What a brutal six months it’s been for Sally Beauty. The stock has dropped 20.5% and now trades at $8.89, rattling many shareholders. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Sally Beauty, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Sally Beauty Will Underperform?

Even though the stock has become cheaper, we're cautious about Sally Beauty. Here are three reasons why we avoid SBH and a stock we'd rather own.

1. Stores Are Closing, a Headwind for Revenue

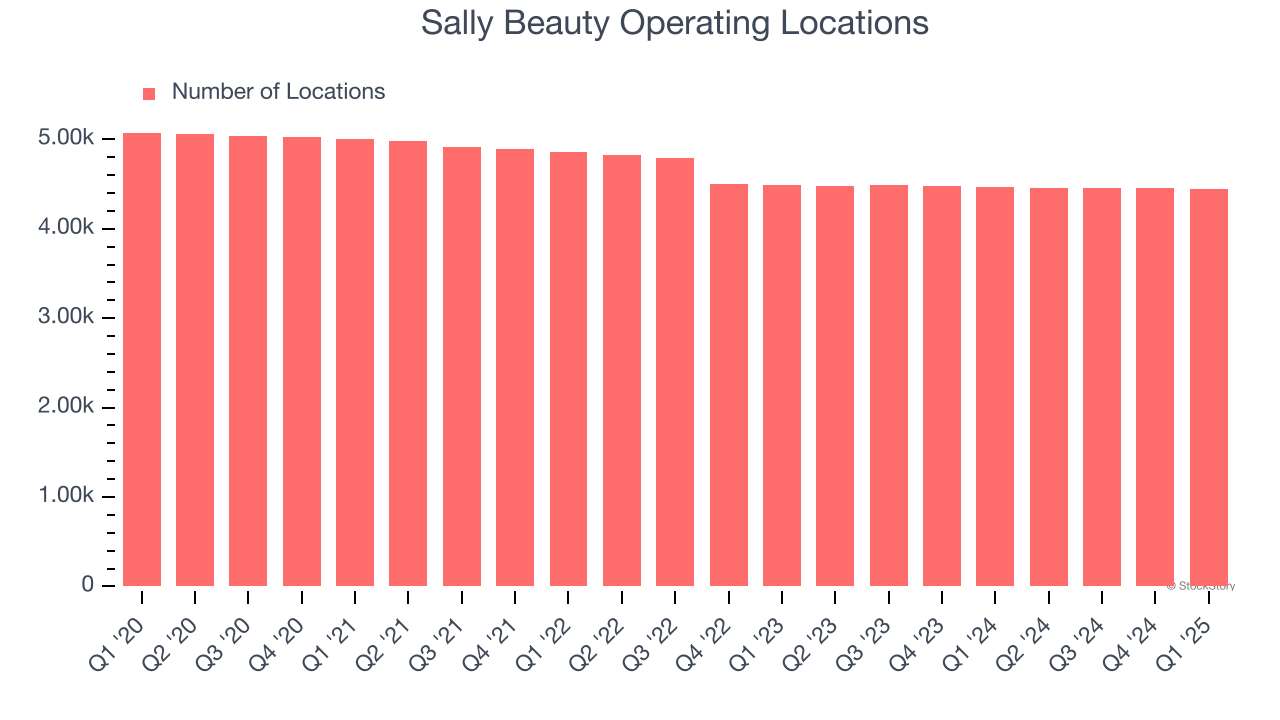

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Sally Beauty operated 4,446 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 2.1% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

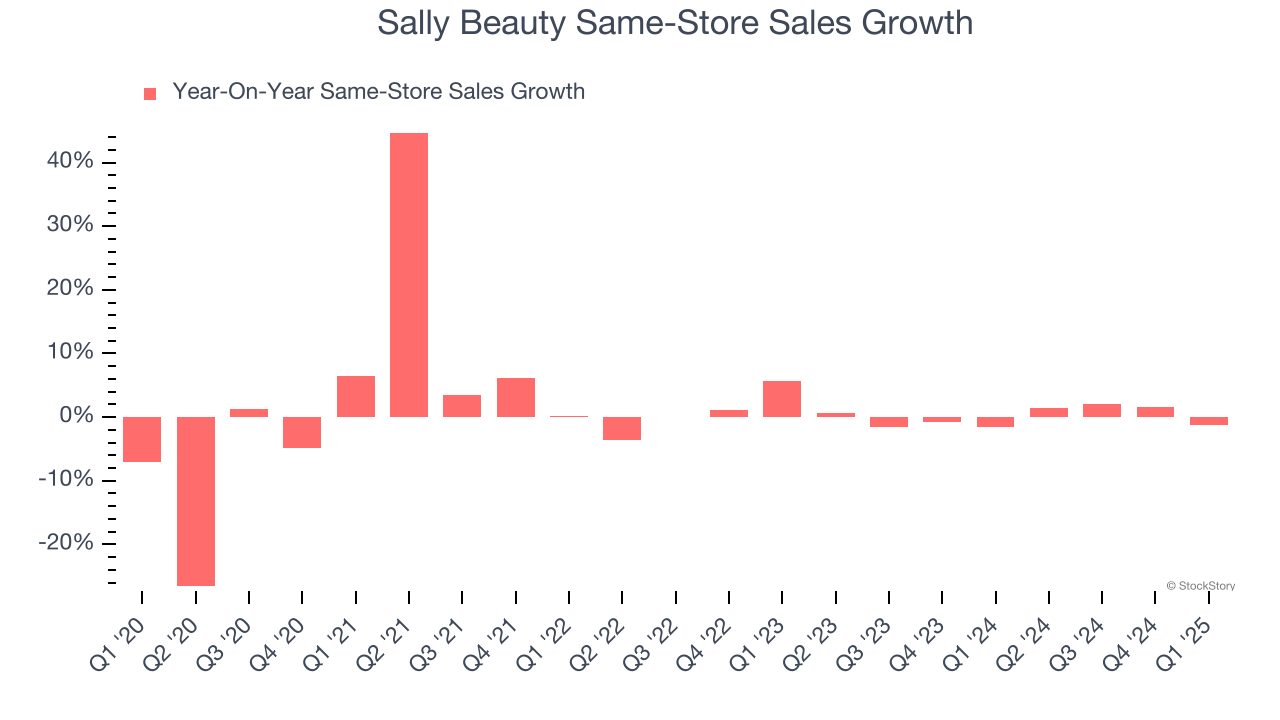

2. Flat Same-Store Sales Indicate Weak Demand

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Sally Beauty’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat.

3. Fewer Distribution Channels Limit its Ceiling

With $3.70 billion in revenue over the past 12 months, Sally Beauty is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

Final Judgment

Sally Beauty falls short of our quality standards. After the recent drawdown, the stock trades at 4.6× forward P/E (or $8.89 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Sally Beauty

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.