Valued at a market cap of $27.6 billion, Brown & Brown, Inc. (BRO) is one of the largest insurance brokerage firms in the United States, specializing in providing insurance products, risk management solutions, and consulting services to businesses, government entities, professional organizations, and individuals. The Florida-based company operates through four main segments: Retail, National Programs, Wholesale Brokerage, and Services, allowing it to offer a wide range of property & casualty insurance, employee benefits, personal lines, and specialty programs.

The insurance company's shares have lagged behind the broader market over the past 52 weeks. BRO stock has decreased 26.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 13.7%. Moreover, shares of the company are down 20.9% on a YTD basis, compared to SPX’s 13.4% gain.

In addition, shares of the company have also underperformed the Financial Select Sector SPDR Fund’s (XLF) 3.2% return over the past 52 weeks and 6.5% rally in 2025.

Brown & Brown released its third-quarter earnings on Oct. 27, and its shares fell 6.1% in the following trading session as pressure on margins and the softer organic growth rate appeared to weigh on investor sentiment. The company delivered $1.6 billion in revenue, up a strong 35.4% year over year, boosted largely by acquisitions. Commissions and fees climbed 34.2% to about $1.6 billion, and adjusted EBITDAC surged 41.8% to $587 million, lifting the margin to 36.6%.

However, income before taxes slipped 1.9% to $311 million, net income declined 3% to $227 million, and diluted EPS fell to $0.68, down roughly 16%.

For the current fiscal year, ending in December 2025, analysts expect BRO’s adjusted EPS to grow 10.7% year-over-year to $4.25. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

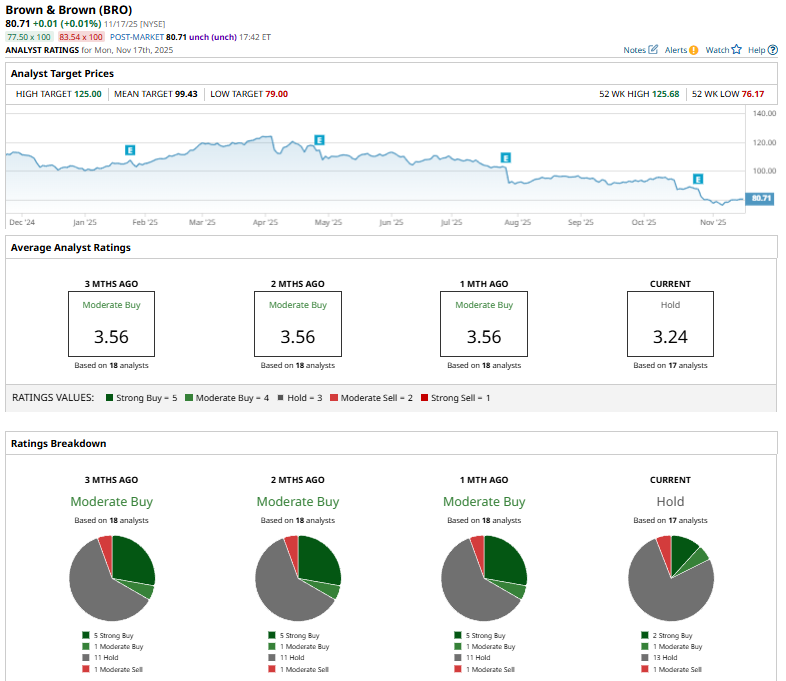

Among the 18 analysts covering the stock, the consensus rating is a “Hold.” That’s based on three “Strong Buy” ratings, one “Moderate Buy,” 13 “Holds,” and one “Moderate Sell.”

On Oct. 14, Bank of America Securities analyst Joshua Shanker reiterated his “Buy” rating on Brown & Brown and maintained a $133 price target.

The mean price target of $99.43 represents a 23.2% premium to BRO’s current price levels. The Street-high price target of $125 suggests a 54.9% potential upside.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Coinbase Stock Fans, Mark Your Calendars for December 17

- Warren Buffett Says to Embrace Stock Volatility Because ‘A Tolerance for Short-Term Swings Improves Our Long-Term Prospects’

- Bridgewater Is Betting Big on This 1 Chip Stock (Not Nvidia). Should You Buy Shares Here?

- S&P Futures Slip on Souring Risk Sentiment