Invesco DB USD Index Bearish ETF (NY:UDN)

All News about Invesco DB USD Index Bearish ETF

EUR/USD: Stable Above 1.09 As Markets Await US CPI ↗

March 12, 2024

Via Talk Markets

Topics

Economy

Via Talk Markets

GBP/USD Forecast: UK Inflation Steadies, US Inflation Rises ↗

February 14, 2024

Via Talk Markets

Topics

Economy

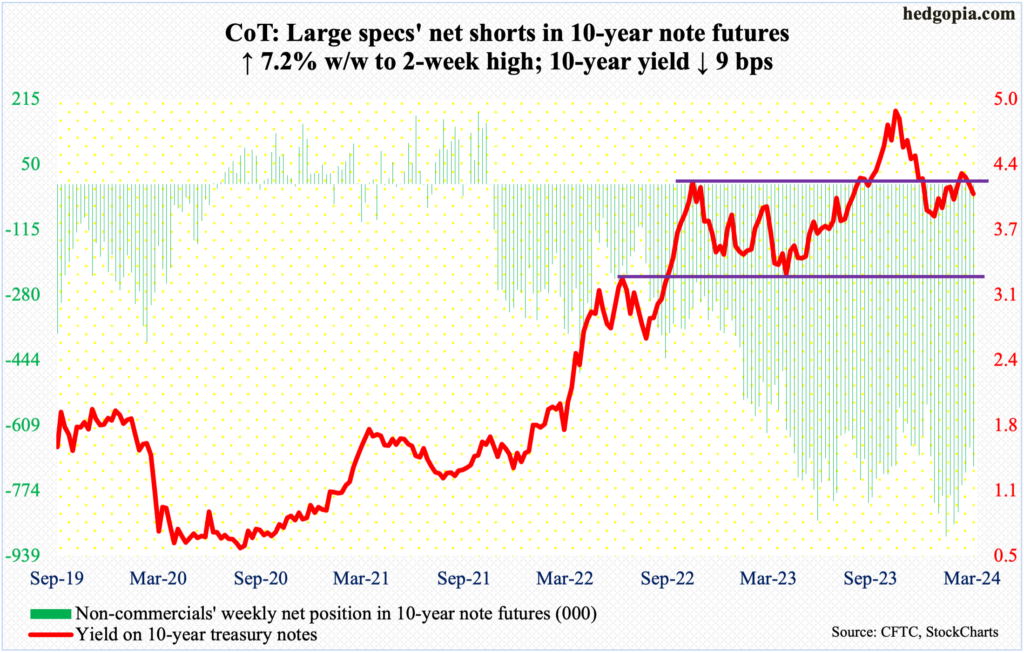

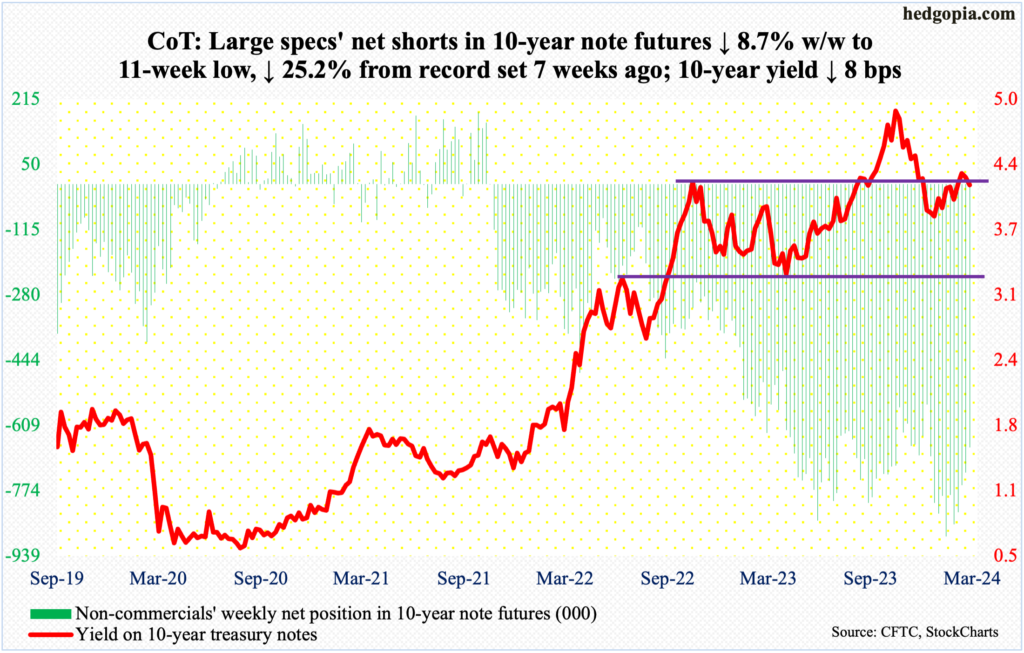

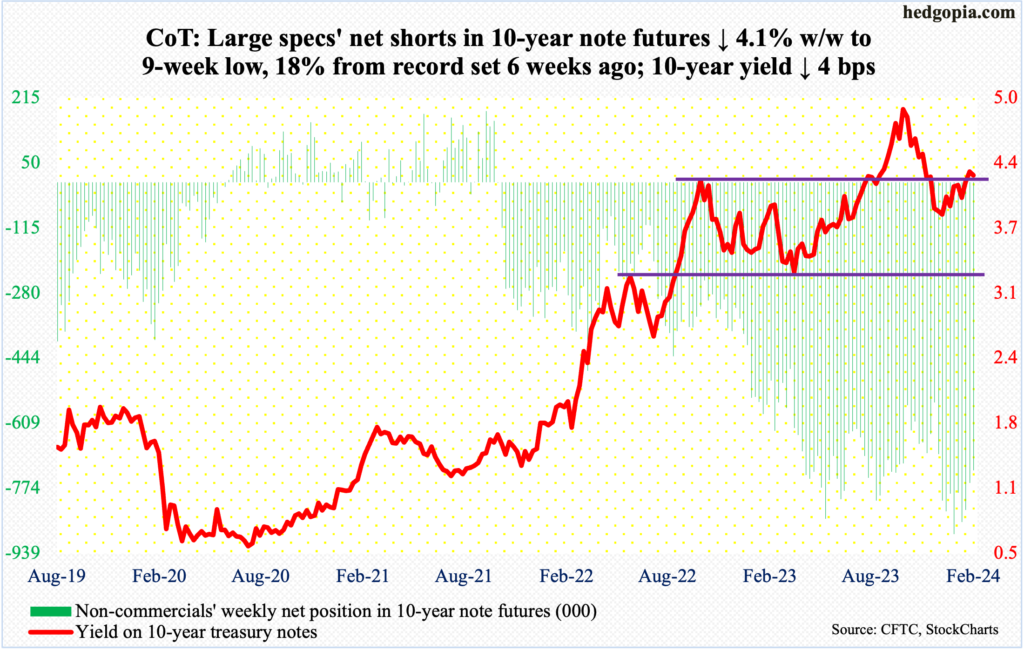

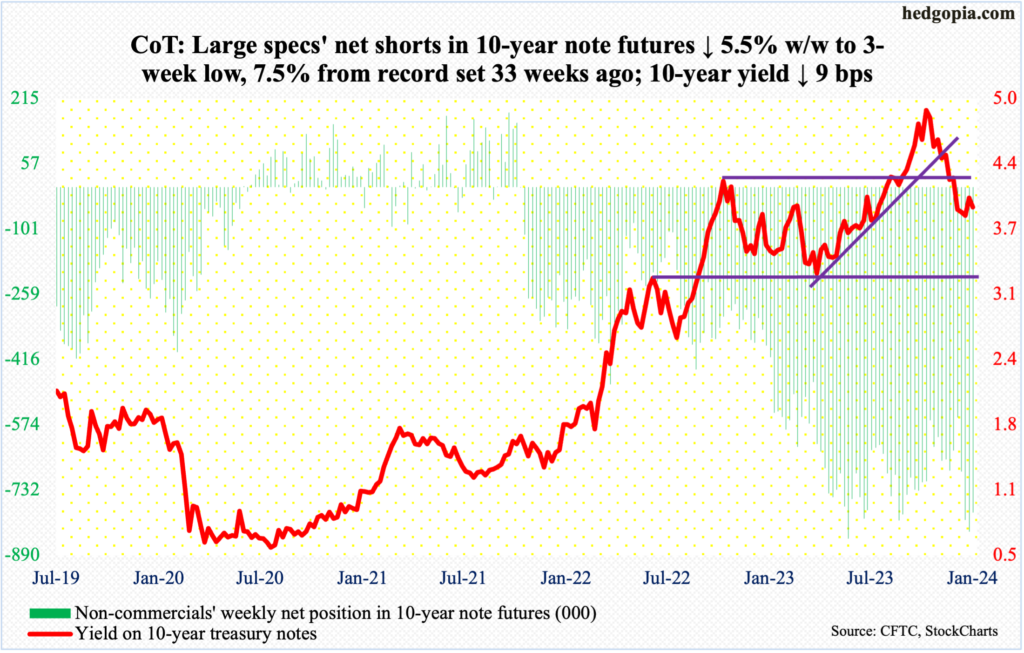

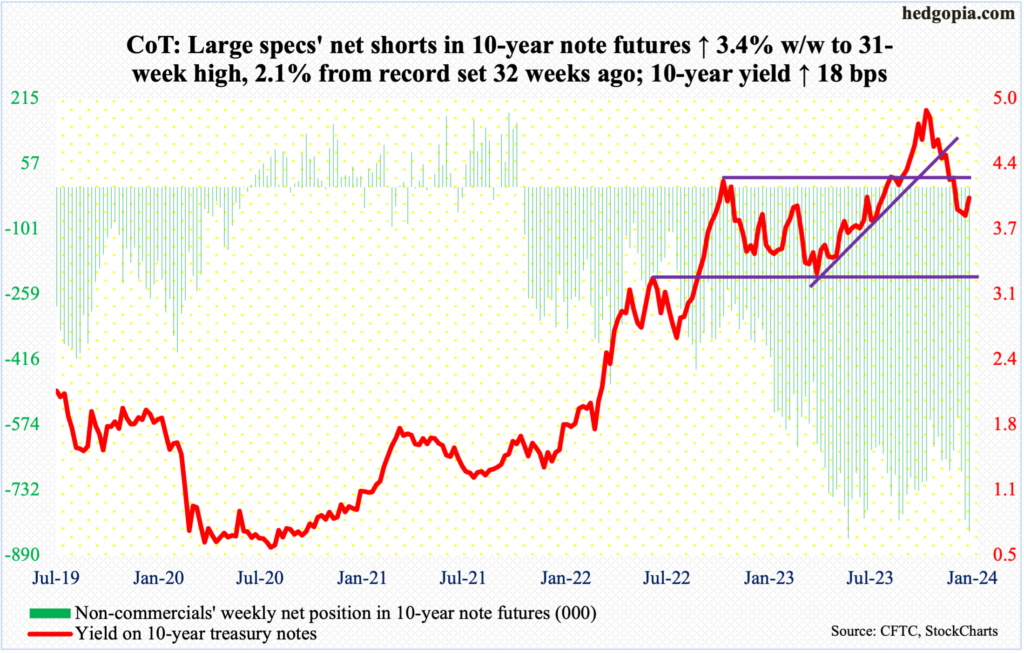

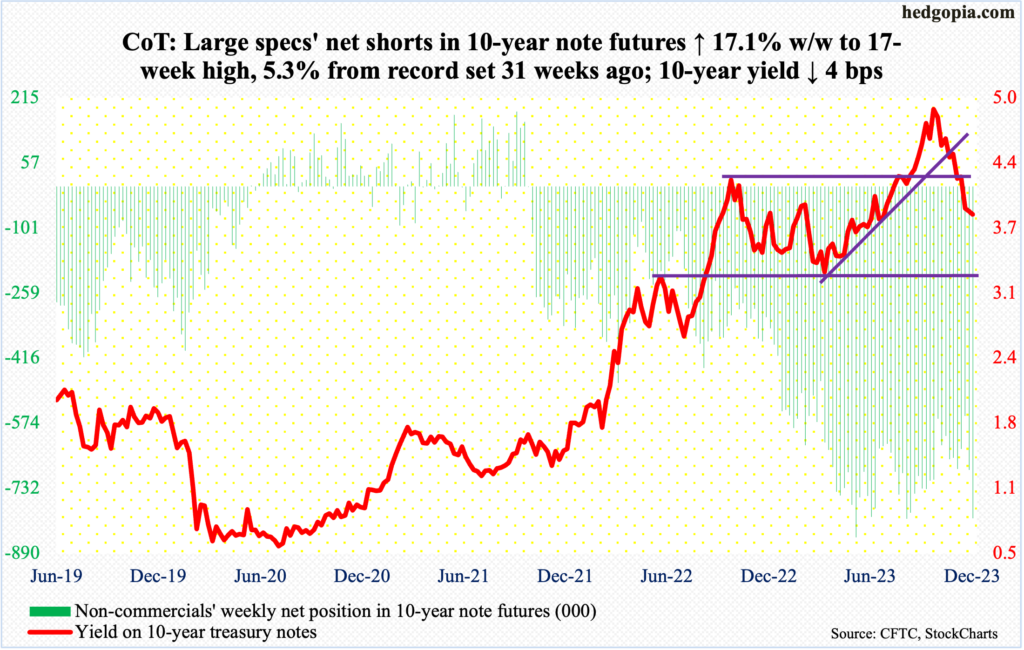

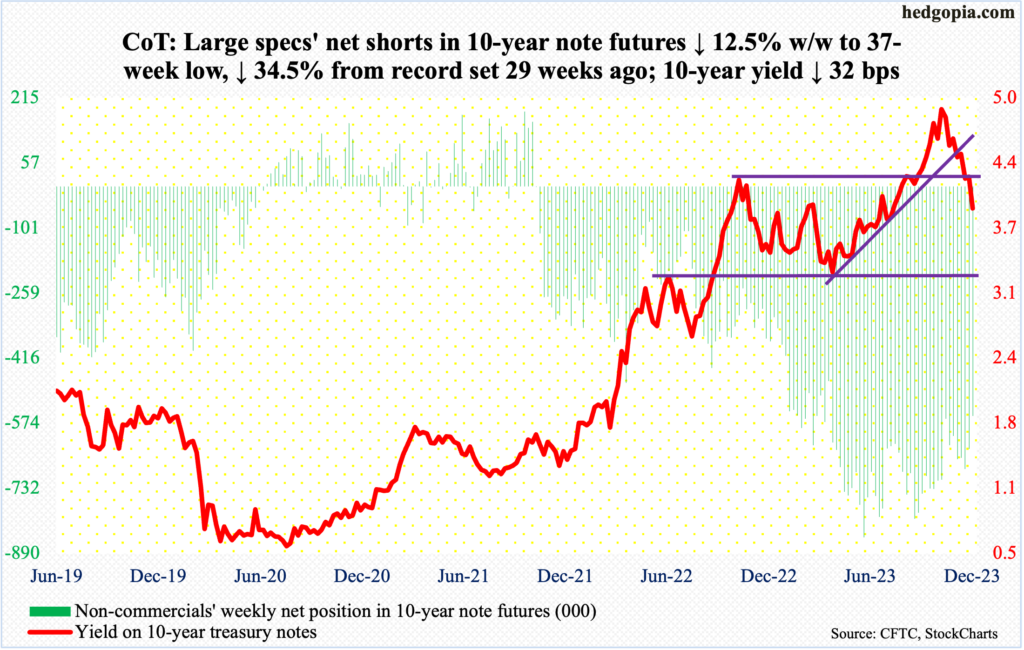

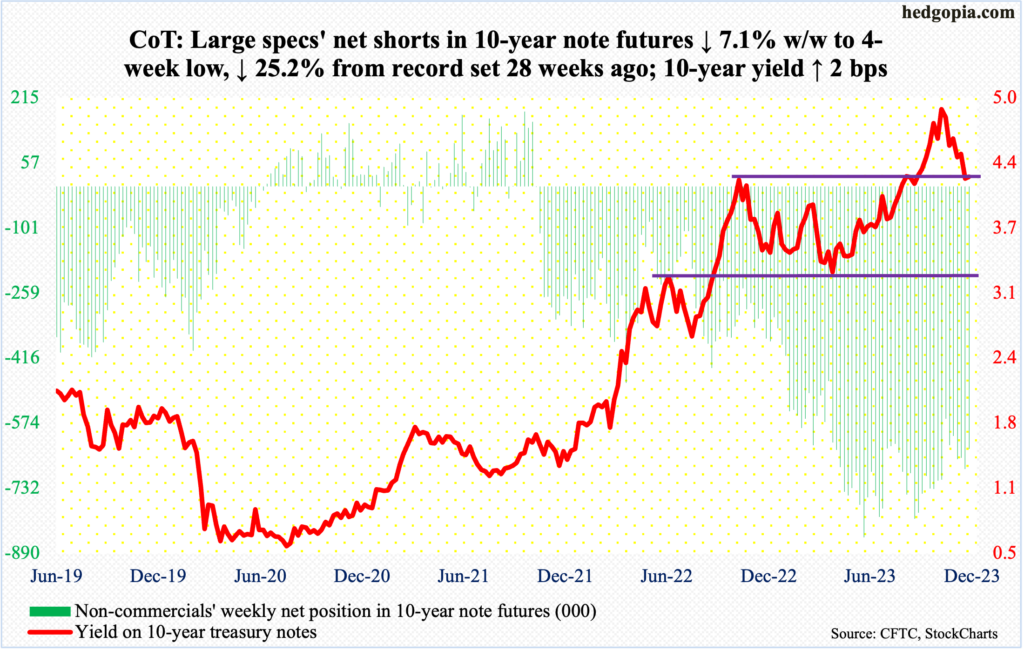

Peek Into Future Through Futures, Hedge Funds Positions, Via CoT ↗

January 07, 2024

Via Talk Markets

Topics

Economy

GBP/USD Price Analysis: Pound Weakens After 2023’s 5% Surge ↗

January 02, 2024

Via Talk Markets

Topics

Economy

USD/CAD Outlook: Dollar Weakens Amid Fed Rate Cut Bets ↗

December 19, 2023

Via Talk Markets

Topics

Economy

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.