What a brutal six months it’s been for Sally Beauty. The stock has dropped 37.7% and now trades at $8.05, rattling many shareholders. This may have investors wondering how to approach the situation.

Is now the time to buy Sally Beauty, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think Sally Beauty Will Underperform?

Even with the cheaper entry price, we're cautious about Sally Beauty. Here are three reasons why SBH doesn't excite us and a stock we'd rather own.

1. Stores Are Closing, a Headwind for Revenue

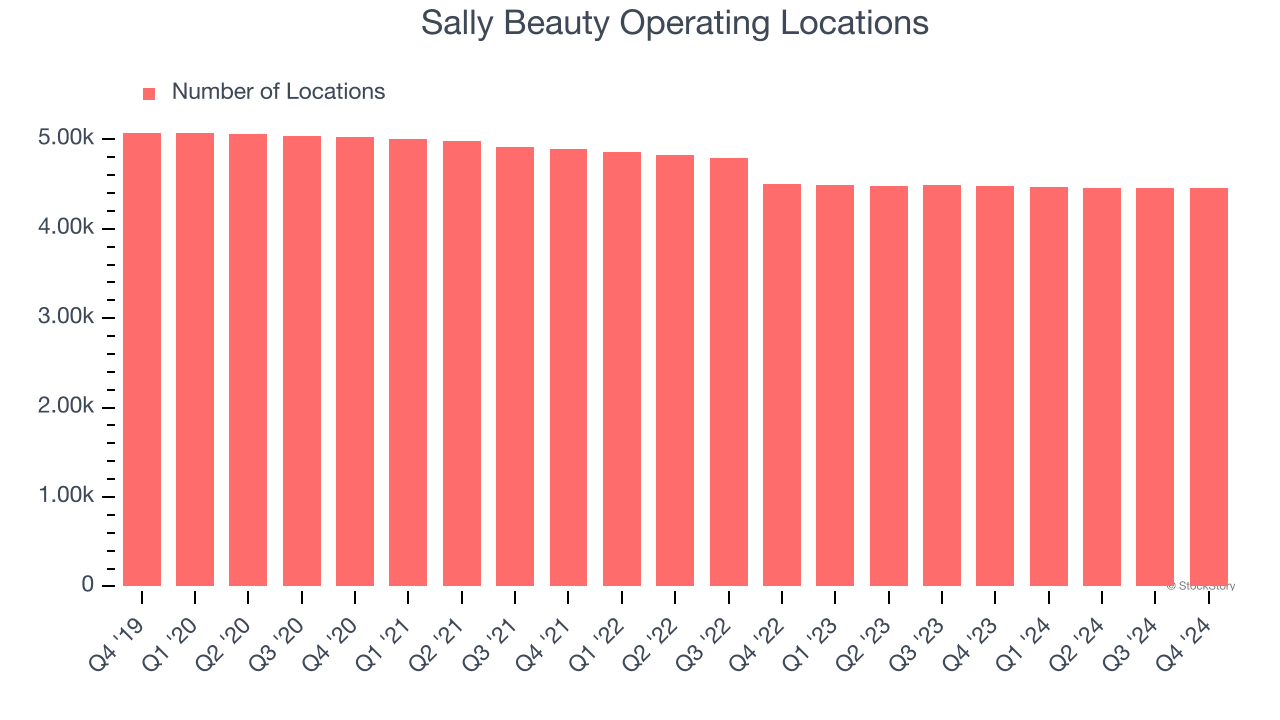

A retailer’s store count often determines how much revenue it can generate.

Sally Beauty operated 4,453 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 3% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

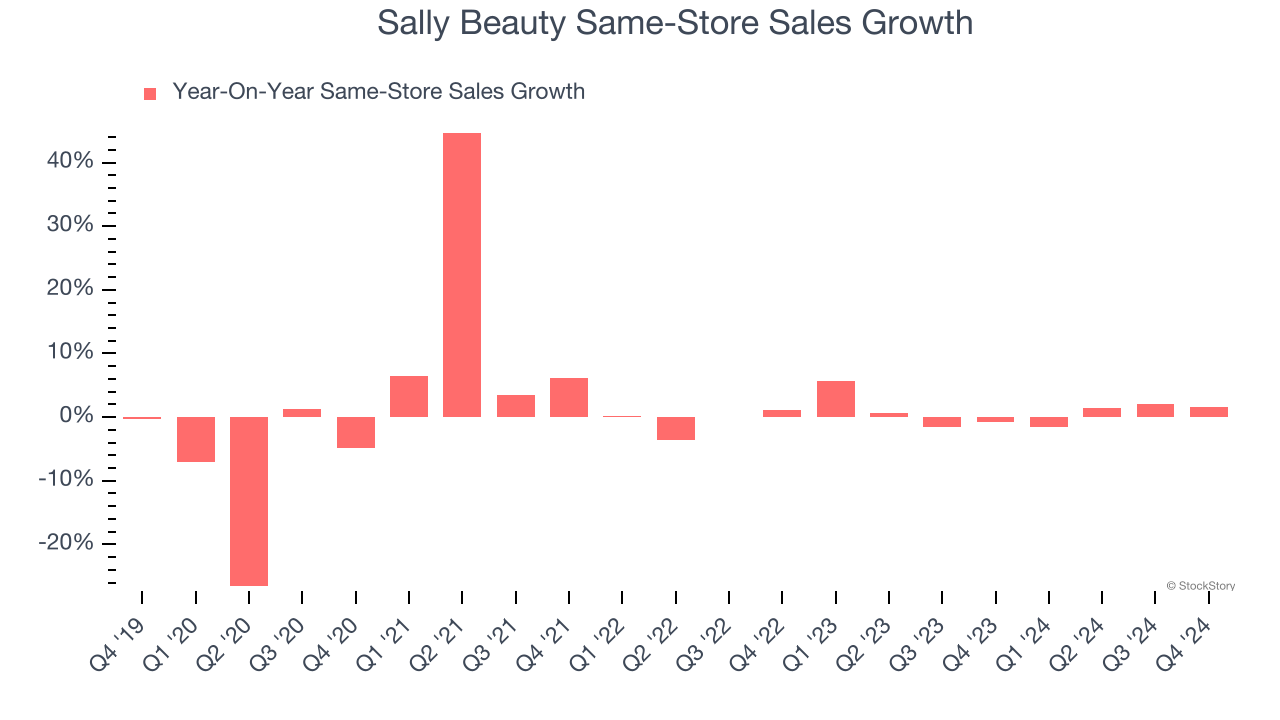

2. Flat Same-Store Sales Indicate Weak Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Sally Beauty’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat.

3. Fewer Distribution Channels Limit its Ceiling

With $3.72 billion in revenue over the past 12 months, Sally Beauty is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

Final Judgment

We see the value of companies helping consumers, but in the case of Sally Beauty, we’re out. Following the recent decline, the stock trades at 4.3× forward P/E (or $8.05 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. Let us point you toward the Amazon and PayPal of Latin America.

Stocks We Like More Than Sally Beauty

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today.