Over the past six months, Wiley’s shares (currently trading at $44.86) have posted a disappointing 15.6% loss while the S&P 500 was down 5.8%. This may have investors wondering how to approach the situation.

Is now the time to buy Wiley, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think Wiley Will Underperform?

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why you should be careful with WLY and a stock we'd rather own.

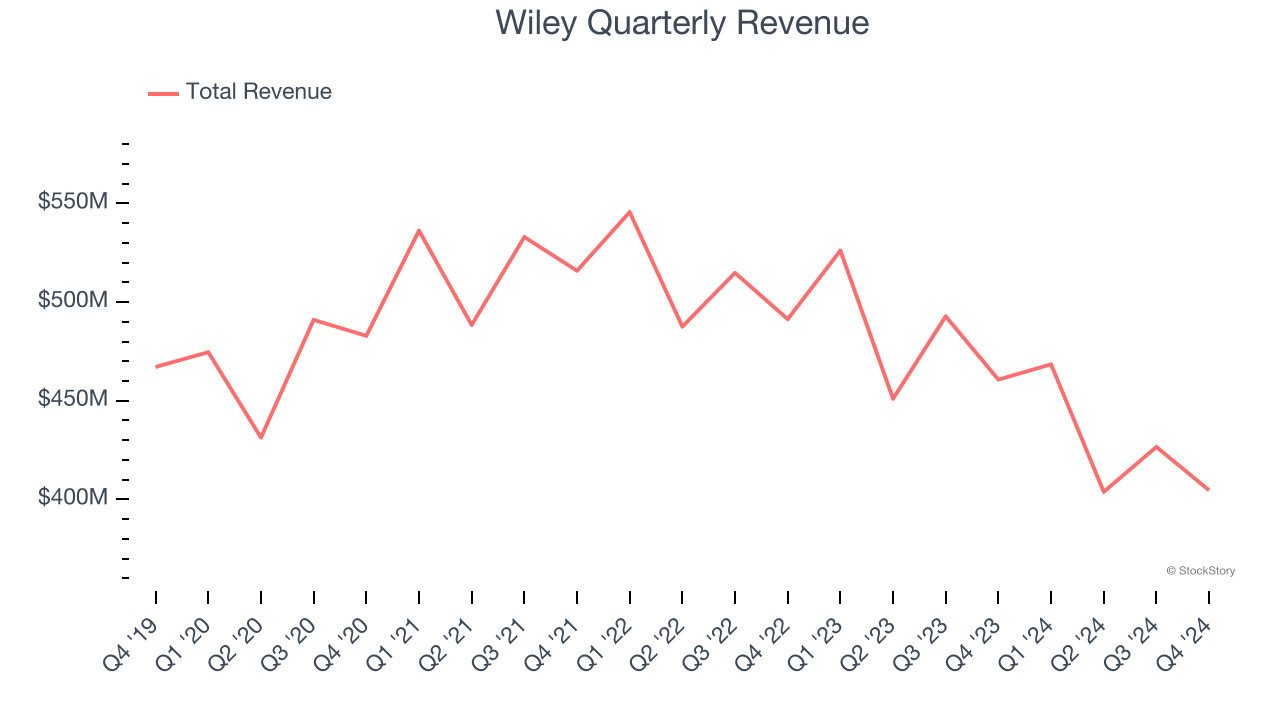

1. Revenue Spiraling Downwards

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Wiley’s demand was weak and its revenue declined by 1.6% per year. This wasn’t a great result and signals it’s a low quality business.

2. EPS Barely Growing

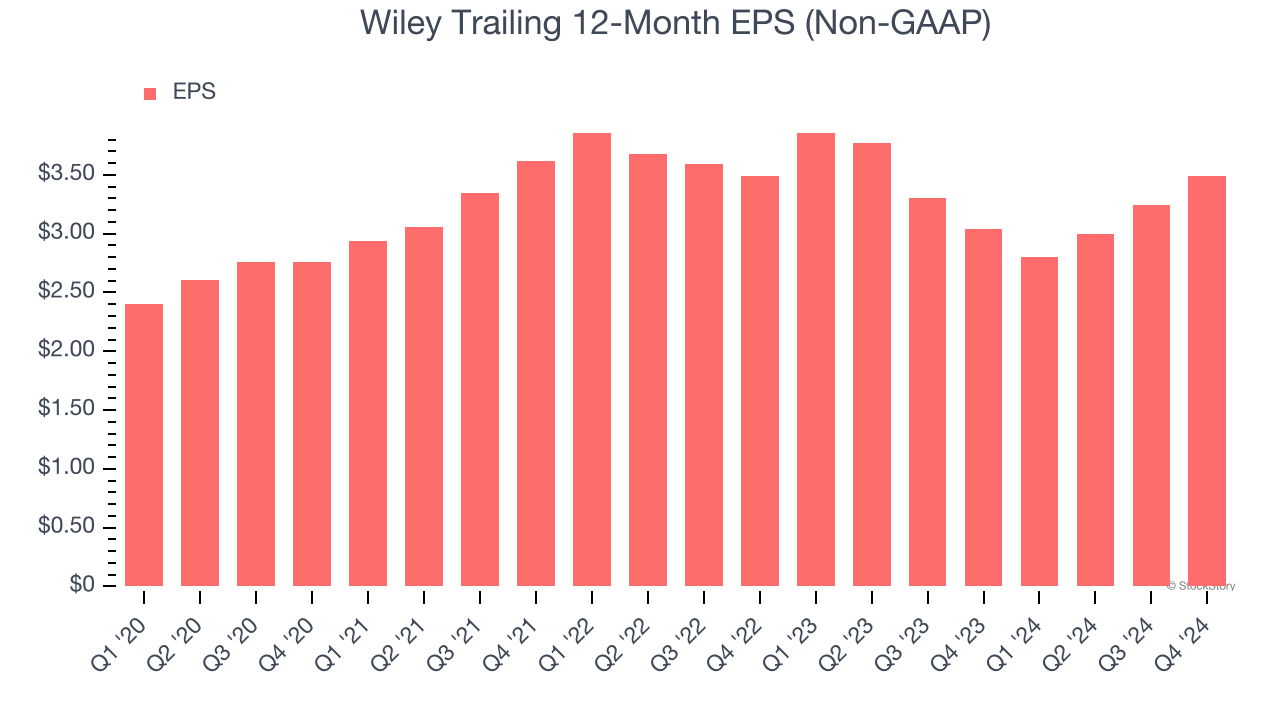

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Wiley’s EPS grew at an unimpressive 5.6% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.6% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

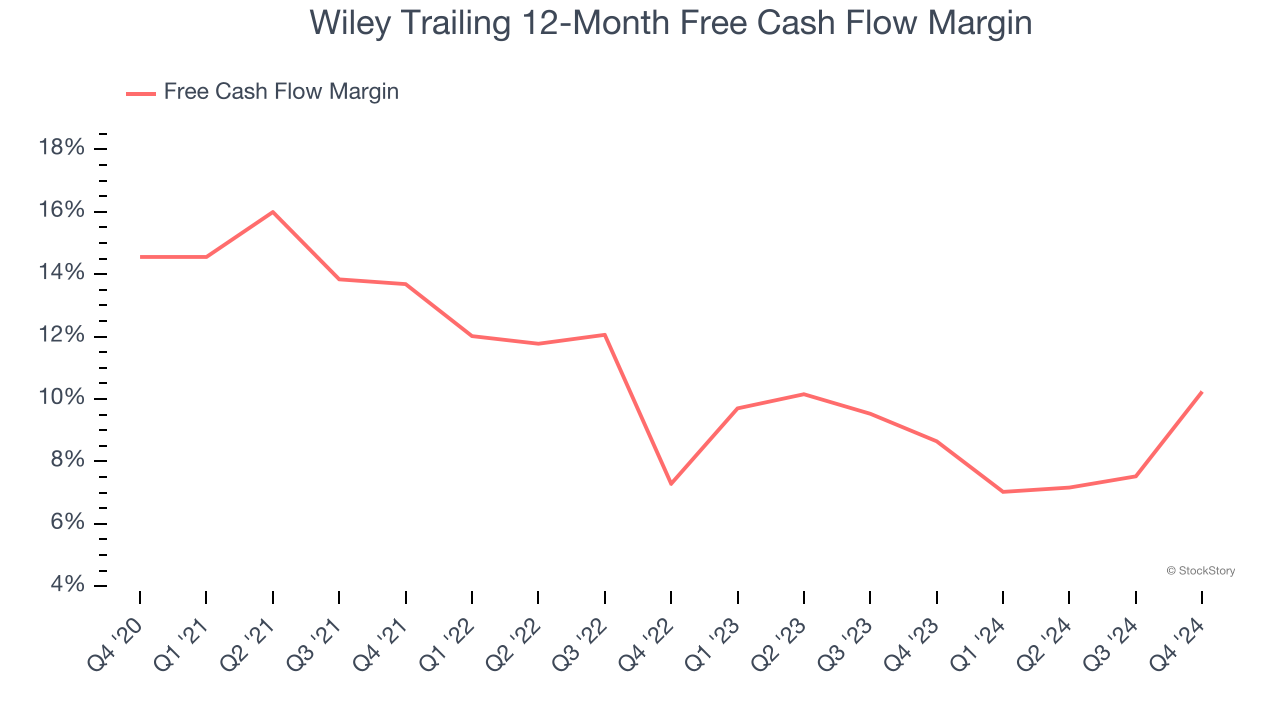

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Wiley’s margin dropped by 4.3 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Wiley’s free cash flow margin for the trailing 12 months was 10.2%.

Final Judgment

Wiley doesn’t pass our quality test. Following the recent decline, the stock trades at 18.6× forward EV-to-EBITDA (or $44.86 per share). This valuation tells us a lot of optimism is priced in - you can find better investment opportunities elsewhere. We’d recommend looking at one of our top digital advertising picks.

Stocks That Overcame Trump’s 2018 Tariffs

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today.