2023 Drill Results Webcast to be Held on Thursday, February 8th

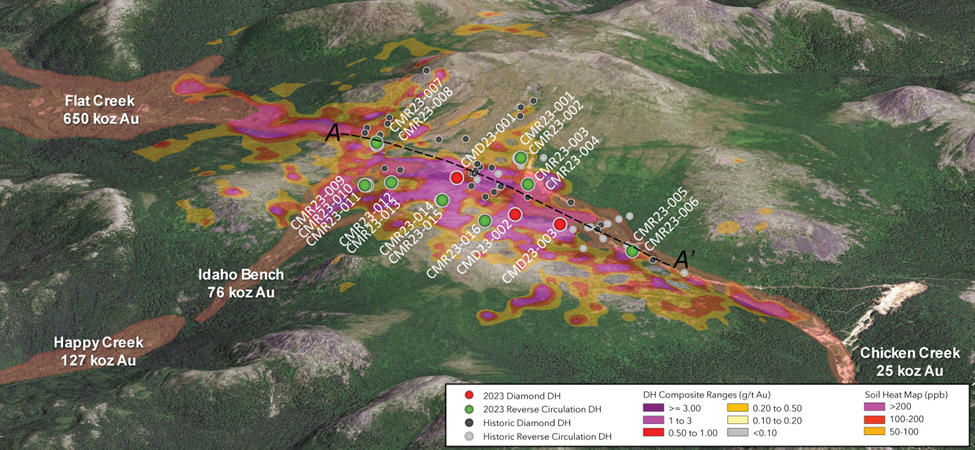

VANCOUVER, BC / ACCESSWIRE / February 7, 2024 / Tectonic Metals Inc. ("Tectonic" or the "Company") (TSXV:TECT) (OTCQB:TETOF), a mineral exploration company applying a disciplined, up-front de-risking strategy to address the economics, community benefits, and sustainability of the Company's projects, today announced the results of the Company's inaugural drill program conducted in 2023 at Chicken Mountain, the Flat Gold Project's bulk-tonnage reduced intrusion target. All 19 holes drilled in 2023 intersected gold mineralization and 12 drill holes ended in mineralization.

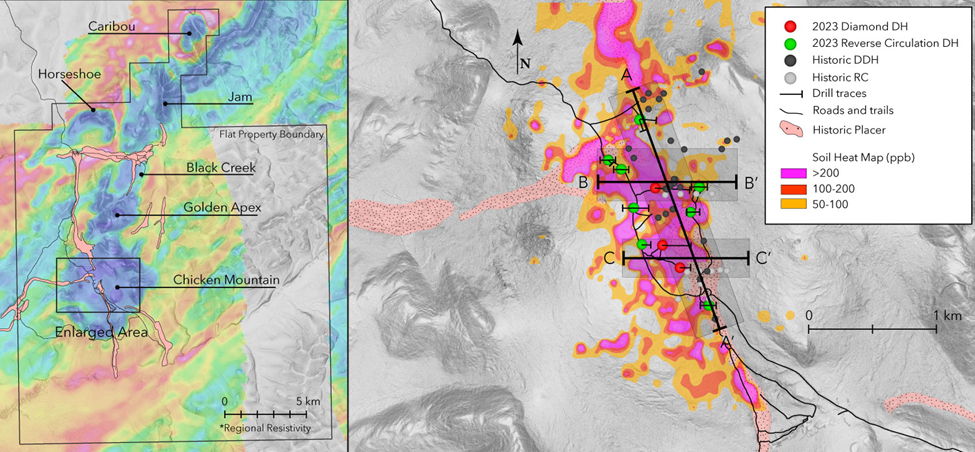

"Our 2023 drilling combined with the historical drilling has delineated 1.8 km of mineralized strike to a vertical depth of 300 m with mineralization remaining open in all directions and strengthening the case for a potential open-pit, multi-million ounce opportunity at Flat's Chicken Mountain target," stated Tony Reda, President and CEO of Tectonic Metals. "A total of 74 holes have been drilled at the Chicken Mountain intrusion target with each drill hole intersecting gold mineralization, which is remarkable and reinforces the notion that we are dealing with a very robust gold system. To further support this finding, it is important to note that Chicken Mountain has been identified as the primary bedrock source for over 1.4 million ounces of recorded placer production2 in the surrounding area. The 1.8 km of drilled strike at Chicken Mountain represents only half of the 4.0 km x ~1.0 km Chicken Mountain gold-in-soil-anomaly, only a third of the 6.0 km x 5.6 km Chicken Mountain geophysical anomaly, and only one intrusion target out of 6 distinct district-scale intrusion targets along a 20 km trend at the 99,840 acre Flat Gold Project in Alaska. Our journey has only begun and more drill testing is warranted across all intrusion targets to fully uncover the tier one potential of the Flat Gold System."

2023 Drill Results Webcast with 3L Capital's Analyst Steven Therrien

Thursday, February 8th, at 6 AM Pacific Time (9 AM Eastern Time)

On Thursday, February 8th, please join Tony Reda, President and CEO of Tectonic Metals, and Steven Therrien, 3L Capital's mining analyst, on a webcast to discuss the results of Tectonic Metals' 2023 Exploration and Drilling Program. Participants of the live event will also have the opportunity to ask questions.

The webcast will take place at 9:00 AM Eastern Time, 8:00 AM Central Time, 7:00 AM Mountain Time, and 6:00 AM Pacific Time.

Participants are encouraged to register early for the webcast using the link below:

https://streamyard.com/watch/Yg5dXmfif576

Following the webcast a recording of the event will be available at the same link.

Figure 1: 2023 Drill Program Plan Map Denoting Long Sections

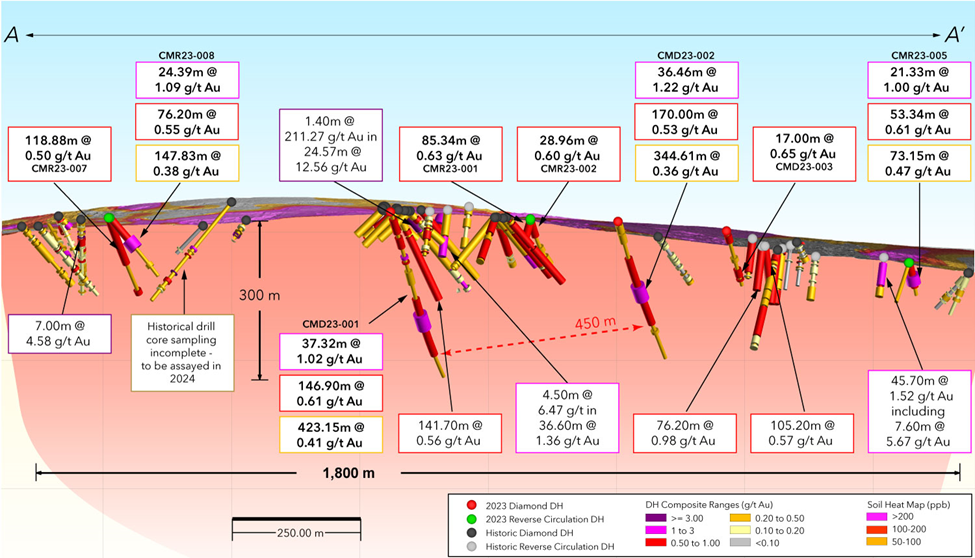

Figure 2: Chicken Mountain Long Section Highlighting Potential Open-Pit, Multi-Million Ounce Opportunity

1.8 km of Mineralized Strike to a Vertical Depth of 300 m and Open (Long Section A-A" Denoted in Plan View of Figure 1)

2023 Drill Highlights and Key Findings:

- All drill holes intersected gold mineralization

- 19 holes drilled across 1.6km of strike down to a maximum vertical depth of 300 m or 428.55m drill hole length, for a total of 2,633m at Chicken Mountain

- 12 drill holes ended in mineralization

- Mineralization remains open in all directions

- Oxidation as deep as 350m down hole

- Low sulphur in all drill holes

- Drilling has identified a potentially higher-grade (>1.0 g/t Au) lode that is open for expansion and warranting drill follow up

- Drilling strengthens the case that Chicken Mountain appears to be a Fort Knox / Reduced Intrusion Related Gold System (RIRGS) characterized by gold hosted within sheeted veining and shear zones, strong correlation of gold with bismuth and tellurium and multiple phases of intrusion, with notable structural/fault/shear zones exhibiting domains of intense hydrothermal alteration and higher-grade mineralization.

- Diamond drilling successfully confirms continuous mineralization to 300 m vertical depth (3 times deeper than average historical drilling and still open in all directions)

- 37.32m at 1.02 g/t Au within a broader mineralized interval of 146.90m at 0.61 g/t Au and the entire drill hole (CMD23-001) being completely mineralized, ending in mineralization, and yielding 423.15m at 0.41 g/t Au

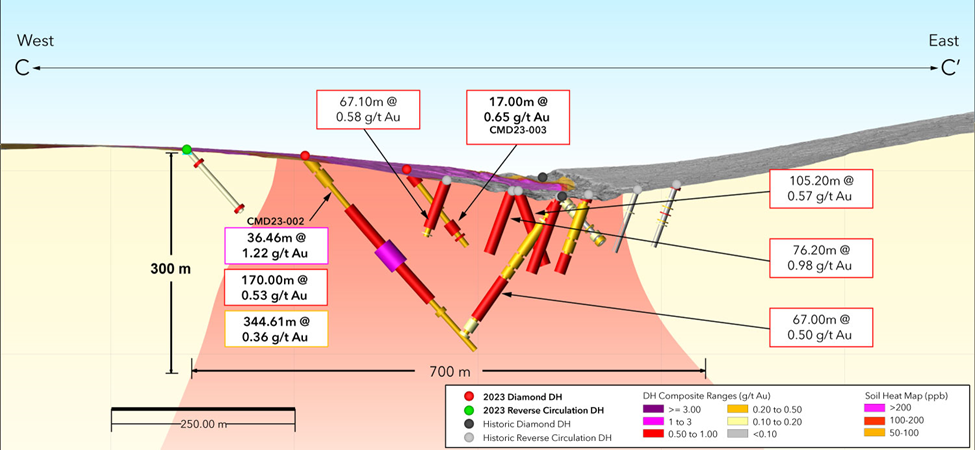

- 36.40m of 1.22 g/t Au within a broader mineralized interval of 170.00m at 0.53g/t Au and the entire drill hole (CMD23-002), a 450m step out from CMD23-001, being completely mineralized, ending in mineralization, and yielding 344.61m of 0.36 g/t Au

- Reverse circulation drilling successfully confirms mineralization beyond the periphery of historical drilling

- Sixteen drill holes testing 1000m of strike along eastern and western margins of the 4km x ~ 1km gold in soil anomaly

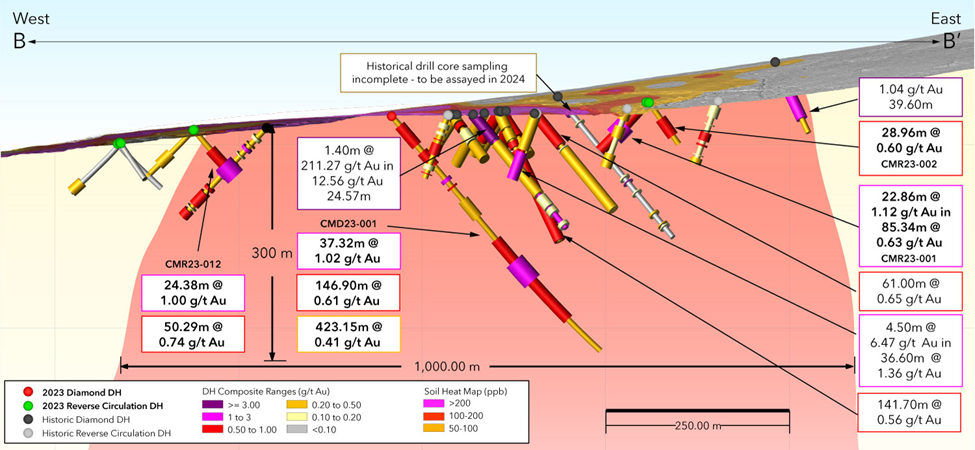

- 22.86m of 1.12 g/t Au within a broader mineralized interval of 89.92 m at 0.60 g/t Au and ending in mineralization (CMR23-001) representing a 62.00m step out from the closest historical collar

- 24.39m of 1.09 g/t Au within a broader mineralized interval of 76.20m at 0.55 g/t Au and ending in mineralization (CMR23-008) representing a 102.00m step out from the closest historical collar

- 24.38m of 1.00 g/t Au within a broader mineralized interval of 50.29m at 0.74 g/t Au and ending in mineralization (CMR23-012) representing a 134.00m step out from the closest historical collar

Figure 3: Long Section of 2023 and Historic Drilling at Chicken Mountain from B-B' Referenced in Figure 1 Plan Map

Figure 4: Long Section 2023 and Historic Drilling at Chicken Mountain from C-C' Referenced in Figure 1 Plan Map

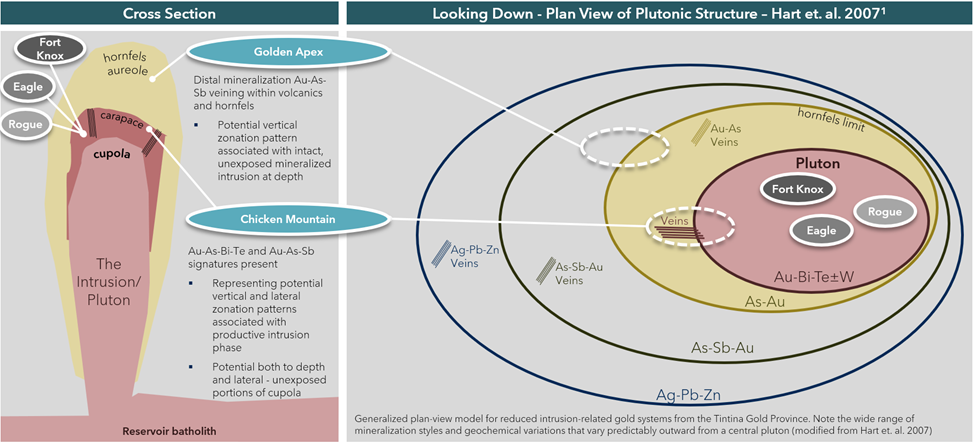

Chicken Mountain - A Reduced Intrusion Related Gold System (RIRGS) akin to the mineralization observed at Kinross Gold Corporation's Fort Knox Mine, Alaska

The Fort Knox Mine is a large open-pit gold mine in the Fairbanks mining district of Alaska, USA, discovered in 1980 and began production in 1996. Since then, Fort Knox has become one of the largest gold-producing mines in Alaska, yielding over 200,000 ounces of gold annually and recently pouring its nine millionth ounce. Based on the Dec. 31, 2022 Annual Mineral and Resource Statement published by Kinross (click here), the average grade of their proven and probable mineral reserves is 0.30 and 0.40 g/t Au respectively.

At Fort Knox, the grades of individual veins are 5 to 50 g/t Au, but most ore blocks have an average of 3 to 5 veins per metre within otherwise barren host rocks, thus yielding ~1 g/t ores. Gold grade is, therefore, mainly controlled by vein density. Fort Knox's lower-grade ores are enriched by higher-grade and overprinting, later-stage quartz shear veins.1

Fairbanks Gold, a company founded and financed by Robert Friedland, a Canadian Mining Hall of Fame Inductee, is credited with the discovery and sale of the Fort Knox Mine to Kinross. The initial drilling and gold discovery (late 1980s) at Chicken Mountain was completed by Fairbanks Gold in tandem with early drilling at Fort Knox.

Similar to Fort Knox, Chicken Mountain is demonstrating the exact same characteristics with gold hosted in sheeted quartz veinlets, fractures and shears within a multiphase granitoid body, an Au-Bi-Te +/- As+W+Sb geochemical association and very low sulphur mineralization. Also similar to Fort Knox, there is strong evidence at Chicken Mountain, that multiple mineralization events and overprinting occurred coinciding with better gold grade. Follow-up drilling will target these high priority enriched areas with the objective of finding the sweet spot of the gold system and/or the carapace of the RIRGS (see Figure 5).

Chicken Mountain geochemical characteristics (Au-Bi-Te +/- As+W+Sb) are indicative of mineralization that is both proximal and distal to the source intrusion/pluton within a RIRGS framework (see Figure 5). This coupled with the kilometre long and wide alteration and gold mineralization halos into the wallrock suggests that the "smoking gun" is there, but the sweet spot (higher-grade, unexposed portions of the cupola/carapace) of the system has yet to fully discovered and more drilling is warranted.

Figure 5: Reduced Intrusion Related Gold Systems ("RIRGS")

Next steps: 2024 Goal of Launching Exploration + Drill Program at Flat's Multiple Intrusion Targets

In 2024, Tectonic plans to continue drill testing new areas of Chicken Mountain. The original historic drilling locations were predicated on drilling underneath historic placer workings and, therefore, there is not enough concrete evidence to support that this is the best part of the Chicken Mountain gold system. In fact, there is more evidence as stated above suggesting that the "sweet spot" of the system has not fully been discovered yet. That said, the 2023 and historic drill results suggest a multi-million resource opportunity already exists at Chicken Mountain and follow-up expansion drilling is warranted.

- Generate drill targets for all of the five other intrusion targets at Flat (see Tectonic previously announced news release here). As stated previously, each of the intrusion targets has the hallmarks of another RIRGS present at Flat.

- Ongoing compilation, interpretation, and examination of the 2023 Chicken Mountain exploration results over the coming months

- Complete detailed analysis and integration of the new data with existing historic exploration information, to assist in developing robust 2024 drill targeting vectors at both Chicken Mountain and at other potential intrusion targets on the Flat Project. Key components include:

- Pathfinder element analysis of soil and drill hole data across the property to elucidate geochemical zonation patterns related to RIRGS targets;

- Detailed structural analysis of oriented core data at Chicken Mountain and structural interpretation of high resolution 2023 LiDAR data to develop a property wide structural framework; and

- 3D magnetic inversion to aid in identifying the presence and locations of non-exposed intrusion cupolas.

- Core cutting and assaying of 2003 historic diamond drill core (a total 744 metres in 4 holes) from Chicken Mountain and nearby intrusion target, Golden Apex, which were only partially sampled despite some samples that returned up to 20 g/t Au.

- Ongoing metallurgical test work, including initial small scale column heap leach tests, that will be performed to continue to de-risk and explore heap leaching as viable recovery method for gold mineralization.

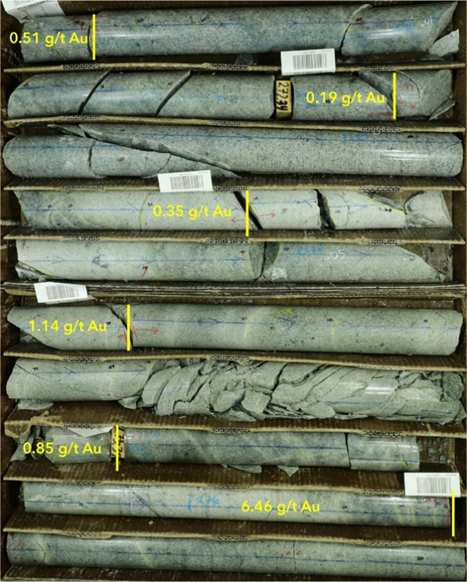

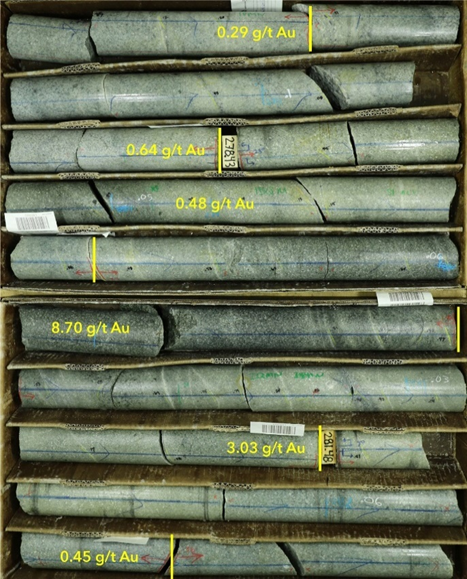

Figure 6: Diamond Drill Cores

Flat drill core shown below exhibits classic Fort Knox / Reduced Intrusion Related Gold System (RIRGS) mineralization, including sheeted quartz-sulphide veinlets forming in cracks and fractures within the host rock and acting as pathways for mineralizing fluids to flow through. Pervasive sericite alteration is another common feature associated with RIRGS and observed in the Flat drill core. This type of alteration occurs when hydrothermal fluids interact with rocks, causing the replacement of minerals such as feldspar and biotite with sericite. This alteration can often be seen as a distinct white or grey color in the host rock as shown in the photos below. Understanding the processes and features associated with RIRGS is essential for successful exploration and mining of these types of deposits.

Diamond drill core from hole CMD23-001

(Box 97-98, From 271.41m to 276.92m)

Diamond drill Core from CMD23-001

(Box 99-100, From 278.92m to 282.72m)

Table 1. Chicken Mountain - significant intercepts of the 2023 drill program.

All widths are interval widths as insufficient data exists currently to determine true zone widths. Drill holes ending in greater than 0.10 g/t Au are noted in table below.

| Hole ID | From (m) | To (m) | Length (m) | Au (g/t) | Comments | |

| CMD23-001 | entire hole |

5.40 |

428.55 |

423.15 |

0.41 |

Ended in Mineralization |

including |

17.00 |

53.00 |

36.00 |

0.61 |

||

or |

36.30 |

38.25 |

1.95 |

5.37 |

||

including |

64.01 |

90.00 |

25.99 |

0.55 |

||

or |

89.00 |

90.00 |

1.00 |

7.67 |

||

including |

112.02 |

118.00 |

5.98 |

1.24 |

||

including |

150.00 |

181.62 |

31.62 |

0.47 |

||

including |

220.10 |

367.00 |

146.90 |

0.61 |

||

or |

220.10 |

221.00 |

0.90 |

5.02 |

||

or |

258.64 |

295.96 |

37.32 |

1.02 |

||

or |

279.43 |

281.48 |

2.05 |

5.72 |

||

or |

310.63 |

311.33 |

0.70 |

5.40 |

||

| CMD23-002 | entire hole |

4.27 |

352.65 |

344.61 |

0.36 |

Ended in Mineralization |

| including | 92.00 |

262.00 |

170.00 |

0.53 |

||

| or | 106.50 |

107.85 |

0.75 |

6.28 |

||

| or | 161.54 |

198.00 |

36.46 |

1.22 |

||

| or | 172.00 |

175.00 |

3.00 |

3.23 |

||

| or | 180.00 |

182.00 |

2.00 |

3.03 |

||

| or | 194.00 |

196.00 |

2.00 |

4.05 |

||

| or | 261.00 |

262.00 |

1.00 |

6.09 |

||

| CMD23-003 | entire hole | 3.52 |

134.12 |

130.50 |

0.30 |

Ended in Mineralization |

| including | 9.45 |

26.80 |

17.35 |

0.59 |

||

| and | 93.00 |

111.00 |

17.00 |

0.65 |

||

| and | 117.00 |

120.50 |

3.50 |

0.65 |

||

| CMR23-001 | entire hole | 1.52 |

91.44 |

89.92 |

0.60 |

Ended in Mineralization |

| including | 41.15 |

64.01 |

22.86 |

1.12 |

||

| or | 59.44 |

62.48 |

3.04 |

4.16 |

||

| CMR23-002 | entire hole | 1.52 |

70.10 |

68.58 |

0.35 |

|

| including | 1.52 |

6.10 |

4.58 |

0.78 |

||

| including | 27.43 |

56.39 |

28.96 |

0.60 |

||

| or | 38.10 |

39.62 |

1.52 |

5.32 |

||

| CMR23-003 | entire hole | 0.00 |

115.82 |

115.82 |

0.34 |

Ended in Mineralization |

| including | 0.00 |

39.62 |

39.62 |

0.56 |

||

| or | 21.34 |

22.86 |

1.52 |

4.44 |

||

| or | 38.10 |

39.62 |

1.52 |

4.48 |

||

| including | 67.06 |

79.25 |

12.19 |

0.45 |

||

| CMR23-004 | entire hole | 0.00 |

53.34 |

53.34 |

0.55 |

Ended in Mineralization |

| including | 0.00 |

48.77 |

48.77 |

0.59 |

||

| or | 24.38 |

25.91 |

1.53 |

4.01 |

||

| or | 35.05 |

36.58 |

1.53 |

6.21 |

||

| CMR23-005 | entire hole | 0.00 |

73.15 |

73.15 |

0.47 |

|

| including | 1.52 |

54.86 |

53.34 |

0.61 |

||

| or | 7.62 |

9.14 |

1.52 |

3.38 |

||

| or | 25.91 |

47.24 |

21.33 |

1.00 |

||

| CMR23-006 | entire hole | 0.00 |

103.63 |

103.63 |

0.22 |

Ended in Mineralization |

| CMR23-007 | entire hole | 1.52 |

201.17 |

199.65 |

0.37 |

Ended in Mineralization |

| including | 1.52 |

120.40 |

118.88 |

0.50 |

||

| or | 9.14 |

10.67 |

1.53 |

8.64 |

||

| or | 83.82 |

85.34 |

1.52 |

3.55 |

||

| or | 96.01 |

97.54 |

1.53 |

4.72 |

||

| including | 190.50 |

201.17 |

10.67 |

0.92 |

||

| or | 193.55 |

195.07 |

1.52 |

3.76 |

||

| CMR23-008 | entire hole | 0.00 |

147.83 |

147.83 |

0.38 |

Ended in Mineralization |

| including | 3.05 |

79.25 |

76.20 |

0.55 |

||

| or | 54.86 |

79.25 |

24.39 |

1.09 |

||

| or | 62.48 |

64.01 |

1.53 |

7.90 |

||

| CMR23-009 | entire hole | 1.52 |

85.34 |

83.82 |

0.03 |

|

| including | 57.91 |

62.48 |

4.57 |

0.25 |

||

| CMR23-010 | entire hole | 1.52 |

96.01 |

94.49 |

0.06 |

|

| including | 74.68 |

94.49 |

19.81 |

0.15 |

||

| CMR23-011 | entire hole | 1.52 |

70.10 |

68.58 |

0.02 |

|

| CMR23-012 | entire hole | 1.52 |

85.34 |

85.34 |

0.46 |

Ended in Mineralization |

| including | 35.05 |

85.34 |

50.29 |

0.74 |

||

| or | 44.20 |

45.72 |

1.52 |

5.27 |

||

| or | 60.96 |

85.34 |

24.38 |

1.00 |

||

| or | 62.48 |

64.01 |

1.53 |

7.65 |

| CMR23-013 | entire hole | 1.52 |

83.82 |

82.30 |

0.21 |

Ended in Mineralization |

| including | 44.20 |

67.06 |

22.86 |

0.45 |

||

| CMR23-014 | entire hole | 0.00 |

188.98 |

188.98 |

0.10 |

|

| including | 9.14 |

16.76 |

7.62 |

0.55 |

||

| including | 83.82 |

89.92 |

6.10 |

0.46 |

||

| including | 100.58 |

9.00 |

4.58 |

0.39 |

||

| CMR23-015 | entire hole | 0.00 |

137.16 |

137.16 |

0.08 |

|

| including | 0.00 |

3.05 |

3.05 |

0.50 |

||

| including | 77.72 |

79.25 |

1.53 |

2.12 |

||

| CMR23-016 | entire hole | 0.00 |

114.30 |

114.30 |

0.14 |

Ended in Mineralization |

| including | 22.86 |

27.43 |

4.57 |

0.59 |

||

| including | 106.68 |

111.25 |

4.57 |

0.74 |

Table 2. 2023 Chicken Mountain Borehole details

Coordinates NAD 83 Zone 4 N

| Hole ID | Type |

Easting | Northing | Azimuth | Dip | Depth |

| CMD23-001 | Core |

552459 |

6917226 |

93 |

-50 |

428.55 |

| CMD23-002 | Core |

552515 |

6916775 |

90 |

-50 |

352.65 |

| CMD23-003 | Core |

552653 |

6916600 |

90 |

-50 |

134.12 |

| CMR23-001 | RC |

552805 |

6917235 |

270 |

-50 |

91.44 |

| CMR23-002 | RC |

552809 |

6917235 |

90 |

-53 |

70.10 |

| CMR23-003 | RC |

552738 |

6917038 |

90 |

-51 |

115.82 |

| CMR23-004 | RC |

552735 |

6917036 |

270 |

-49 |

53.34 |

| CMR23-005 | RC |

552878 |

6916304 |

90 |

-58 |

73.15 |

| CMR23-006 | RC |

552875 |

6916303 |

270 |

-49 |

103.63 |

| CMR23-007 | RC |

552341 |

6917768 |

95 |

-50 |

201.17 |

| CMR23-008 | RC |

552334 |

6917763 |

161 |

-49 |

147.83 |

| CMR23-009 | RC |

552086 |

6917446 |

90 |

-51 |

85.34 |

| CMR23-010 | RC |

552090 |

6917446 |

270 |

-49 |

96.01 |

| CMR23-011 | RC |

552088 |

6917446 |

135 |

-47 |

68.58 |

| CMR23-012 | RC |

552190 |

6917372 |

90 |

-51 |

85.34 |

| CMR23-013 | RC |

552189 |

6917372 |

270 |

-49 |

83.82 |

| CMR23-014 | RC |

552290 |

6917068 |

90 |

-52 |

188.98 |

| CMR23-015 | RC |

552285 |

6917069 |

270 |

-50 |

137.16 |

| CMR23-016 | RC |

552354 |

6916780 |

90 |

-50 |

114.30 |

Figure 7: 2023 Chicken Mountain Drill Hole IDs

Please refer to footnote 2 for more information on placer production.

The Flat Gold System - Alaska's Next Tier 1 Opportunity

Tectonic is currently assessing the Flat Gold System in partnership with Doyon Limited ("Doyon"), one of Alaska's largest native regional corporations and a significant Tectonic investor. The Flat Gold System is a network of interconnected geophysical anomalies that indicate six confirmed and potential under-explored bulk tonnage intrusion-related gold systems. The system spans a 20km trend and has produced approximately 1.4 million ounces of Placer Gold between 1908 and 19662.

Tectonic is currently evaluating Chicken Mountain, a confirmed intrusion that features a four-kilometer long gold in-soil anomaly and 55 historic drill holes, all of which intersected and 25 of which ended in gold mineralization. Highlight intersects from this historical drilling3 include 12.56 g/t Au over 24.7m, 211 g/t Au over 1.4m, 0.98 g/t Au over 76m, 1.36 g/t over 36.6m, and 5.62 over 7.6m. Chicken Mountain was the focus of the Company's 2023 drilling program and can be found on Google Earth here.

Preliminary metallurgical analysis to-date has demonstrated rapid leach kinetics and gold recoveries averaging 95% from bottle roll testing4. This, combined with gold intersections at or near surface, suggest Chicken Mountain could represent an open pit, heap leach opportunity.

Hart, C.J.R., 2007, Reduced intrusion-related gold systems, in Goodfellow, W.D., ed., Mineral deposits of Canada: A Synthesis of Major Deposit Types, District Metallogeny, the Evolution of Geological Provinces, and Exploration Methods: Geological Association of Canada, Mineral Deposits Division, Special Publication No. 5, p. 95-112.

Placer production figures from "Mineral Occurrence and Development Potential Report, Locatable and Salable Minerals, Bering Sea-Western Interior Resource Management Plan, BLM-Alaska Technical Report 60", prepared by the U.S. Department of the Interior, Bureau of Land Management, November 2010.

Please refer to Tectonic's news release dated September 28, 2021 for historic drill results.

Please refer to Tectonic's news release dated February 16, 2023 for metallurgical testing.

About Tectonic Metals Inc. ("Tectonic" or the "Company")

Tectonic brings a highly disciplined capital allocation and development process to mineral exploration. By consistently limiting their focus to tier 1 opportunities that fit their formula for mine economics, and de-risking projects upfront, the team has established a tremendous track record of success. Members of the Tectonic team have been directly involved in identifying and monetizing several significant gold discoveries throughout N. America that have created a tremendous amount of value for shareholders and stakeholders.

To learn more about Tectonic, pleaseclick here.

Qualified Person

Tectonic's disclosure of a technical or scientific nature in this press release has been reviewed, verified, and approved by Peter Kleespies, M.Sc., P.Geo., Tectonic's Vice President Exploration, who serves as a Qualified Person under the definition of National Instrument 43-101.

The analytical work for the 2023 Flat drilling program was performed by ALS Global (ALS) an internationally recognized and accredited analytical services provider, which is independent of Tectonic. All samples were submitted to ALS's Fairbanks, Alaska facility where they were prepared and shipped to ALS's ALS Global Reno, Nevada facility where preparation comprising crushing to >70% passing below 2mm, and split using a rotary splitter with1000g splits pulverized to 85% passing below 75 microns PRP70-250 (crush, split, and pulverize 250g to 200 mesh). All samples underwent analysis for gold by Au-AA23, a 30-gram Fire Assay fusion with an atomic absorption finish (AAS). Additional pulp samples were then sent to ALS Vancouver, Canada, where they underwent analysis for multi-element (ME-MS61, 48 element, 0.25g pulp with four acid digestion and inductively coupled plasma mass spectrometry (ICP_MS) finish) and mercury (Hg-MS42, 0.50g pulp with aqua regia digestion and inductively coupled plasma mass spectrometry (ICP_MS) finish).

Quality Assurance and Quality Control procedures include the insertion of coarse blanks and certified assay standards into the sample string, ¼ core and second RC split field duplicates, and Tectonic supplied sample bags for pulp duplicates at a rate of approximately 1/10 (10%). Samples are placed in sealed and security tagged bags and shipped directly to the ALS preparation facility in Fairbanks, Alaska.

On behalf of Tectonic Metals Inc.,

Tony Reda

President and Chief Executive Officer

For further information about Tectonic Metals Inc. or this news release, please visit our website at www.tectonicmetals.com or contact Tom McMillan, Investor Relations, at toll-free 1.888.685.8558 or by email at tom@tectonicmetals.com.

Cautionary Note Regarding Forward-Looking Statements

Certain information in this news release constitutes forward-looking information and statements under applicable securities law. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements are often identified by terms such as "may", "should", "anticipate", "expect", "intend" and similar expressions and include, but are not limited to, the potential for mineralization at Tectonic's projects, any future exploration activities and the size; the receipt of any regulatory approvals, including the final approval of the TSXV.

Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental and other approvals and financing on time, obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, accuracy of any mineral resources, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Tectonic, and there is no assurance they will prove to be correct.

Although Tectonic considers these beliefs and assumptions to be reasonable based on information currently available to it, they may prove to be incorrect, and the forward-looking statements in this release are subject to numerous risks, uncertainties and other factors that may cause future results to differ materially from those expressed or implied in such forward-looking statements. Forward-looking statements necessarily involve known and unknown risks, including, without limitation: the Company's ability to implement its business strategies; risks associated with mineral exploration and production; risks associated with general economic conditions; adverse industry events; marketing and transportation costs; loss of markets; volatility of commodity prices; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; industry and government regulation; changes in legislation, income tax and regulatory matters; competition; currency and interest rate fluctuations; and other risks.

Readers are further cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. Although Tectonic has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Tectonic does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Service Provider(as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Tectonic Metals Inc.

View the original press release on accesswire.com