The S&P 500 (SPY) is now exploring new heights above 6,000. But not everything is rainbows and lollipops.

Unfortunately, market breadth has narrowed once again with investors pressing the “Easy Button” with their old friends in the Magnificent 7. In fact, small caps have gone from November’s big winners to December’s big losers.

We will talk about what this means...and how to chart a course to outperformance in the weeks ahead in this edition of the Reitmeister Total Return.

Market Outlook

First things first...

Last week I sent you guys a message about a special presentation from my friend Amber Hestla entitled: Why Most Will Fail to Profit from “Trump Bump 2.0”?

Gladly they recorded the presentation and you can watch it now >

Back to our conversation about the stock market, all of December has been spent with the S&P 500 above 6,000. Yet that is like clapping with just one hand as all broader measures for the month are in negative territory including the Equal Weighted S&P 500 (RSP) as well as the small caps in the Russell 2000 (IWM).

This fits in with a typical seasonal narrative. That being the groups that led the way for the majority of the year put a cherry on top in December.

The next step in that journey is likely a hearty round of profit taking for those same groups in January as investors delay the tax consequences for one year. And then a big rotation happens to other worthy groups.

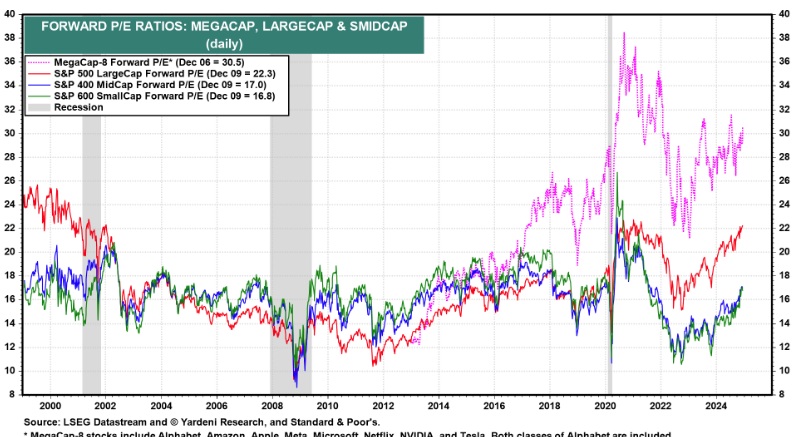

This updated PE chart by market cap tells you quite clearly which are the worthy groups that should benefit in that looming rotation:

As you can see in the pink line above, the MegaCaps have nose bleed valuations versus historical norms. The Magnificent 7 are the main stocks in that group and this chart says they are pretty much in bubble territory and should underperform going forward.

The seemingly more reasonable PE of 22 for the rest of the large caps is definitely on the high side of history. Not a bubble...but not much more can be pumped into the group without becoming a bubble. This is why I think that most of 2025 is spent below 6,000 for the S&P 500 with a high of 6,300.

Gladly that points to small and mid caps as the place to be in the new year. Not only do those companies offer superior earnings growth over their larger peers...but also a PE about 20-30% lower. That is why I keep saying that its time for smaller stocks to shine.

That rotation from large to small seemed to be underway after the November election. Yet in December has taken a noticeable pause.

That’s OK...that just gives a chance to load up the truck now with the stocks that are ready to outperform in the year ahead.

The very stocks you will find in the next section...

What To Do Next?

Discover my current portfolio of 10 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999).

All of these hand selected picks are all based on my 44 years of investing experience seeing bull markets...bear markets...and everything between.

And right now this portfolio is beating the stuffing out of the market.

If you are curious to learn more, and want to see my top 10 timely stock recommendations, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top 10 Stocks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares were trading at $602.68 per share on Tuesday afternoon, down $2.00 (-0.33%). Year-to-date, SPY has gained 27.99%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Is the Stock Market Healthy? appeared first on StockNews.com