iShares iBoxx $ High Yield Corporate Bond ETF (NY:HYG)

All News about iShares iBoxx $ High Yield Corporate Bond ETF

Crude, Crypto, & Credit Crumble As S&P Nears Record High ↗

December 28, 2023

Via Talk Markets

Topics

Stocks

U.S. Weekly FundFlows: Equity ETFs Attracted $10.0 Billion Of Net Inflows During the Fund-Flows Week ↗

December 07, 2023

Via Talk Markets

Topics

ETFs

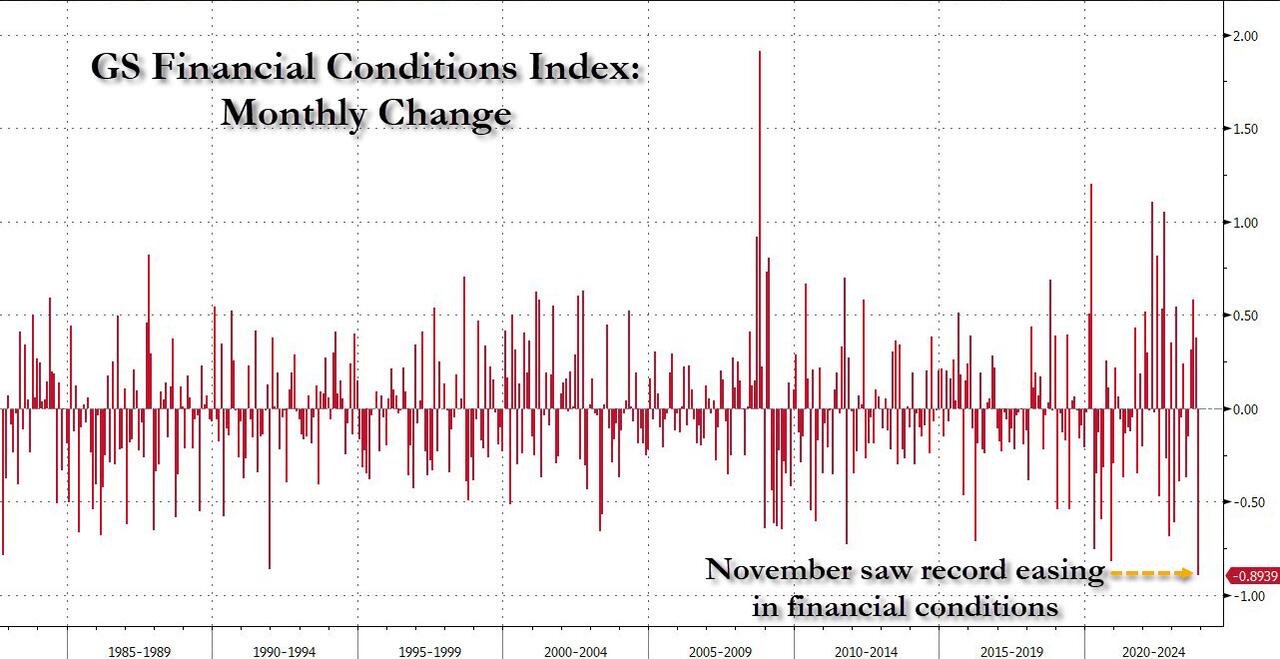

"A November To Remember": The Best And Worst Performing Assets In November And YTD ↗

December 01, 2023

Via Talk Markets

Topics

Stocks

SPY Breadth And Hawkish Fed Talk ↗

November 21, 2023

Via Talk Markets

U.S. Weekly FundFlows: Equity ETFs Attract $7.8 Billion In Inflows ↗

November 03, 2023

Via Talk Markets

Topics

ETFs

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.