Lucid Motors (LCID) made waves at CES 2026 by unveiling a production-intent robotaxi in partnership with Nuro and Uber Technologies (UBER). The announcement marks a bold push into autonomous vehicle services that could reshape the struggling electric vehicle maker's future.

The EV maker showcased a customized version of its Lucid Gravity SUV equipped with cutting-edge autonomous technology. It also featured high-resolution cameras, solid-state lidar sensors, and 360-degree perception capabilities powered by Nvidia's (NVDA) DRIVE AGX Thor computing platform.

The robotaxi stands out for innovative features, including halo-mounted LEDs that display rider initials for easy identification, interactive cabin screens for climate and entertainment controls, and real-time visualizations showing passengers exactly what the vehicle sees on the road. The spacious interior accommodates up to six passengers and offers generous luggage space, making it a premium group travel solution.

Autonomous testing began last month in the San Francisco Bay Area, with Nuro leading supervised trials using engineering prototypes. The companies expect to launch commercial service in the Bay Area later this year, with production slated to begin at Lucid's Arizona factory.

This announcement comes as Lucid aims to diversify its revenue streams. The company produced 18,378 vehicles in 2025, up 104% from 2024. However, Lucid remains unprofitable, given the capital-intensive nature of the automobile industry and rising competition from new and established competitors.

The robotaxi partnership leverages Nuro's proven autonomous technology and Uber's massive ride-hailing network, potentially unlocking a lucrative market beyond traditional vehicle sales.

Lucid Motors Is Poised for Solid Growth

Over the last 12 months, the company has wrestled with tariff impacts, magnet shortages, and an aluminum supplier fire. Despite these headwinds, Lucid Group has recently produced 1,000 vehicles per week, allowing it to meet its 2025 goal of producing between 18,000 and 20,000 units. It suggests that Lucid is transitioning beyond luxury vehicles toward mainstream EV production.

The company's current lineup includes the award-winning Air sedan and the recently launched Gravity SUV, both positioned in the premium segment, with roughly 70% of sales coming through leases. Management reports encouraging market share gains and strong near-term momentum, particularly for Gravity, which accounts for the majority of production and sales.

Lucid plans to enter the mass-premium market in late 2026 with a mid-sized platform priced at around $50,000. This three-vehicle platform will be manufactured at a new facility in Saudi Arabia, thereby avoiding Chinese tariffs. The Saudi plant will also feature next-generation motors that are more compact and efficient than current models.

What is the LCID Stock Price Target?

Analysts tracking LCID stock forecast revenue to increase from $808 million in 2024 to $9.7 billion in 2029. Despite stellar top-line growth, the auto manufacturer is forecast to post a net loss through 2029 as it focuses on expanding manufacturing capabilities. Wall Street projects its cumulative cash outflow to surpass $10 billion between 2025 and 2029. In this period, its free cash flow margins are slated to improve from -267% to -9%.

Lucid ended Q3 with $2.33 billion in cash, which means it will need to raise additional capital to cover its cash burn. Current shareholders should brace for significant dilution over the next five years, making LCID a high-risk investment right now.

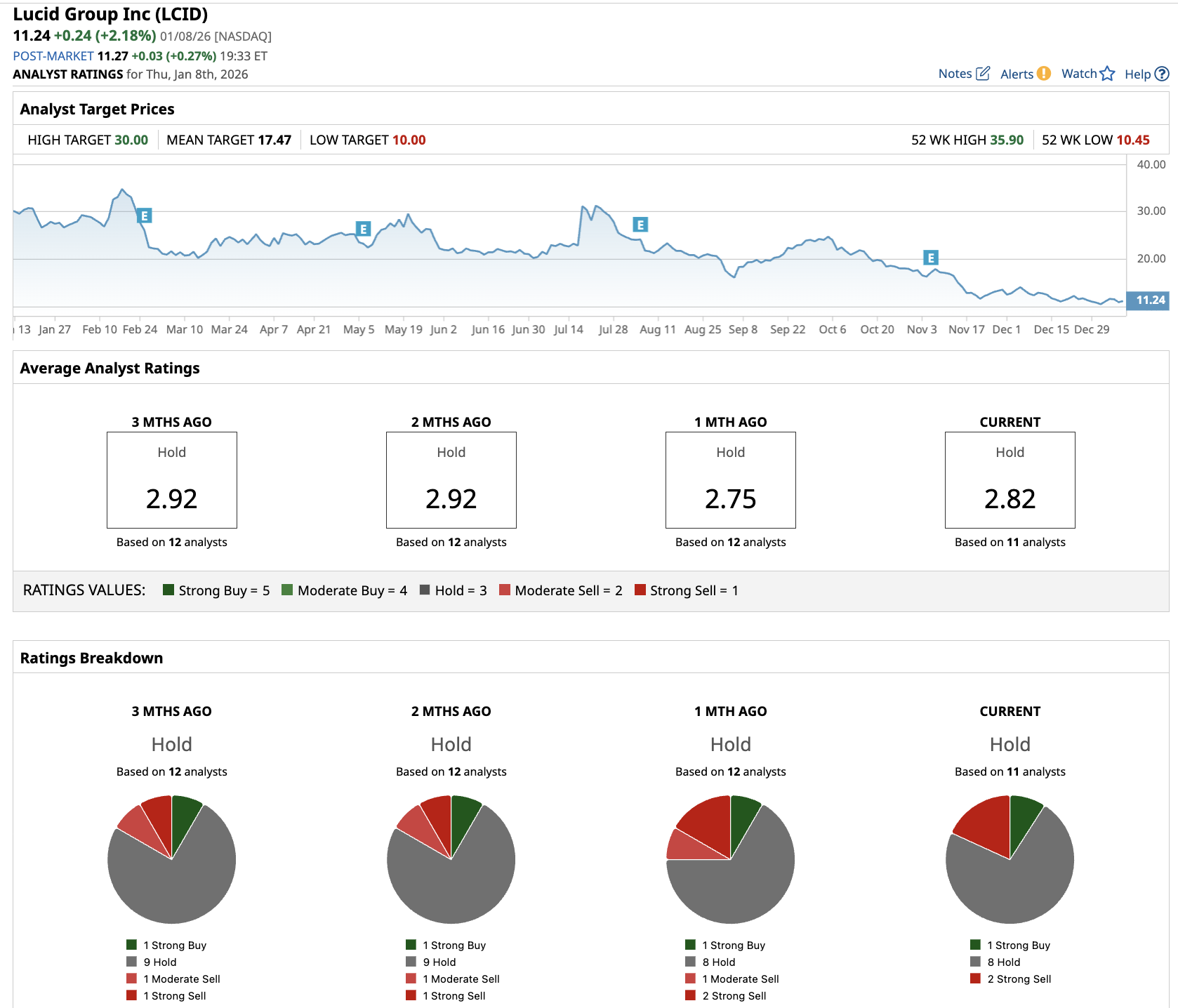

Out of the 11 analysts covering LCID stock, one recommends “Strong Buy,” eight recommend “Hold,” and two recommend “Strong Sell.” The average LCID stock price target is about $17.50, above the current price of $11.24.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart