Over the last six months, Atlantic Union Bankshares’s shares have sunk to $31.19, producing a disappointing 19.3% loss while the S&P 500 was flat. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Atlantic Union Bankshares, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Atlantic Union Bankshares Not Exciting?

Even though the stock has become cheaper, we're cautious about Atlantic Union Bankshares. Here are three reasons why you should be careful with AUB and a stock we'd rather own.

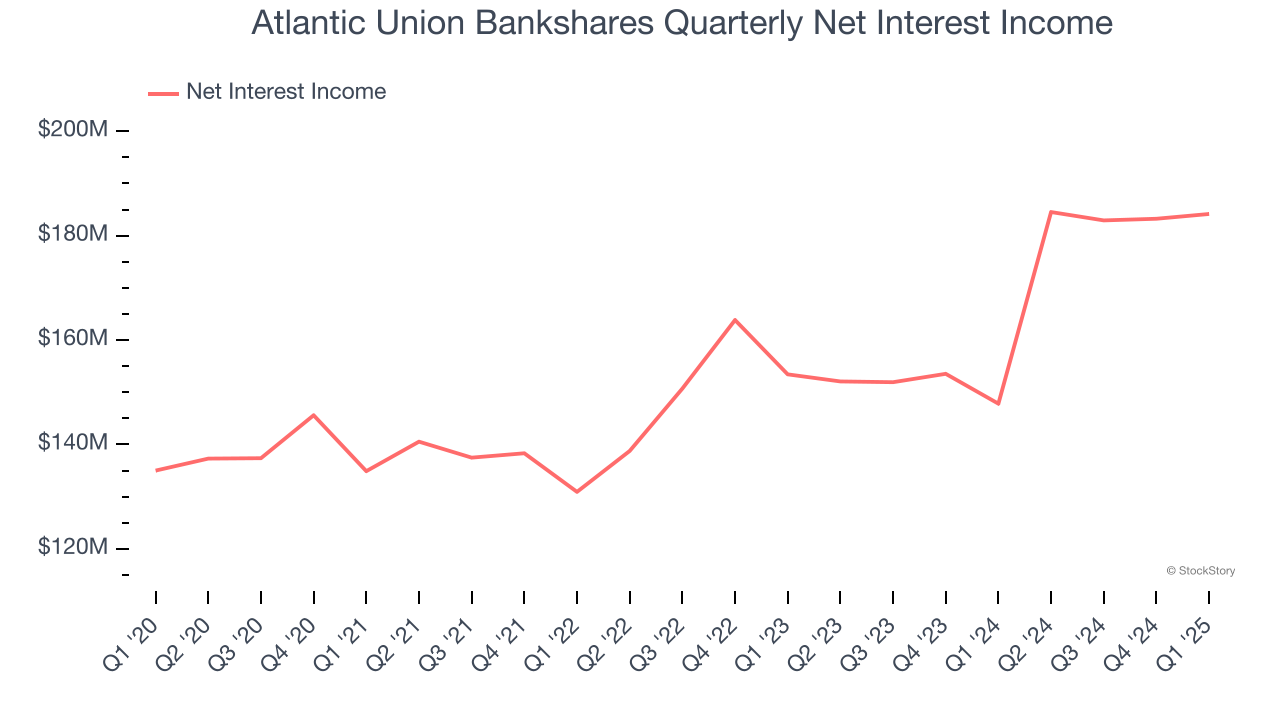

1. Net Interest Income Points to Soft Demand

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

Atlantic Union Bankshares’s net interest income has grown at a 7.3% annualized rate over the last four years, slightly worse than the broader bank industry.

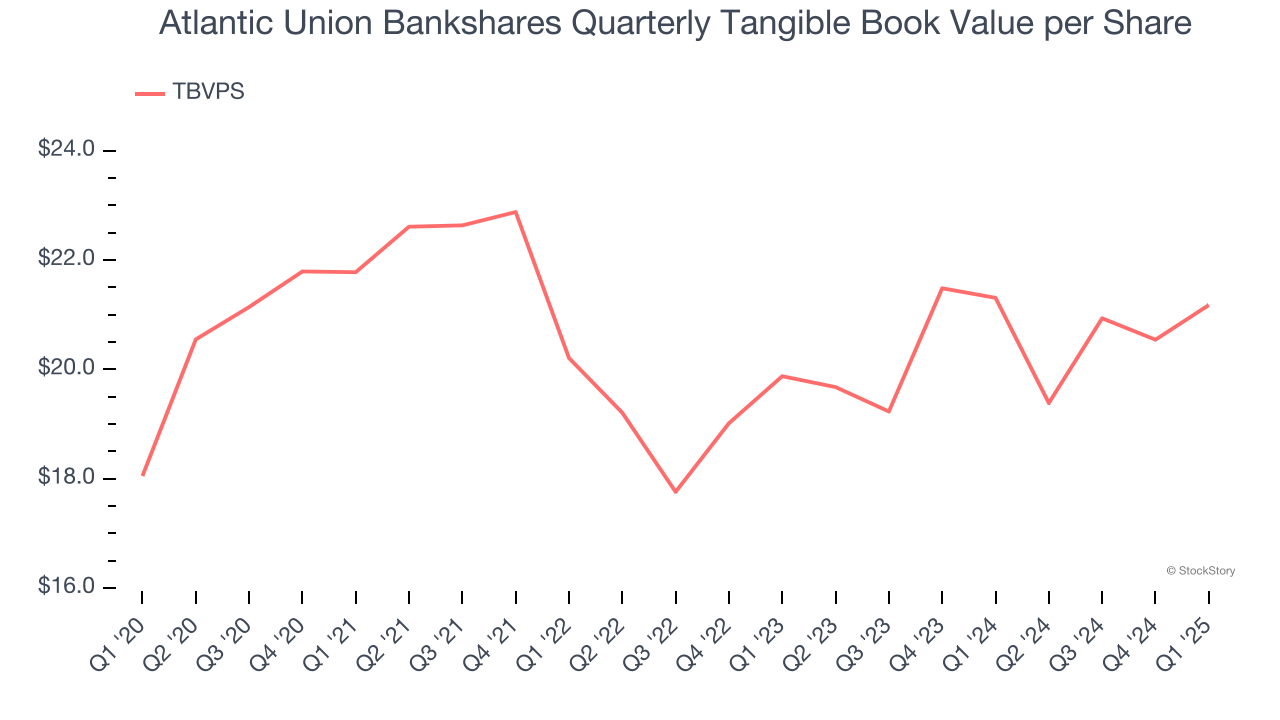

2. Substandard TBVPS Growth Indicates Limited Asset Expansion

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

Disappointingly for investors, Atlantic Union Bankshares’s TBVPS grew at a sluggish 3.2% annual clip over the last two years.

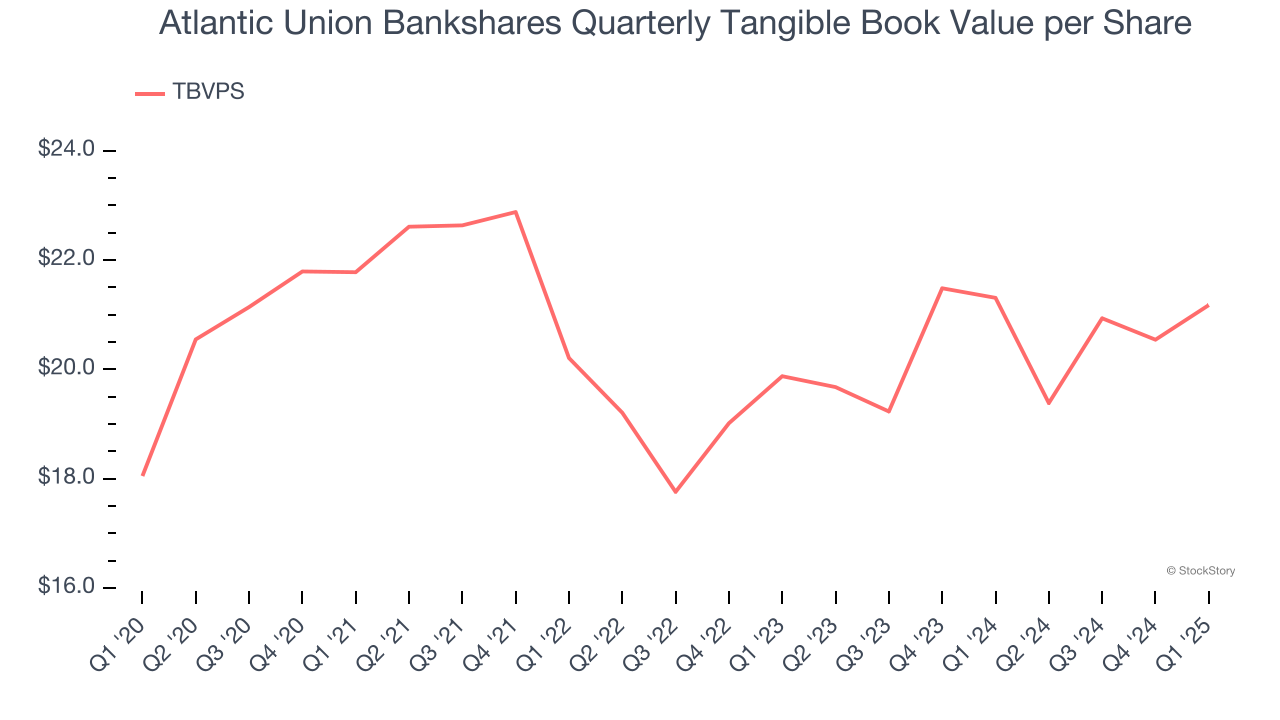

3. TBVPS Projections Show Stormy Skies Ahead

A bank’s tangible book value per share (TBVPS) increases when it generates higher net interest margins and keeps credit losses low, allowing it to compound shareholder value over time.

Over the next 12 months, Consensus estimates call for Atlantic Union Bankshares’s TBVPS to shrink by 7.5% to $19.59, a sour projection.

Final Judgment

Atlantic Union Bankshares isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 0.9× forward P/B (or $31.19 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. Let us point you toward an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Atlantic Union Bankshares

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.