Over the past six months, Amazon’s shares (currently trading at $213.64) have posted a disappointing 7.6% loss while the S&P 500 was flat. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Amazon, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Amazon Not Exciting?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why you should be careful with AMZN and a stock we'd rather own.

1. Weak Operating Could Cause Trouble

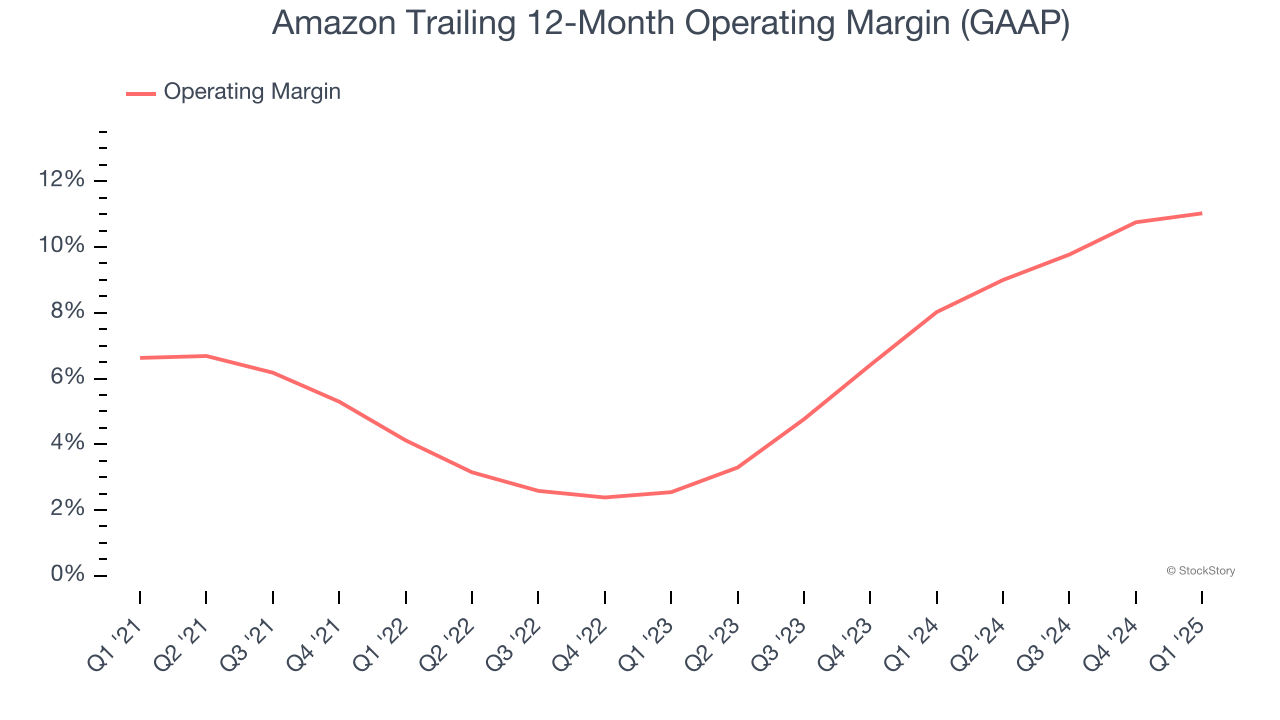

Amazon may be growing, but was its incremental revenue profitable? This is a fundamental question for investors because its e-commerce business caps its gross margin, which averaged 45.2% over the last five years and lagged its pure-play tech peers.

Adding further uncertainty is that Amazon sacrifices profits today for further dominance down the line by investing in diverse areas such as logistics, developer talent, and new markets. This makes the range of outcomes wide but also provides a buying opportunity for bulls with a differentiated view. Ultimately, the company’s long-term margin structure will depend on its pricing power, operating leverage, and mix of business lines.

Amazon was profitable over the last five years but held back by its large cost base. Its average operating of 6.8% was weak for a consumer internet business. This is partly structural – rather than developing business software with few maintenance costs, Amazon sells physical goods online where it must acquire and hold physical inventory.

2. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills or invest for the future.

Amazon has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3%, lousy for a consumer internet business.

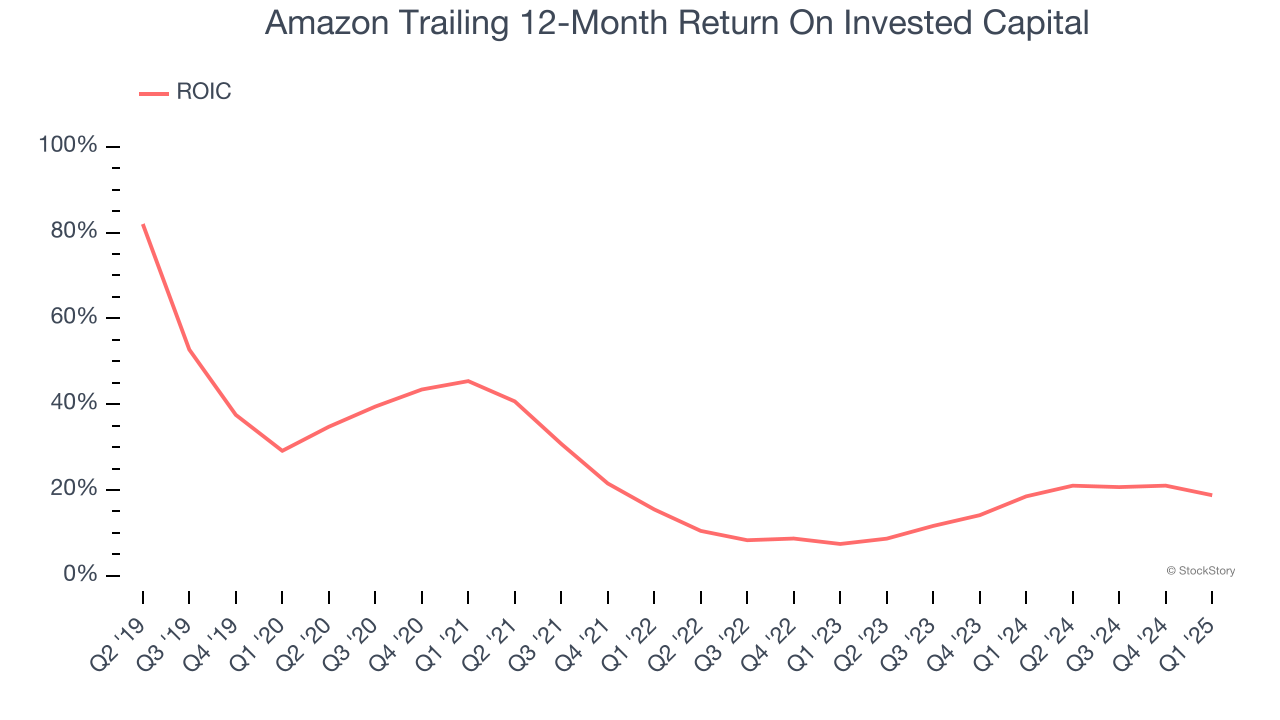

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Amazon’s ROIC has decreased significantly over the last few years. This is because it’s investing aggressively to capture multiple opportunities in its core markets as well as new ones like healthcare. Given the long-term nature of ROICs, only time will tell if its recent bets bear fruit.

Final Judgment

Amazon isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 33.9× forward price-to-earnings (or $213.64 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.