(Please enjoy this updated version of my weekly commentary published August 04, 2021 from the POWR Growth newsletter).

Market Commentary

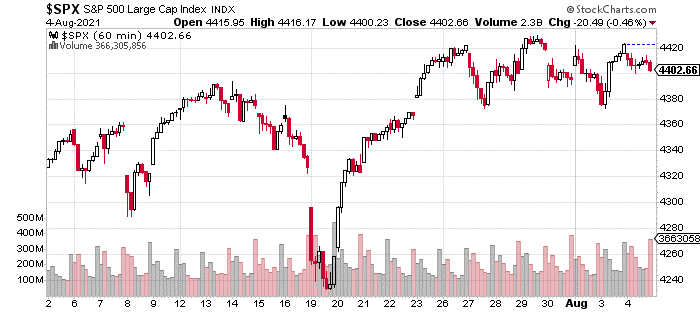

As usual, let’s start with the one-month, hourly chart which shows that the market has basically been in consolidation mode over the past week:

On a short-term basis, I like this setup as these types of consolidations tend to resolve higher, and we have a low-risk, double-bottom setup. Going back to the March 2020 bottom, these double bottom-type setups (separated by a week) have a 6/6 rate of moving higher and often in a vertical fashion.

I believe our portfolio is well-positioned with a mix of positions showing relative strength that could break out to new highs if the broader market continues higher. We also have some positions which are oversold on a short-term basis and could rocket higher with the right catalyst.

Finally, we’ve added a variety of defensive positions that will outperform if growth expectations continue to falter which could certainly happen if the outbreak in case counts continues due to the Delta Variant.

This basically encapsulates the challenge of the current market environment. Certain parts of the market are in a sky is falling-mode like Treasury yields as the 10-year hit 1.13% today.

Yet, the major averages like the S&P 500 continue to blithely trend higher, while indices like the Russell 2000 with more exposure to small and mid-caps trade in a choppy, range-bound manner.

As we noted in last week’s commentary, the neat and tidy resolution would be a quick slide lower which would cause bearish sentiment to spike and fear to replace greed as the market’s primary emotion.

Despite my desires, this is clearly not happening, as the market is choosing to work off its excesses through “rolling corrections” with fear pervading certain parts of the market, while others continue moving higher.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

SPY shares were trading at $440.82 per share on Thursday afternoon, up $1.84 (+0.42%). Year-to-date, SPY has gained 18.68%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of POWR Growth newsletter. Learn more about Jaimini’s background, along with links to his most recent articles.

The post How Long Will the Market Tug of War Continue? appeared first on StockNews.com