What a fantastic six months it’s been for Allient. Shares of the company have skyrocketed 47.3%, setting a new 52-week high of $36.15. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Allient, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Allient Will Underperform?

We’re glad investors have benefited from the price increase, but we don't have much confidence in Allient. Here are three reasons why ALNT doesn't excite us and a stock we'd rather own.

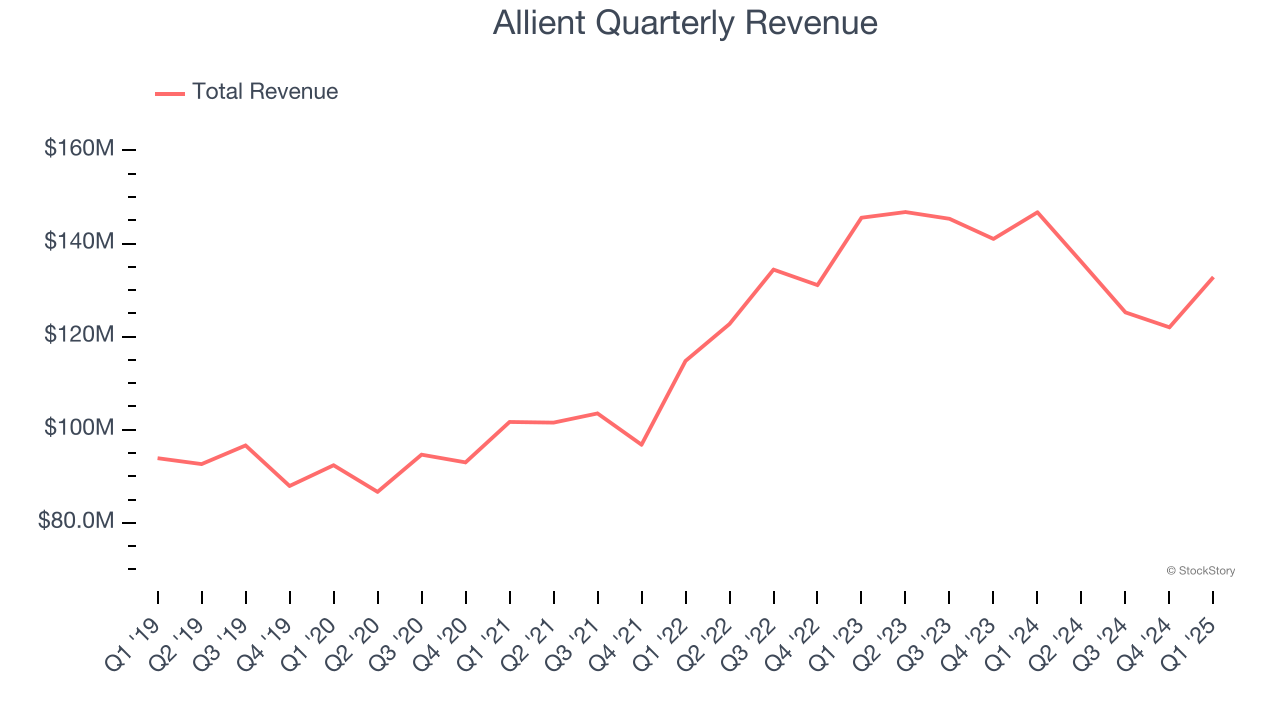

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Allient’s 6.9% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the industrials sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Allient’s revenue to rise by 3.7%. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

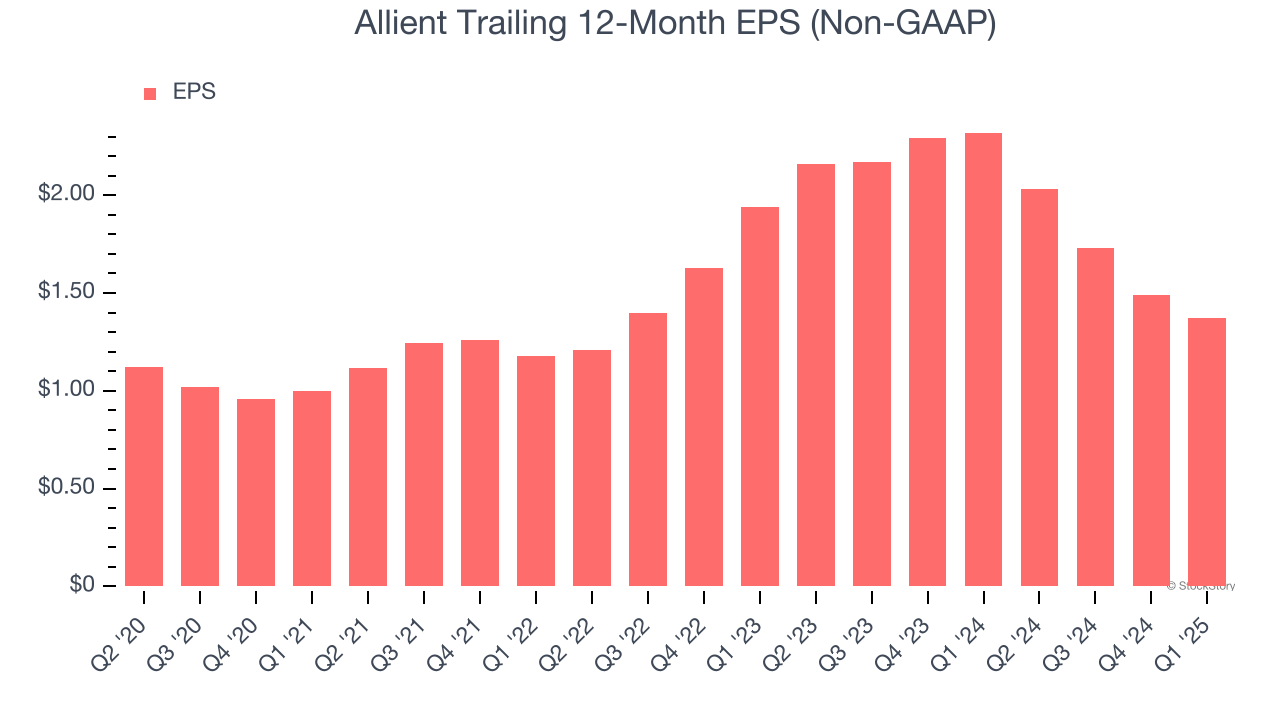

3. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Allient’s EPS grew at a weak 3.6% compounded annual growth rate over the last five years, lower than its 6.9% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Allient, we’ll be cheering from the sidelines. After the recent surge, the stock trades at 18.8× forward P/E (or $36.15 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are superior stocks to buy right now. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Allient

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.