Once hailed as the “Tesla of China,” Chinese electric vehicle (EV) startup Nio (NIO) has been out of favor with markets. NIO peaked in early 2021 when its market cap surpassed $100 billion but closed in the red for the past four consecutive years. It did break its losing streak last year, and while the stock fell sharply from its 2025 highs, it still managed to gain around 17%. Let's dig into Nio’s 2026 forecast and examine whether the stock can gain further this year.

Nio Reached the Milestone of Producing 1 Million Cars

Let’s begin by looking at the company’s recent performance. Nio delivered 48,135 vehicles in December, which was 54.6% higher year-over-year (YoY) and a new monthly high. In Q4 2025, it delivered 124,807 vehicles, which, while below the 150,000 that it had previously forecast, was still up a cool 71.7% as compared to the corresponding period in 2024.

The company has reached the milestone of hitting the production milestone of 1 million cars, which is no mean achievement considering the state of the EV industry. Nio’s ES8 SUV, whose cumulative deliveries surpassed 40,000 units in December, has been a key driver of rising sales in recent months.

NIO's financial performance has also improved, and in Q3 2025, gross margin was 13.9% as compared to 10.7% in the corresponding quarter in the previous year. Its net loss fell 31.2% YoY to $488.9 million and was narrower than expected. The company ended the quarter with cash and cash equivalents of $5.1 billion.

NIO Stock 2026 Forecast

Nio has set an ambitious target of achieving volume growth of between 40% and 50% in 2026. Its deliveries rose 46.9% to 326,028 last year, and achieving the top end of the guidance would mean its 2026 deliveries getting closer to half a million this year. The carmaker expects to launch five new models in 2026, which, coupled with the Onvo L90 and the ES8, are expected to drive deliveries.

Nio is also upbeat on improving its bottom line and has expressed optimism over hitting a breakeven on adjusted profits in Q4 2025. If the company were to achieve the feat, it would be a significant milestone considering the massive losses the industry is infamous for. For 2026, Nio is targeting full-year profitability on a non-GAAP basis.

China Is Supporting Its EV Industry

Notably, while EV penetration rates in the U.S. have sagged and things are only expected to worsen in the near term following the withdrawal of the $7,500 EV tax credit, China has a supportive policy towards new energy vehicles (NEVs). This category includes both battery electric vehicles (BEVs) and hybrid cars.

In December, China’s NEV penetration rate surged to a record high of 60.4%, which means that six out of every ten cars sold in the month were either fully electric or hybrid. Along with domestic markets, Chinese EV companies are now looking to conquer global markets. Last year, China exported more cars than Japan, ending the country’s two-decade-long dominance in global car exports. Also last year, China-based BYD (BYDDY) grabbed the title of the world’s largest seller of BEVs from Tesla (TSLA) and looks set to hold the crown for the foreseeable future, given the wide gulf.

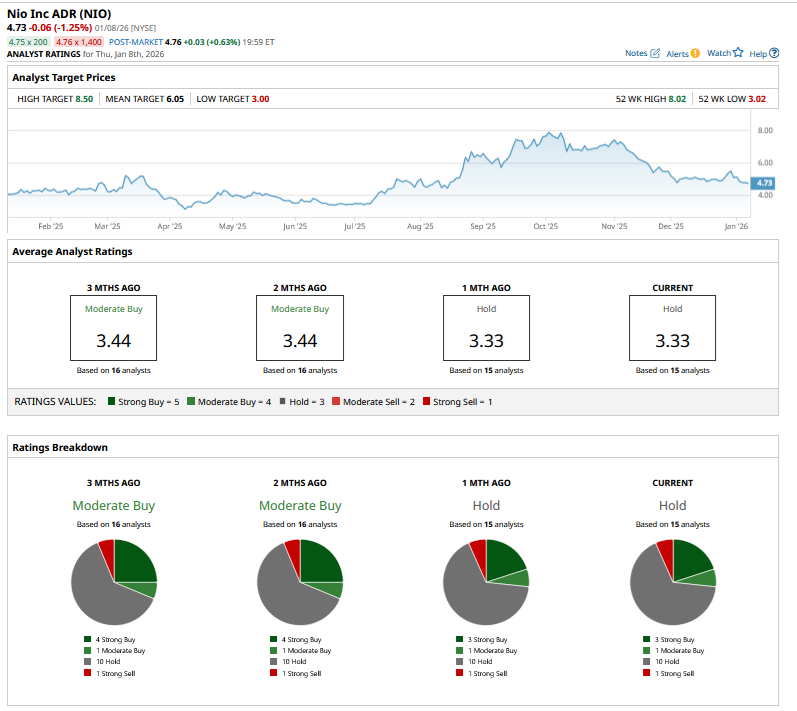

NIO Stock Target Price

Sell-side analysts are split on Nio, and of the 15 analysts polled by Barchart, only four rate it as a “Buy” equivalent. 10 analysts rate the stock as a “Hold,” while one rates it as a “Strong Sell.” NIO’s mean target price of $6.05 is almost 28% higher than current prices.

Why NIO Stock Looks Like a Buy

Nio is still reeling under the overhang of the allegations of inflating revenues that Singapore’s sovereign wealth fund GIC leveled last year. The company is facing a U.S. lawsuit over the issue, which is a material risk that is tough to price.

I, meanwhile, believe the stock is worth the risk and looks quite cheap at a forward price-to-sales multiple of 0.67x, which, for context, is lower than Li Auto (LI) and less than half of XPeng Motors (XPEV). To be sure, these companies are not strictly comparable, as while Li Auto is profitable (albeit facing declining sales), XPeng is more of a physical artificial intelligence (AI) play.

However, I find NIO’s risk-reward quite attractive at current prices and believe that if the company can deliver on the delivery and profitability guidance for 2026, the stock could have a stellar 2026 and build on last year's gains.

On the date of publication, Mohit Oberoi had a position in: NIO , XPEV , TSLA , LI . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart