( click to enlarge )

( click to enlarge )Cemtrex Inc (NASDAQ:CETX) is showing signs of a short-term trend reversal. The stock broke this downtrend line today and the volume spiked along with move, which could be a sign that a bounce could in order. Lets see whether the stock can gather enough momentum to break through $3.38 tomorrow (declining EMA13). If the Bulls are able to push through this level, there will be another rally towards $3.64. The daily technical indicators are also showing signs of reversal. On watch.

( click to enlarge )

( click to enlarge )Regulus Therapeutics Inc (NASDAQ:RGLS) is showing signs of an upcoming breakout. Watch the flag formation closely. A move above $1.30 would constitute a technical entry for the short-term trader looking for a quick trade.

( click to enlarge )

( click to enlarge )Gevo, Inc. (NASDAQ:GEVO) Looks like a bottom formation (potential rouding bottom) in progress on the daily candle chart. A breakout over $1.13 on volume would send this flying. Technical indicators are also giving the first bullish signs. On watch.

( click to enlarge )

( click to enlarge )Superconductor Technologies, Inc. (NASDAQ:SCON) After a big rally on Tuesday and Wednesday, the stock has been pulling back on volume. It's now consolidating and is still above all of its major short-term exponential moving averages. The short-term trend is bullish and a move to the $1.50 again appears likely.

( click to enlarge )

( click to enlarge )Pacific Biosciences of California (NASDAQ:PACB) Great run on very strong volume surge. Price has started to bounce and broke out from a small descending channel today closing above resistance 4.84. The stock seems to be ready for another run up. Some technicals are turning up here. Further strength above 5.13 opens the door to 5.32. Put her on your radar.

( click to enlarge )

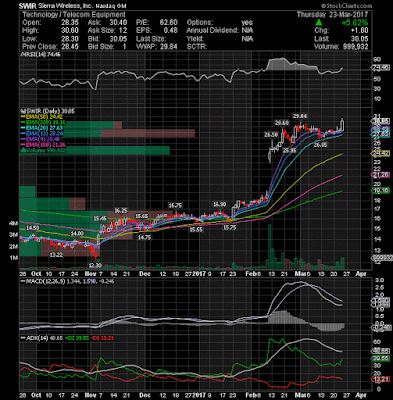

( click to enlarge )Sierra Wireless, Inc. (NASDAQ:SWIR) has been on fire the past few months, and looks ready to make another upside move. The stock broke out of a consolidation range today as the stock closed up $1.6 on the day. Thursday’s high was $30.60 which is resistance for Friday’s continuation move. As long as the stock stay above 29 area, the bullish scenario is still intact.

If you want to contact me for advertising opportunities on blog or twitter, then get in touch via email

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC