's current price. The Street-high price target of $80 suggests a 21.3% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart