Erie, Pennsylvania-based Erie Indemnity Company (ERIE) is a managing attorney-in-fact for the subscribers at the Erie Insurance Exchange. Valued at a market cap of $13.2 billion, the company provides issuance and renewal services, sales-related services, underwriting services, and information technology services.

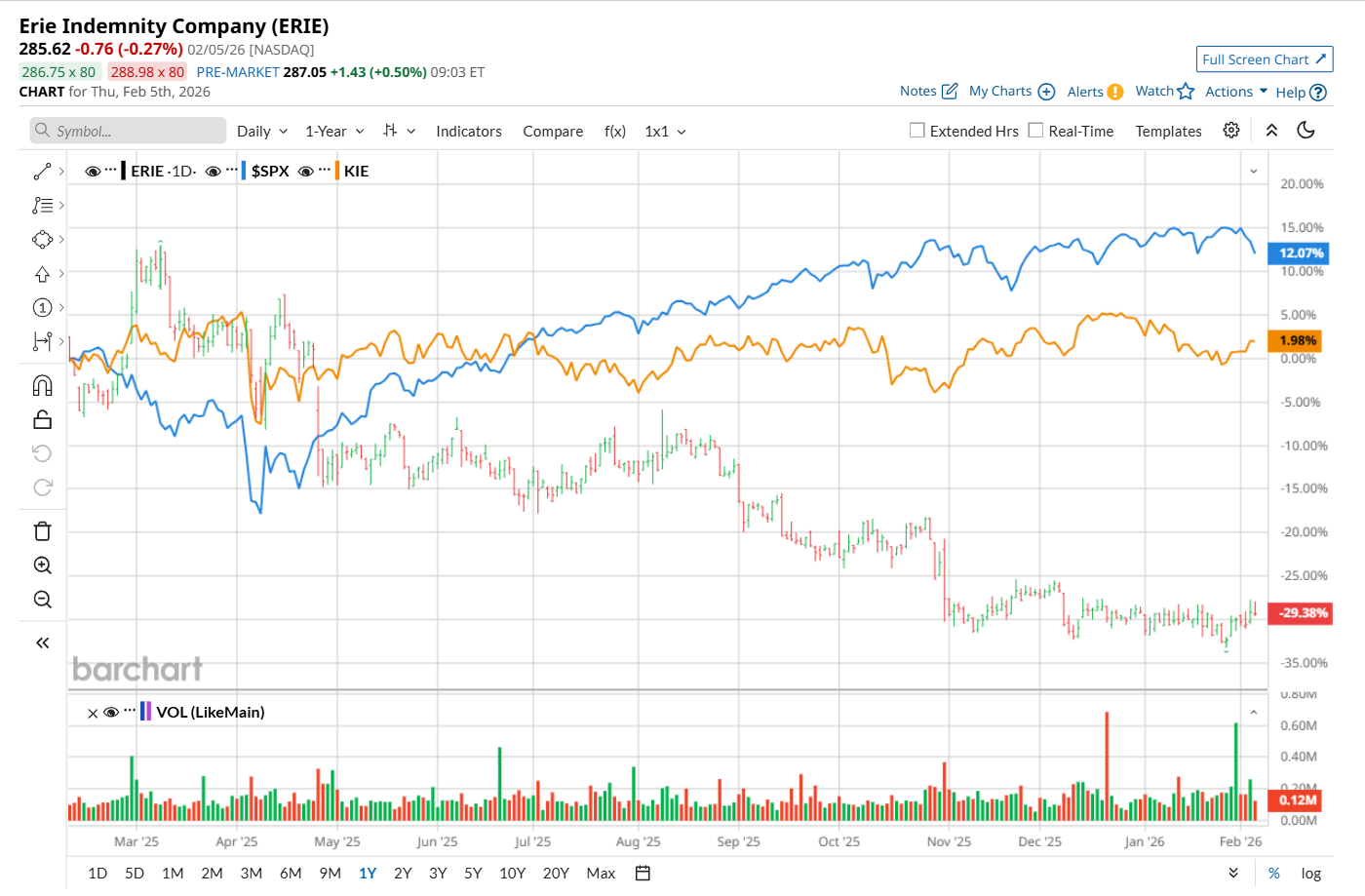

This financial company has considerably underperformed the broader market over the past 52 weeks. Shares of ERIE have declined 29.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.2%. Meanwhile, on a YTD basis, the stock is down marginally, broadly in line with SPX.

Narrowing the focus, ERIE has also lagged behind the State Street SPDR S&P Insurance ETF (KIE), which rose 2% over the past 52 weeks. However, it has aligned with KIE’s slight loss on a YTD basis.

On Oct. 30, ERIE delivered its Q3 results, and its shares plunged 5.5% in the following trading session. The company’s operating income increased 16% year-over-year to $208.9 million, while its management fee revenue - policy issuance and renewal services grew 7.3% from the same period last year.

For fiscal 2025, ending in December, analysts expect ERIE’s EPS to grow 9.7% year over year to $12.59. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in two of the last four quarters, while missing on two other occasions.

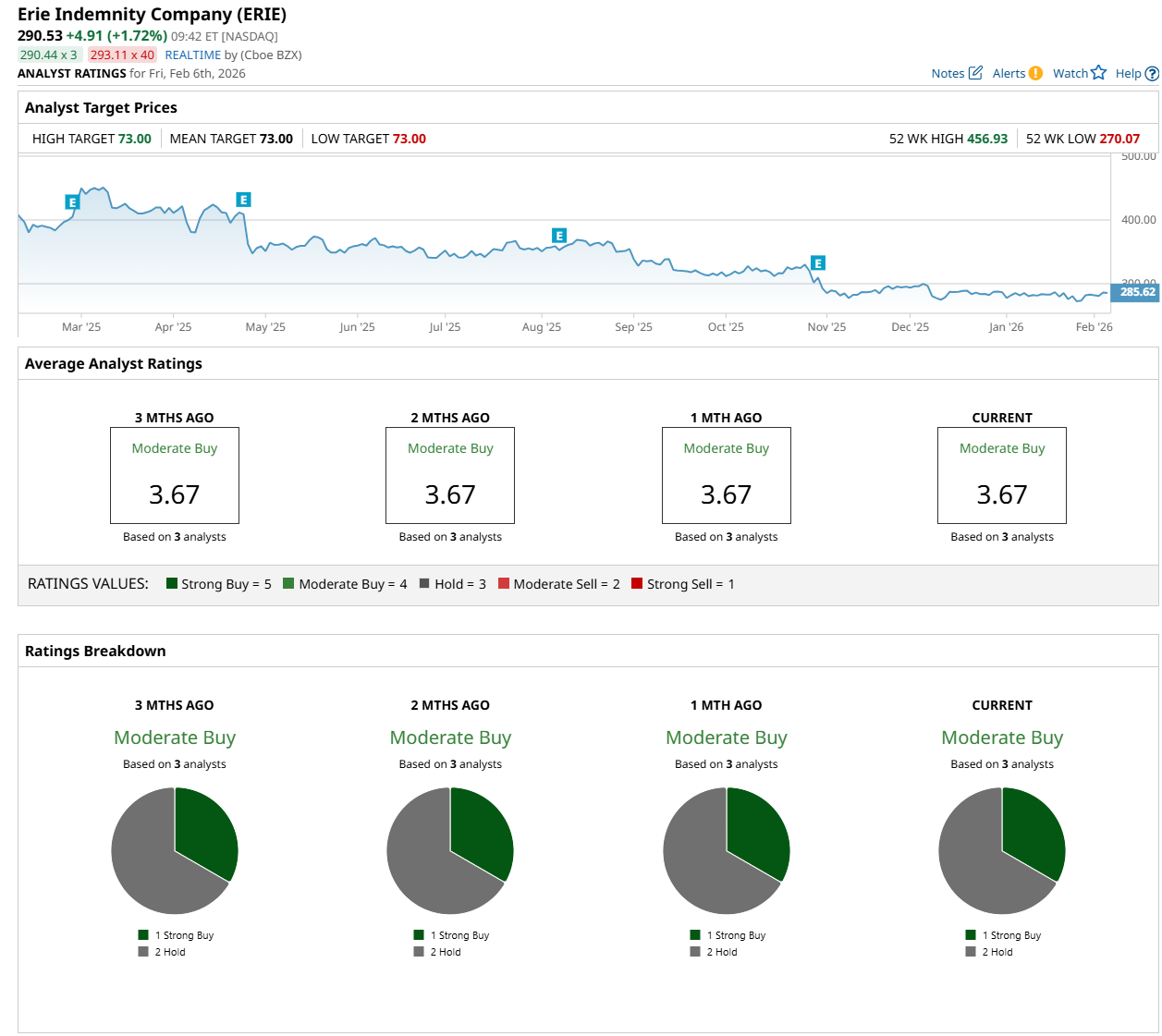

Among the three analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on one “Strong Buy,” and two "Hold” ratings.

The configuration has remained stable over the past three months.

The company is trading above its mean price target and Street-high price target of $73.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart