The recent rally in silver prices was driven by its correlation with gold and strong underlying fundamentals, particularly industrial demand. While a recent correction was a natural response to the rally becoming "overheated" on a technical level, many of the core reasons for the ascent remain in place, suggesting a potential for prices to continue rising.

Why silver rallied: Fundamentals, not just gold

Unlike gold, which is driven almost exclusively by investment demand, silver is a hybrid that responds to investor sentiment and industrial forces. Several key fundamental factors fueled its rally alongside gold's momentum.

Industrial demand and the "green economy"

- Solar panels: Silver's use in solar photovoltaics (PVs) has been a primary demand driver, with the solar sector alone expected to consume nearly 196 million ounces in 2025.

- Electric vehicles (EVs): With rising vehicle electrification and greater vehicle sophistication, the automotive industry's demand for silver is also increasing.

- AI and electronics: Silver is critical for advanced electronics, including use in AI data centers, which are projected to see significant growth in power demand over the coming years.

Structural supply deficit

- The silver market faces a fifth consecutive year of significant supply deficits, with demand consistently outstripping supply since 2021.

- This supply crunch is difficult to resolve quickly, as most silver is produced as a byproduct of base metal mining. Mining supplies have lagged for years due to underinvestment and declining ore grades.

Safe-haven investment and low-rate expectations

- Following gold: As a fellow precious metal, silver benefits from the "safe haven" appeal that drove gold to record highs. Both metals saw increased investment due to geopolitical tensions, economic uncertainty, and concerns over fiat currency debasement.

- Lower opportunity cost: Expectations of future Federal Reserve interest rate cuts make non-yielding assets like silver and gold more attractive compared to fixed-income investments.

- "Poor man's gold": As gold prices became less accessible, silver's lower price point attracted more retail investors, amplifying the buying pressure.

Can silver continue to rally?

Despite the recent correction, analysts remain generally bullish on silver's longer-term prospects. While short-term volatility is likely, the underlying fundamentals propelling the initial rally suggest a potential for continued upside.

- Deficit remains: The ongoing structural supply deficit is unlikely to resolve quickly. Production constraints and persistent industrial demand should provide a strong price floor.

- Industrial demand continues: The demand from the "green economy," AI, and general electronics is still projected to be robust. While some manufacturers may reduce the amount of silver used (a process called "thrifting"), the overall trajectory for industrial demand remains strong.

- Gold-silver ratio: Market participants note that the gold-silver ratio remains high by historical standards, indicating that silver is still undervalued relative to gold. Historically, this ratio has tended to "snap back" during precious metals rallies, meaning silver could still play catch-up with gold's gains.

- Potential "silver squeeze": Market speculation suggests a "silver squeeze" is possible. Years of deficits have diminished above-ground inventories, making the market vulnerable to sharp price spikes if demand intensifies.

- Long-term outlook: Longer-term investors remain bullish and have published bullish price targets extending into 2026, pointing to a continued upward trend for silver and gold.

Potential headwinds

However, silver's famously volatile nature means its path forward is not guaranteed to be smooth.

- Higher volatility: Silver is known to swing more sharply than gold. While this can result in higher percentage gains during bull markets, prices can drop faster during market downturns.

- Economic slowdown: A global economic slowdown or recession could reduce industrial activity and weigh on prices since a significant portion of silver demand is industrial.

- Investment sentiment shifts: A reversal in investor sentiment away from safe-haven assets, possibly driven by more apparent economic stability or higher interest rates, could put downward pressure on gold and silver.

Technical Picture

Source: Barchart

The December silver futures contract has rallied 25 handles to an all-time high of $53.765 per ounce, off its April 2025 low. The 89% rally eventually found some profit-taking at the all-time highs. Like the gold market, the 50-day simple moving average (SMA) has kept the uptrend in check. Prices are approaching the SMA again. Traders may find price support in the vicinity of the SMA.

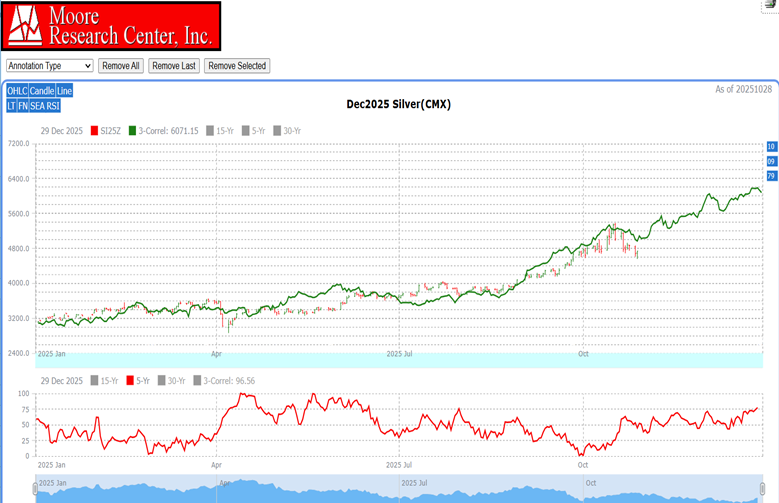

Seasonal and Correlation Pattern

Source: Moore Research Center, Inc. (MRCI)

MRCI research has found two patterns that may interest silver bulls. The fundamentals we discussed earlier coincide with these patterns. The first pattern is the correlation (green) of the current silver market with three other years: 1979 (95%), 2009 (85%), and 2010 (84%), with the potential for a significant upward movement within 30 days.

Additionally, the 5-year seasonal pattern (red) shows silver has positively moved during the 4th quarter since the pandemic. Like the stock indexes (SPY), October has been a month in which silver has reached a significant bottom.

The fundamentals, the technical picture, 3 years of market correlations, and a 5-year seasonal pattern may be the tailwind that silver prices will need to make another run at their all-time high prices.

As a crucial reminder, while seasonal patterns can provide valuable insights, they should not be the basis for trading decisions. Traders must consider various technical and fundamental indicators, risk management strategies, and market conditions to make informed and balanced trading decisions.

Assets to participate in the silver move

Traders and investors seeking a bullish position in the silver market can access several key assets, including silver futures contracts (e.g., COMEX standard size SI, micro-size SO), options on futures and equities are available as well, physical silver bullion or coins, and silver ETFs like the iShares Silver Trust (SLV) or Physical Silver Shares ETF (SIVR), which track spot silver prices and offer liquid, cost-efficient exposure without direct metal storage.

In closing…

Silver prices rallied because of gold's safe-haven demand and silver's own industrial use in solar panels, electric vehicles, and AI electronics, plus a supply deficit that has lasted five years since 2021. The metal hit $53.765 per ounce before correcting, with support now near the 50-day moving average; the deficit, ongoing industrial needs, a high gold-silver ratio, and possible squeeze keep the case for higher prices, though volatility, economic slowdowns, or shifts away from safe-haven buying pose risks. Technical correlations to 1979, 2009, and 2010, plus a post-pandemic fourth-quarter uptrend, align with the fundamentals.

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart